Best Buy trades at $80.24 and has moved in lockstep with the market. Its shares have returned 20.3% over the last six months while the S&P 500 has gained 21.3%.

Is now the time to buy Best Buy, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Best Buy Not Exciting?

We don't have much confidence in Best Buy. Here are three reasons you should be careful with BBY and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Best Buy’s demand has been shrinking over the last two years as its same-store sales have averaged 2.7% annual declines.

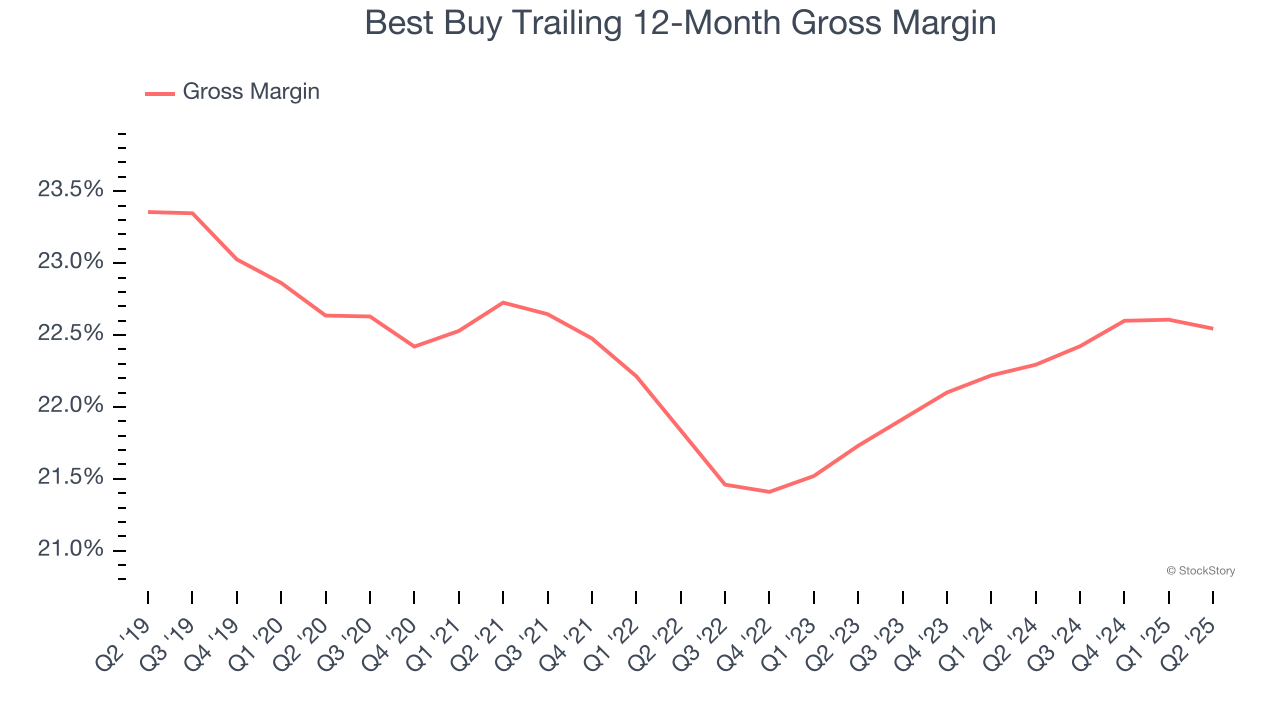

2. Low Gross Margin Reveals Weak Structural Profitability

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Best Buy has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 22.4% gross margin over the last two years. Said differently, Best Buy had to pay a chunky $77.58 to its suppliers for every $100 in revenue.

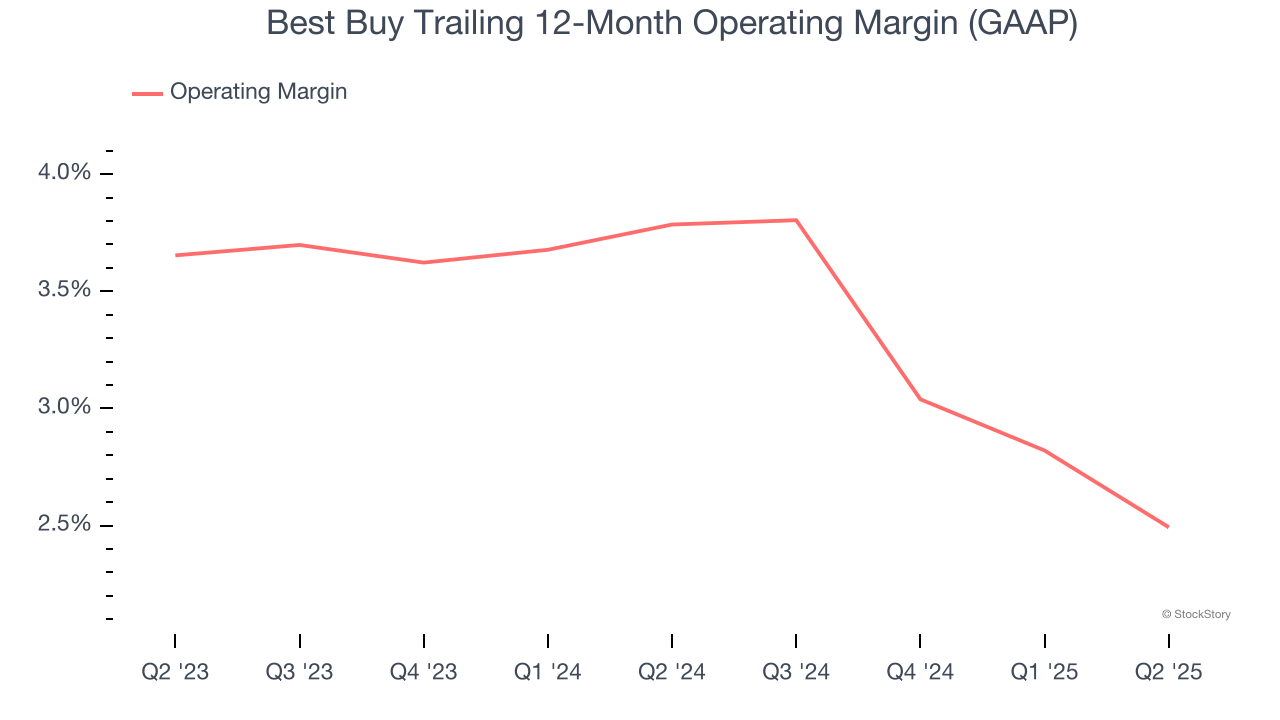

3. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Best Buy was profitable over the last two years but held back by its large cost base. Its average operating margin of 3.1% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

Best Buy’s business quality ultimately falls short of our standards. That said, the stock currently trades at 12.5× forward P/E (or $80.24 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Best Buy

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.