Energy drink company Celsius (NASDAQ: CELH) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 173% year on year to $725.1 million. Its non-GAAP profit of $0.42 per share was 49.7% above analysts’ consensus estimates.

Is now the time to buy Celsius? Find out by accessing our full research report, it’s free for active Edge members.

Celsius (CELH) Q3 CY2025 Highlights:

- Revenue: $725.1 million vs analyst estimates of $716.4 million (173% year-on-year growth, 1.2% beat)

- Adjusted EPS: $0.42 vs analyst estimates of $0.28 (49.7% beat)

- Adjusted EBITDA: $205.6 million vs analyst estimates of $145.5 million (28.4% margin, 41.3% beat)

- Operating Margin: -11%, down from -1.2% in the same quarter last year

- Market Capitalization: $15.46 billion

John Fieldly, Chairman and CEO of Celsius Holdings, said: “The third quarter marked another important step in Celsius Holdings’ transformation in a year full of growth catalysts. We strengthened our long-term partnership with PepsiCo and united CELSIUS, Alani Nu, and Rockstar Energy under one total energy portfolio. Combined, our brands grew nearly twice as fast as the U.S. energy drink category, driven by Alani Nu’s incredible momentum and improving trends for our core CELSIUS brand. Limited-time offerings across the portfolio also performed exceptionally well - support for our belief that innovation and consumer engagement continue to power our growth. With a broader portfolio, a deeper leadership bench, and the reach of PepsiCo’s system, we’re operating from a position of strength and staying focused on building sustainable growth for the long term.”

Company Overview

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ: CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2.13 billion in revenue over the past 12 months, Celsius is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

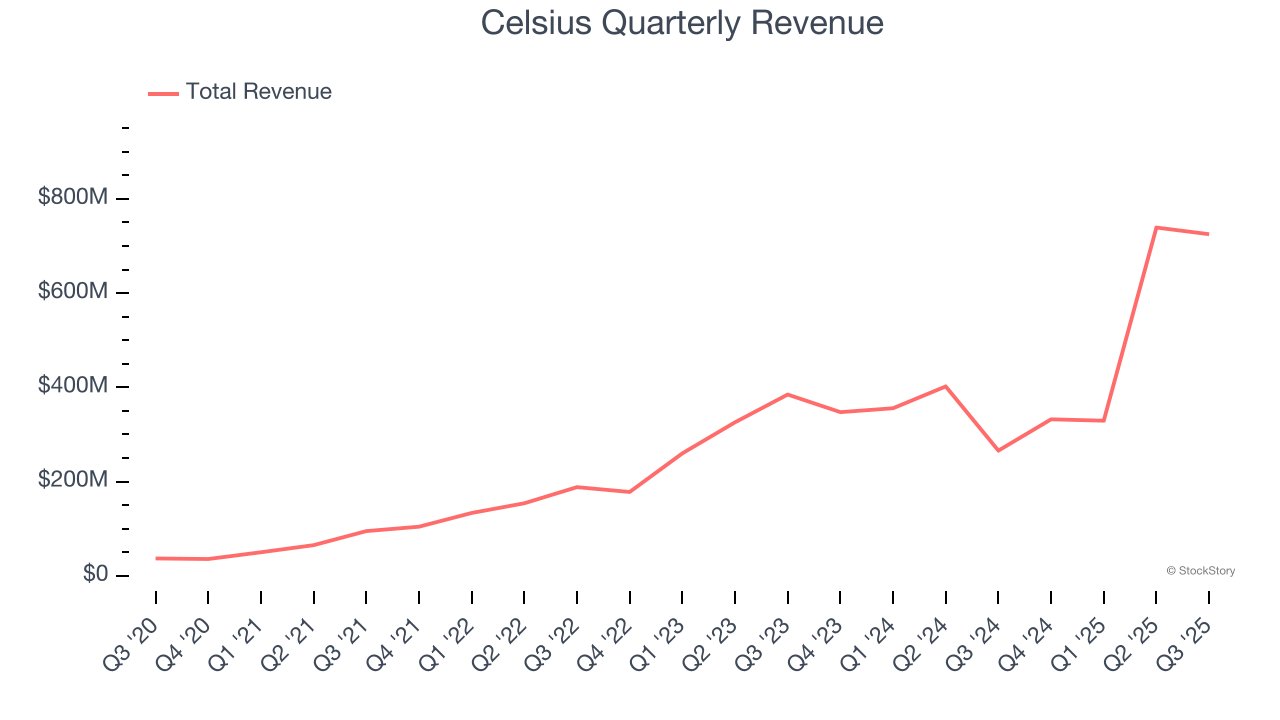

As you can see below, Celsius’s sales grew at an incredible 54.2% compounded annual growth rate over the last three years. This is a great starting point for our analysis because it shows Celsius’s demand was higher than many consumer staples companies.

This quarter, Celsius reported magnificent year-on-year revenue growth of 173%, and its $725.1 million of revenue beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 49.9% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and suggests the market is forecasting success for its products.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

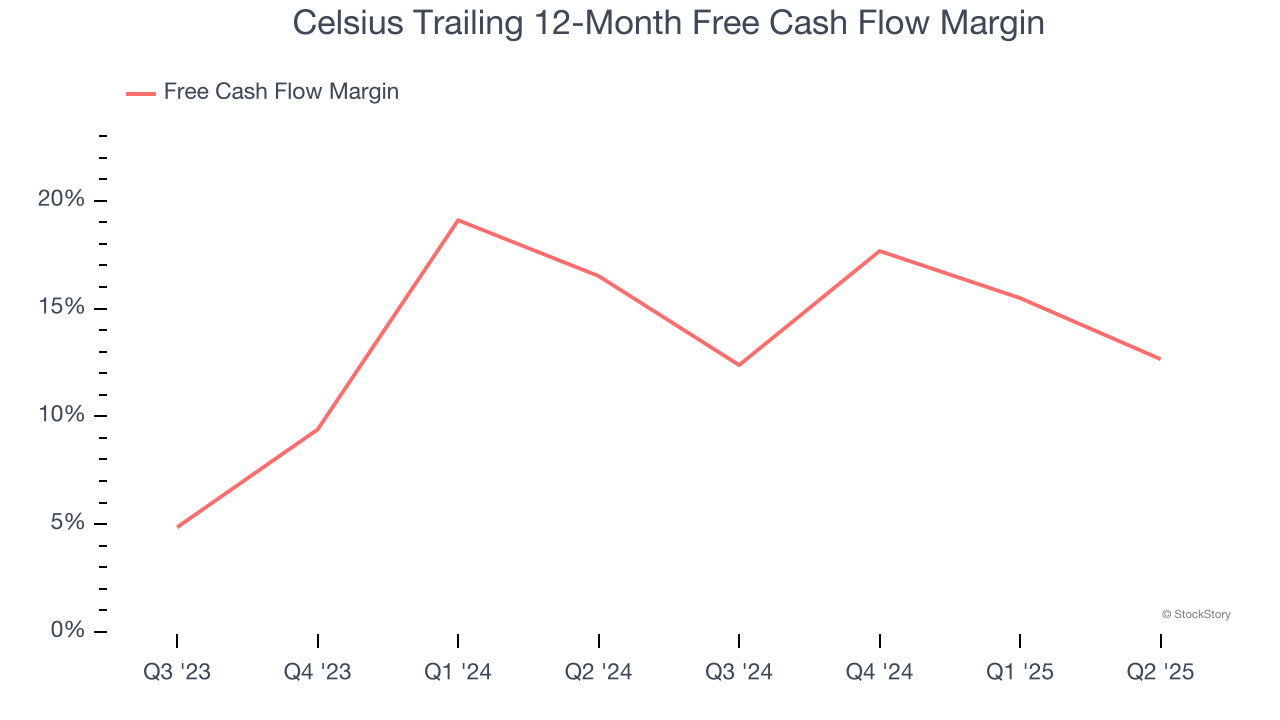

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Celsius has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 13.4% over the last two years.

Key Takeaways from Celsius’s Q3 Results

It was good to see Celsius beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The market seemed to be hoping for more, and the stock traded down 12.2% to $52.60 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.