Home warranty company Frontdoor (NASDAQ: FTDR) announced better-than-expected revenue in Q3 CY2025, with sales up 14.4% year on year to $618 million. Guidance for next quarter’s revenue was better than expected at $420 million at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $1.58 per share was 4.6% above analysts’ consensus estimates.

Is now the time to buy Frontdoor? Find out by accessing our full research report, it’s free for active Edge members.

Frontdoor (FTDR) Q3 CY2025 Highlights:

- Revenue: $618 million vs analyst estimates of $611 million (14.4% year-on-year growth, 1.1% beat)

- Adjusted EPS: $1.58 vs analyst estimates of $1.51 (4.6% beat)

- Adjusted EBITDA: $195 million vs analyst estimates of $187.6 million (31.6% margin, 3.9% beat)

- Revenue Guidance for Q4 CY2025 is $420 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $547.5 million at the midpoint, above analyst estimates of $541.2 million

- Operating Margin: 23%, down from 25.7% in the same quarter last year

- Free Cash Flow Margin: 9.4%, up from 3% in the same quarter last year

- Market Capitalization: $4.79 billion

“Frontdoor is on pace for another year of record financial performance," said Chairman and Chief Executive Officer Bill Cobb.

Company Overview

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ: FTDR) is a provider of home warranty and service plans.

Revenue Growth

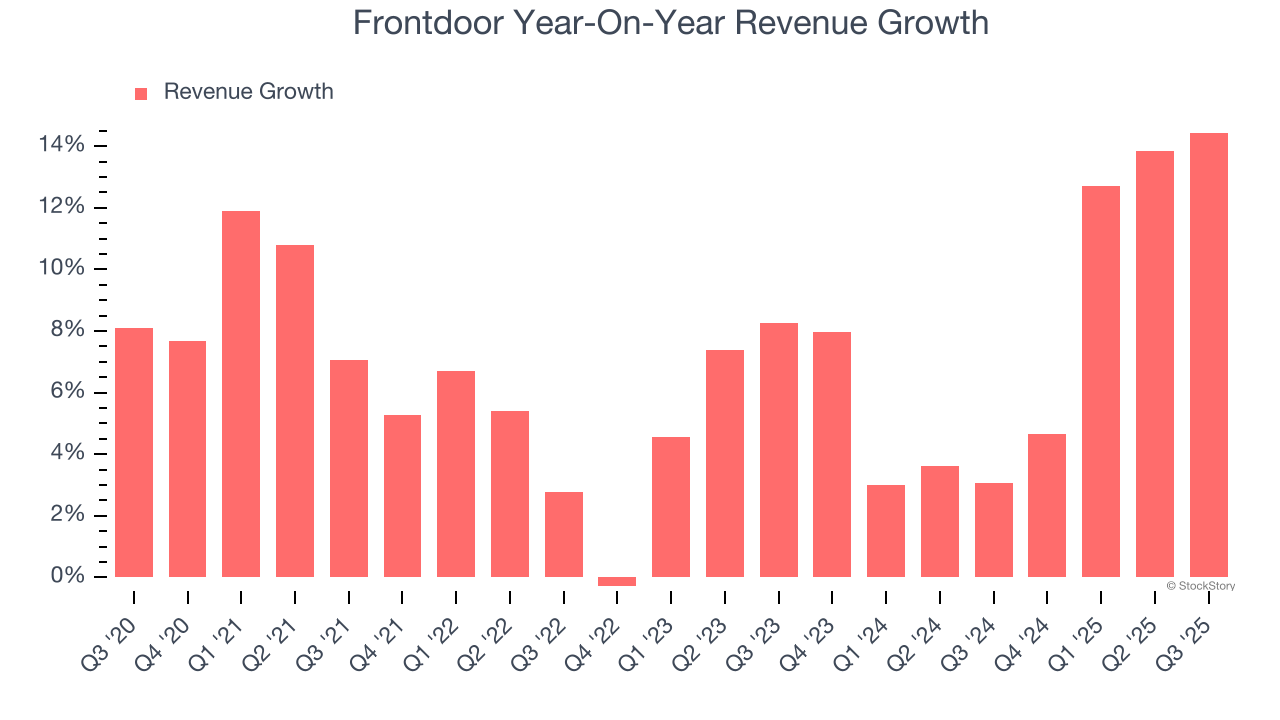

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Frontdoor’s 7.1% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Frontdoor’s annualized revenue growth of 8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Frontdoor reported year-on-year revenue growth of 14.4%, and its $618 million of revenue exceeded Wall Street’s estimates by 1.1%. Company management is currently guiding for a 9.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

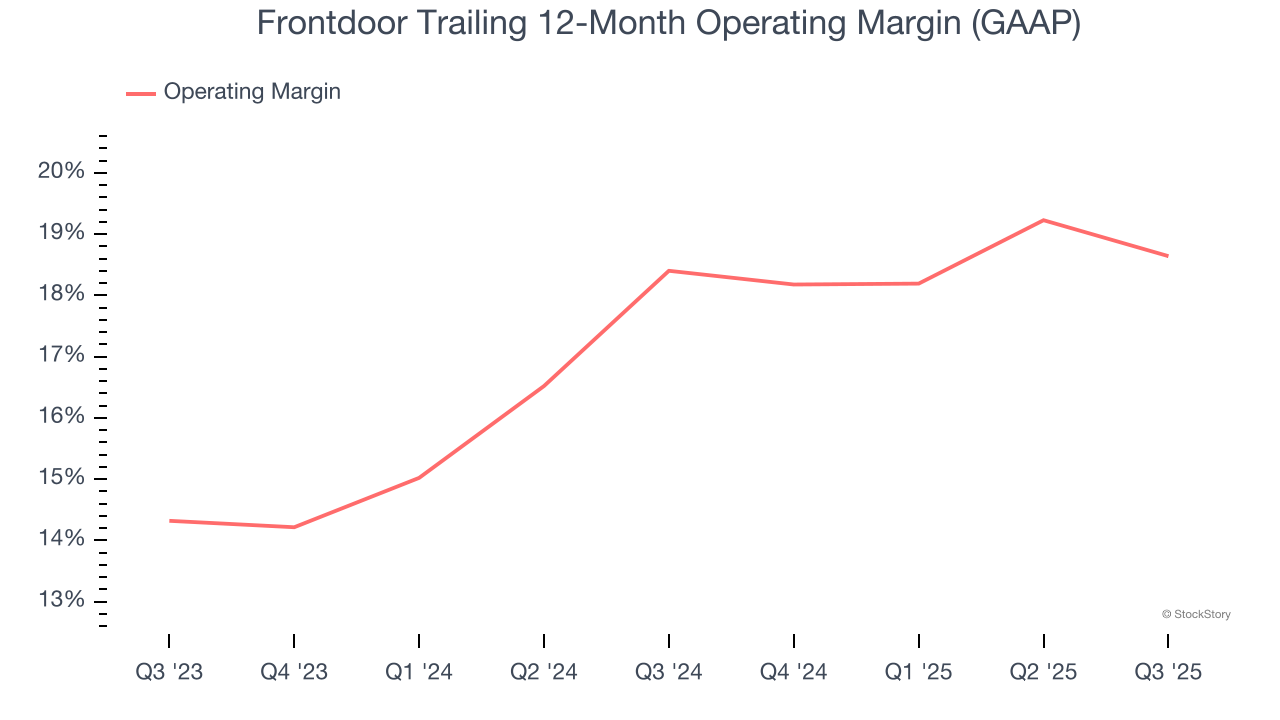

Frontdoor’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 18.5% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q3, Frontdoor generated an operating margin profit margin of 23%, down 2.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

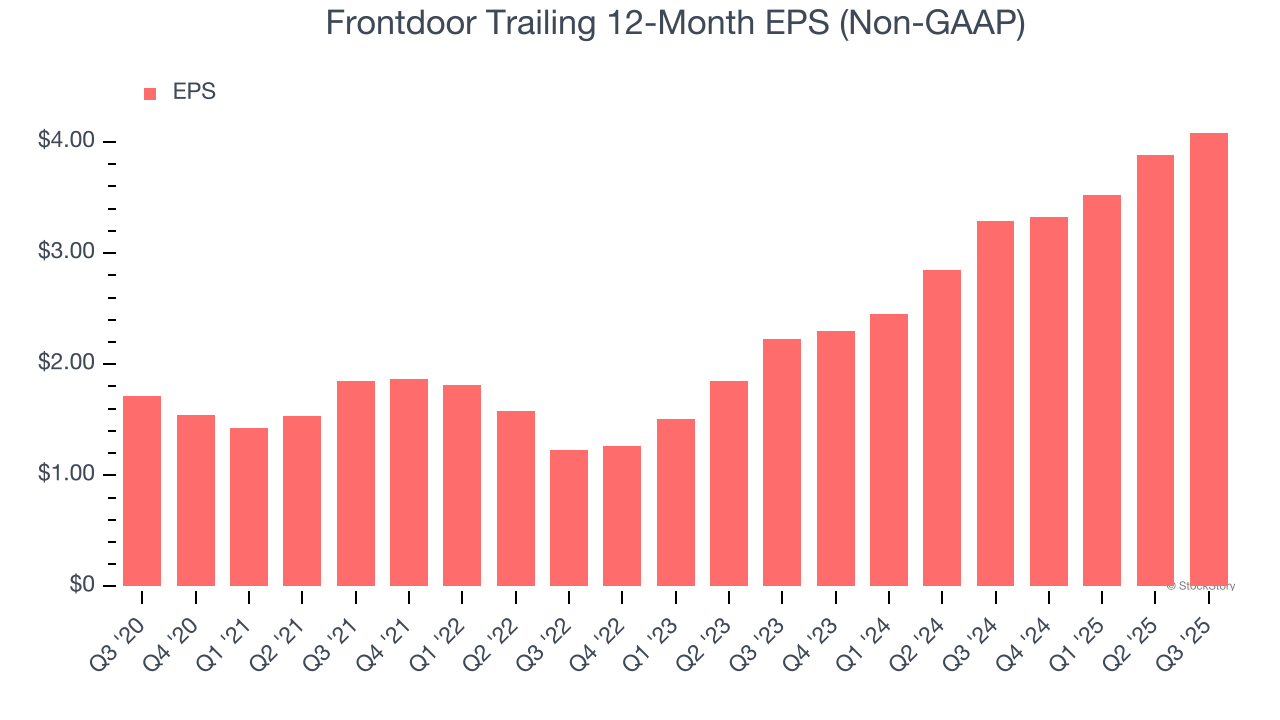

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Frontdoor’s EPS grew at a remarkable 19% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Frontdoor reported adjusted EPS of $1.58, up from $1.38 in the same quarter last year. This print beat analysts’ estimates by 4.6%. Over the next 12 months, Wall Street expects Frontdoor’s full-year EPS of $4.08 to grow 3%.

Key Takeaways from Frontdoor’s Q3 Results

It was encouraging to see Frontdoor beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The stock remained flat at $65.74 immediately after reporting.

So should you invest in Frontdoor right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.