Cloud observability platform Dynatrace (NYSE: DT) announced better-than-expected revenue in Q3 CY2025, with sales up 18.1% year on year to $493.8 million. Guidance for next quarter’s revenue was better than expected at $505.5 million at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $0.44 per share was 7.5% above analysts’ consensus estimates.

Is now the time to buy Dynatrace? Find out by accessing our full research report, it’s free for active Edge members.

Dynatrace (DT) Q3 CY2025 Highlights:

- Revenue: $493.8 million vs analyst estimates of $487.4 million (18.1% year-on-year growth, 1.3% beat)

- Adjusted EPS: $0.44 vs analyst estimates of $0.41 (7.5% beat)

- Adjusted Operating Income: $152.8 million vs analyst estimates of $143.4 million (30.9% margin, 6.6% beat)

- The company slightly lifted its revenue guidance for the full year to $1.99 billion at the midpoint from $1.98 billion

- Management raised its full-year Adjusted EPS guidance to $1.63 at the midpoint, a 2.2% increase

- Operating Margin: 14.8%, up from 11.2% in the same quarter last year

- Free Cash Flow Margin: 5.6%, down from 54.9% in the previous quarter

- Annual Recurring Revenue: $1.90 billion vs analyst estimates of $1.87 billion (17.5% year-on-year growth, 1.4% beat)

- Billings: $378.6 million at quarter end, up 3.8% year on year

- Market Capitalization: $14.96 billion

“Our strong second quarter results were fueled by the growing demand for end-to-end observability driven by large-scale tool consolidations,” said Rick McConnell, CEO of Dynatrace.

Company Overview

With its platform processing over 30 trillion pieces of IT performance data daily, Dynatrace (NYSE: DT) provides an AI-powered platform that helps organizations monitor, secure, and optimize their applications and IT infrastructure across cloud environments.

Revenue Growth

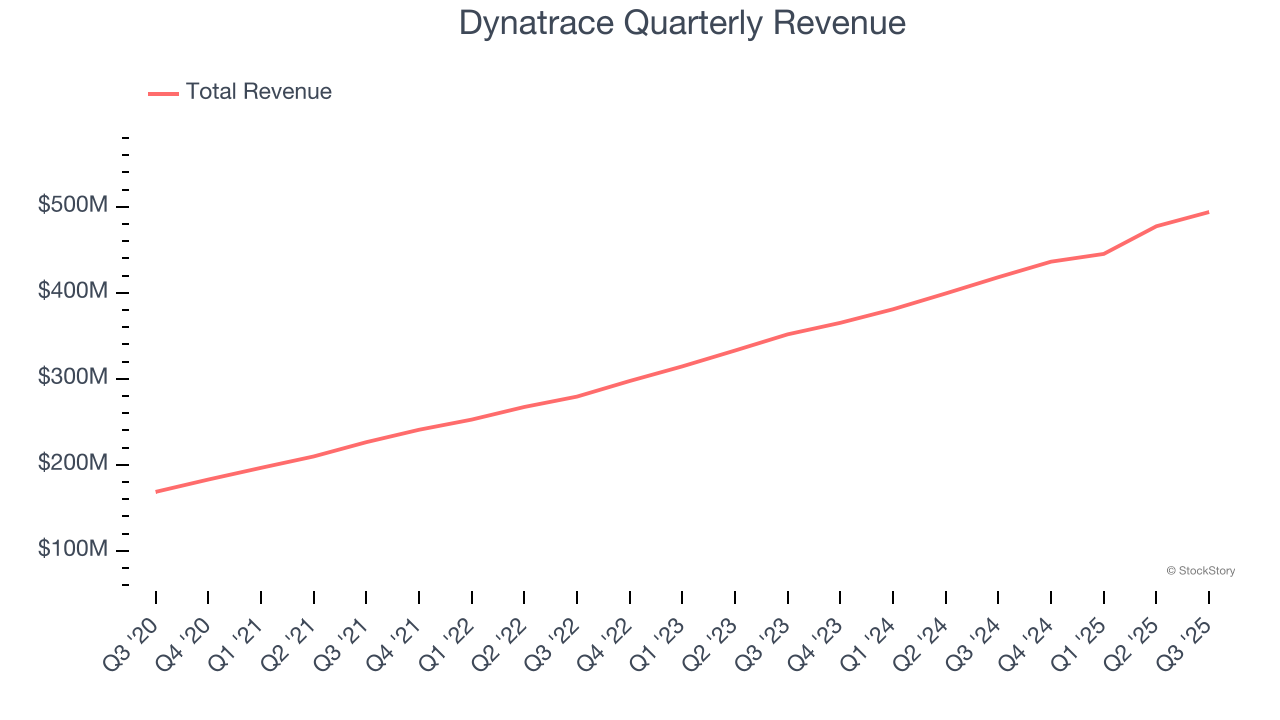

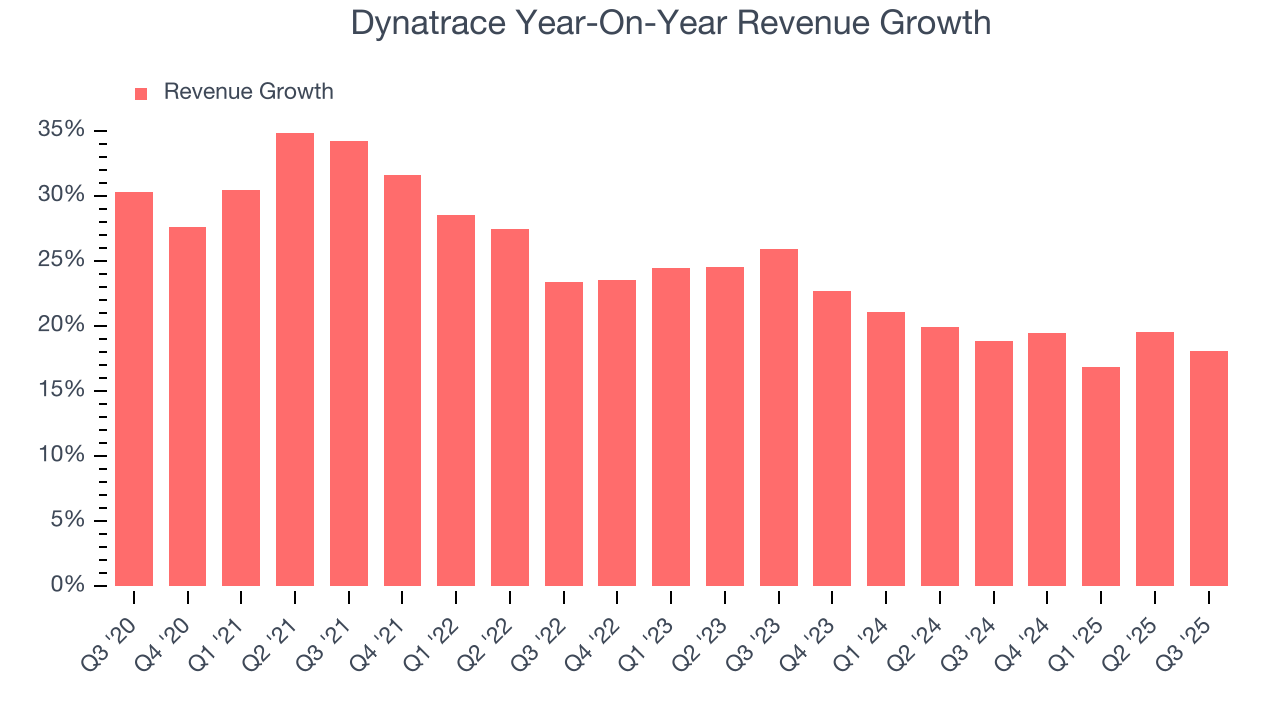

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Dynatrace grew its sales at a solid 24.6% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Dynatrace’s annualized revenue growth of 19.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Dynatrace reported year-on-year revenue growth of 18.1%, and its $493.8 million of revenue exceeded Wall Street’s estimates by 1.3%. Company management is currently guiding for a 15.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

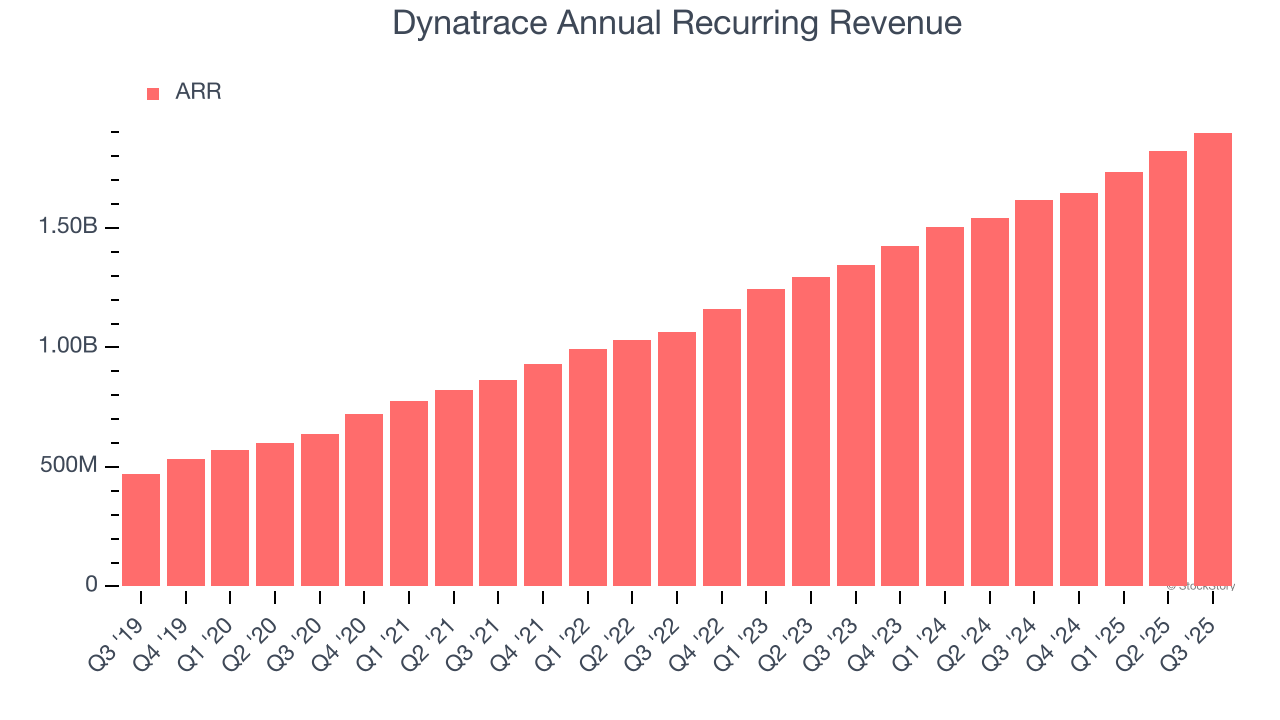

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Dynatrace’s ARR punched in at $1.90 billion in Q3, and over the last four quarters, its growth slightly outpaced the sector as it averaged 16.7% year-on-year increases. This performance aligned with its total sales growth and shows the company is securing longer-term commitments. Its growth also contributes positively to Dynatrace’s revenue predictability, a trait long-term investors typically prefer.

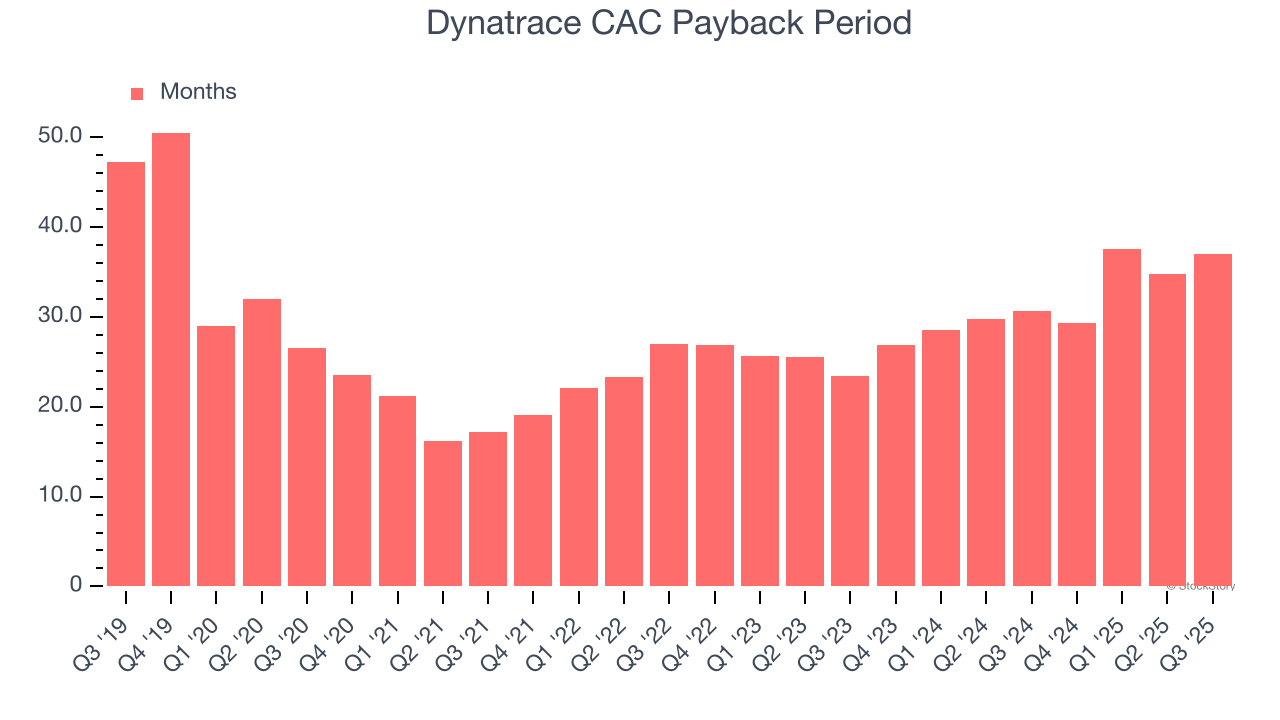

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Dynatrace is efficient at acquiring new customers, and its CAC payback period checked in at 37 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from Dynatrace’s Q3 Results

It was good to see Dynatrace provide full-year EPS guidance that slightly beat analysts’ expectations. We were also happy its annual recurring revenue narrowly outperformed Wall Street’s estimates. Full-year revenue and EPS guidance were both raised. On the other hand, its billings missed. Zooming out, we still think this was a decent quarter. The stock traded up 2.9% to $51.08 immediately following the results.

Is Dynatrace an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.