Custom Truck One Source has had an impressive run over the past six months as its shares have beaten the S&P 500 by 16.8%. The stock now trades at $5.74, marking a 36.7% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Custom Truck One Source, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Custom Truck One Source Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about Custom Truck One Source. Here are three reasons you should be careful with CTOS and a stock we'd rather own.

1. Lackluster Revenue Growth

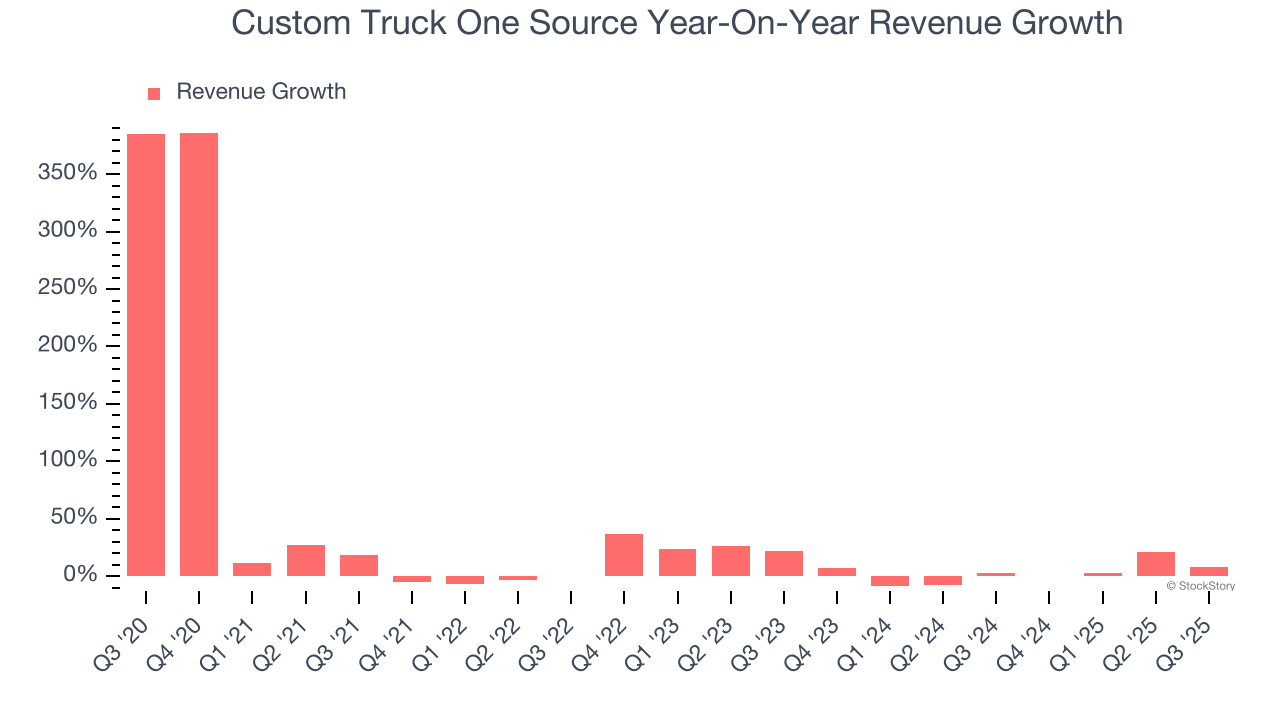

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Custom Truck One Source’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.9% over the last two years was well below its five-year trend.

2. EPS Took a Dip Over the Last Two Years

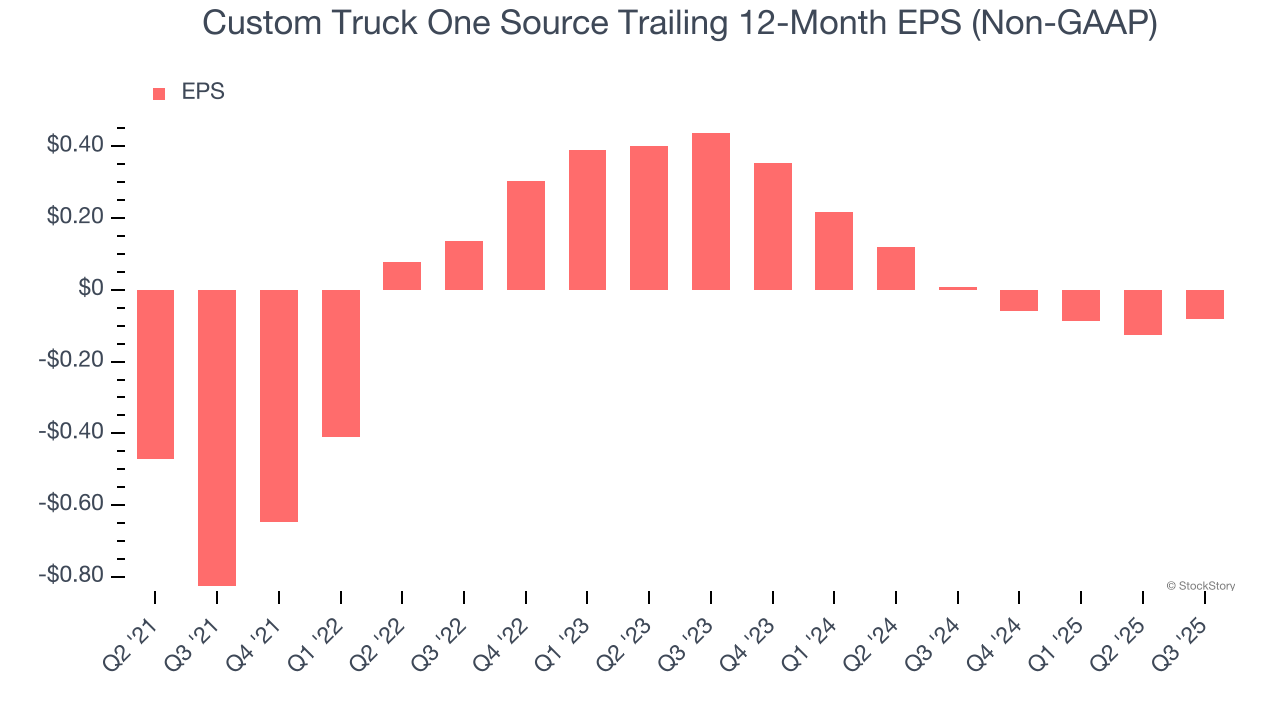

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Custom Truck One Source, its EPS declined by 47.9% annually over the last two years while its revenue grew by 2.9%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

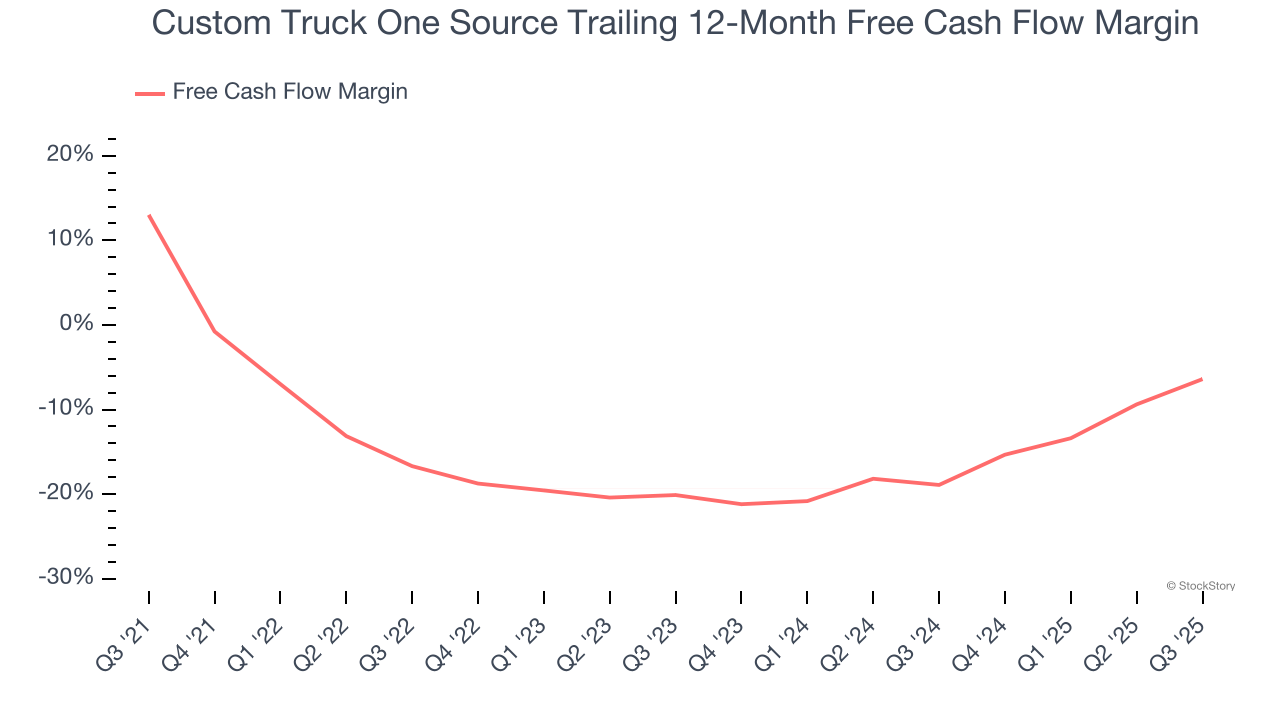

As you can see below, Custom Truck One Source’s margin dropped by 19.4 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Custom Truck One Source’s free cash flow margin for the trailing 12 months was negative 6.4%.

Final Judgment

Custom Truck One Source isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 3.2× forward EV-to-EBITDA (or $5.74 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Custom Truck One Source

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.