Product design software company PTC (NASDAQ: PTC) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 42.7% year on year to $893.8 million. On the other hand, next quarter’s revenue guidance of $630 million was less impressive, coming in 1.4% below analysts’ estimates. Its non-GAAP profit of $3.47 per share was 52.7% above analysts’ consensus estimates.

Is now the time to buy PTC? Find out by accessing our full research report, it’s free for active Edge members.

PTC (PTC) Q3 CY2025 Highlights:

- Revenue: $893.8 million vs analyst estimates of $752.9 million (42.7% year-on-year growth, 18.7% beat)

- Adjusted EPS: $3.47 vs analyst estimates of $2.27 (52.7% beat)

- Adjusted Operating Income: $526.3 million vs analyst estimates of $367.6 million (58.9% margin, 43.2% beat)

- Revenue Guidance for Q4 CY2025 is $630 million at the midpoint, below analyst estimates of $639 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.72 at the midpoint, beating analyst estimates by 4.3%

- Operating Margin: 48.5%, up from 31% in the same quarter last year

- Free Cash Flow Margin: 11.2%, down from 37.6% in the previous quarter

- Annual Recurring Revenue: $2.48 billion vs analyst estimates of $2.47 billion (9.9% year-on-year growth, in line)

- Market Capitalization: $23 billion

"Q4 capped a year of solid execution and focus. The divestiture of Kepware and ThingWorx will sharpen our portfolio around CAD, PLM, ALM, and SLM – the foundation of our Intelligent Product Lifecycle vision," said Neil Barua, President and CEO, PTC.

Company Overview

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ: PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

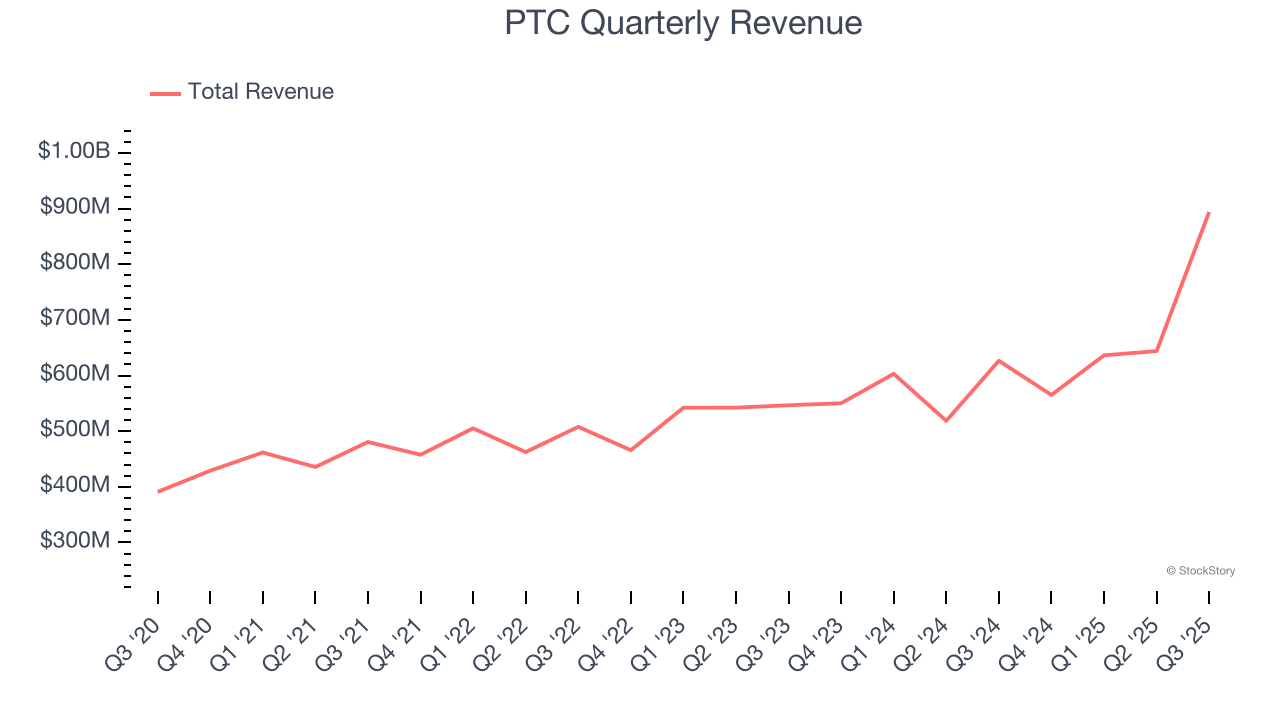

Revenue Growth

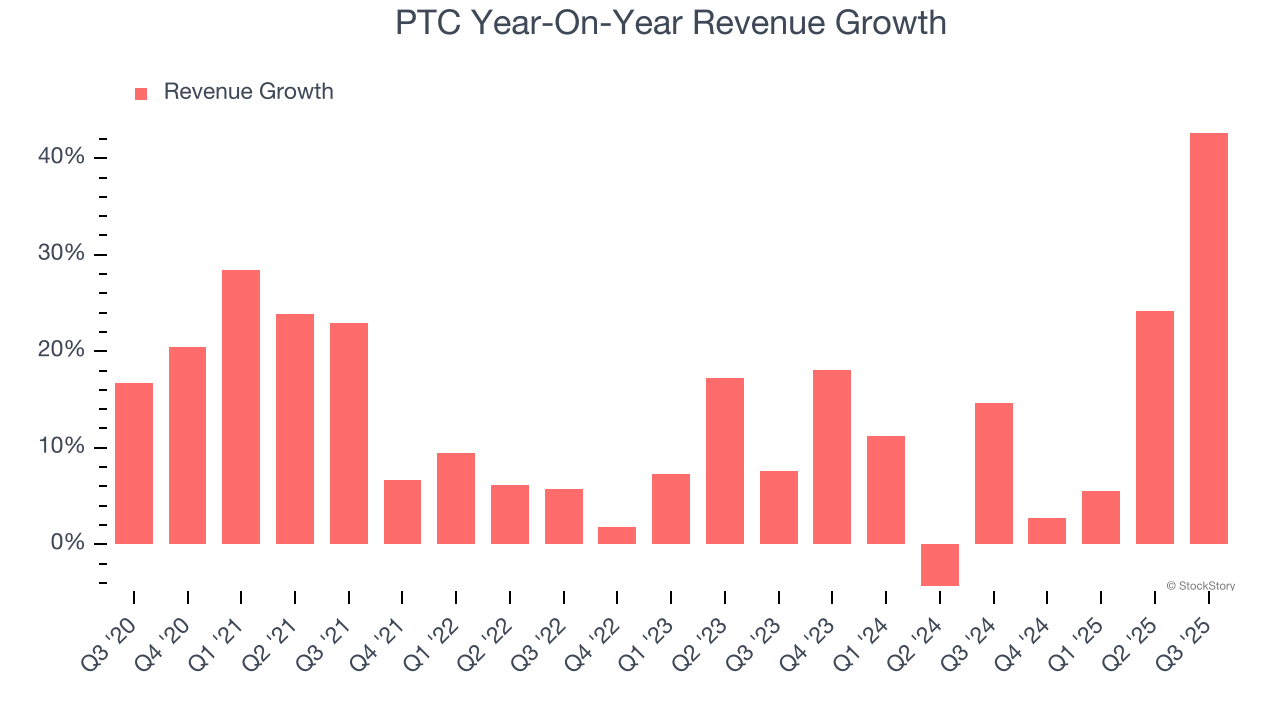

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, PTC grew its sales at a 13.4% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. PTC’s annualized revenue growth of 14.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, PTC reported magnificent year-on-year revenue growth of 42.7%, and its $893.8 million of revenue beat Wall Street’s estimates by 18.7%. Company management is currently guiding for a 11.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

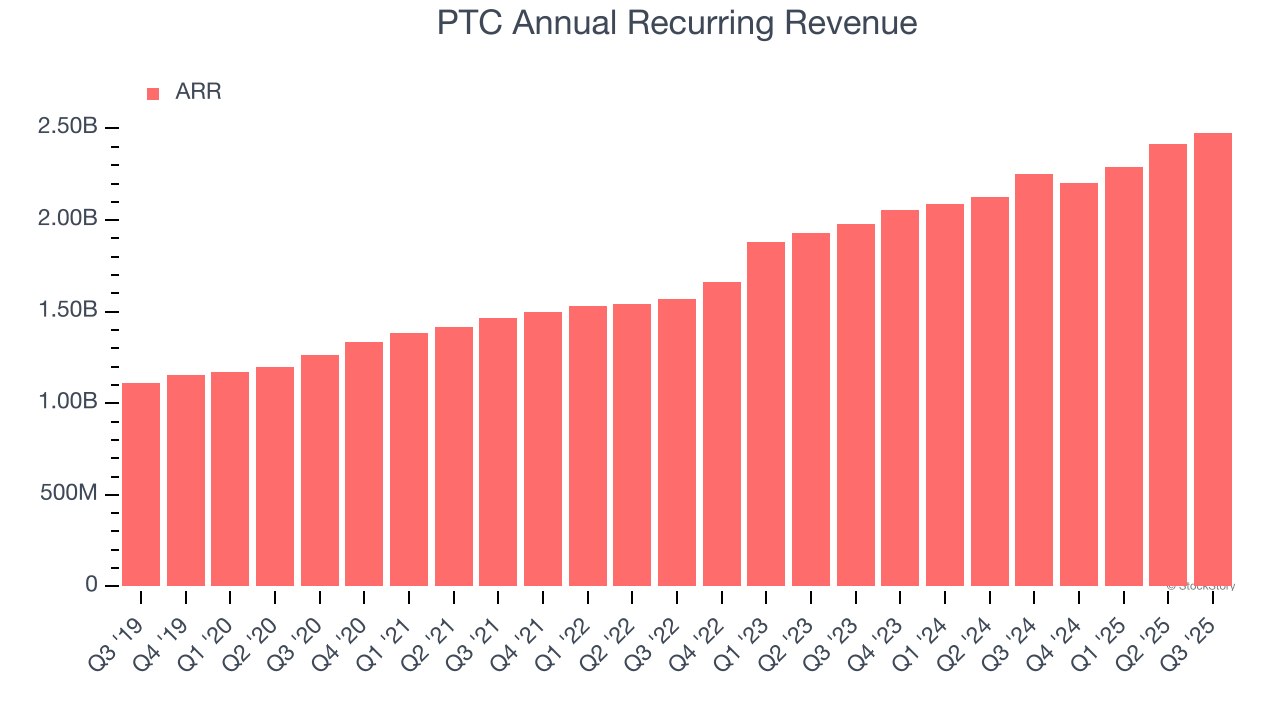

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

PTC’s ARR came in at $2.48 billion in Q3, and over the last four quarters, its growth was underwhelming as it averaged 10.1% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

PTC is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15.2 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from PTC’s Q3 Results

We were impressed by how significantly PTC blew past analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this print was mixed. The market seemed to be hoping for more, and the stock traded down 3.6% to $183 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.