Financial technology company NCR Atleos (NYSE: NATL) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 4% year on year to $1.12 billion. Its GAAP profit of $0.34 per share was 51.4% below analysts’ consensus estimates.

Is now the time to buy NCR Atleos? Find out by accessing our full research report, it’s free for active Edge members.

NCR Atleos (NATL) Q3 CY2025 Highlights:

Company Overview

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos (NYSE: NATL) provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

Revenue Growth

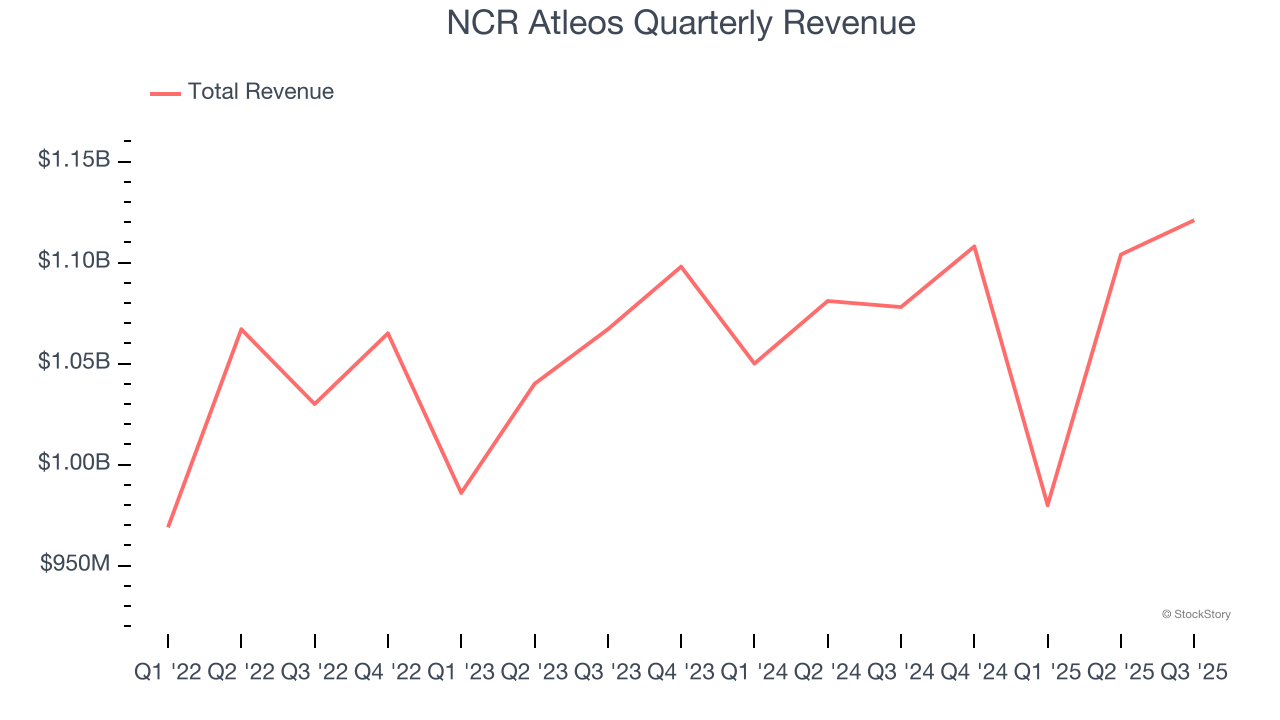

Reviewing a company’s top-line performance can reveal insights into its business quality. Growth can signal it’s capitalizing on a new product or emerging industry trend. NCR Atleos’s annualized revenue growth rate of 1.8% over the last two years was sluggish for a financials business.

This quarter, NCR Atleos reported modest year-on-year revenue growth of 4% but beat Wall Street’s estimates by 0.6%.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from NCR Atleos’s Q3 Results

We struggled to find many positives in these results. Overall, this was a softer quarter. The stock traded down 8.4% to $34.71 immediately after reporting.

NCR Atleos’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.