Funeral services company Carriage Services (NYSE: CSV) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 2% year on year to $102.7 million. The company expects the full year’s revenue to be around $415 million, close to analysts’ estimates. Its non-GAAP profit of $0.75 per share was 3% above analysts’ consensus estimates.

Is now the time to buy Carriage Services? Find out by accessing our full research report, it’s free for active Edge members.

Carriage Services (CSV) Q3 CY2025 Highlights:

- Revenue: $102.7 million vs analyst estimates of $101.4 million (2% year-on-year growth, 1.3% beat)

- Adjusted EPS: $0.75 vs analyst estimates of $0.73 (3% beat)

- Adjusted EBITDA: $32.98 million vs analyst estimates of $31.74 million (32.1% margin, 3.9% beat)

- The company reconfirmed its revenue guidance for the full year of $415 million at the midpoint

- Management slightly raised its full-year Adjusted EPS guidance to $3.28 at the midpoint

- EBITDA guidance for the full year is $131 million at the midpoint, below analyst estimates of $132.3 million

- Operating Margin: 17%, down from 23.1% in the same quarter last year

- Free Cash Flow Margin: 17.5%, down from 19.9% in the same quarter last year

- Market Capitalization: $673.6 million

Carlos Quezada, Vice Chairman and CEO, stated, "We are pleased with our third-quarter performance, which reflects the strength of our strategy and the dedication of our team. Our adjusted diluted EPS of $0.75 represents a 17.2% increase over last year's $0.64, underscoring our commitment to disciplined execution and purposeful growth.

Company Overview

Established in 1991, Carriage Services (NYSE: CSV) is a provider of funeral and cemetery services in the United States.

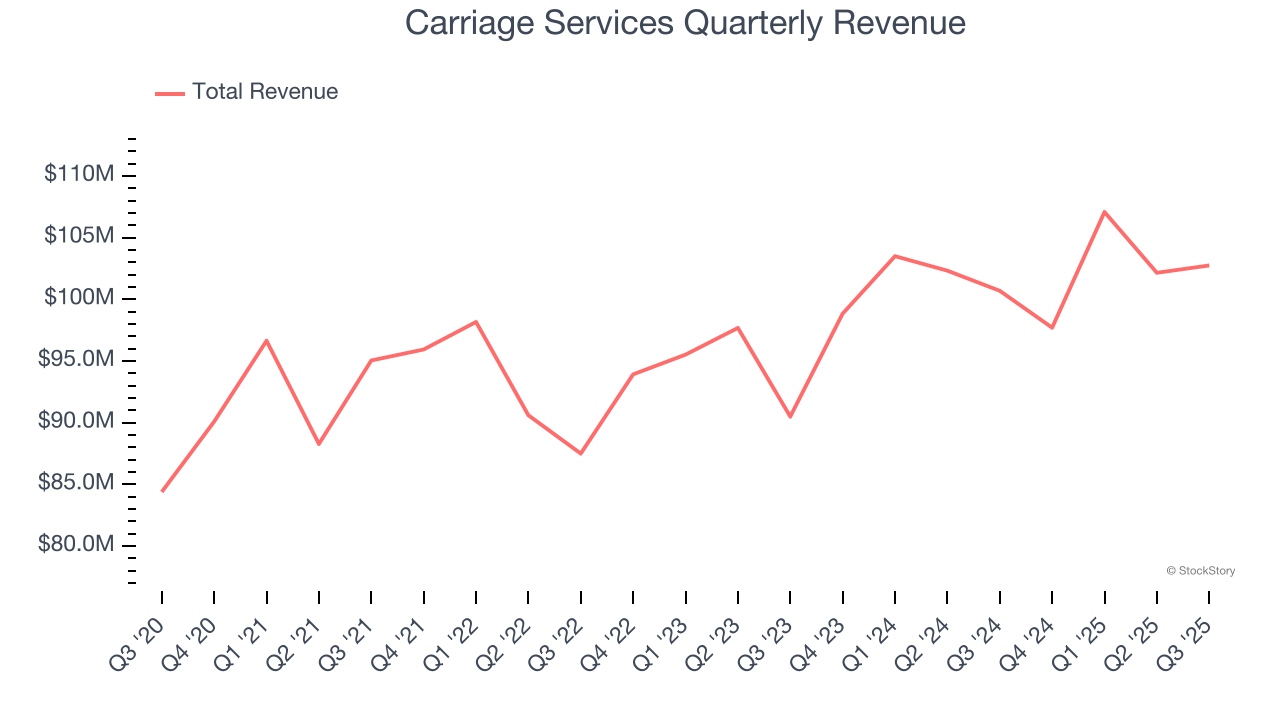

Revenue Growth

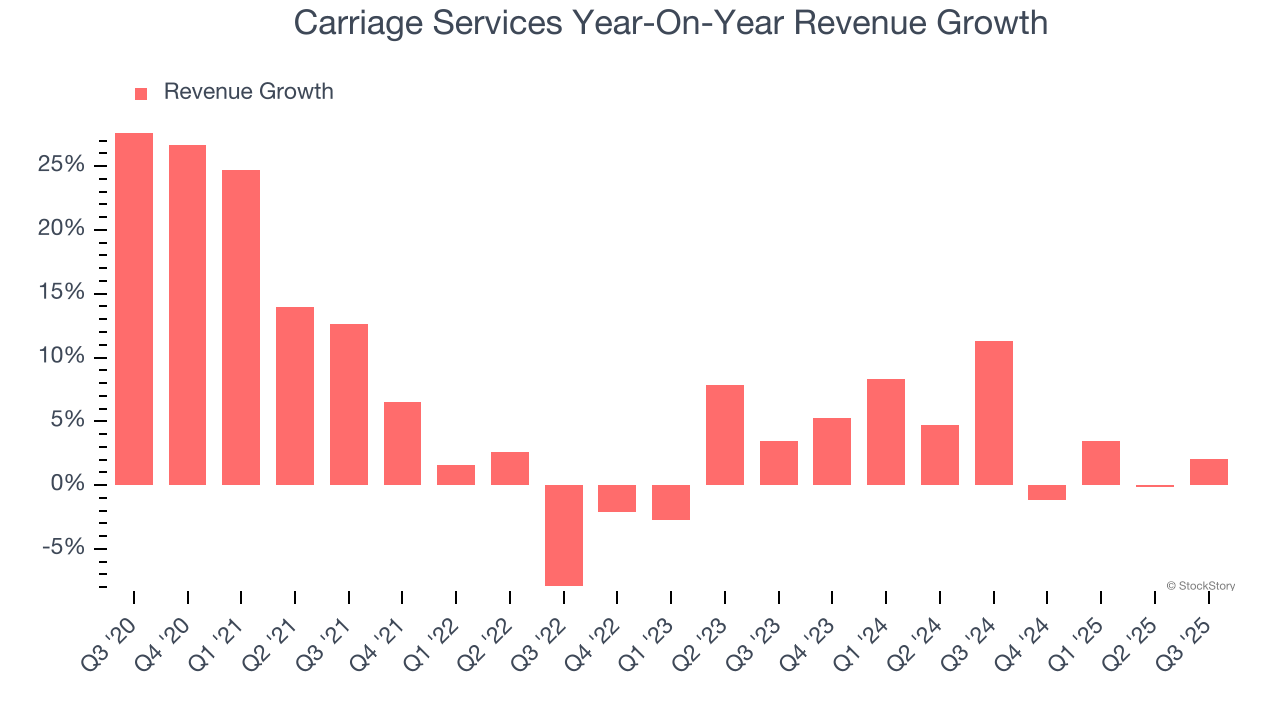

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Carriage Services’s 5.7% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Carriage Services’s recent performance shows its demand has slowed as its annualized revenue growth of 4.2% over the last two years was below its five-year trend.

This quarter, Carriage Services reported modest year-on-year revenue growth of 2% but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

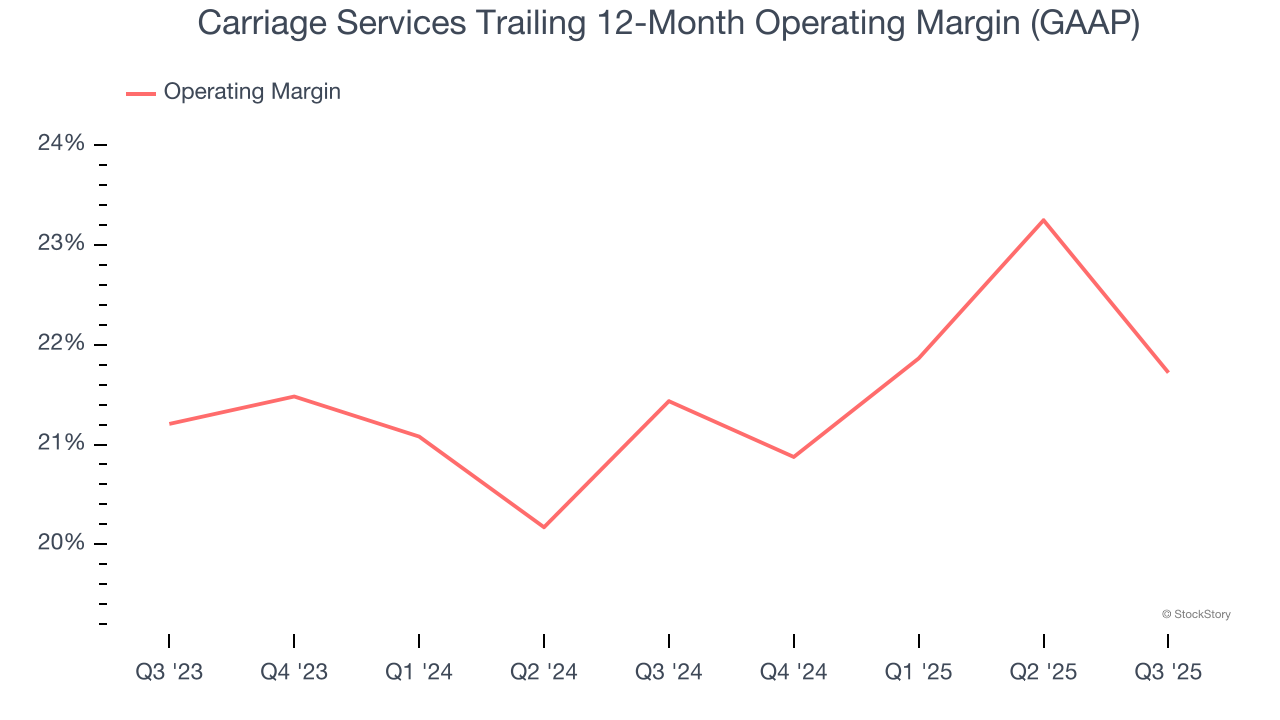

Operating Margin

Carriage Services’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 21.6% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Carriage Services generated an operating margin profit margin of 17%, down 6.1 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

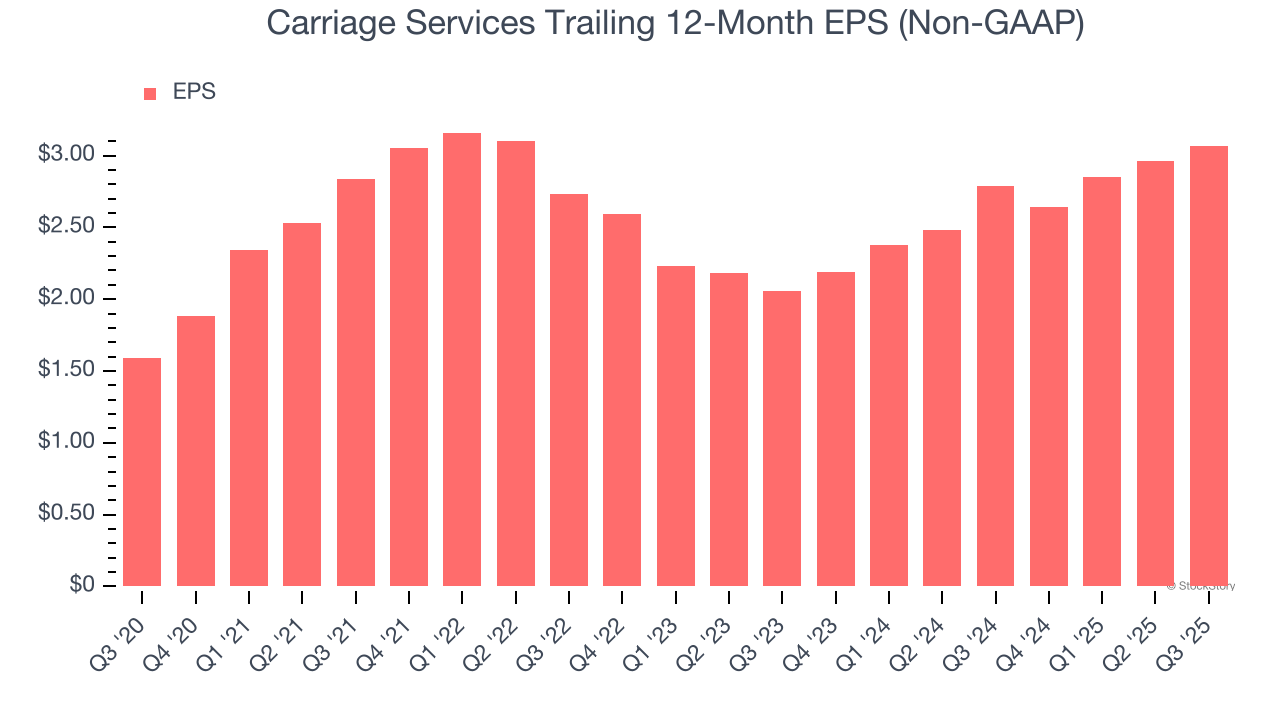

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Carriage Services’s EPS grew at a solid 14.1% compounded annual growth rate over the last five years, higher than its 5.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q3, Carriage Services reported adjusted EPS of $0.75, up from $0.64 in the same quarter last year. This print beat analysts’ estimates by 3%. Over the next 12 months, Wall Street expects Carriage Services’s full-year EPS of $3.07 to grow 10.1%.

Key Takeaways from Carriage Services’s Q3 Results

It was good to see Carriage Services narrowly top analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $43.98 immediately following the results.

Big picture, is Carriage Services a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.