Global insurance giant MetLife (NYSE: MET) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 1.4% year on year to $17.36 billion. Its non-GAAP profit of $2.37 per share was 2.2% above analysts’ consensus estimates.

Is now the time to buy MetLife? Find out by accessing our full research report, it’s free for active Edge members.

MetLife (MET) Q3 CY2025 Highlights:

Company Overview

Founded in 1863 by a group of New York businessmen during the Civil War era, MetLife (NYSE: MET) is a global financial services company that provides insurance, annuities, employee benefits, and asset management services to individuals and businesses worldwide.

Revenue Growth

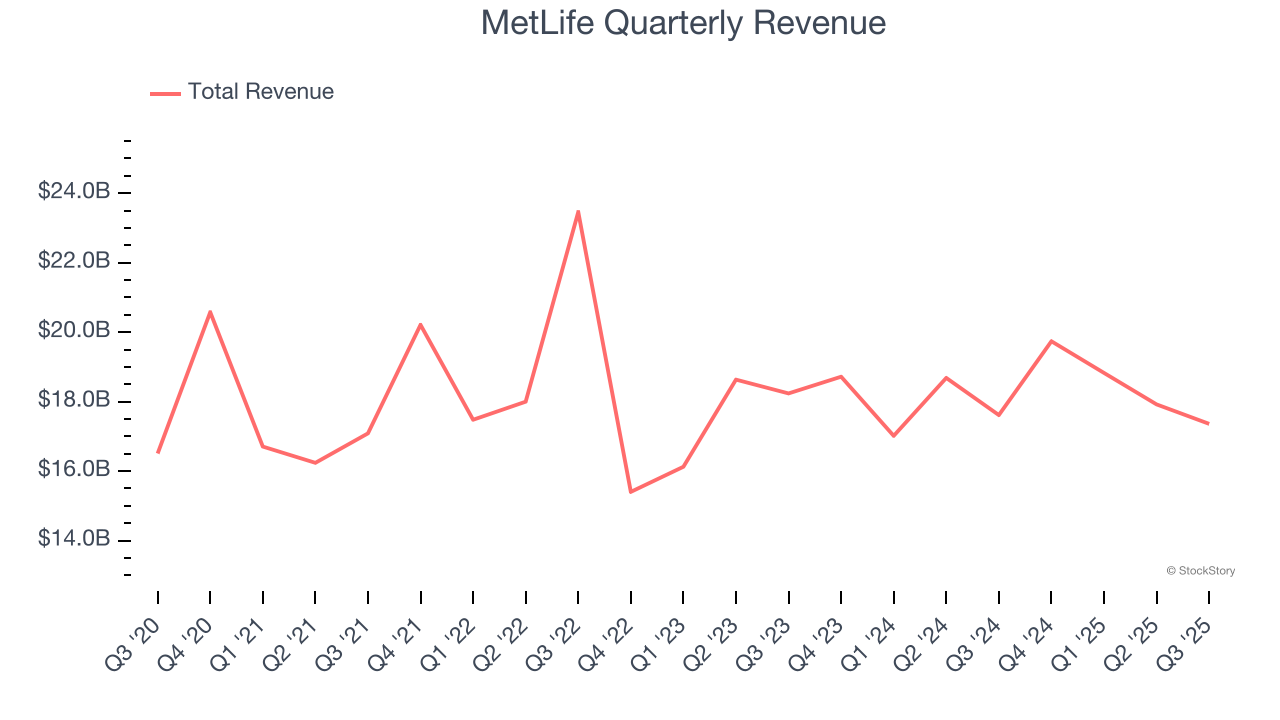

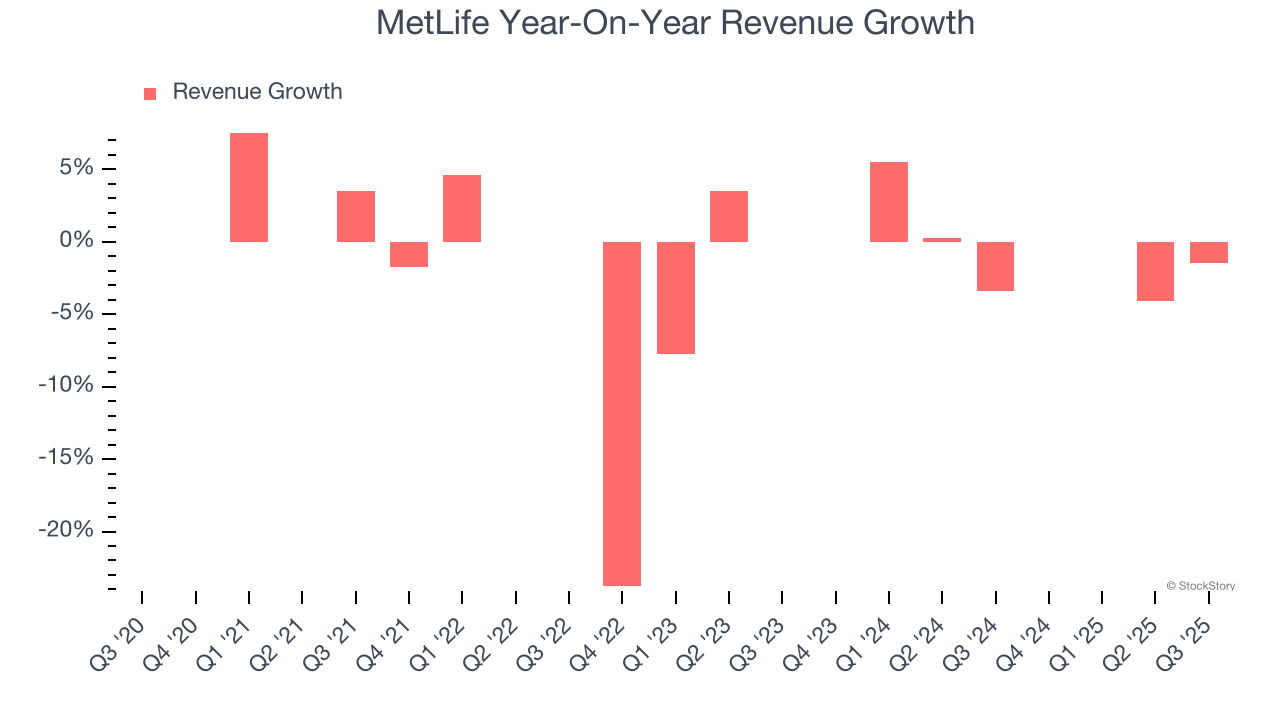

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Regrettably, MetLife’s revenue grew at a sluggish 2.9% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. MetLife’s annualized revenue growth of 3.9% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, MetLife missed Wall Street’s estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $17.36 billion of revenue.

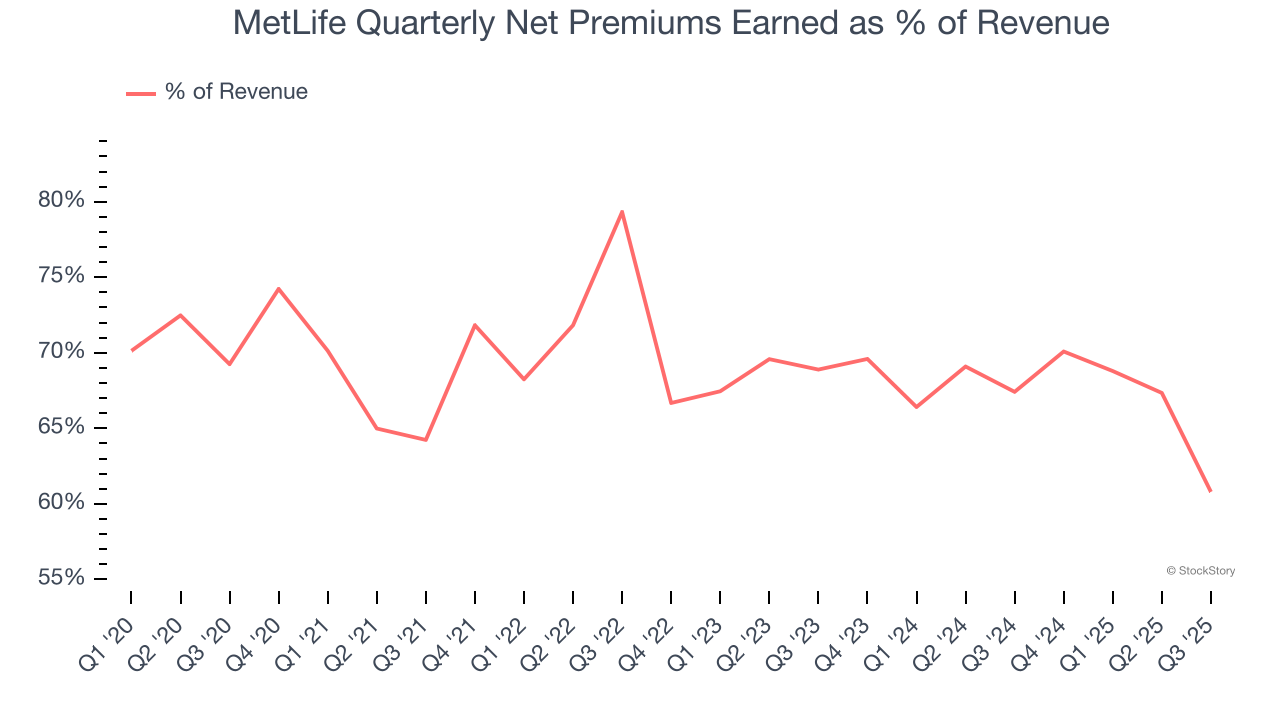

Net premiums earned made up 69.1% of the company’s total revenue during the last five years, meaning insurance operations are MetLife’s largest source of revenue.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Book Value Per Share (BVPS)

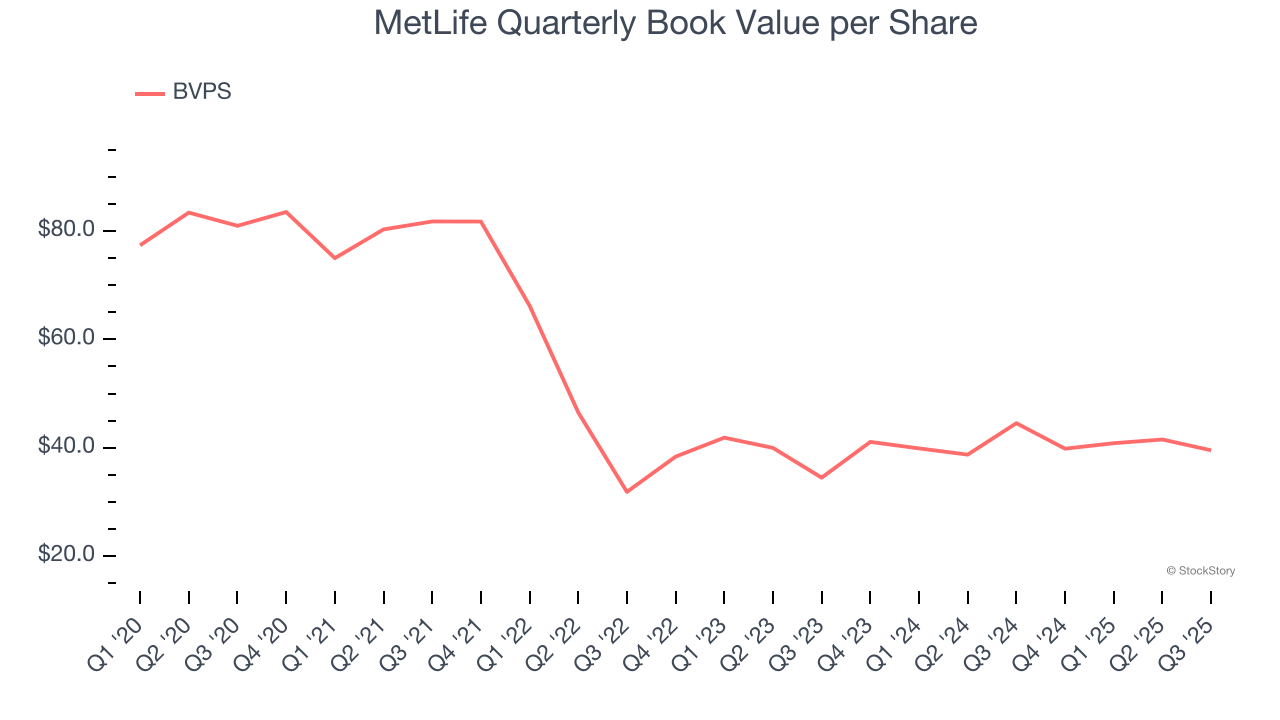

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float–premiums collected but not yet paid out–are invested, creating an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

MetLife’s BVPS declined at a 13.4% annual clip over the last five years. However, BVPS growth has accelerated recently, growing by 7.1% annually over the last two years from $34.47 to $39.52 per share.

Over the next 12 months, Consensus estimates call for MetLife’s BVPS to grow by 60% to $57.64, elite growth rate.

Key Takeaways from MetLife’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its net premiums earned fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.2% to $77.75 immediately after reporting.

MetLife may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.