Stock photography and footage provider Shutterstock (NYSE: SSTK) announced better-than-expected revenue in Q3 CY2025, with sales up 3.8% year on year to $260.1 million. Its non-GAAP profit of $0.99 per share was 13.9% below analysts’ consensus estimates.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it’s free for active Edge members.

Shutterstock (SSTK) Q3 CY2025 Highlights:

- With regards to the pending merger with Getty Images, the company said "we remain committed to the merger and will continue to engage with the UK's Competition and Markets Authority and will work with Getty Images to expeditiously secure the necessary clearances."

- Revenue: $260.1 million vs analyst estimates of $256.1 million (3.8% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.99 vs analyst expectations of $1.15 (13.9% miss)

- Adjusted EBITDA: $79.43 million vs analyst estimates of $68.5 million (30.5% margin, 16% beat)

- Operating Margin: 12.5%, up from 7.2% in the same quarter last year

- Free Cash Flow Margin: 28.9%, up from 5.8% in the previous quarter

- Paid Downloads: 111.7 million, in line with the same quarter last year

- Market Capitalization: $769.8 million

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "Shutterstock achieved another strong quarter of financial results. Revenue grew 4% on the back of the fast-growing Data, Distribution, and Services business, while Adjusted EBITDA margins remained over 30% for the second consecutive quarter, and Free Cash Flow significantly increased. Despite the evolving competitive landscape, we continue to improve the value proposition of our unlimited content products by including AI image, video, and audio generative models as part of our offering. Additionally, we are attracting new logos and expanding relationships with existing customers within our Data, Distribution, and Services business. "

Company Overview

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

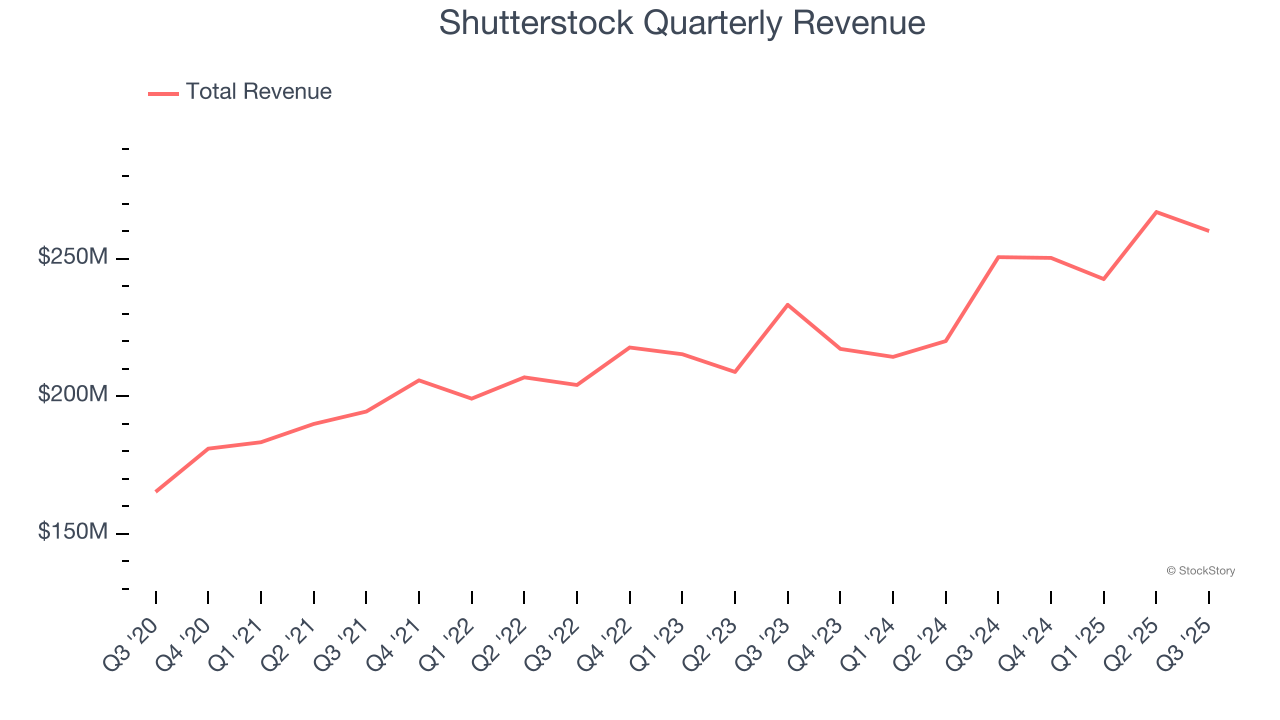

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Shutterstock’s sales grew at a tepid 7.7% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Shutterstock reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Paid Downloads

Request Growth

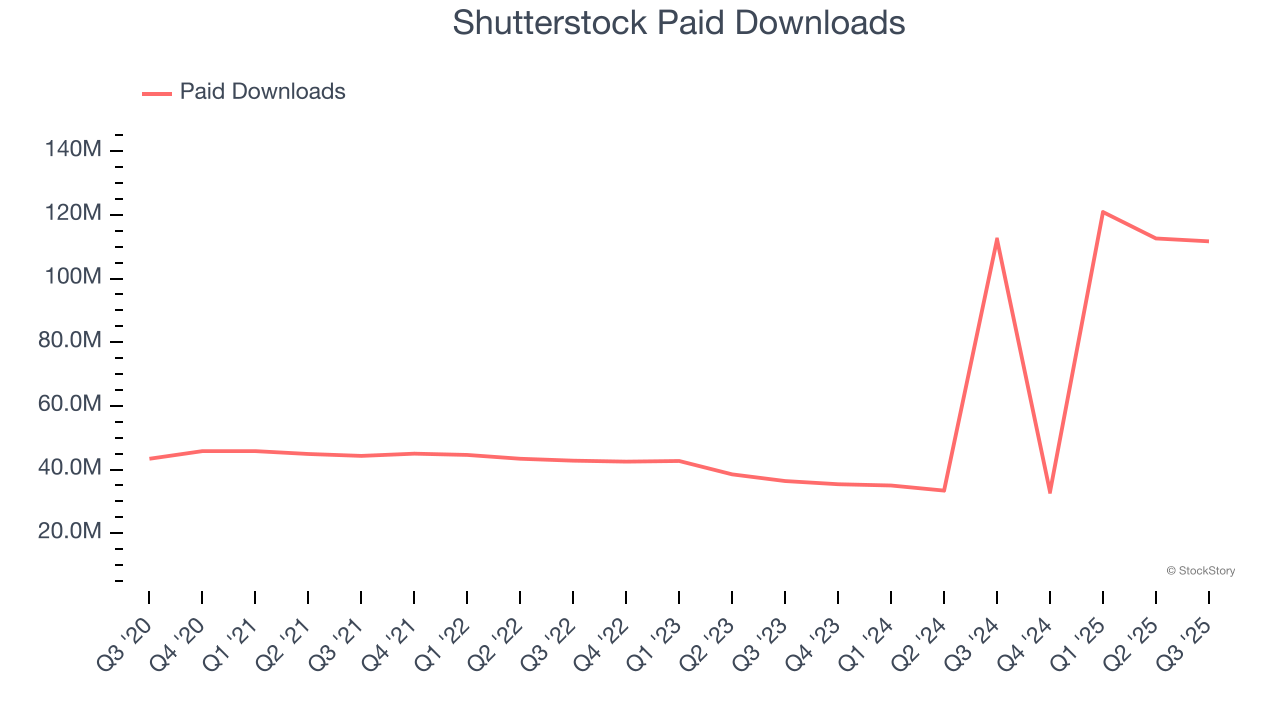

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Shutterstock’s paid downloads, a key performance metric for the company, increased by 79.5% annually to 111.7 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

Unfortunately, Shutterstock’s paid downloads were flat year on year in Q3. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for requests yet.

Revenue Per Request

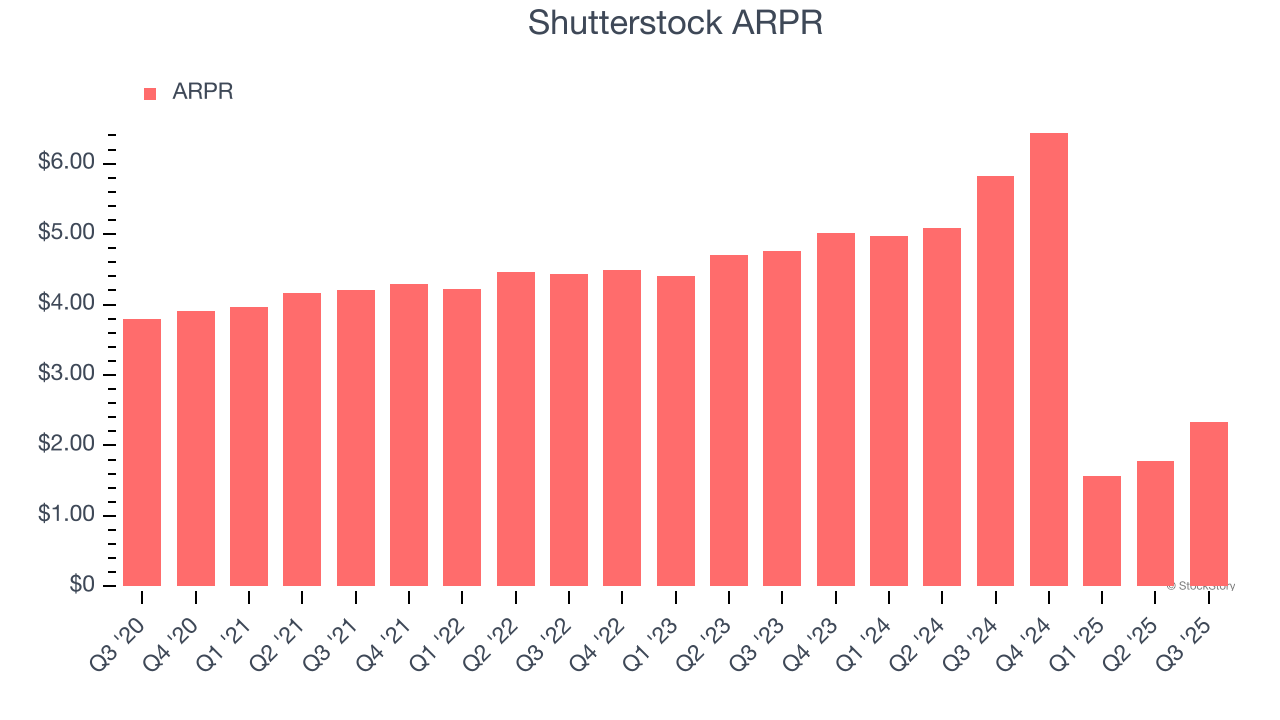

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. ARPR also gives us unique insights into a user’s average order size and Shutterstock’s take rate, or "cut", on each order.

Shutterstock’s ARPR fell over the last two years, averaging 13.8% annual declines. This isn’t great, but the increase in paid downloads is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Shutterstock tries boosting ARPR by taking a more aggressive approach to monetization, it’s unclear whether requests can continue growing at the current pace.

This quarter, Shutterstock’s ARPR clocked in at $2.33. It declined 60% year on year, worse than the change in its paid downloads.

Key Takeaways from Shutterstock’s Q3 Results

We were impressed by how significantly Shutterstock blew past analysts’ EBITDA expectations this quarter. We were also excited its number of paid downloads outperformed Wall Street’s estimates by a wide margin. On the other hand, its number of requests was disappointing. Zooming out, we think this quarter featured some important positives. The stock traded up 6.1% to $23.06 immediately following the results.

Indeed, Shutterstock had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.