Plant-based food and beverage company SunOpta (NASDAQ: STKL) announced better-than-expected revenue in Q3 CY2025, with sales up 16.6% year on year to $205.4 million. The company’s full-year revenue guidance of $872.5 million at the midpoint came in 7.9% above analysts’ estimates. Its non-GAAP profit of $0.05 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy SunOpta? Find out by accessing our full research report, it’s free for active Edge members.

SunOpta (STKL) Q3 CY2025 Highlights:

- Revenue: $205.4 million vs analyst estimates of $195.3 million (16.6% year-on-year growth, 5.2% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.03 ($0.02 beat)

- Adjusted EBITDA: $23.58 million vs analyst estimates of $23.62 million (11.5% margin, in line)

- The company lifted its revenue guidance for the full year to $872.5 million at the midpoint from $810 million, a 7.7% increase

- EBITDA guidance for the full year is $105 million at the midpoint, above analyst estimates of $101.2 million

- Operating Margin: 3.3%, up from 0.9% in the same quarter last year

- Free Cash Flow Margin: 5.9%, similar to the same quarter last year

- Market Capitalization: $625.2 million

"We delivered outstanding revenue growth in the third quarter and affirmed the strength of our competitive position, the diversity of our revenue streams and the robust demand across our portfolio," said Brian Kocher, Chief Executive Officer of SunOpta.

Company Overview

Committed to clean-label foods, SunOpta (NASDAQ: STKL) is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of organic products.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $792.4 million in revenue over the past 12 months, SunOpta is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

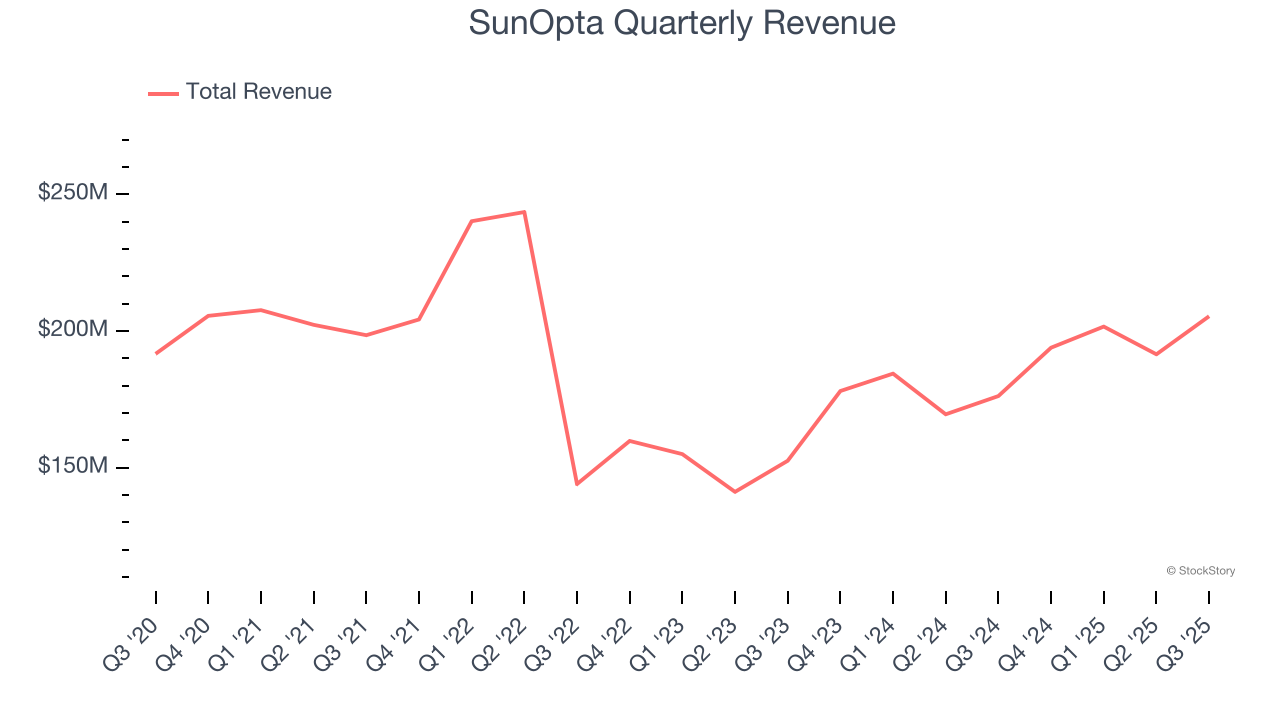

As you can see below, SunOpta’s revenue declined by 1.6% per year over the last three years despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, SunOpta reported year-on-year revenue growth of 16.6%, and its $205.4 million of revenue exceeded Wall Street’s estimates by 5.2%.

Looking ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months, an acceleration versus the last three years. This projection is admirable and suggests its newer products will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

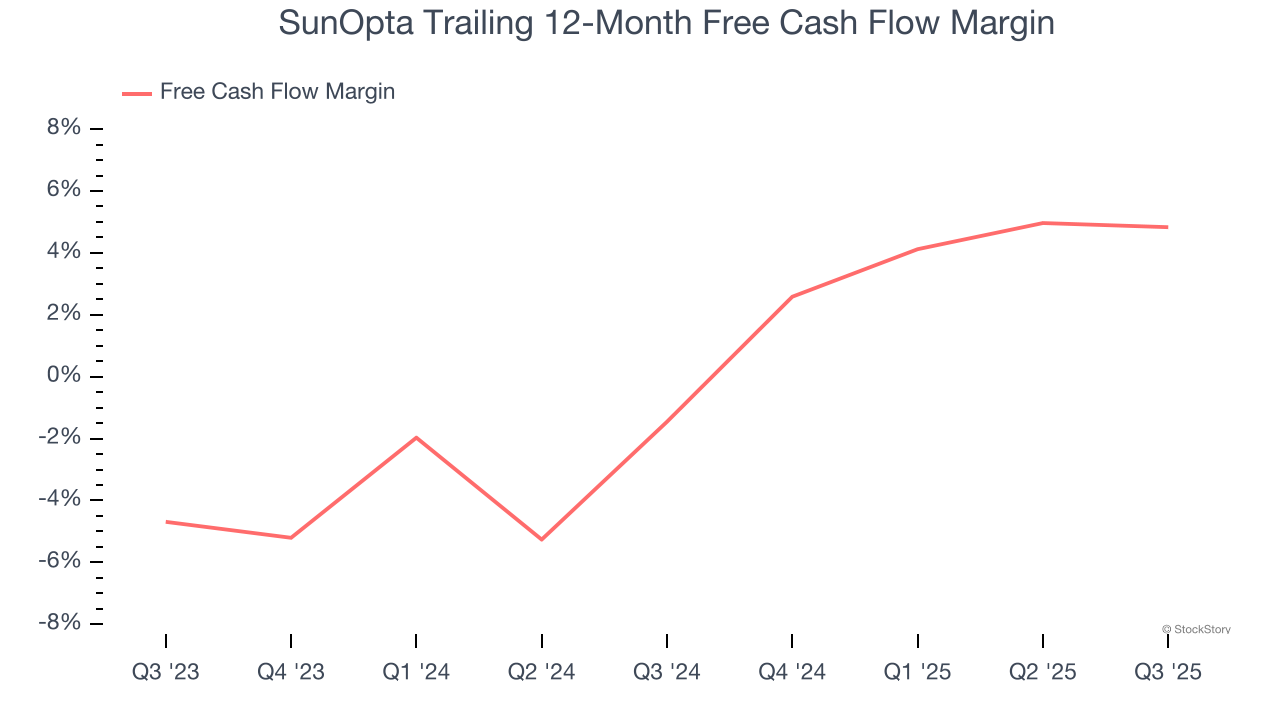

SunOpta has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that SunOpta’s margin expanded by 6.3 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

SunOpta’s free cash flow clocked in at $12.06 million in Q3, equivalent to a 5.9% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Key Takeaways from SunOpta’s Q3 Results

It was good to see SunOpta beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its gross margin missed. Zooming out, we think this was a solid print. The stock remained flat at $5.22 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.