Private prison operator CoreCivic (NYSE: CXW) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 18.1% year on year to $580.4 million. Its non-GAAP profit of $0.24 per share was 7.7% below analysts’ consensus estimates.

Is now the time to buy CoreCivic? Find out by accessing our full research report, it’s free for active Edge members.

CoreCivic (CXW) Q3 CY2025 Highlights:

- Revenue: $580.4 million vs analyst estimates of $541.2 million (18.1% year-on-year growth, 7.3% beat)

- Adjusted EPS: $0.24 vs analyst expectations of $0.26 (7.7% miss)

- Adjusted EBITDA: $88.83 million vs analyst estimates of $90.96 million (15.3% margin, 2.3% miss)

- Management lowered its full-year Adjusted EPS guidance to $1.03 at the midpoint, a 6.8% decrease

- EBITDA guidance for the full year is $357 million at the midpoint, below analyst estimates of $371.5 million

- Operating Margin: 22.5%, up from 9% in the same quarter last year

- Market Capitalization: $1.97 billion

Damon T. Hininger, CoreCivic's Chief Executive Officer, commented, "Ongoing demand for the solutions we provide, particularly from U.S. Immigration and Customs Enforcement (ICE), contributed to a solid third quarter. Despite the prolonged federal government shutdown, as law enforcement is an essential government service, our detention populations and our revenues have been unaffected by the shutdown. We expect detainee populations to continue to grow as ICE implements its interior enforcement plan, contributing to a strong 2025. The recently announced contract awards at four facilities negatively impact our financial guidance for the fourth quarter for start-up expenses related to these contracts, but these new contracts are expected to drive our 2026 results even stronger, when we expect these facilities to achieve stabilized occupancy. Following these activations, we have five remaining idle facilities containing over 7,000 beds."

Company Overview

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2.09 billion in revenue over the past 12 months, CoreCivic is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

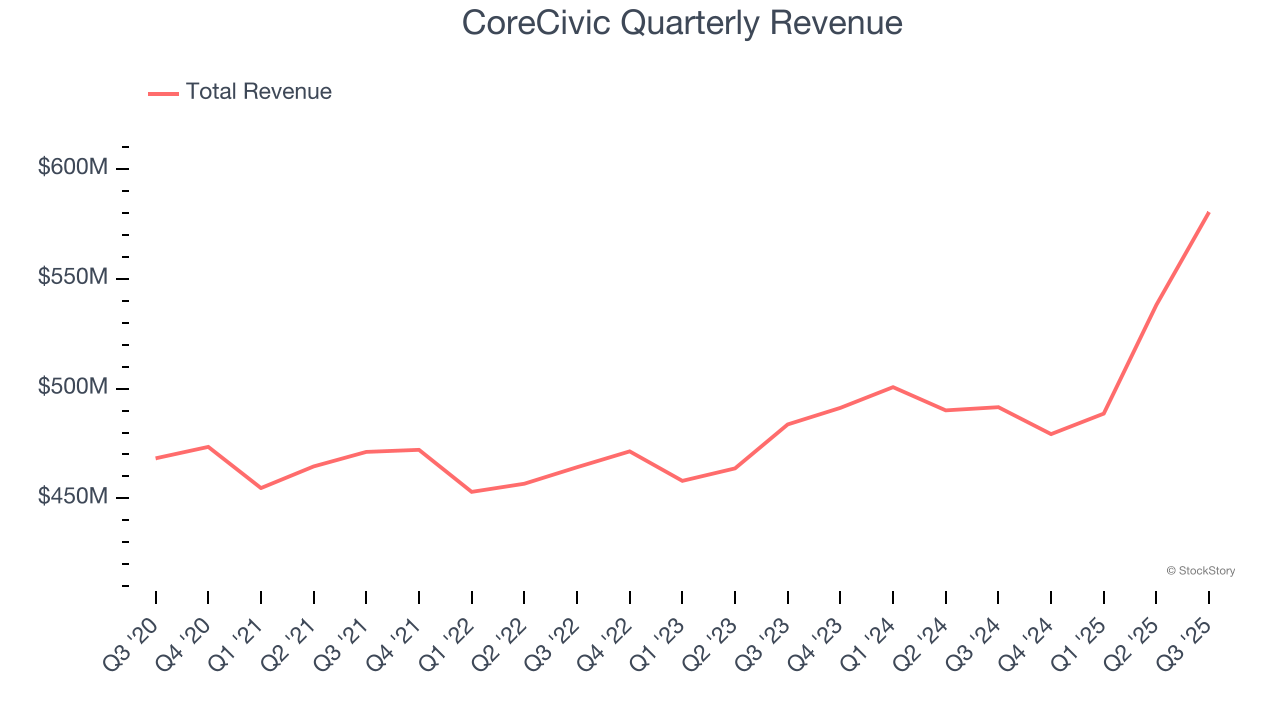

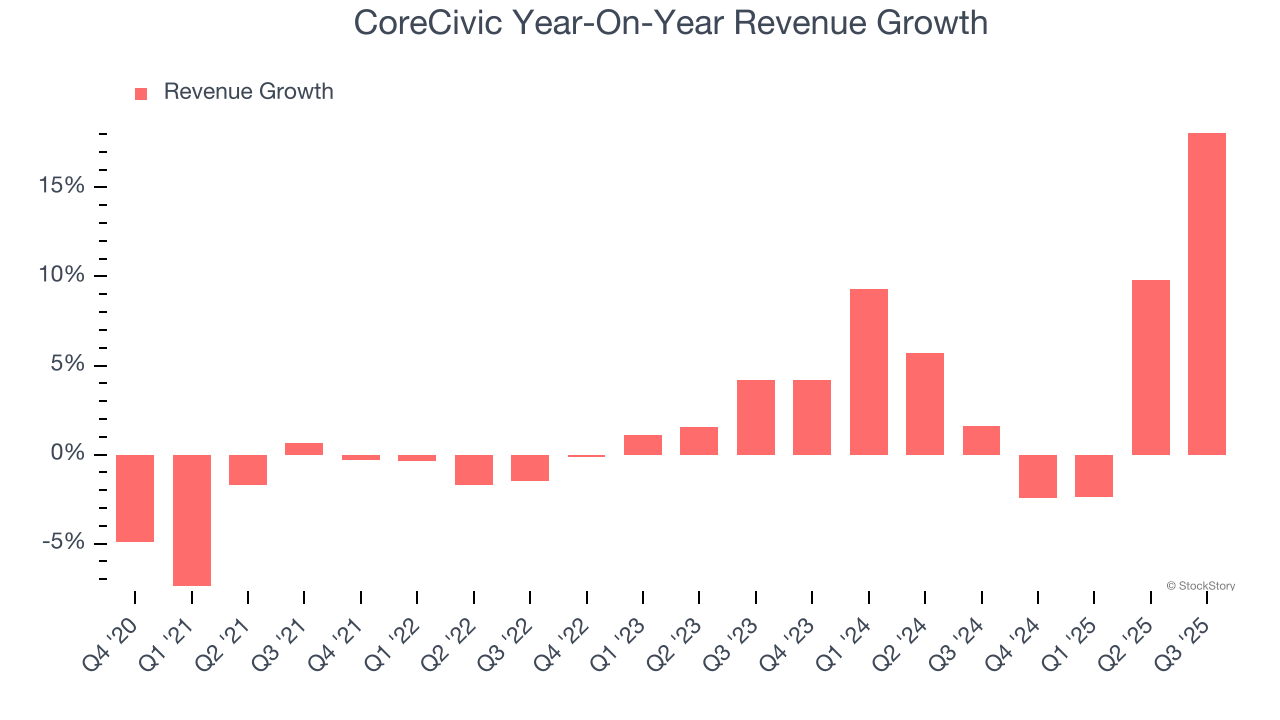

As you can see below, CoreCivic grew its sales at a sluggish 1.6% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CoreCivic’s annualized revenue growth of 5.4% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, CoreCivic reported year-on-year revenue growth of 18.1%, and its $580.4 million of revenue exceeded Wall Street’s estimates by 7.3%.

Looking ahead, sell-side analysts expect revenue to grow 12.3% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

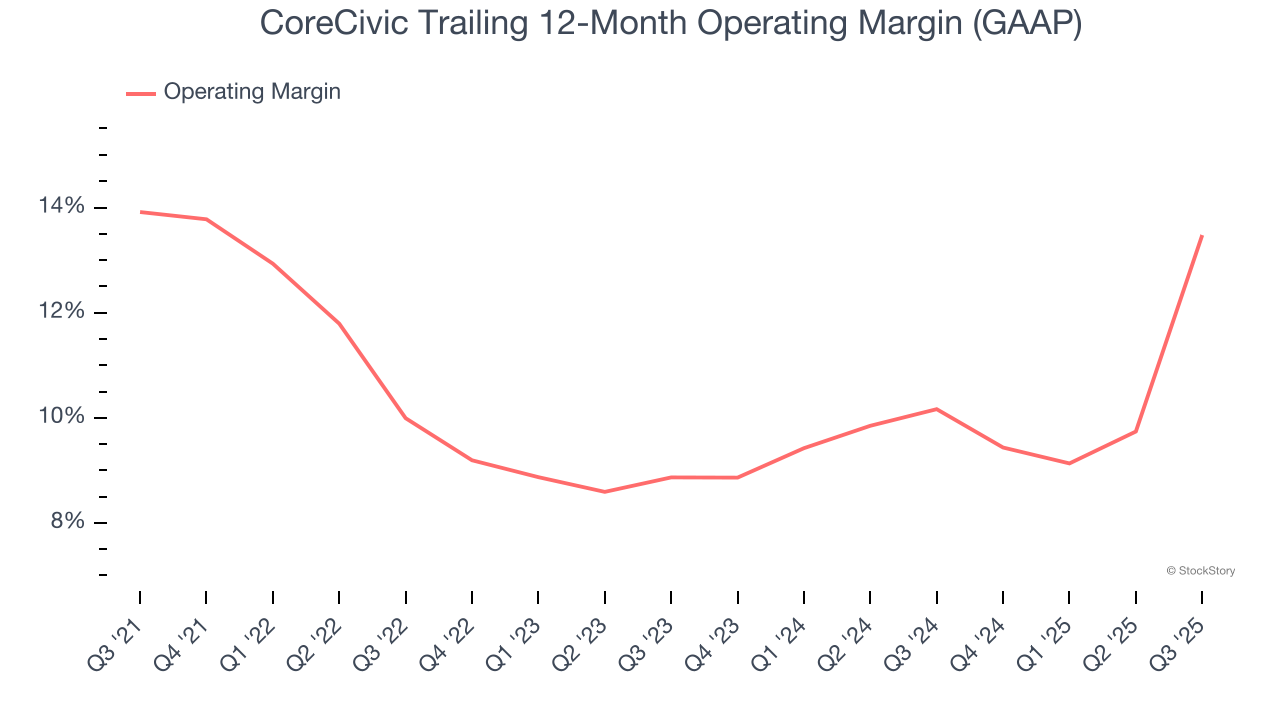

CoreCivic’s operating margin has risen over the last 12 months and averaged 11.3% over the last five years. Its profitability was higher than the broader business services sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, CoreCivic’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, CoreCivic generated an operating margin profit margin of 22.5%, up 13.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

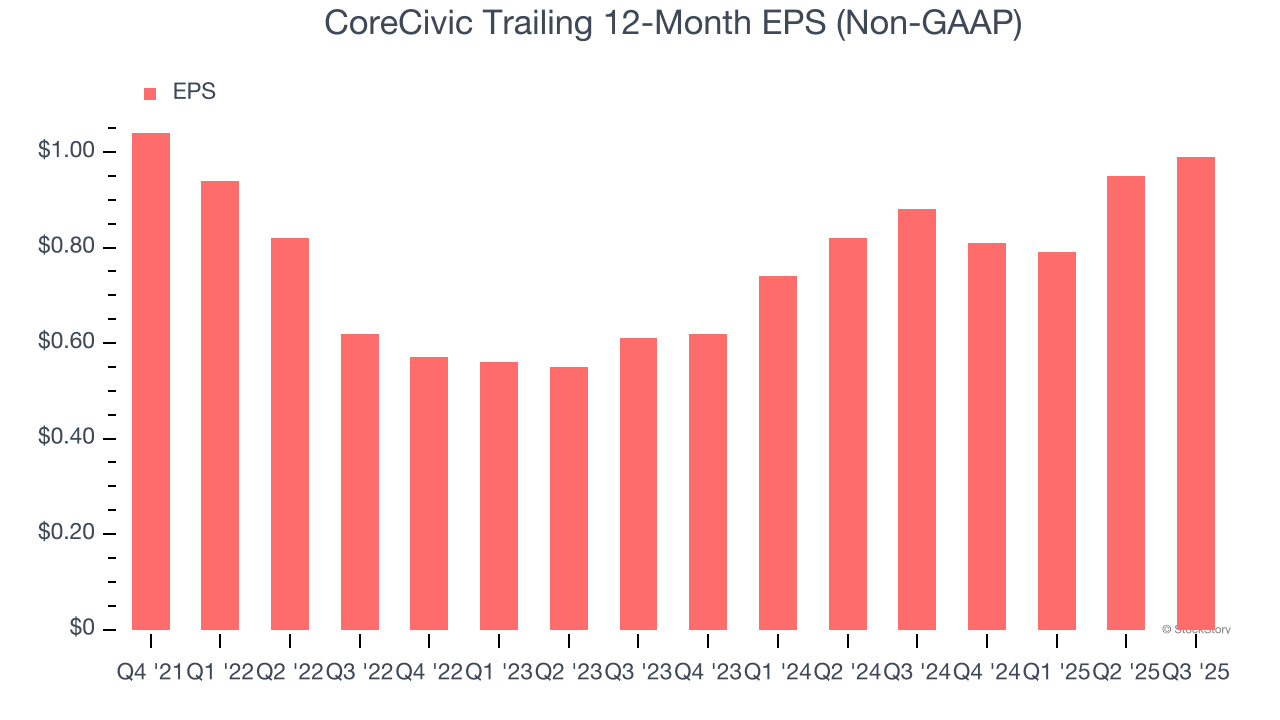

CoreCivic’s full-year EPS grew at a weak 1.9% compounded annual growth rate over the last four years, worse than the broader business services sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

CoreCivic’s EPS grew at an astounding 27.4% compounded annual growth rate over the last two years, higher than its 5.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

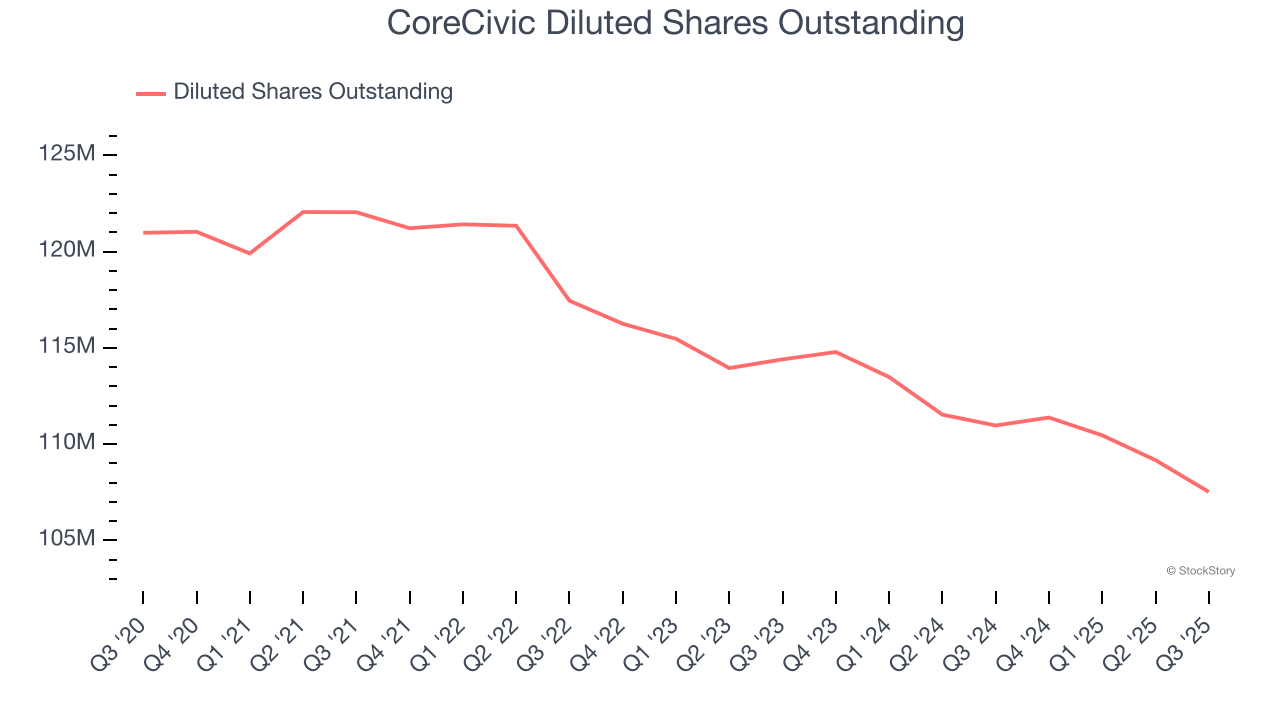

We can take a deeper look into CoreCivic’s earnings quality to better understand the drivers of its performance. CoreCivic’s operating margin has expanded over the last two yearswhile its share count has shrunk 6%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, CoreCivic reported adjusted EPS of $0.24, up from $0.20 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects CoreCivic’s full-year EPS of $0.99 to grow 53.5%.

Key Takeaways from CoreCivic’s Q3 Results

We were impressed by how significantly CoreCivic blew past analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $18.59 immediately following the results.

CoreCivic’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.