Online accommodations platform Airbnb (NASDAQ: ABNB) met Wall Streets revenue expectations in Q3 CY2025, with sales up 9.7% year on year to $4.10 billion. The company expects next quarter’s revenue to be around $2.69 billion, coming in 0.7% above analysts’ estimates. Its GAAP profit of $2.21 per share was 4.8% below analysts’ consensus estimates.

Is now the time to buy Airbnb? Find out by accessing our full research report, it’s free for active Edge members.

Airbnb (ABNB) Q3 CY2025 Highlights:

- Revenue: $4.10 billion vs analyst estimates of $4.08 billion (9.7% year-on-year growth, in line)

- EPS (GAAP): $2.21 vs analyst expectations of $2.32 (4.8% miss)

- Adjusted EBITDA: $2.05 billion vs analyst estimates of $2.04 billion (50.1% margin, 0.7% beat)

- Revenue Guidance for Q4 CY2025 is $2.69 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 39.7%, down from 40.9% in the same quarter last year

- Free Cash Flow Margin: 32.9%, up from 31.1% in the previous quarter

- Nights and Experiences Booked: 134 million, up 11.2 million year on year

- Market Capitalization: $75 billion

Company Overview

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

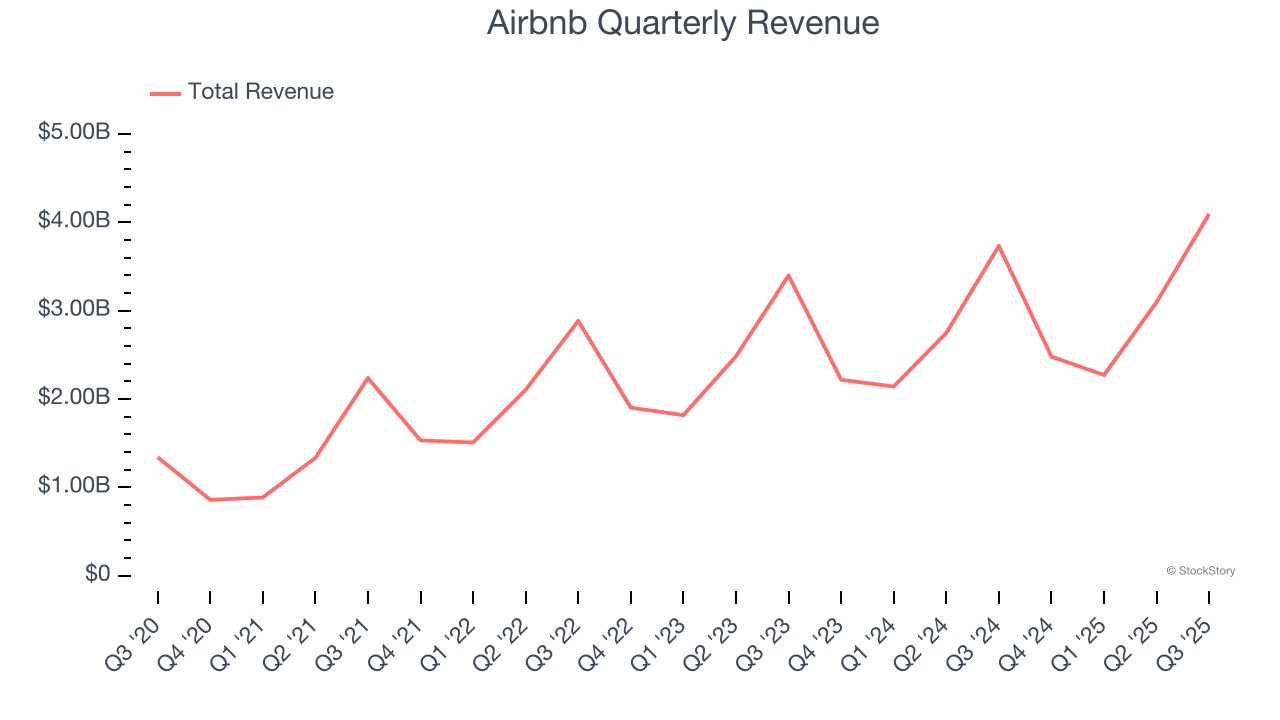

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Airbnb’s sales grew at a solid 14.2% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Airbnb grew its revenue by 9.7% year on year, and its $4.10 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Nights And Experiences Booked

Booking Growth

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb’s nights and experiences booked, a key performance metric for the company, increased by 9.4% annually to 134 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q3, Airbnb added 11.2 million nights and experiences booked, leading to 9.1% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

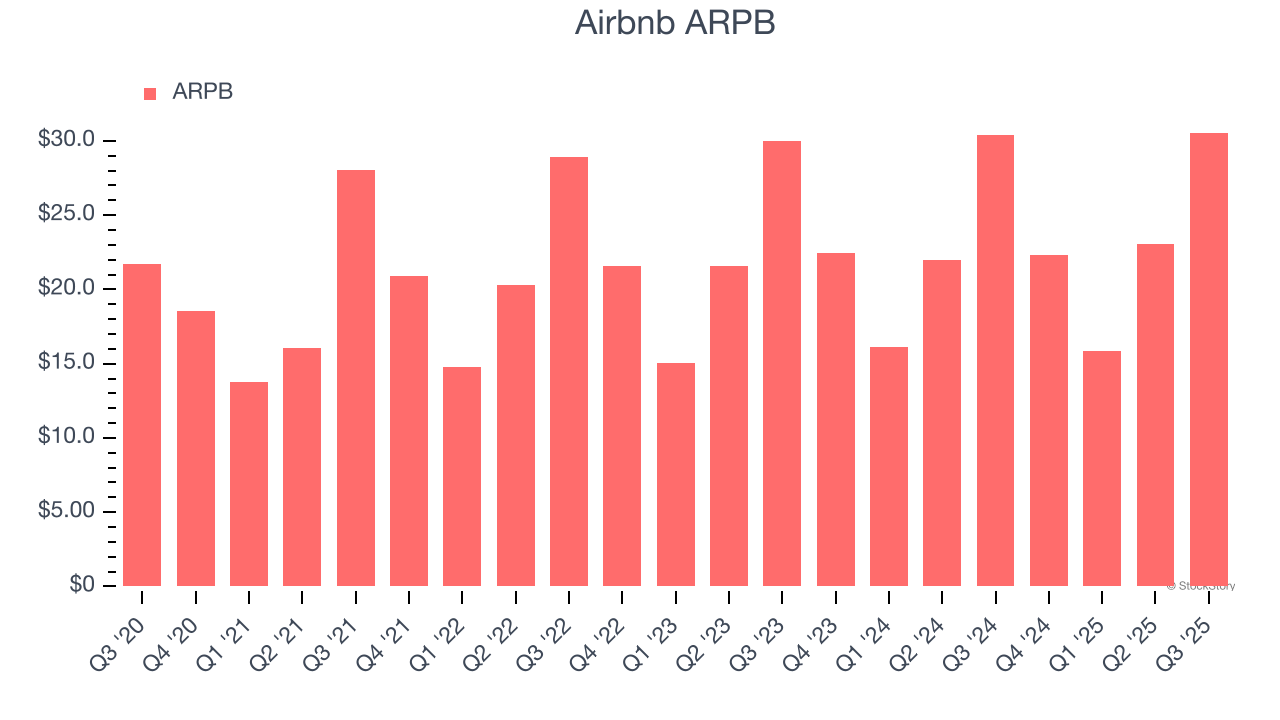

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Airbnb can charge.

Airbnb’s ARPB growth has been subpar over the last two years, averaging 2.2%. This isn’t great, but the increase in nights and experiences booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Airbnb tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Airbnb’s ARPB clocked in at $30.56. It was flat year on year, worse than the change in its nights and experiences booked.

Key Takeaways from Airbnb’s Q3 Results

It was encouraging to see Airbnb beat analysts’ number of nights and experiences booked expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 4.5% to $126 immediately after reporting.

Is Airbnb an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.