Fashion brand Ralph Lauren (NYSE: RL) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 16.5% year on year to $2.01 billion. Its non-GAAP profit of $3.79 per share was 10% above analysts’ consensus estimates.

Is now the time to buy Ralph Lauren? Find out by accessing our full research report, it’s free for active Edge members.

Ralph Lauren (RL) Q3 CY2025 Highlights:

- Revenue: $2.01 billion vs analyst estimates of $1.89 billion (16.5% year-on-year growth, 6.5% beat)

- Adjusted EPS: $3.79 vs analyst estimates of $3.45 (10% beat)

- Operating Margin: 12.2%, up from 10.4% in the same quarter last year

- Free Cash Flow was -$40.6 million, down from $55.5 million in the same quarter last year

- Constant Currency Revenue rose 14% year on year (5.6% in the same quarter last year)

- Market Capitalization: $19.2 billion

"We are off to a strong start in the execution of our Next Great Chapter: Drive strategic plan introduced at our Investor Day in September, with second quarter performance outpacing our expectations across geographies, channels and consumer segments," said Patrice Louvet, President and Chief Executive Officer.

Company Overview

Originally founded as a necktie company, Ralph Lauren (NYSE: RL) is an iconic American fashion brand known for its classic and sophisticated style.

Revenue Growth

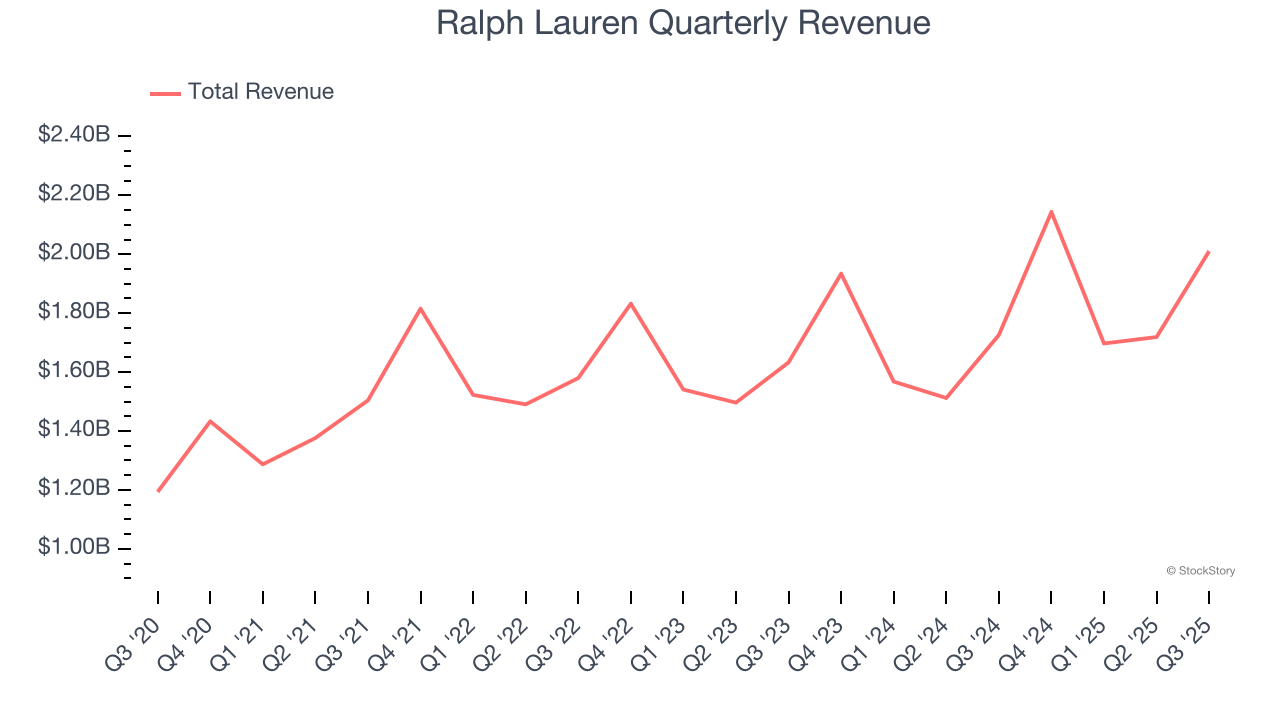

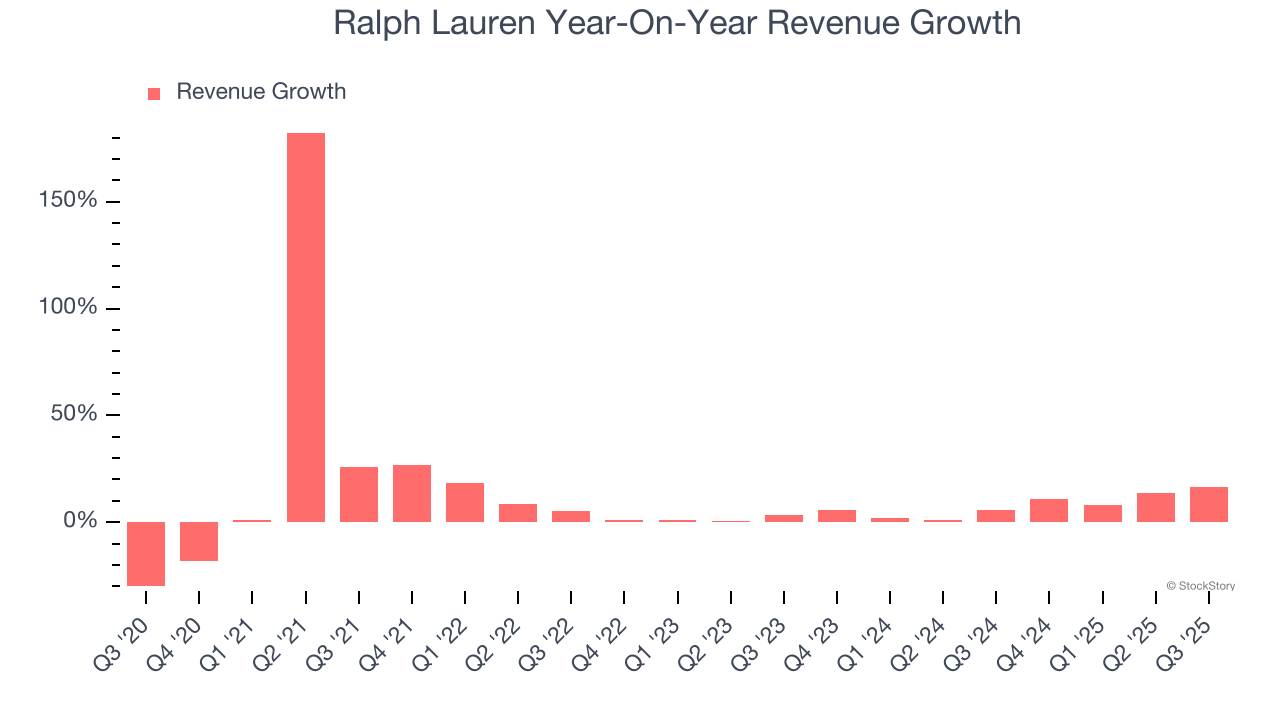

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Ralph Lauren grew its sales at a tepid 10% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Ralph Lauren’s recent performance shows its demand has slowed as its annualized revenue growth of 7.9% over the last two years was below its five-year trend.

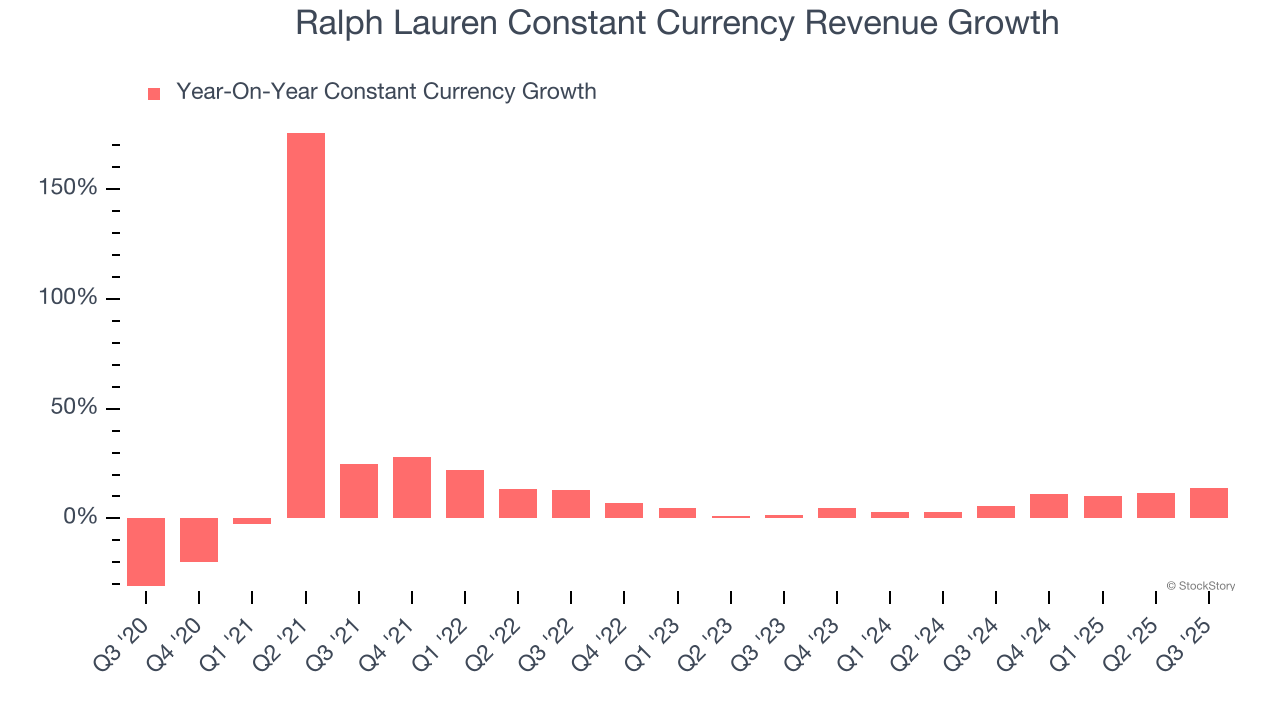

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 7.9% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Ralph Lauren has properly hedged its foreign currency exposure.

This quarter, Ralph Lauren reported year-on-year revenue growth of 16.5%, and its $2.01 billion of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

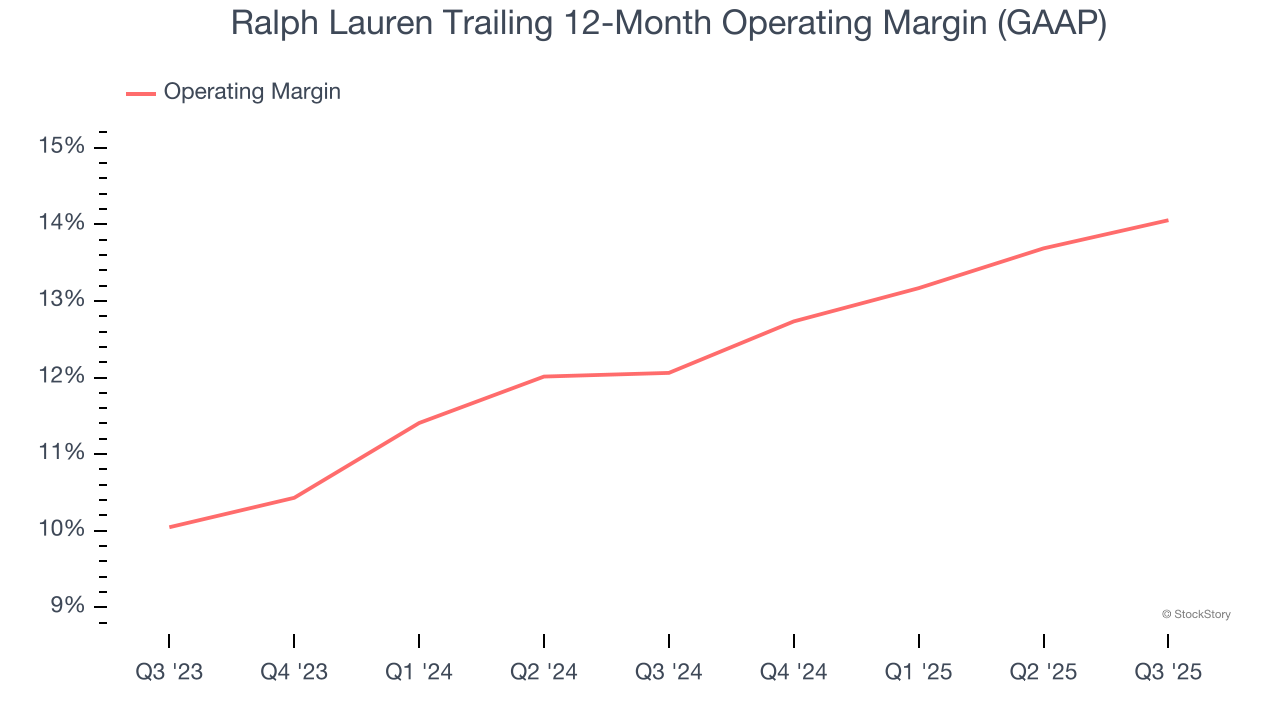

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Ralph Lauren’s operating margin has risen over the last 12 months and averaged 13.1% over the last two years. Its solid profitability for a consumer discretionary business shows it’s an efficient company that manages its expenses effectively.

This quarter, Ralph Lauren generated an operating margin profit margin of 12.2%, up 1.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

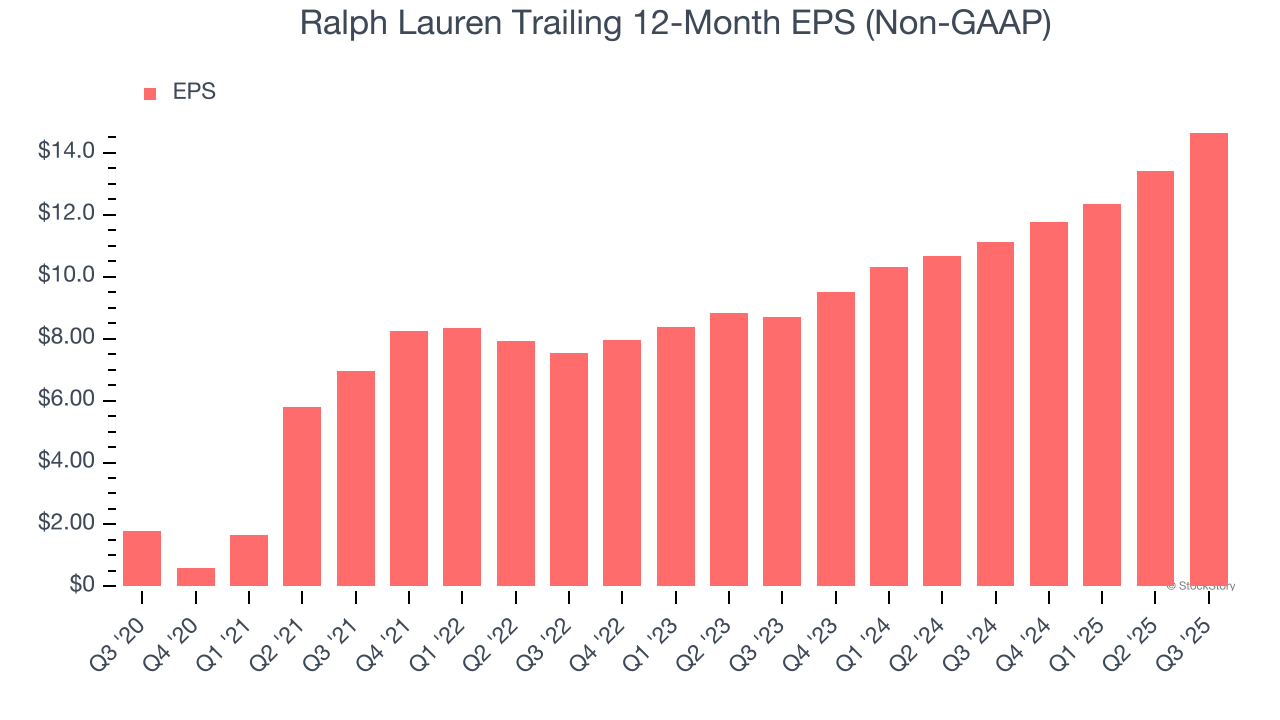

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Ralph Lauren’s EPS grew at an astounding 52.1% compounded annual growth rate over the last five years, higher than its 10% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Ralph Lauren reported adjusted EPS of $3.79, up from $2.54 in the same quarter last year. This print beat analysts’ estimates by 10%. Over the next 12 months, Wall Street expects Ralph Lauren’s full-year EPS of $14.65 to grow 4.5%.

Key Takeaways from Ralph Lauren’s Q3 Results

We were impressed by how significantly Ralph Lauren blew past analysts’ constant currency revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $318 immediately after reporting.

Ralph Lauren may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.