Cloud monitoring platform Datadog (NASDAQ: DDOG) announced better-than-expected revenue in Q3 CY2025, with sales up 28.4% year on year to $885.7 million. On top of that, next quarter’s revenue guidance ($914 million at the midpoint) was surprisingly good and 3.2% above what analysts were expecting. Its non-GAAP profit of $0.55 per share was 20.4% above analysts’ consensus estimates.

Is now the time to buy Datadog? Find out by accessing our full research report, it’s free for active Edge members.

Datadog (DDOG) Q3 CY2025 Highlights:

- Revenue: $885.7 million vs analyst estimates of $852.4 million (28.4% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.55 vs analyst estimates of $0.46 (20.4% beat)

- Adjusted Operating Income: $207.4 million vs analyst estimates of $179.4 million (23.4% margin, 15.6% beat)

- Revenue Guidance for Q4 CY2025 is $914 million at the midpoint, above analyst estimates of $885.7 million

- Management raised its full-year Adjusted EPS guidance to $2.01 at the midpoint, a 10.7% increase

- Operating Margin: -0.7%, down from 2.9% in the same quarter last year

- Free Cash Flow Margin: 24.2%, up from 20% in the previous quarter

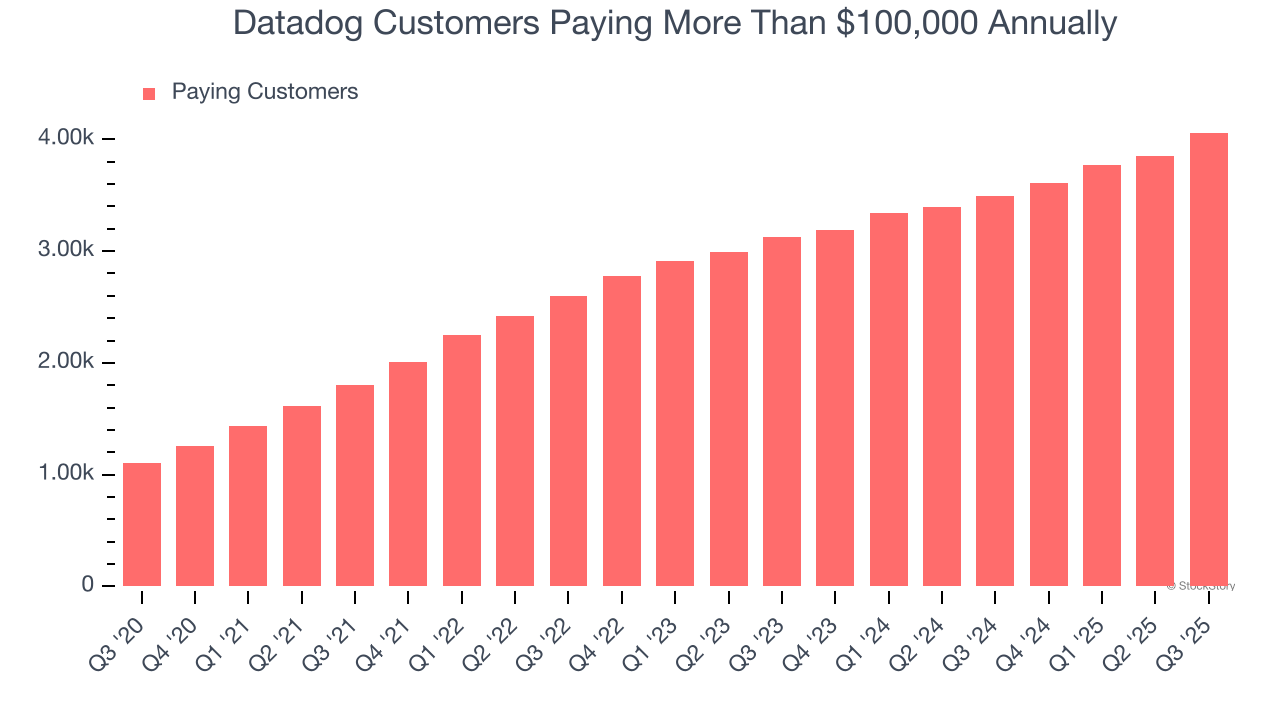

- Customers: 4,060 customers paying more than $100,000 annually

- Billings: $892.6 million at quarter end, up 29.6% year on year

- Market Capitalization: $54.05 billion

"Datadog had a strong third quarter, with 28% year-over-year revenue growth, $251 million in operating cash flow, and $214 million in free cash flow," said Olivier Pomel, co-founder and CEO of Datadog.

Company Overview

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ: DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

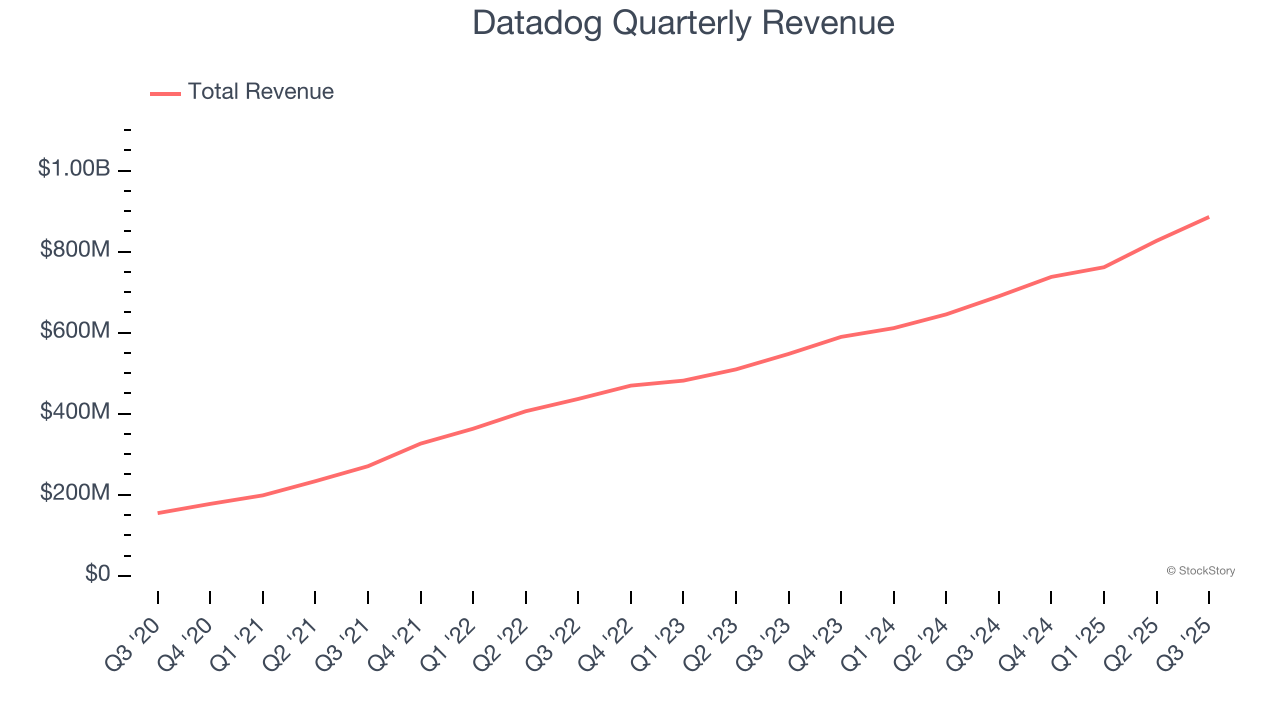

Revenue Growth

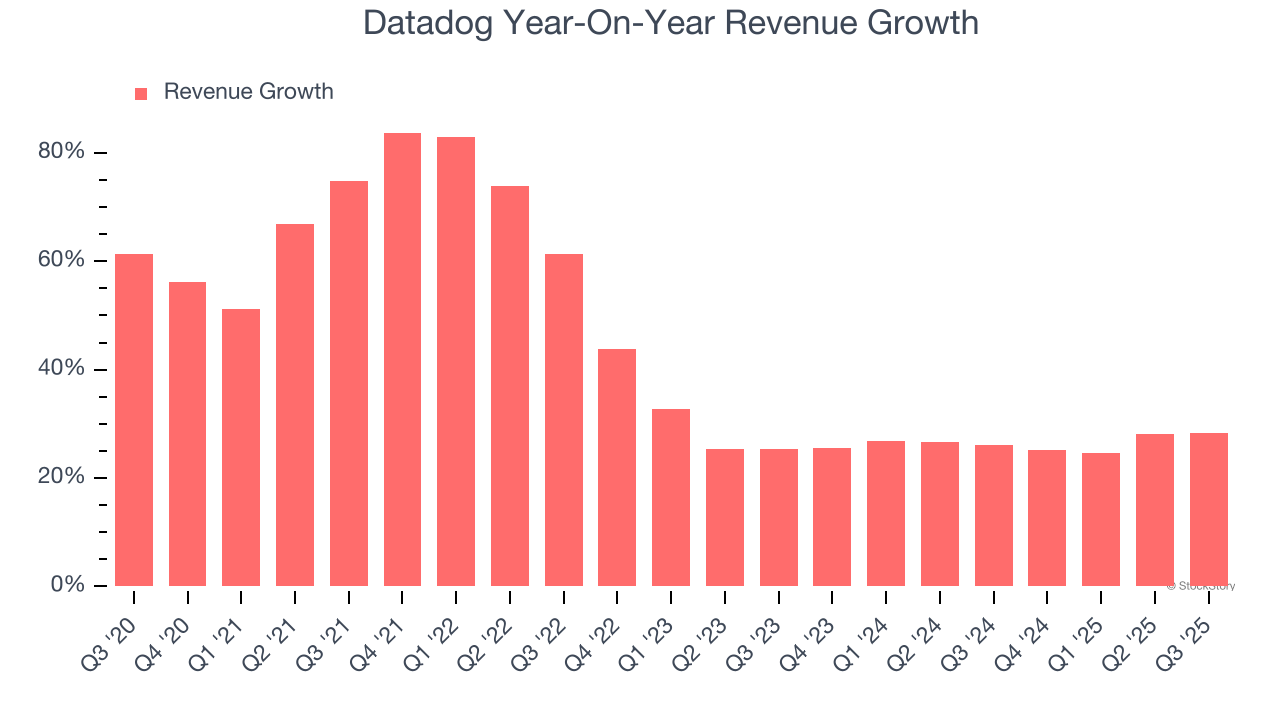

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Datadog’s 42.9% annualized revenue growth over the last five years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Datadog’s annualized revenue growth of 26.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Datadog reported robust year-on-year revenue growth of 28.4%, and its $885.7 million of revenue topped Wall Street estimates by 3.9%. Company management is currently guiding for a 23.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.2% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market is forecasting success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

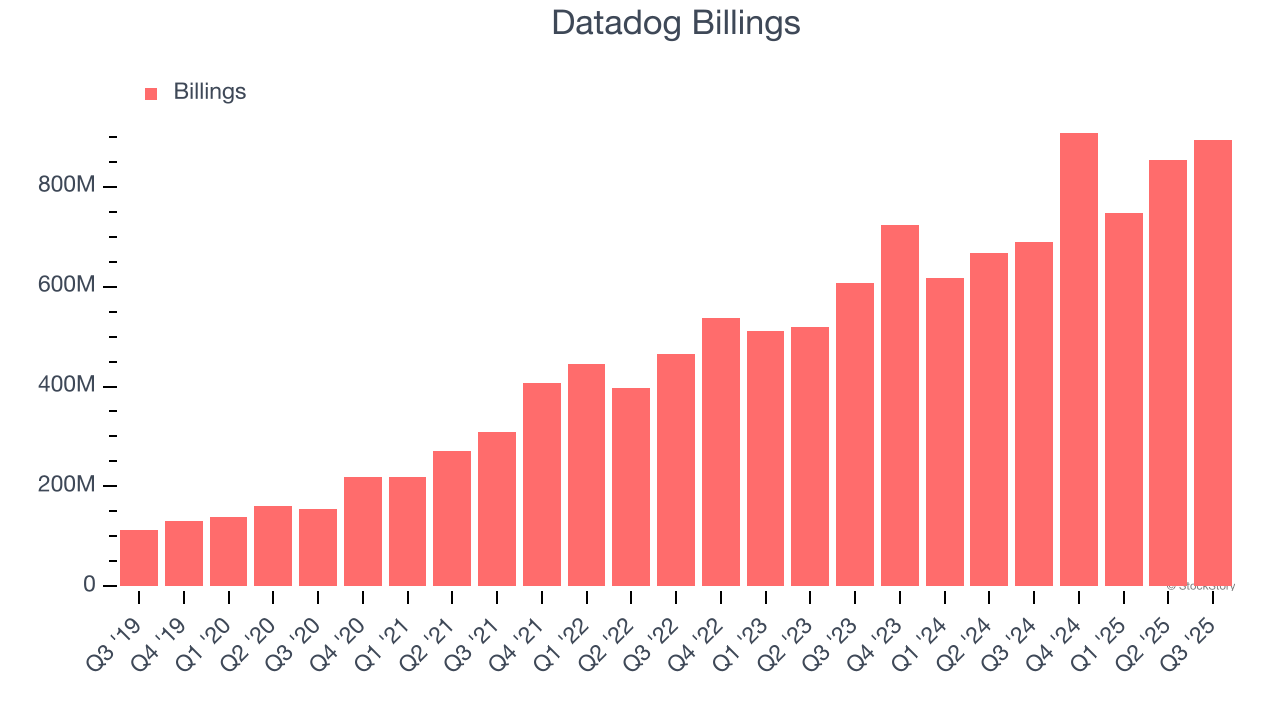

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Datadog’s billings punched in at $892.6 million in Q3, and over the last four quarters, its growth was fantastic as it averaged 26% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Enterprise Customer Base

This quarter, Datadog reported 4,060 enterprise customers paying more than $100,000 annually, an increase of 210 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that Datadog’s go-to-market strategy is working well.

Key Takeaways from Datadog’s Q3 Results

We were impressed by Datadog’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad it had many new large contract wins. Zooming out, we think this was a solid print. The stock traded up 9.4% to $169.62 immediately after reporting.

Datadog put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.