Cloud technology company Akamai Technologies (NASDAQ: AKAM) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 5% year on year to $1.05 billion. The company expects next quarter’s revenue to be around $1.08 billion, close to analysts’ estimates. Its non-GAAP profit of $1.86 per share was 13.7% above analysts’ consensus estimates.

Is now the time to buy Akamai Technologies? Find out by accessing our full research report, it’s free for active Edge members.

Akamai Technologies (AKAM) Q3 CY2025 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.04 billion (5% year-on-year growth, 1% beat)

- Adjusted EPS: $1.86 vs analyst estimates of $1.64 (13.7% beat)

- Adjusted Operating Income: $322 million vs analyst estimates of $291.1 million (30.5% margin, 10.6% beat)

- Revenue Guidance for Q4 CY2025 is $1.08 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $7.03 at the midpoint, a 4.9% increase

- Operating Margin: 15.7%, up from 7% in the same quarter last year

- Free Cash Flow Margin: 31.2%, up from 22.6% in the previous quarter

- Market Capitalization: $10.46 billion

"Akamai delivered a strong quarter, with solid top-line performance and excellent bottom-line results – highlighted by outperformance on margins and significant year-over-year EPS growth. We were particularly pleased by the continued success of our high-growth security products and the momentum in Cloud Infrastructure Services, where revenue growth accelerated to 39% year-over-year," said Dr. Tom Leighton, Akamai's Chief Executive Officer.

Company Overview

With a massive distributed network spanning 4,100+ points of presence in nearly 130 countries, Akamai Technologies (NASDAQ: AKAM) provides a global distributed cloud platform that helps businesses deliver, secure, and optimize their digital experiences online.

Revenue Growth

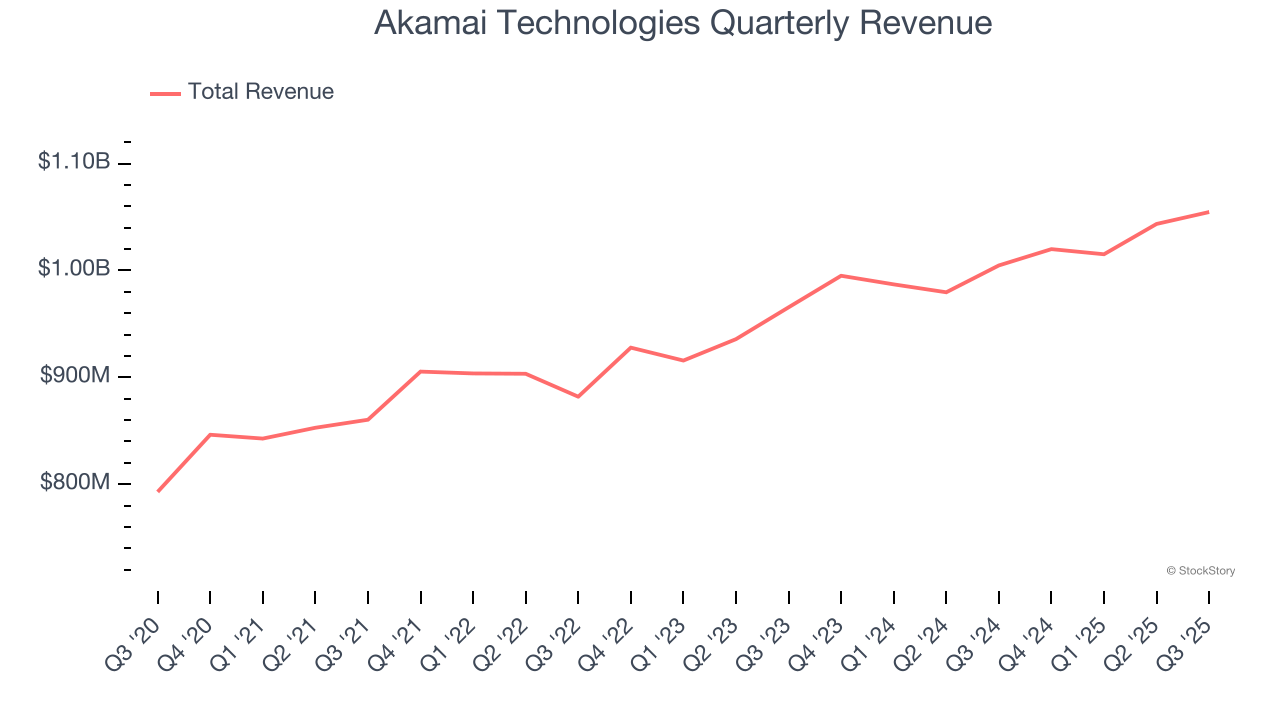

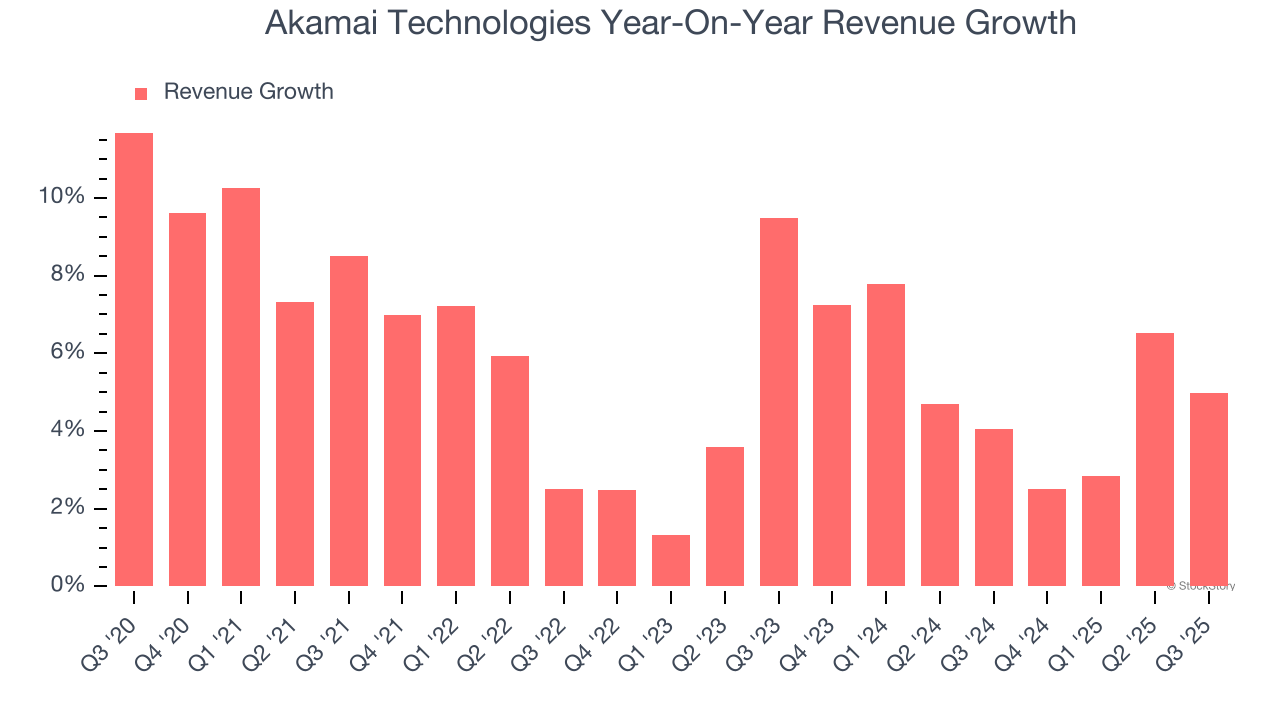

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Akamai Technologies grew its sales at a weak 5.8% compounded annual growth rate. This fell short of our benchmark for the software sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Akamai Technologies’s annualized revenue growth of 5.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Akamai Technologies reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 5.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Akamai Technologies’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Akamai Technologies’s products and its peers.

Key Takeaways from Akamai Technologies’s Q3 Results

We were impressed by Akamai Technologies’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 6.6% to $77.84 immediately after reporting.

Akamai Technologies put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.