Technology real estate company Opendoor (NASDAQ: OPEN) reported revenue ahead of Wall Streets expectations in Q3 CY2025, but sales fell by 33.6% year on year to $915 million. Its GAAP loss of $0.12 per share was 68.5% below analysts’ consensus estimates.

Is now the time to buy Opendoor? Find out by accessing our full research report, it’s free for active Edge members.

Opendoor (OPEN) Q3 CY2025 Highlights:

- Revenue: $915 million vs analyst estimates of $848.7 million (33.6% year-on-year decline, 7.8% beat)

- EPS (GAAP): -$0.12 vs analyst expectations of -$0.07 (68.5% miss)

- Adjusted EBITDA: -$33 million vs analyst estimates of -$19.39 million (-3.6% margin, 70.2% miss)

- EBITDA guidance for Q4 CY2025 is $45 million at the midpoint, above analyst estimates of -$41.15 million

- Operating Margin: -7.4%, down from -4.9% in the same quarter last year

- Free Cash Flow Margin: 47.2%, up from 4.1% in the same quarter last year

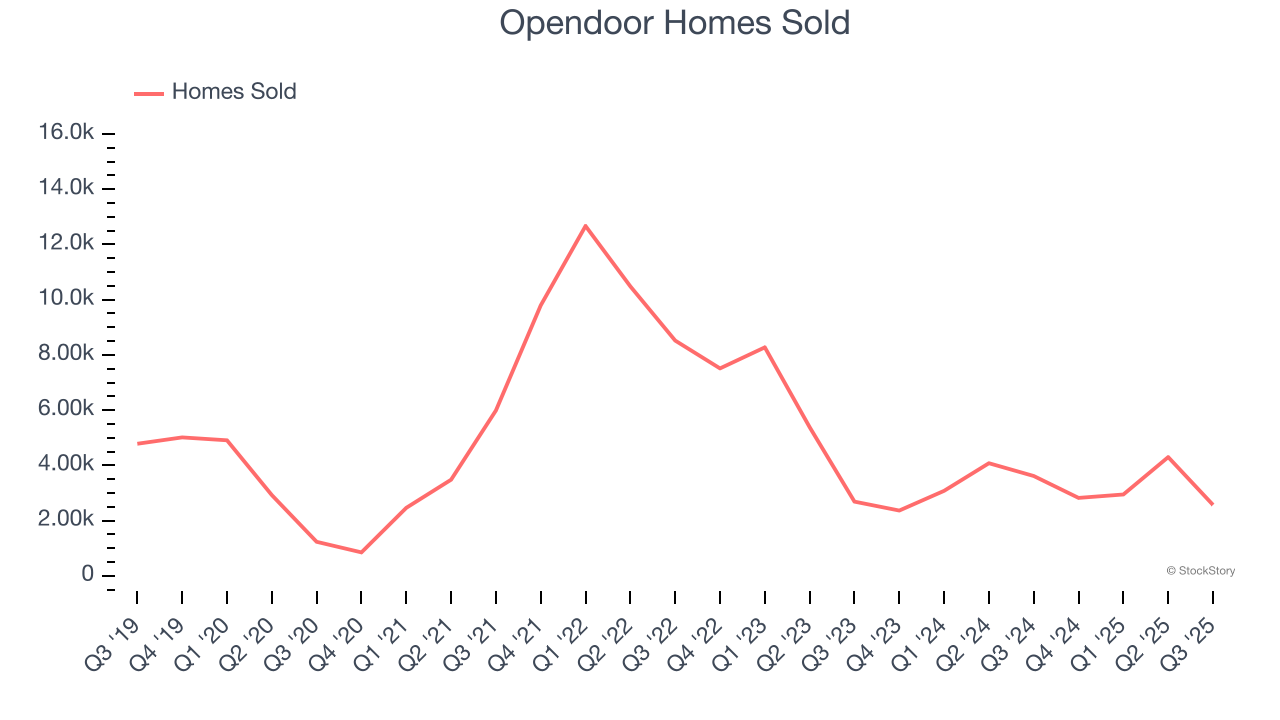

- Homes Sold: 2,568, down 1,047 year on year

- Market Capitalization: $5.32 billion

“We are refounding Opendoor as a software and AI company. In my first month as CEO, we've made a decisive break from the past -- returning to the office, eliminating reliance on consultants, and launching over a dozen AI-powered products and features that demonstrate our renewed velocity. Our business will succeed by building technology that makes selling, buying, and owning a home easier and more joyful -- not from charging high spreads and hoping the macro saves us,” said Kaz Nejatian, CEO of Opendoor.

Company Overview

Founded by real estate guru Eric Wu, Opendoor (NASDAQ: OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Revenue Growth

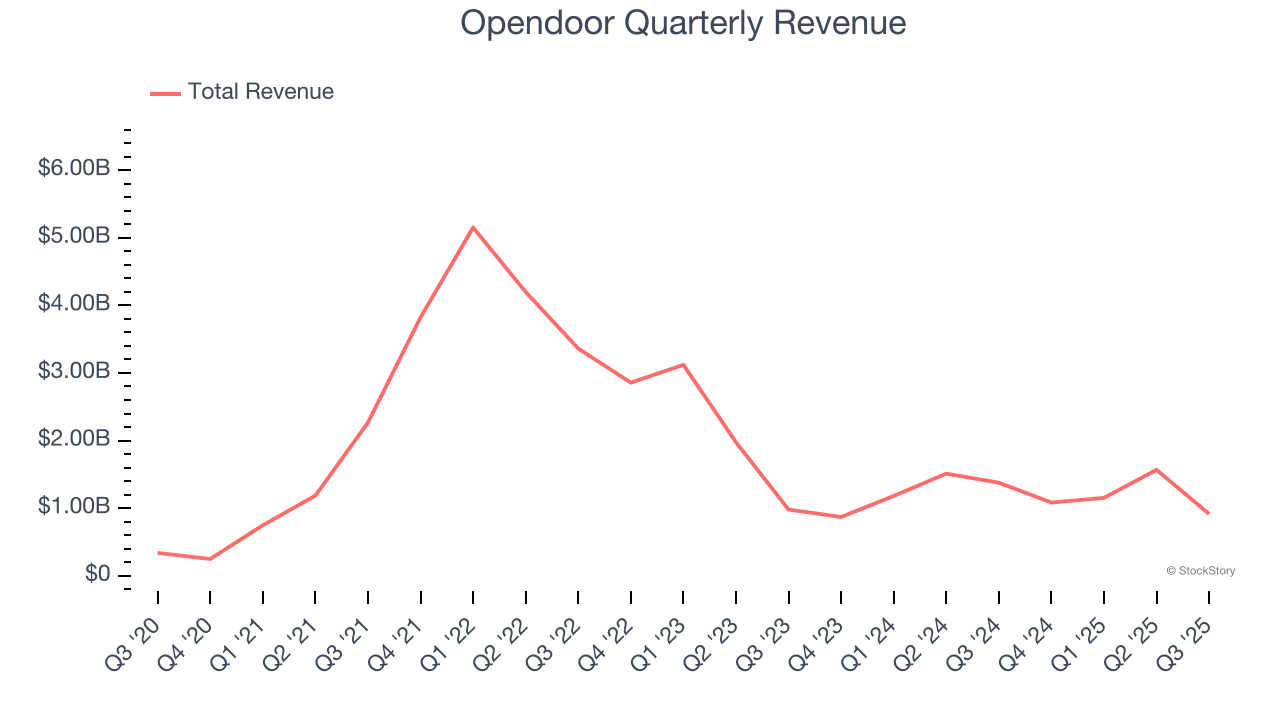

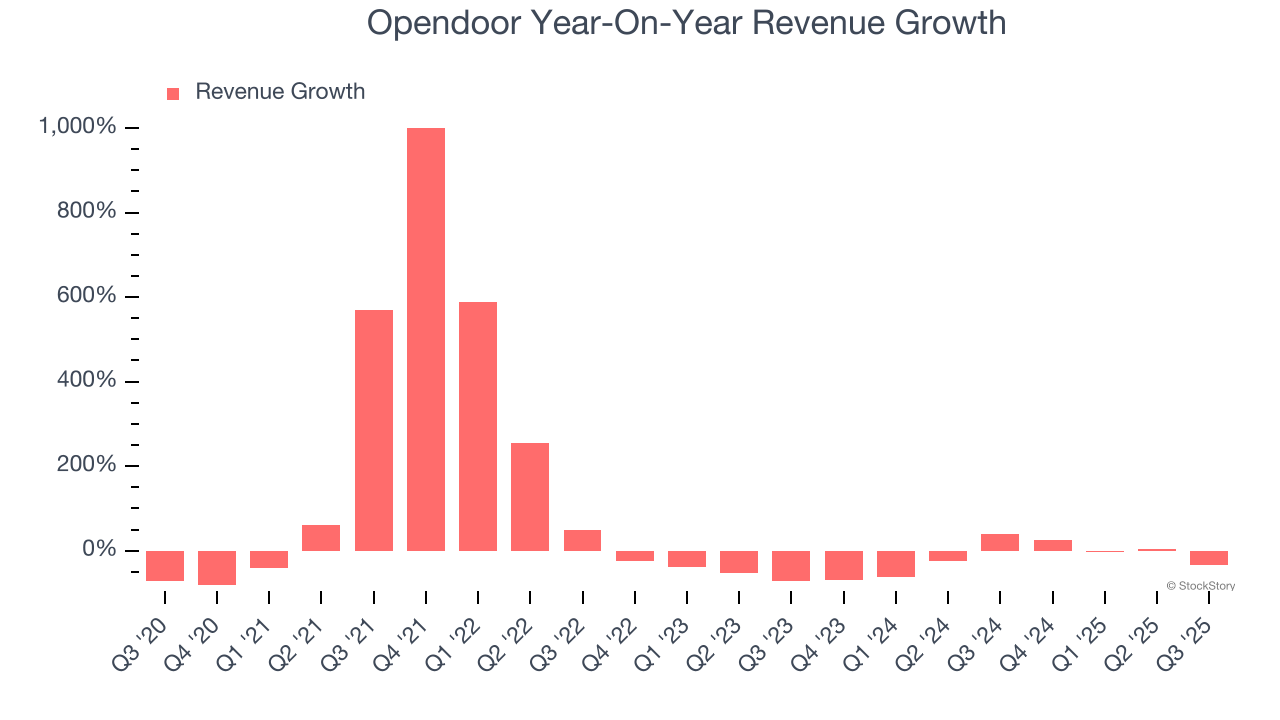

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Opendoor’s 5.6% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Opendoor’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 27.3% annually.

We can better understand the company’s revenue dynamics by analyzing its number of homes sold, which reached 2,568 in the latest quarter. Over the last two years, Opendoor’s homes sold averaged 16.2% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Opendoor’s revenue fell by 33.6% year on year to $915 million but beat Wall Street’s estimates by 7.8%.

Looking ahead, sell-side analysts expect revenue to decline by 23% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

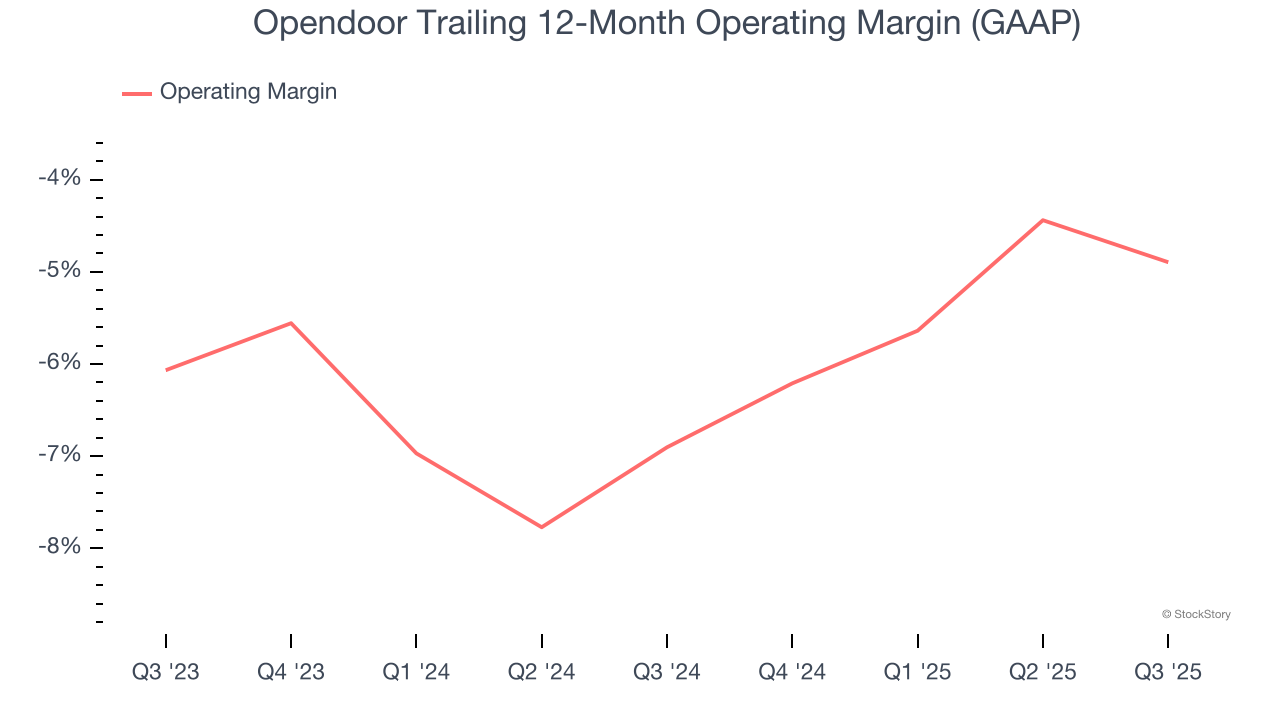

Opendoor’s operating margin has risen over the last 12 months, but it still averaged negative 5.9% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, Opendoor generated a negative 7.4% operating margin. The company's consistent lack of profits raise a flag.

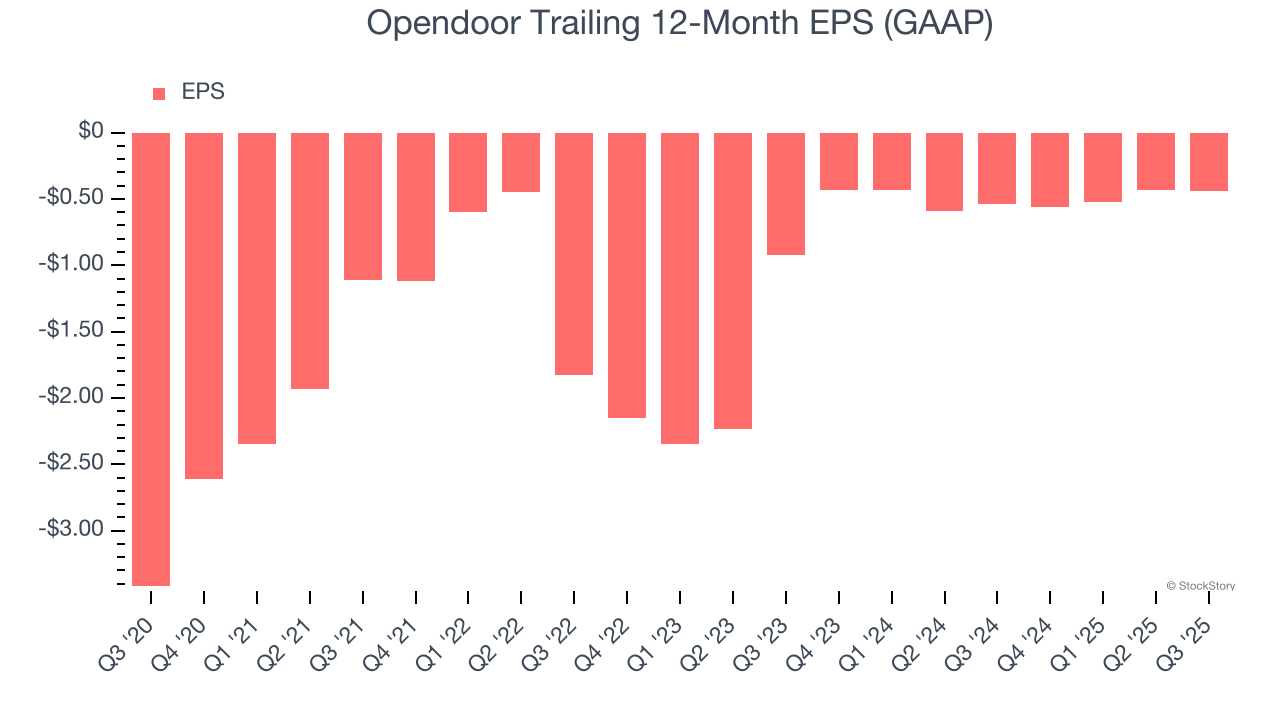

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Opendoor’s full-year earnings are still negative, it reduced its losses and improved its EPS by 33.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, Opendoor reported EPS of negative $0.12, down from negative $0.11 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Opendoor to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.44 will advance to negative $0.36.

Key Takeaways from Opendoor’s Q3 Results

We were impressed by Opendoor’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS and EBITDA whiffed. Overall, this was a mixed quarter. The stock traded down 8.5% to $5.99 immediately after reporting.

Big picture, is Opendoor a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.