Genetic testing company Natera (NASDAQ: NTRA). reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 34.7% year on year to $592.2 million. The company’s full-year revenue guidance of $2.22 billion at the midpoint came in 6.1% above analysts’ estimates. Its GAAP loss of $0.64 per share was 74.5% below analysts’ consensus estimates.

Is now the time to buy Natera? Find out by accessing our full research report, it’s free for active Edge members.

Natera (NTRA) Q3 CY2025 Highlights:

- Revenue: $592.2 million vs analyst estimates of $514.4 million (34.7% year-on-year growth, 15.1% beat)

- EPS (GAAP): -$0.64 vs analyst expectations of -$0.37 (74.5% miss)

- The company lifted its revenue guidance for the full year to $2.22 billion at the midpoint from $2.06 billion, a 7.8% increase

- Operating Margin: -16.5%, down from -8.9% in the same quarter last year

- Sales Volumes rose 21.4% year on year (28% in the same quarter last year)

- Market Capitalization: $27.44 billion

“Results in the third quarter were excellent, including our largest increase in quarterly clinical MRD units to date,” said Steve Chapman, chief executive officer of Natera.

Company Overview

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ: NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

Revenue Growth

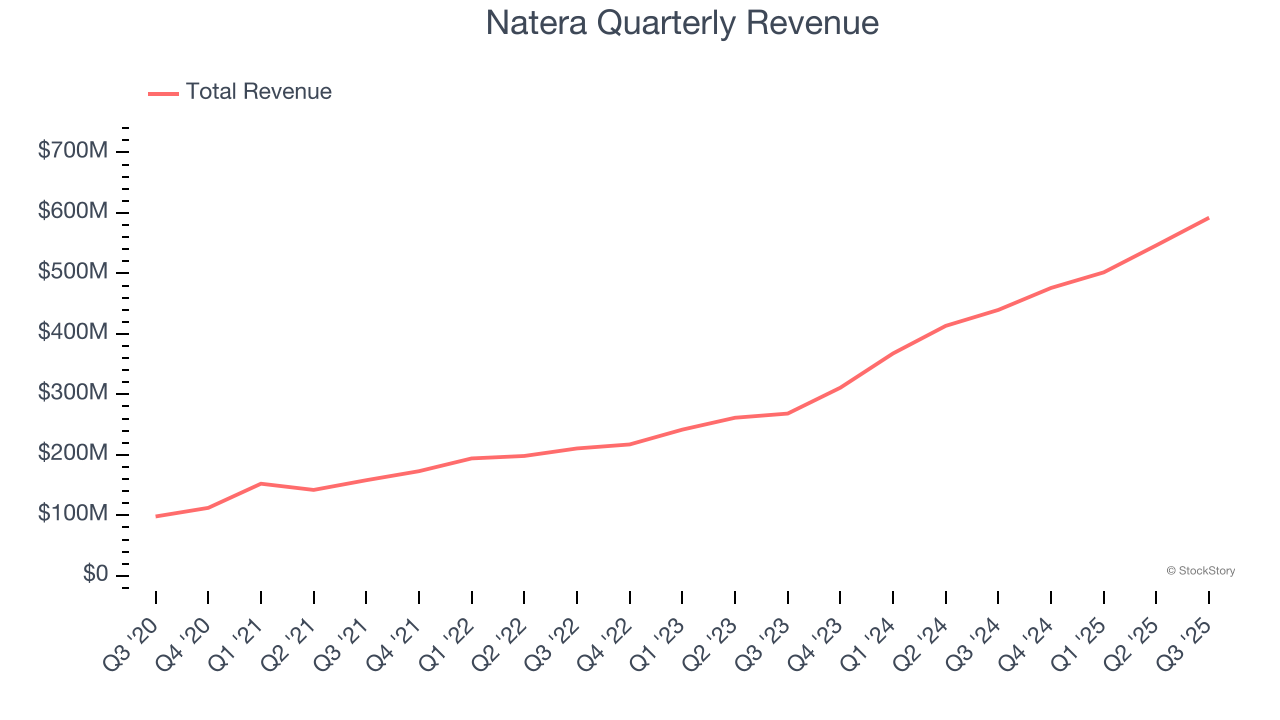

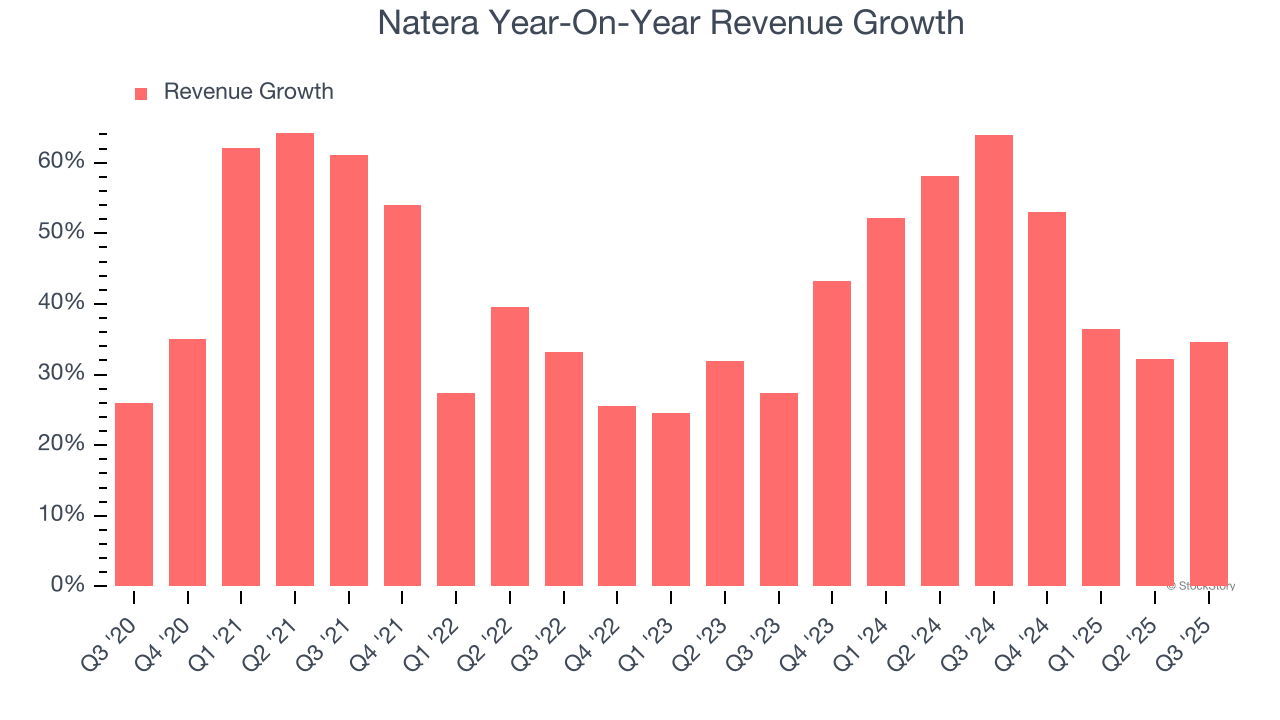

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Natera’s sales grew at an incredible 42.4% compounded annual growth rate over the last five years. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Natera’s annualized revenue growth of 46.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

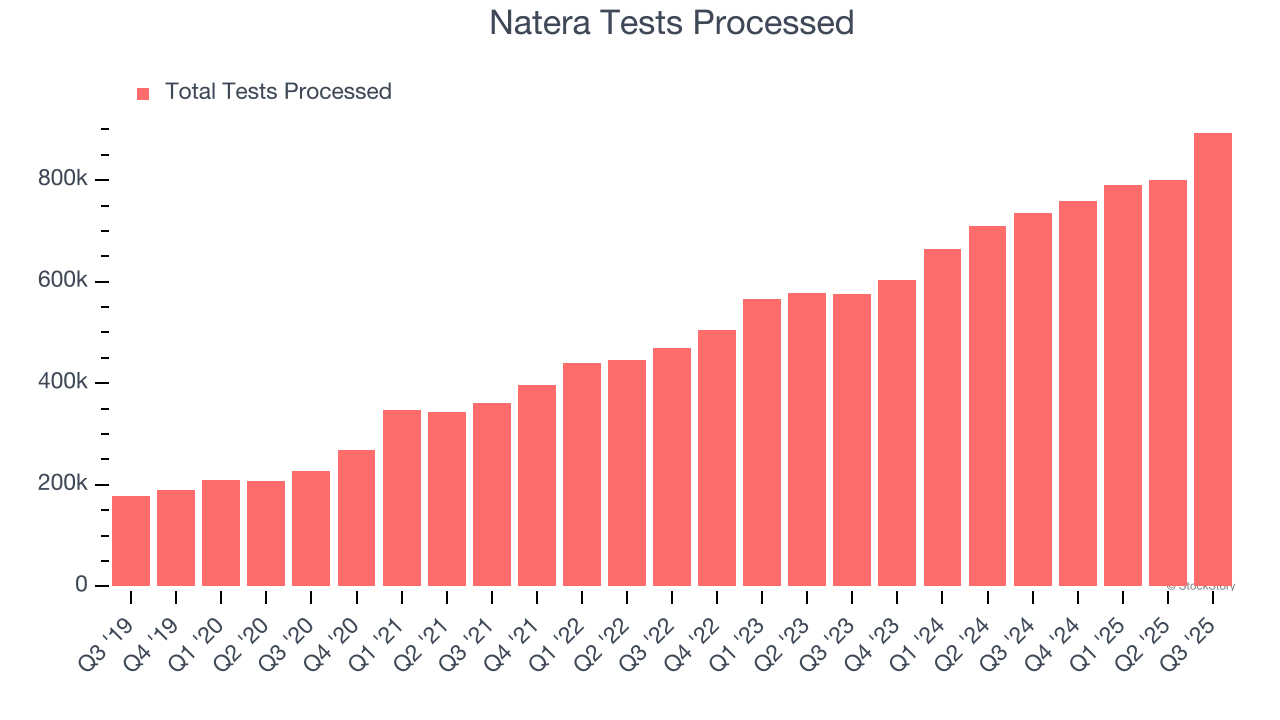

We can dig further into the company’s revenue dynamics by analyzing its number of tests processed, which reached 893,600 in the latest quarter. Over the last two years, Natera’s tests processed averaged 20.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Natera reported wonderful year-on-year revenue growth of 34.7%, and its $592.2 million of revenue exceeded Wall Street’s estimates by 15.1%.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and implies the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

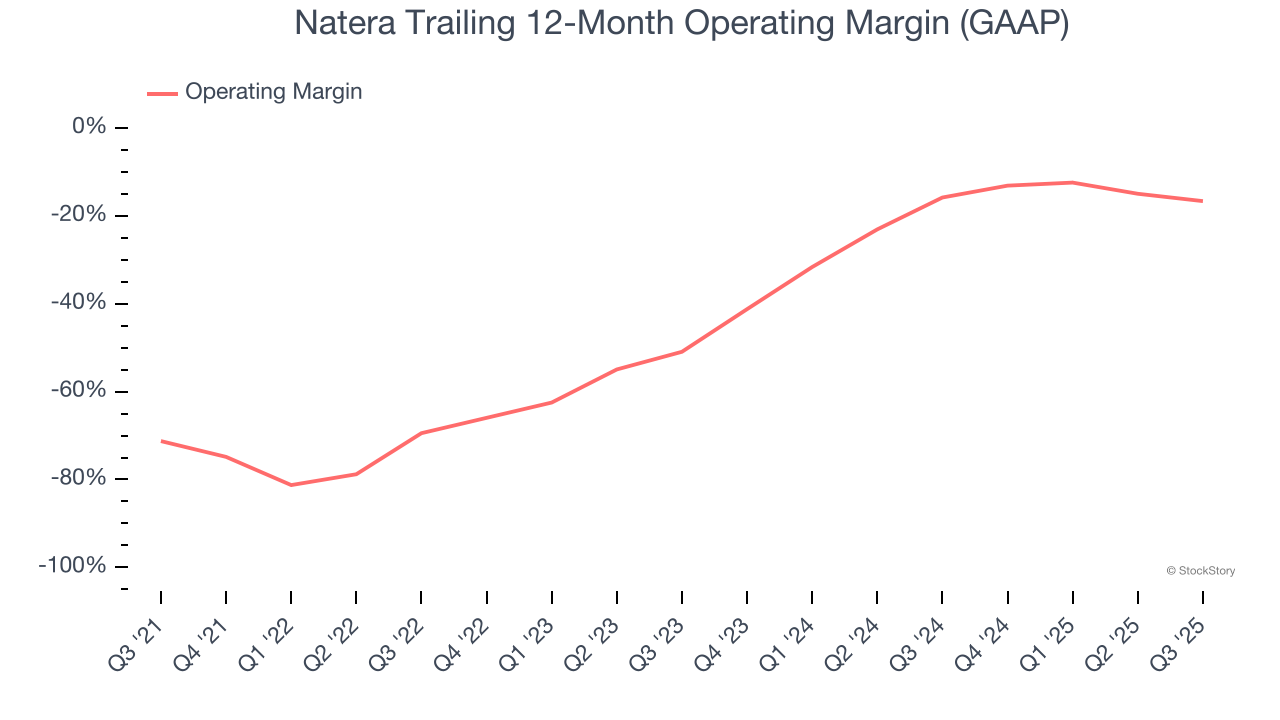

Natera’s high expenses have contributed to an average operating margin of negative 34.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Natera’s operating margin rose by 54.6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 34.3 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, Natera generated a negative 16.5% operating margin.

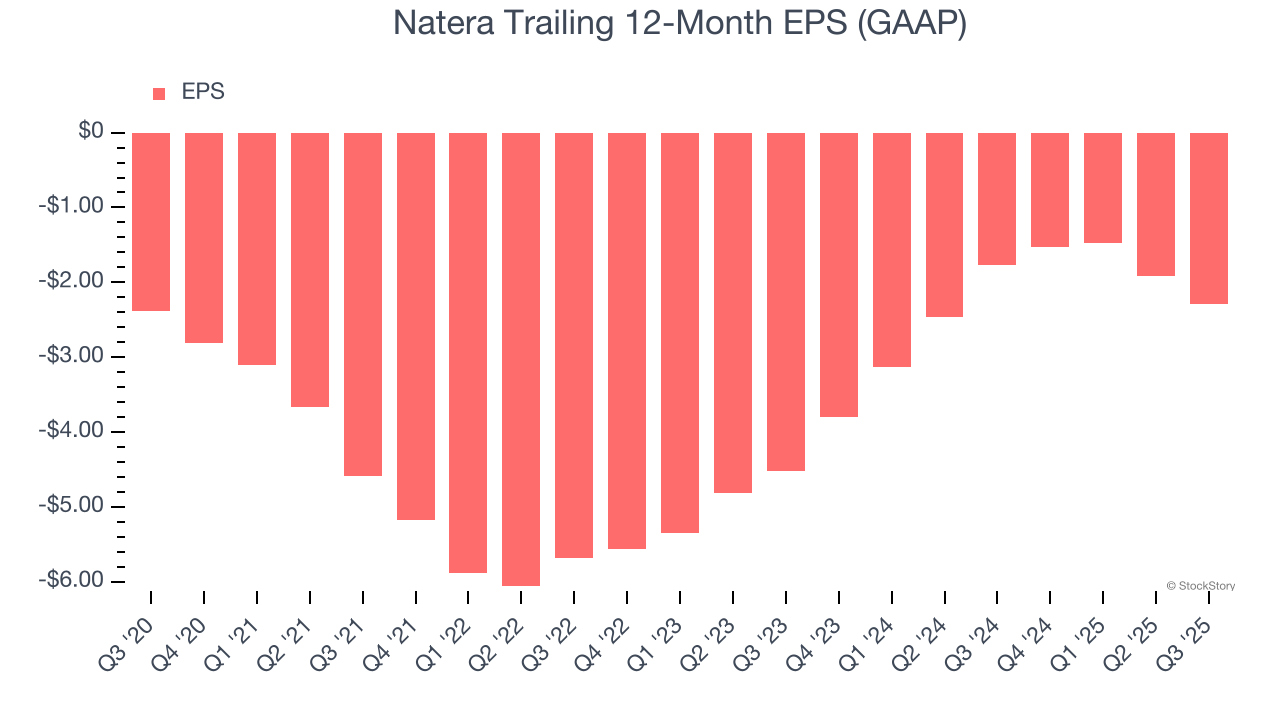

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Natera’s full-year EPS was flat over the last five years. Its performance was underwhelming, but at least the company is doing well in other parts of the business.

In Q3, Natera reported EPS of negative $0.64, down from negative $0.26 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Natera to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.29 will advance to negative $1.20.

Key Takeaways from Natera’s Q3 Results

We were impressed by how significantly Natera blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its EPS missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.8% to $208 immediately after reporting.

Indeed, Natera had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.