Medication company Viatris (NASDAQ: VTRS) beat Wall Street’s revenue expectations in Q3 CY2025, but sales were flat year on year at $3.76 billion. The company’s full-year revenue guidance of $14.1 billion at the midpoint came in 1.2% above analysts’ estimates. Its non-GAAP profit of $0.67 per share was 8.5% above analysts’ consensus estimates.

Is now the time to buy Viatris? Find out by accessing our full research report, it’s free for active Edge members.

Viatris (VTRS) Q3 CY2025 Highlights:

- Revenue: $3.76 billion vs analyst estimates of $3.61 billion (flat year on year, 4.3% beat)

- Adjusted EPS: $0.67 vs analyst estimates of $0.62 (8.5% beat)

- Adjusted EBITDA: $1.15 billion vs analyst estimates of $1.08 billion (30.7% margin, 6.7% beat)

- The company lifted its revenue guidance for the full year to $14.1 billion at the midpoint from $13.75 billion, a 2.5% increase

- Management raised its full-year Adjusted EPS guidance to $2.30 at the midpoint, a 3.1% increase

- EBITDA guidance for the full year is $4.1 billion at the midpoint, in line with analyst expectations

- Operating Margin: 4.8%, down from 6% in the same quarter last year

- Free Cash Flow Margin: 17.5%, down from 20% in the same quarter last year

- Market Capitalization: $12.53 billion

Company Overview

Created through the 2020 merger of Mylan and Pfizer's Upjohn division, Viatris (NASDAQ: VTRS) is a healthcare company that develops, manufactures, and distributes branded and generic medicines across more than 165 countries worldwide.

Revenue Growth

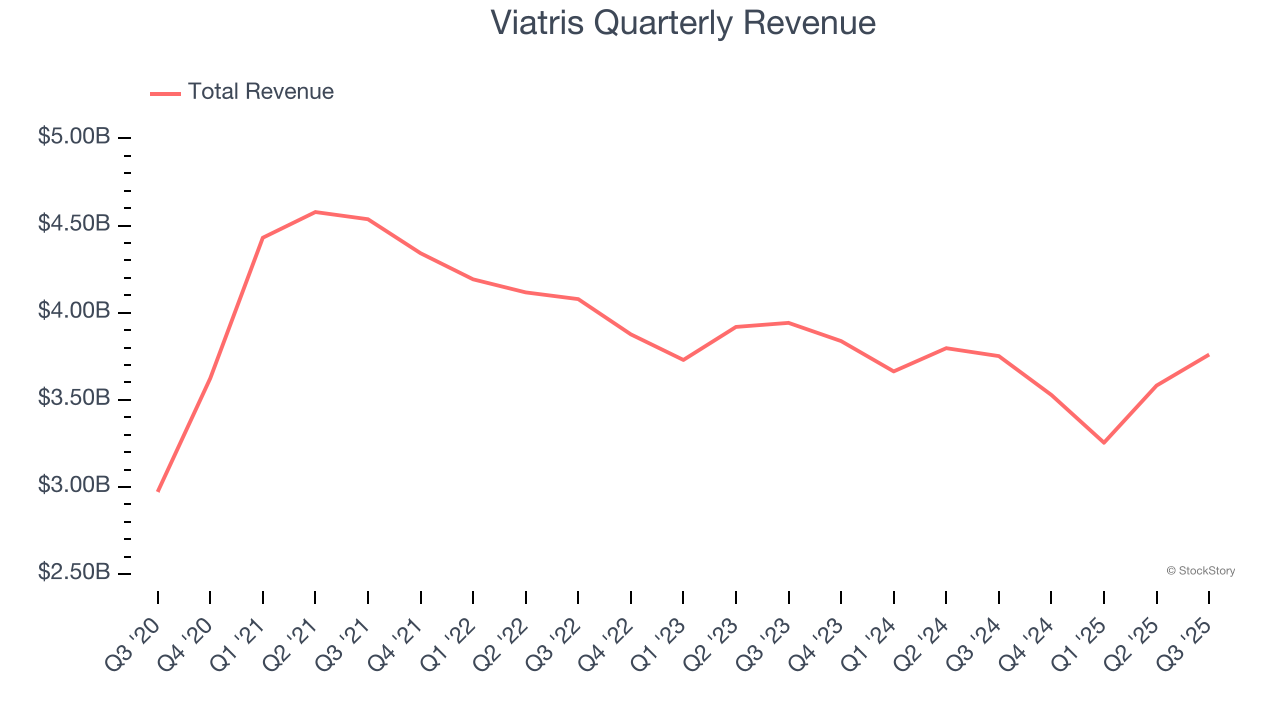

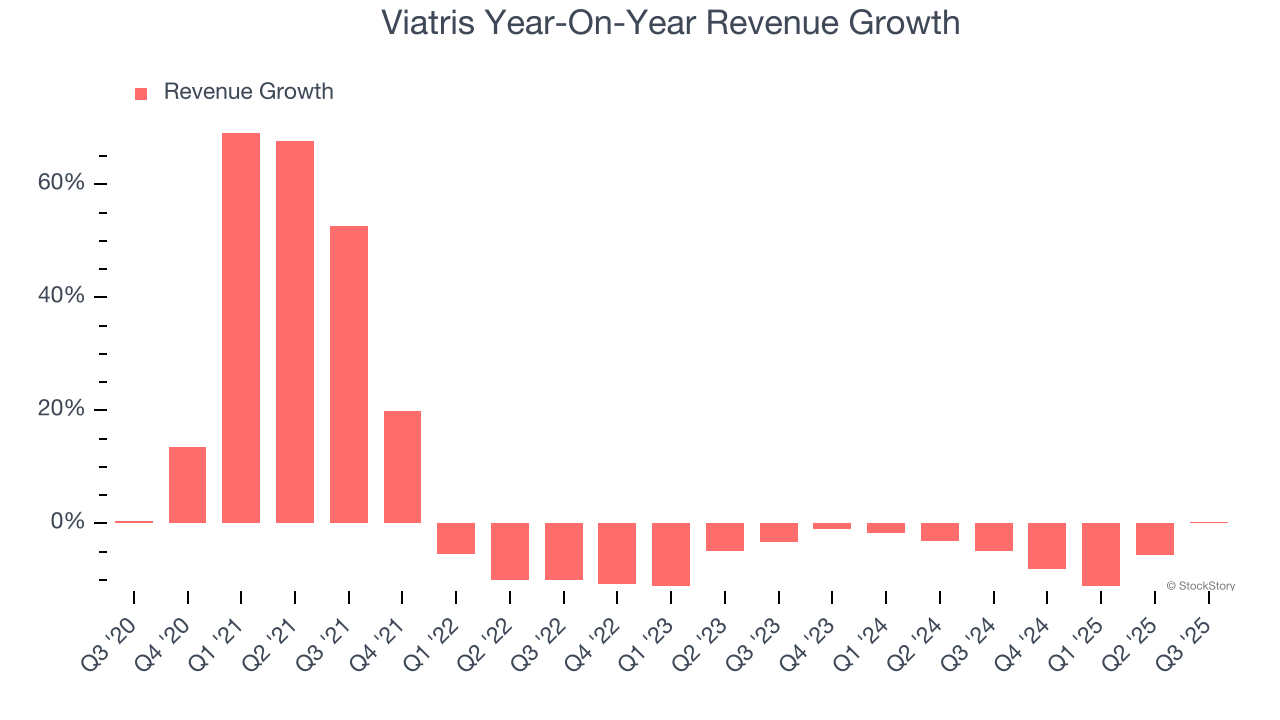

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Viatris’s sales grew at a mediocre 4.2% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Viatris’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually.

This quarter, Viatris’s $3.76 billion of revenue was flat year on year but beat Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

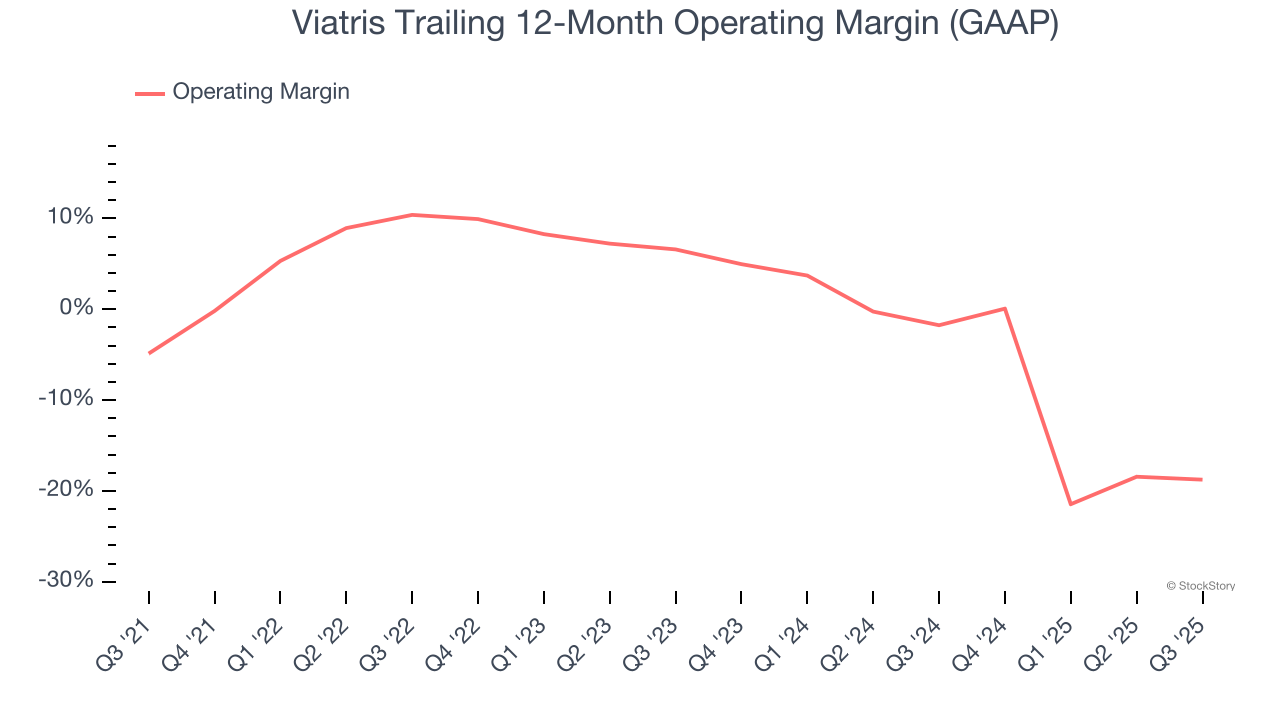

Although Viatris was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.3% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Viatris’s operating margin decreased by 13.9 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 25.4 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Viatris generated an operating margin profit margin of 4.8%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Viatris, its EPS declined by 13.1% annually over the last five years while its revenue grew by 4.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Viatris’s earnings can give us a better understanding of its performance. As we mentioned earlier, Viatris’s operating margin declined by 13.9 percentage points over the last five years. Its share count also grew by 125%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Viatris reported adjusted EPS of $0.67, down from $0.75 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.5%. Over the next 12 months, Wall Street expects Viatris’s full-year EPS of $2.34 to stay about the same.

Key Takeaways from Viatris’s Q3 Results

We enjoyed seeing Viatris beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 4.6% to $10.30 immediately after reporting.

Big picture, is Viatris a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.