Title insurance company Fidelity National Financial (NYSE: FNF) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 11.9% year on year to $4.03 billion. Its non-GAAP profit of $1.63 per share was 14.5% above analysts’ consensus estimates.

Is now the time to buy Fidelity National Financial? Find out by accessing our full research report, it’s free for active Edge members.

Fidelity National Financial (FNF) Q3 CY2025 Highlights:

Chris Blunt, F&G's Chief Executive Officer, said, "We delivered outstanding third quarter results highlighted by record assets under management before flow reinsurance of $71 billion fueled by one of our best sales quarters in history, the launch of our new reinsurance sidecar, and strong performance across our business through the third quarter as we execute on our strategy and make continued progress towards our 2023 Investor Day targets. Our business continues to benefit from increased scale and disciplined expense management, as our ratio of operating expense to AUM before flow reinsurance has improved to 52 basis points, down 10 basis points from the third quarter of 2024, with further improvement expected by the end of the year. Our high quality investment portfolio is performing well and credit related impairments remain below our pricing assumption. F&G is becoming a more fee based, higher margin and capital light business as we leverage our position as one of the industry's largest sellers of annuities and life insurance."

Company Overview

Issuing more title insurance policies than any other company in the United States, Fidelity National Financial (NYSE: FNF) provides title insurance and escrow services for real estate transactions while also offering annuities and life insurance through its F&G subsidiary.

Revenue Growth

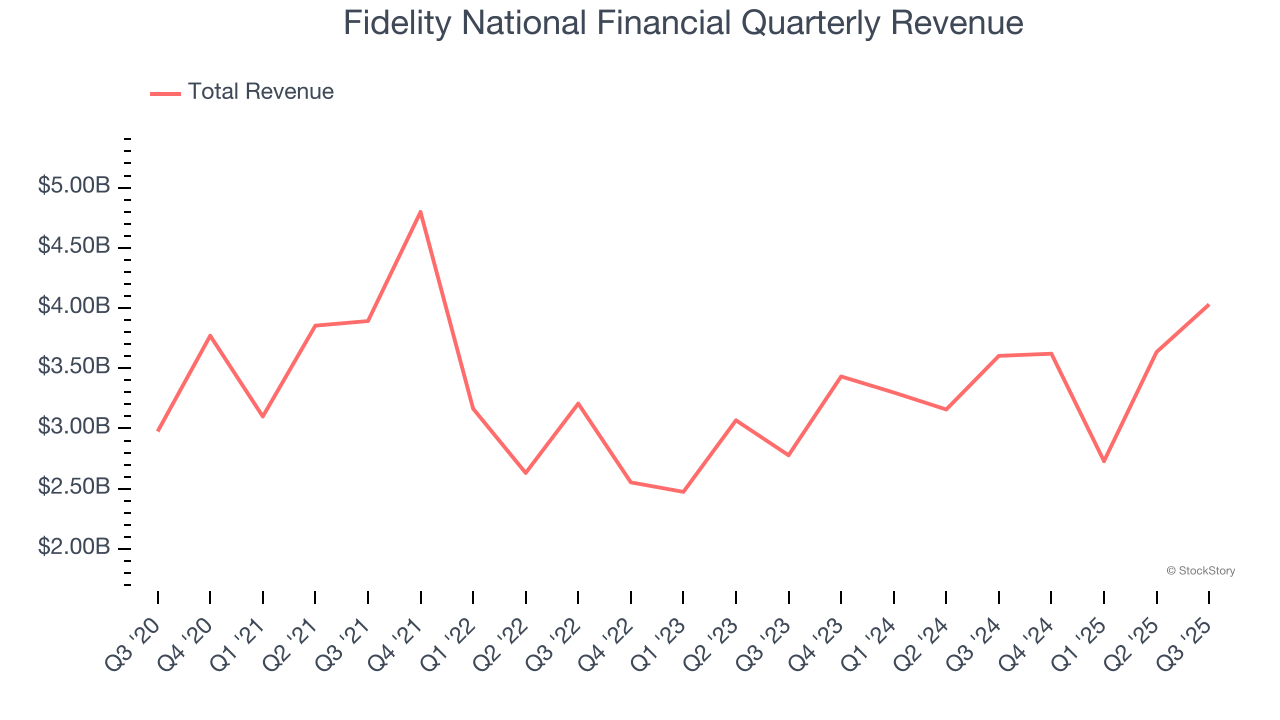

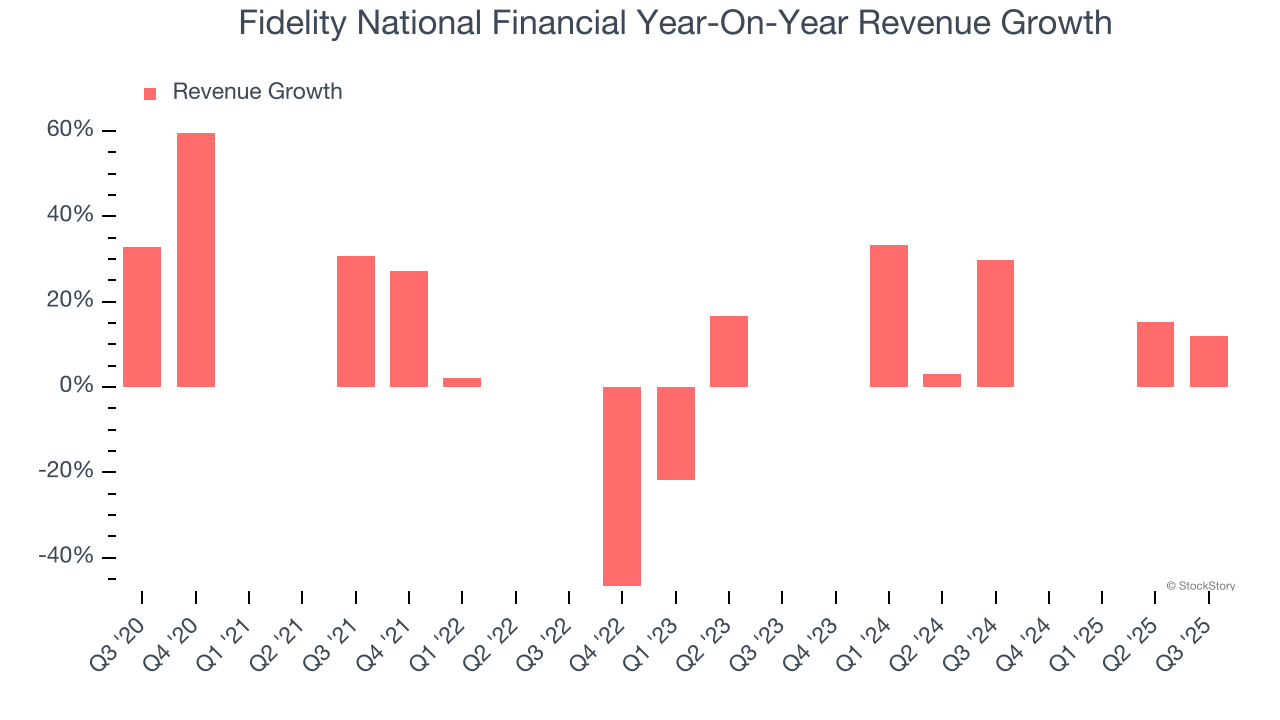

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Fidelity National Financial grew its revenue at a decent 8.4% compounded annual growth rate. Its growth was slightly above the average insurance company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Fidelity National Financial’s annualized revenue growth of 13.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Fidelity National Financial reported year-on-year revenue growth of 11.9%, and its $4.03 billion of revenue exceeded Wall Street’s estimates by 13%.

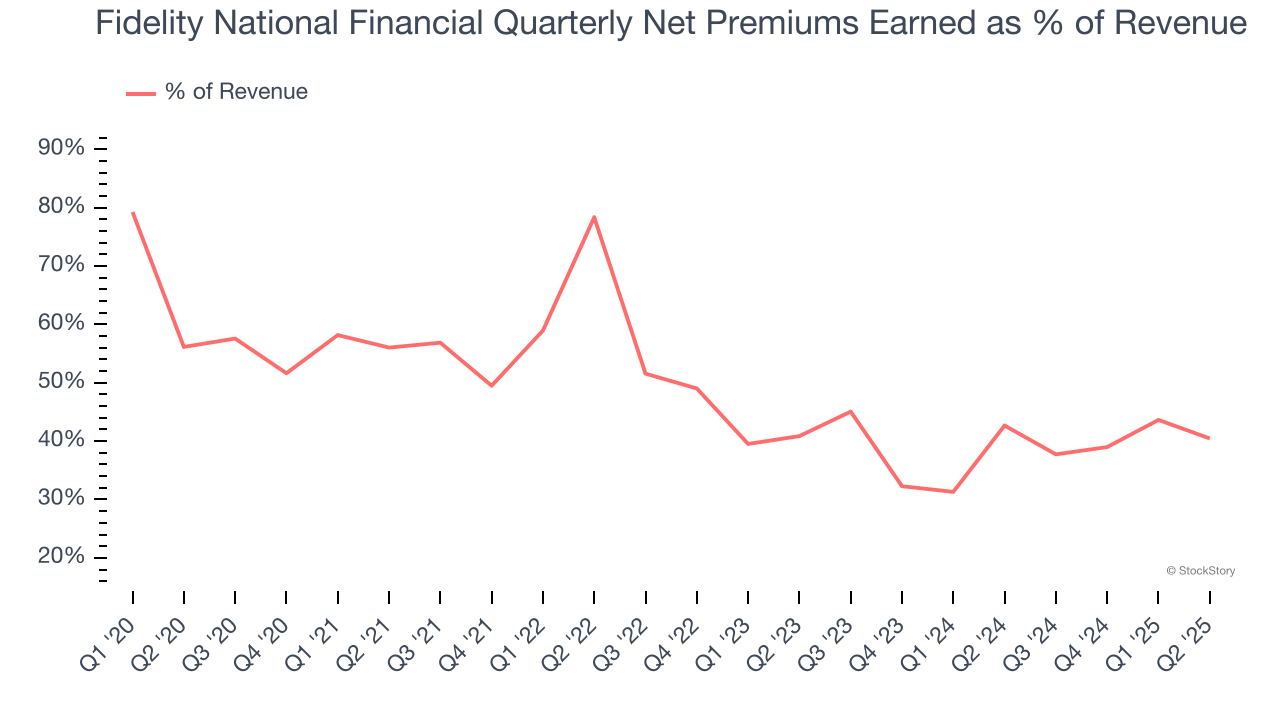

Net premiums earned made up 47.4% of the company’s total revenue during the last five years, meaning Fidelity National Financial’s growth drivers strike a balance between insurance and non-insurance activities.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

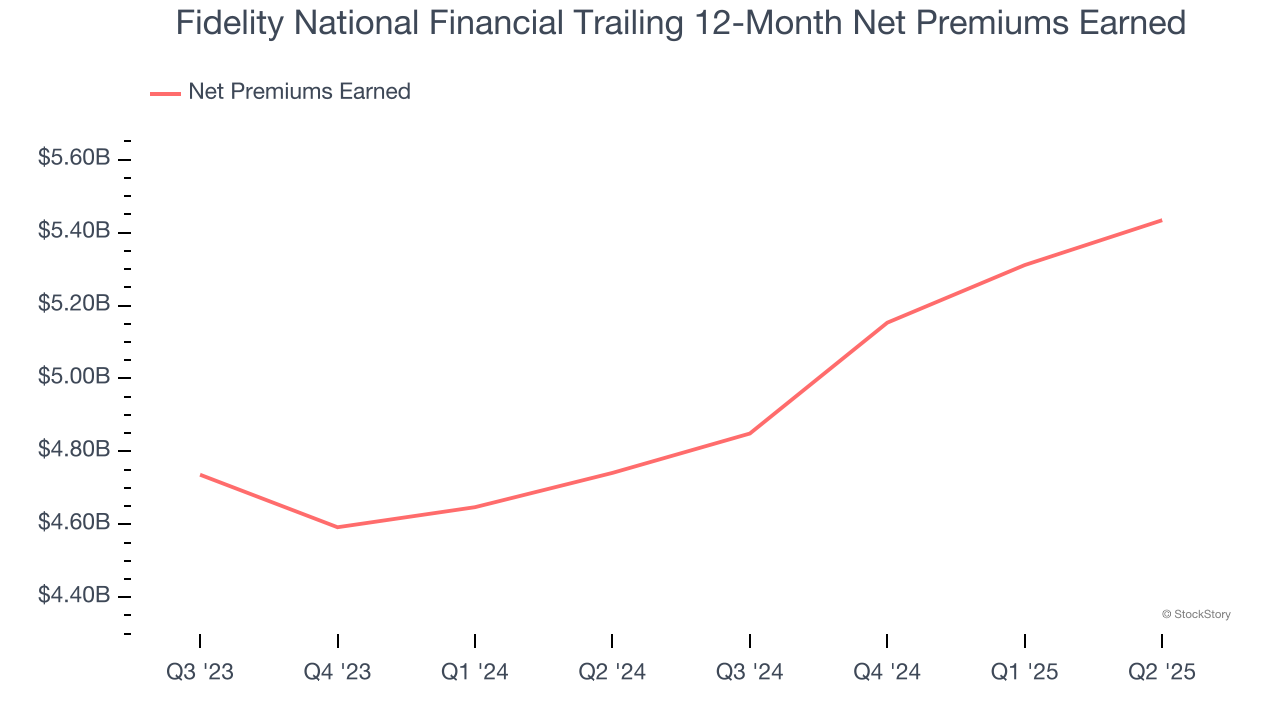

Fidelity National Financial’s net premiums earned was flat over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

When analyzing Fidelity National Financial’s net premiums earned over the last two years, we can see that growth accelerated to 8.1% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. These extra revenue streams are important to the bottom line, yet their performance can be inconsistent. Some firms have been more successful and consistent in managing their float, but sharp fluctuations in the fixed income and equity markets can dramatically affect short-term results.

Key Takeaways from Fidelity National Financial’s Q3 Results

We were impressed by how significantly Fidelity National Financial blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.9% to $55.61 immediately after reporting.

Fidelity National Financial may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.