Video game publisher Take Two (NASDAQ: TTWO) announced better-than-expected revenue in Q3 CY2025, with sales up 20.3% year on year to $1.77 billion. On top of that, next quarter’s revenue guidance ($1.60 billion at the midpoint) was surprisingly good and 6.7% above what analysts were expecting. Its GAAP loss of $0.73 per share was 17.1% below analysts’ consensus estimates.

Is now the time to buy Take-Two? Find out by accessing our full research report, it’s free for active Edge members.

Take-Two (TTWO) Q3 CY2025 Highlights:

- Grand Theft Auto VI release date is set for November 19, 2026

- Revenue: $1.77 billion vs analyst estimates of $1.71 billion (20.3% year-on-year growth, 3.8% beat)

- EPS (GAAP): -$0.73 vs analyst expectations of -$0.62 (17.1% miss)

- Adjusted EBITDA: $116.7 million vs analyst estimates of $288 million (6.6% margin, 59.5% miss)

- The company lifted its revenue guidance for the full year to $6.43 billion at the midpoint from $6.15 billion, a 4.6% increase

- EPS (GAAP) guidance for the full year is -$2.08 at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $608 million at the midpoint, below analyst estimates of $910.2 million

- Operating Margin: -5.5%, up from -20.1% in the same quarter last year

- Free Cash Flow was $96.5 million, up from -$69.8 million in the previous quarter

- Market Capitalization: $47 billion

Strauss Zelnick, Chairman and CEO of Take-Two Interactive, stated: “We achieved outstanding second quarter results by releasing new hit titles, driving innovation in live services, and maintaining our commitment to developing the highest quality products. With momentum across our business, particularly in mobile and NBA 2K, we are raising our Fiscal Year 2026 Net Bookings forecast for the second consecutive quarter. Rockstar Games will now release Grand Theft Auto VI on November 19, 2026, and we remain both excited and confident they will deliver an unrivalled blockbuster entertainment experience. With the most robust pipeline in our Company’s history, we expect to achieve record levels of Net Bookings in Fiscal 2027, which will establish a new baseline for our business and set us on a path of enhanced profitability.”

Company Overview

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ: TTWO) is one of the world’s largest video game publishers.

Revenue Growth

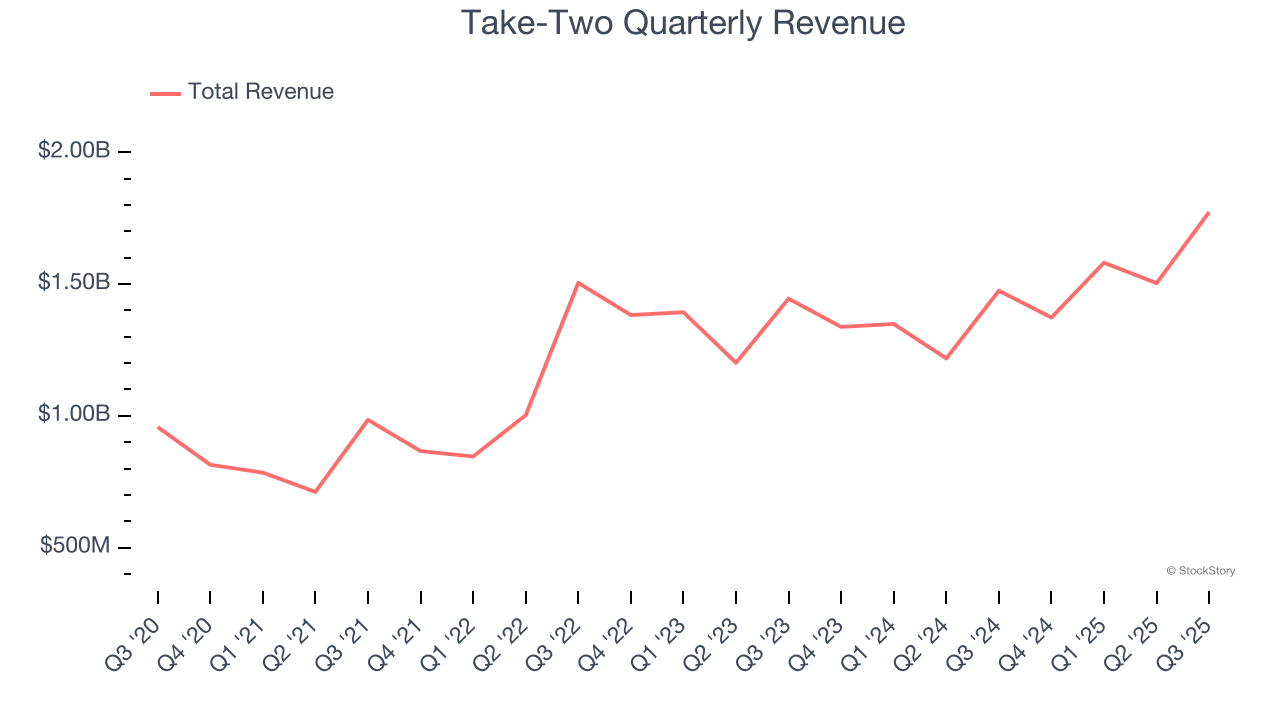

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Take-Two’s sales grew at a decent 13.9% compounded annual growth rate over the last three years. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Take-Two reported robust year-on-year revenue growth of 20.3%, and its $1.77 billion of revenue topped Wall Street estimates by 3.8%. Company management is currently guiding for a 16.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 37.2% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

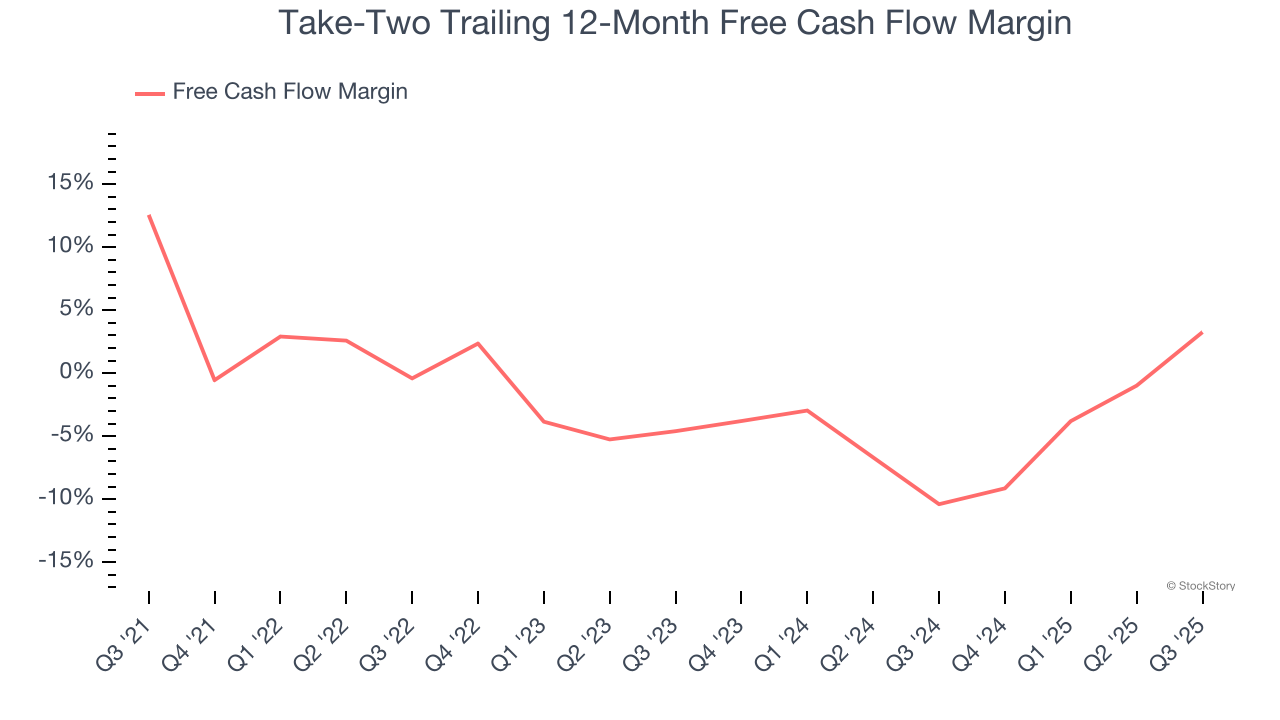

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Take-Two posted positive free cash flow this quarter, the broader story hasn’t been so clean. Take-Two’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 3.1%. This means it lit $3.06 of cash on fire for every $100 in revenue. This is a stark contrast from its EBITDA margin, and its investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Taking a step back, an encouraging sign is that Take-Two’s margin expanded by 3.7 percentage points over the last few years. The company’s improvement and free cash flow generation this quarter show it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

Take-Two’s free cash flow clocked in at $96.5 million in Q3, equivalent to a 5.4% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

Key Takeaways from Take-Two’s Q3 Results

It was great to see Take-Two beat analysts' revenue expectations and raise its full-year revenue guidance. On the other hand, its EPS and EBITDA missed significantly, and its full-year EBITDA guidance fell well short of Wall Street’s estimates. Overall, this print was mixed. Investors were likely hoping for stronger profitability, and shares traded down 6.9% to $235.60 immediately following the results.

So do we think Take-Two is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.