Infrastructure engineering software company Bentley Systems (NASDAQ: BSY) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 12% year on year to $375.5 million. Its non-GAAP profit of $0.27 per share was in line with analysts’ consensus estimates.

Is now the time to buy Bentley Systems? Find out by accessing our full research report, it’s free for active Edge members.

Bentley Systems (BSY) Q3 CY2025 Highlights:

- Revenue: $375.5 million vs analyst estimates of $369.8 million (12% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.27 vs analyst estimates of $0.27 (in line)

- Adjusted Operating Income: $121.9 million vs analyst estimates of $120.8 million (32.5% margin, 0.9% beat)

- Operating Margin: 22.5%, up from 20.5% in the same quarter last year

- Free Cash Flow Margin: 29.5%, up from 15.7% in the previous quarter

- Net Revenue Retention Rate: 109%, in line with the previous quarter

- Annual Recurring Revenue: $1.41 billion vs analyst estimates of $1.40 billion (10.6% year-on-year growth, in line)

- Billings: $364.4 million at quarter end, up 12.3% year on year

- Market Capitalization: $15.4 billion

CEO Nicholas Cumins said, “AI was top of mind at our Year in Infrastructure conference, where we engaged with industry leaders on its potential to help close the engineering capacity gap and deliver the infrastructure the world needs. Our Going Digital Award submissions illustrated how users are already applying AI in meaningful ways, and we unveiled new AI capabilities across our portfolio—underscoring Bentley’s comprehensive and principled approach to Infrastructure AI. We are excited about the long-term opportunity AI represents for our users and for Bentley.

Company Overview

Pioneering the concept of "digital twins" for infrastructure projects long before it became an industry buzzword, Bentley Systems (NASDAQ: BSY) provides software solutions that help engineers design, build, and operate infrastructure projects across sectors including roads, bridges, utilities, mining, and industrial facilities.

Revenue Growth

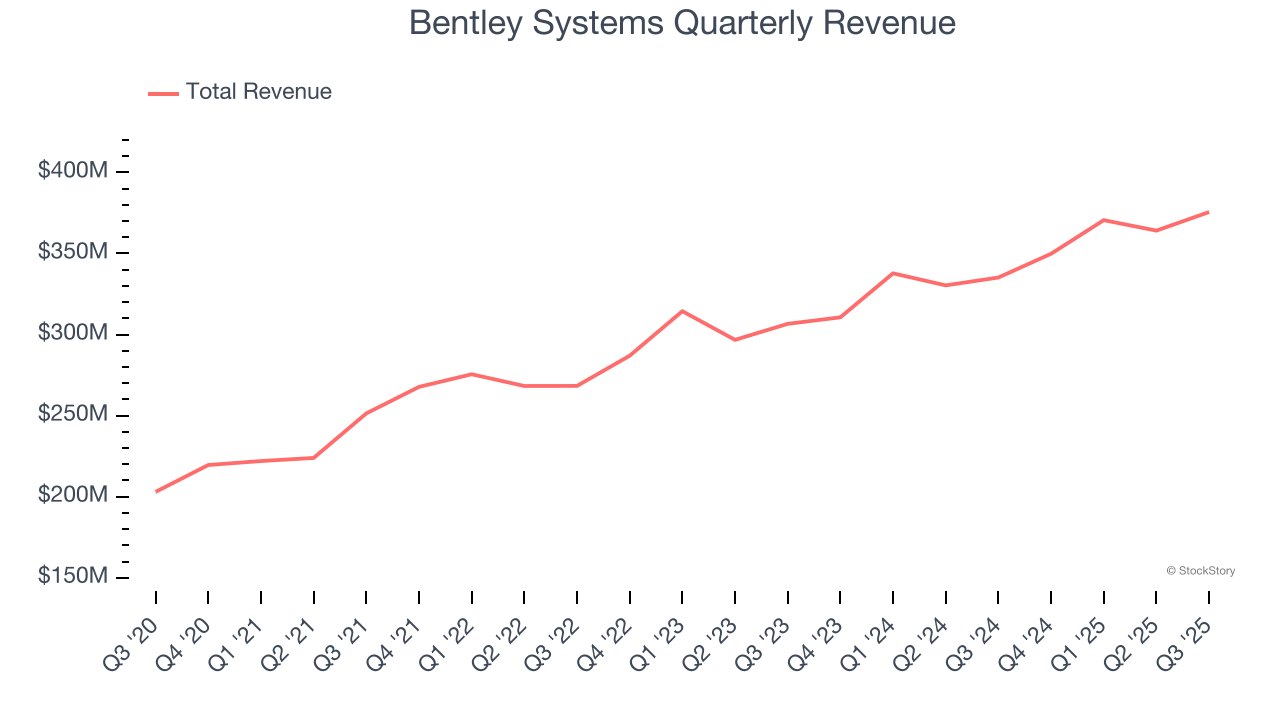

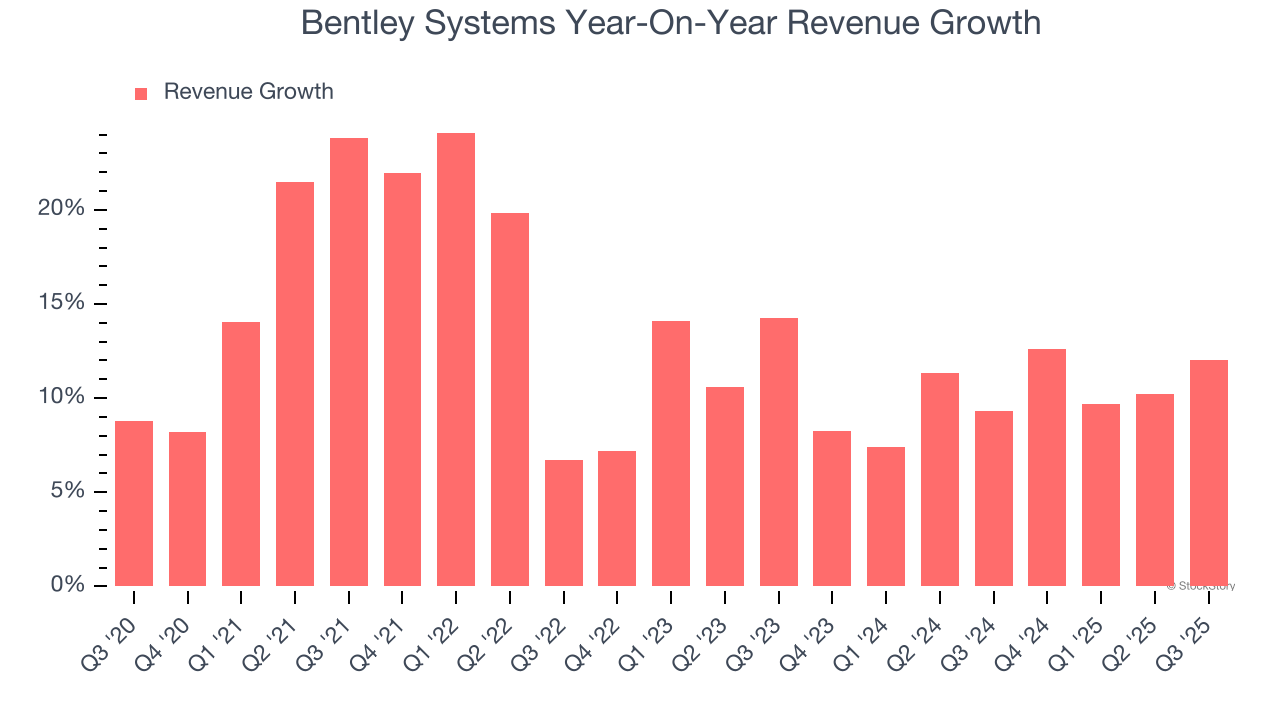

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Bentley Systems grew its sales at a 13.2% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Bentley Systems’s recent performance shows its demand has slowed as its annualized revenue growth of 10.1% over the last two years was below its five-year trend.

This quarter, Bentley Systems reported year-on-year revenue growth of 12%, and its $375.5 million of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Bentley Systems’s ARR came in at $1.41 billion in Q3, and over the last four quarters, its growth was underwhelming as it averaged 11.1% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

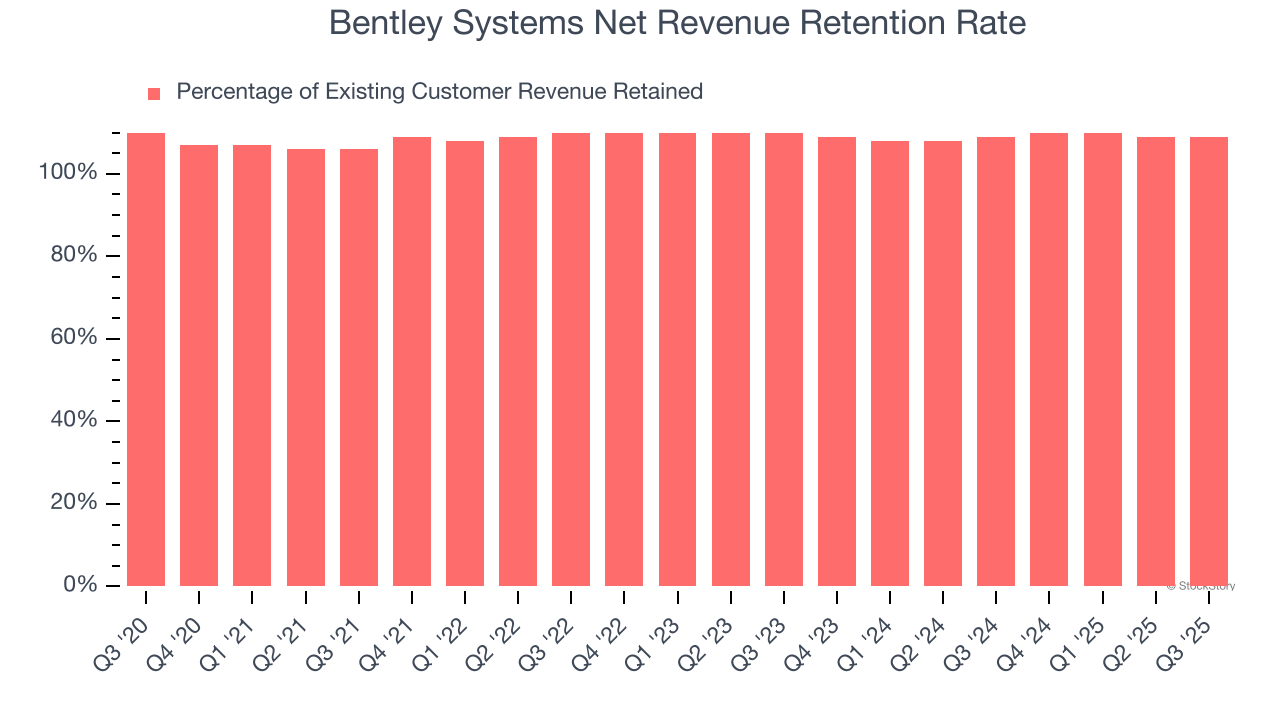

Bentley Systems’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 110% in Q3. This means Bentley Systems would’ve grown its revenue by 9.5% even if it didn’t win any new customers over the last 12 months.

Bentley Systems has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from Bentley Systems’s Q3 Results

We enjoyed seeing Bentley Systems beat analysts’ EBITDA expectations this quarter. We were also happy its billings outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $48.95 immediately following the results.

So should you invest in Bentley Systems right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.