Business development company Main Street Capital (NYSE: MAIN) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.2% year on year to $139.8 million. Its non-GAAP profit of $1.03 per share was 5.2% above analysts’ consensus estimates.

Is now the time to buy Main Street Capital? Find out by accessing our full research report, it’s free for active Edge members.

Main Street Capital (MAIN) Q3 CY2025 Highlights:

In commenting on the Company's operating results for the third quarter of 2025, Dwayne L. Hyzak, Main Street's Chief Executive Officer, stated, "We are pleased with our performance in the third quarter, which resulted in another quarter of strong operating results highlighted by an annualized return on equity of 17.0%, favorable levels of net investment income per share and distributable net investment income per share and another record for net asset value per share primarily driven by a significant net fair value increase of our existing lower middle market investment portfolio. We believe that these continued strong results demonstrate the sustainable strength of our overall platform, the benefits of our differentiated and diversified investment strategies, the unique contributions of our asset management business and the continued underlying strength and quality of our portfolio companies."

Company Overview

With a focus on building long-term partnerships rather than quick transactions, Main Street Capital (NYSE: MAIN) is a business development company that provides long-term debt and equity capital to lower middle market and middle market companies.

Revenue Growth

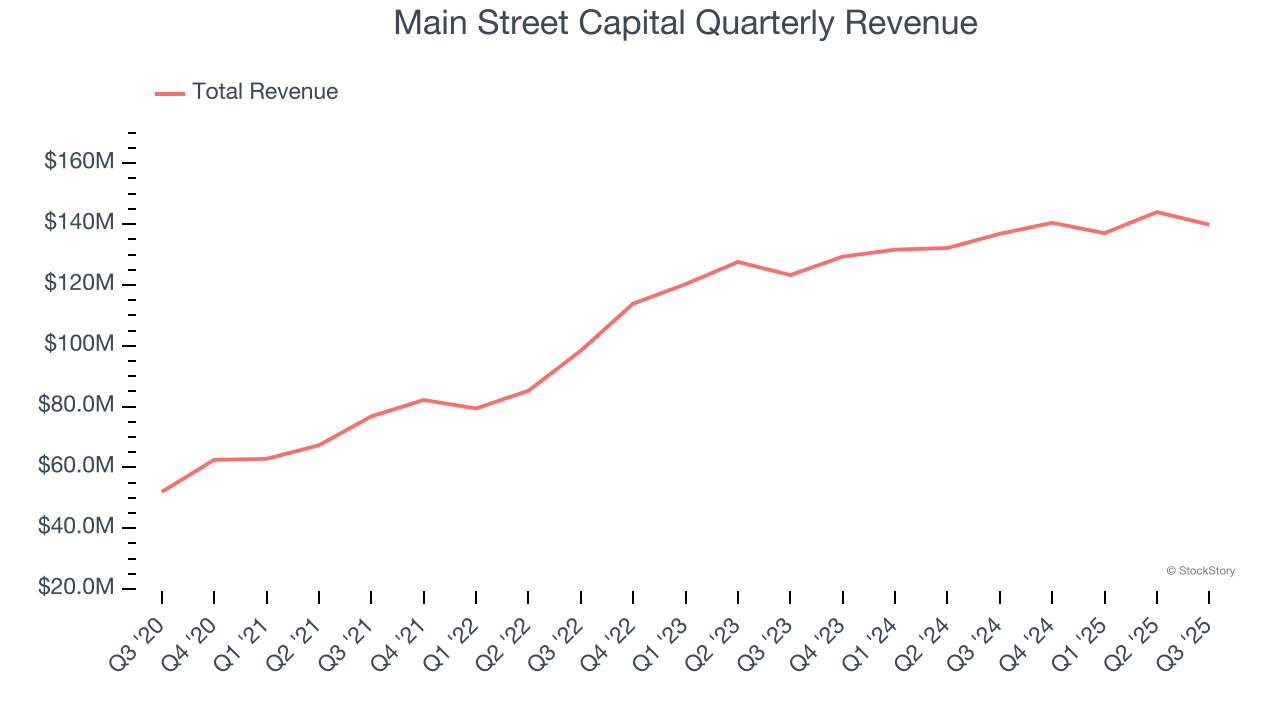

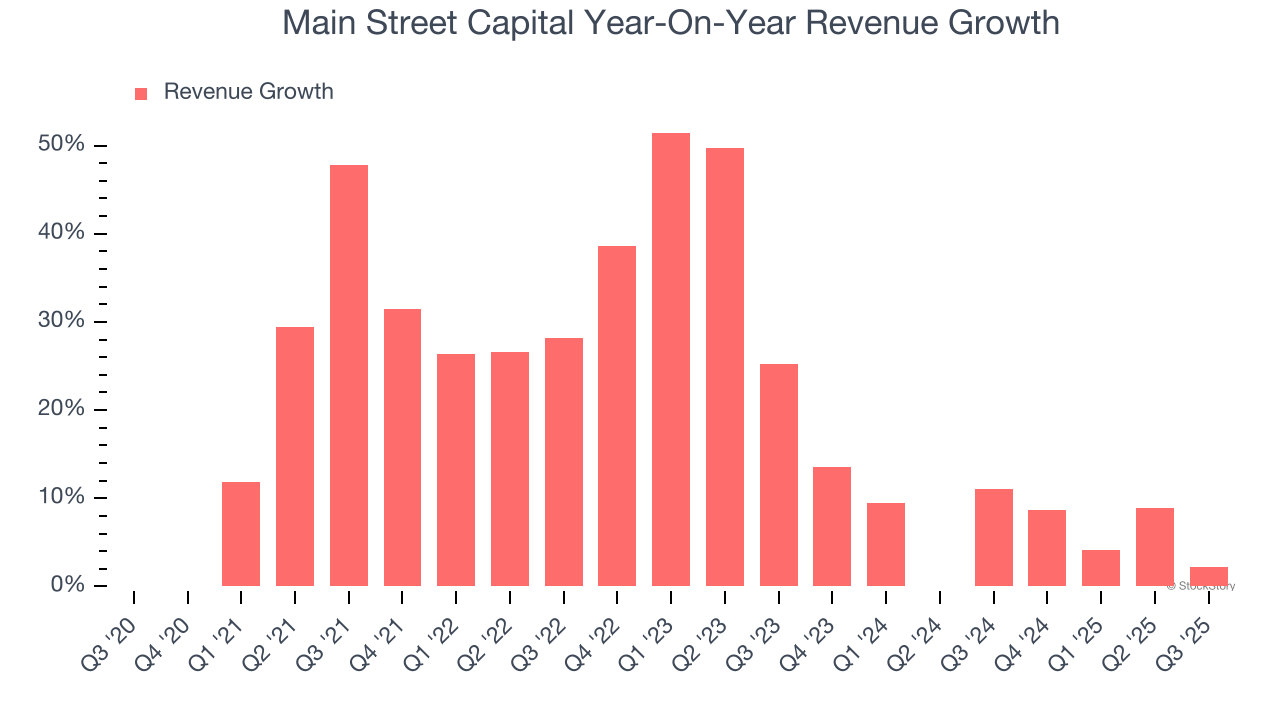

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Main Street Capital grew its revenue at an excellent 20.5% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Main Street Capital’s annualized revenue growth of 7.6% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Main Street Capital grew its revenue by 2.2% year on year, and its $139.8 million of revenue was in line with Wall Street’s estimates.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Main Street Capital’s Q3 Results

It was good to see Main Street Capital beat analysts’ EPS expectations this quarter. The stock remained flat at $57.29 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.