Hair care company Olaplex (NASDAQ: OLPX) beat Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 3.8% year on year to $114.6 million. The company expects the full year’s revenue to be around $420.5 million, close to analysts’ estimates. Its GAAP profit of $0.02 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Olaplex? Find out by accessing our full research report, it’s free for active Edge members.

Olaplex (OLPX) Q3 CY2025 Highlights:

- Revenue: $114.6 million vs analyst estimates of $109.9 million (3.8% year-on-year decline, 4.2% beat)

- EPS (GAAP): $0.02 vs analyst estimates of $0 ($0.02 beat)

- Adjusted EBITDA: $30.79 million vs analyst estimates of $26.85 million (26.9% margin, 14.7% beat)

- The company reconfirmed its revenue guidance for the full year of $420.5 million at the midpoint

- Operating Margin: 3.7%, down from 23.5% in the same quarter last year

- Market Capitalization: $707.1 million

Amanda Baldwin, OLAPLEX’s Chief Executive Officer, commented: "We are pleased with our third quarter results that reflect investments in sales and marketing, continued progress in our executional capabilities and the early results of our latest new product introductions. We are reaffirming our annual guidance and remain focused on our Bonds and Beyond strategy for sustainable, profitable long-term growth."

Company Overview

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $418.6 million in revenue over the past 12 months, Olaplex is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Olaplex’s demand was weak over the last three years. Its sales fell by 17.3% annually, a poor baseline for our analysis.

This quarter, Olaplex’s revenue fell by 3.8% year on year to $114.6 million but beat Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months. While this projection indicates its newer products will fuel better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

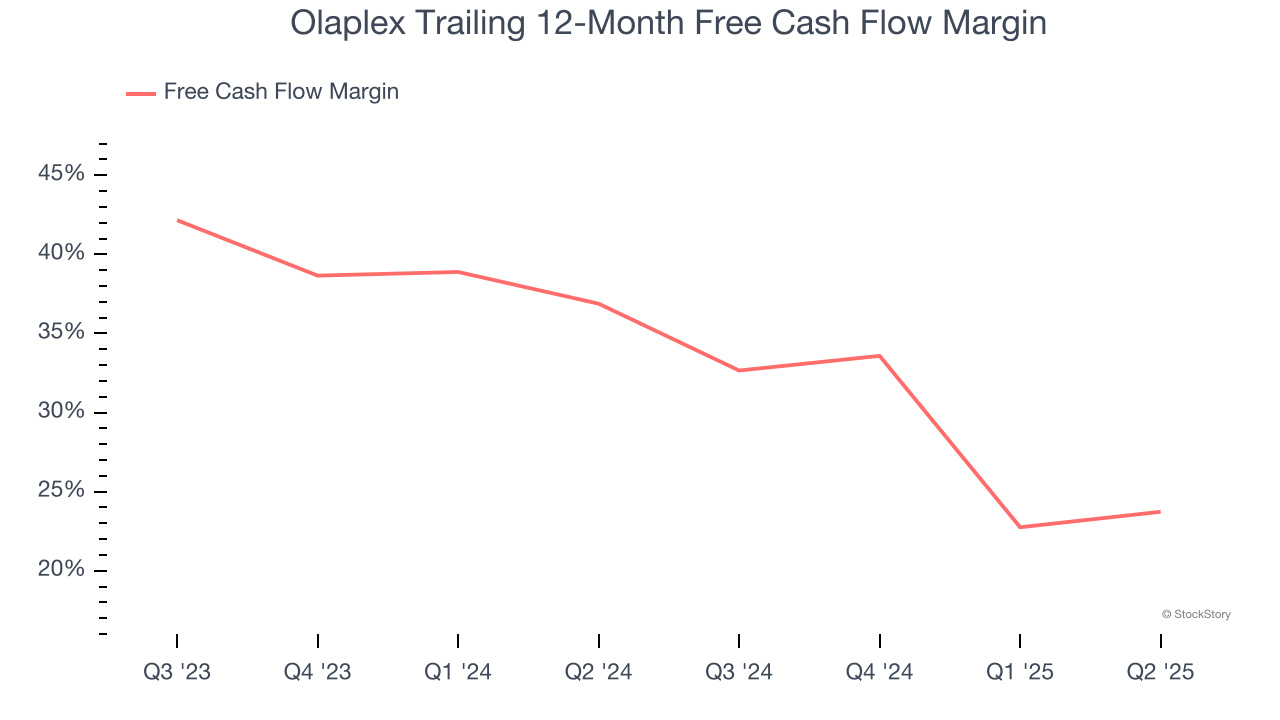

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Olaplex has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 28.3% over the last two years.

Key Takeaways from Olaplex’s Q3 Results

It was good to see Olaplex beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance was in line and its gross margin fell slightly short of Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.9% to $1.09 immediately following the results.

Indeed, Olaplex had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.