Local business platform Yelp (NYSE: YELP) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 4.4% year on year to $376 million. The company expects the full year’s revenue to be around $1.46 billion, close to analysts’ estimates. Its GAAP profit of $0.61 per share was 16.1% above analysts’ consensus estimates.

Is now the time to buy Yelp? Find out by accessing our full research report, it’s free for active Edge members.

Yelp (YELP) Q3 CY2025 Highlights:

- Revenue: $376 million vs analyst estimates of $368.2 million (4.4% year-on-year growth, 2.1% beat)

- EPS (GAAP): $0.61 vs analyst estimates of $0.53 (16.1% beat)

- Adjusted EBITDA: $98.07 million vs analyst estimates of $84.85 million (26.1% margin, 15.6% beat)

- The company dropped its revenue guidance for the full year to $1.46 billion at the midpoint from $1.47 billion, a 0.5% decrease

- EBITDA guidance for the full year is $362.5 million at the midpoint, above analyst estimates of $357.8 million

- Operating Margin: 14.1%, up from 12.9% in the same quarter last year

- Free Cash Flow Margin: 31.6%, up from 12.2% in the previous quarter

- Market Capitalization: $2.03 billion

“Our third quarter results reflect continued execution against our product-led strategy,” said Jeremy Stoppelman, Yelp’s co-founder and Chief Executive Officer.

Company Overview

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Revenue Growth

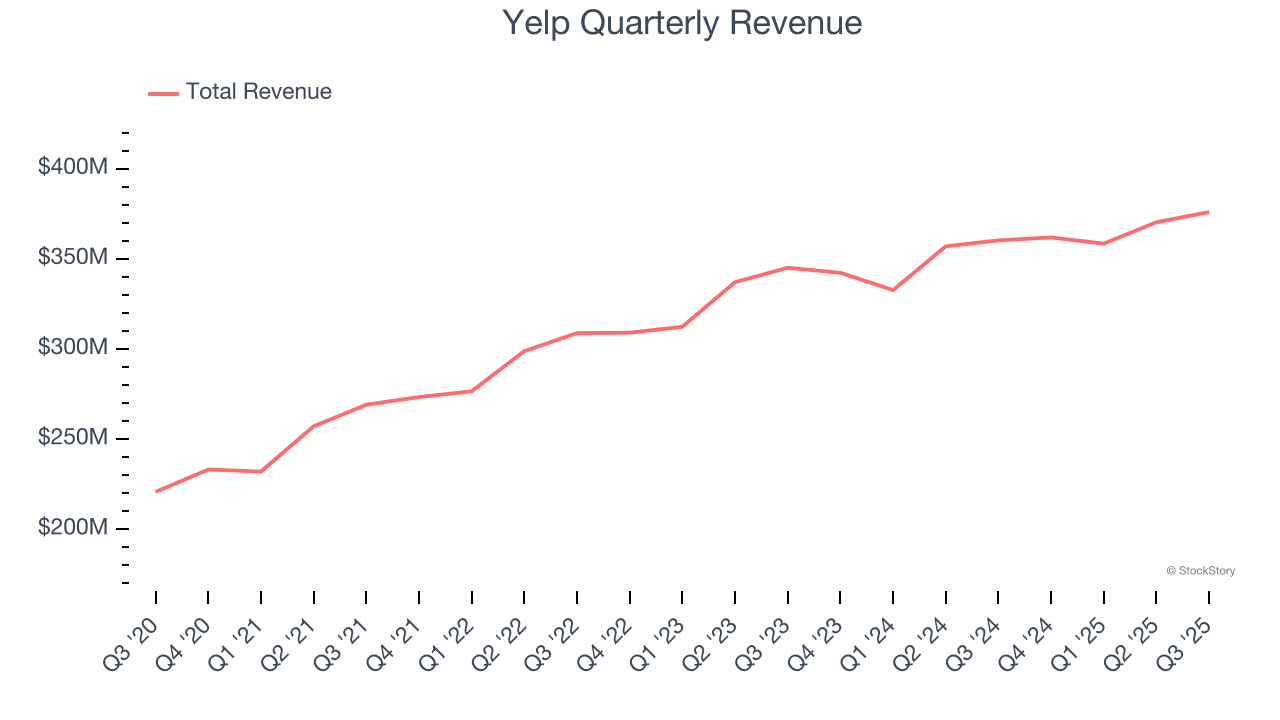

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Yelp grew its sales at a mediocre 8.2% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Yelp.

This quarter, Yelp reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

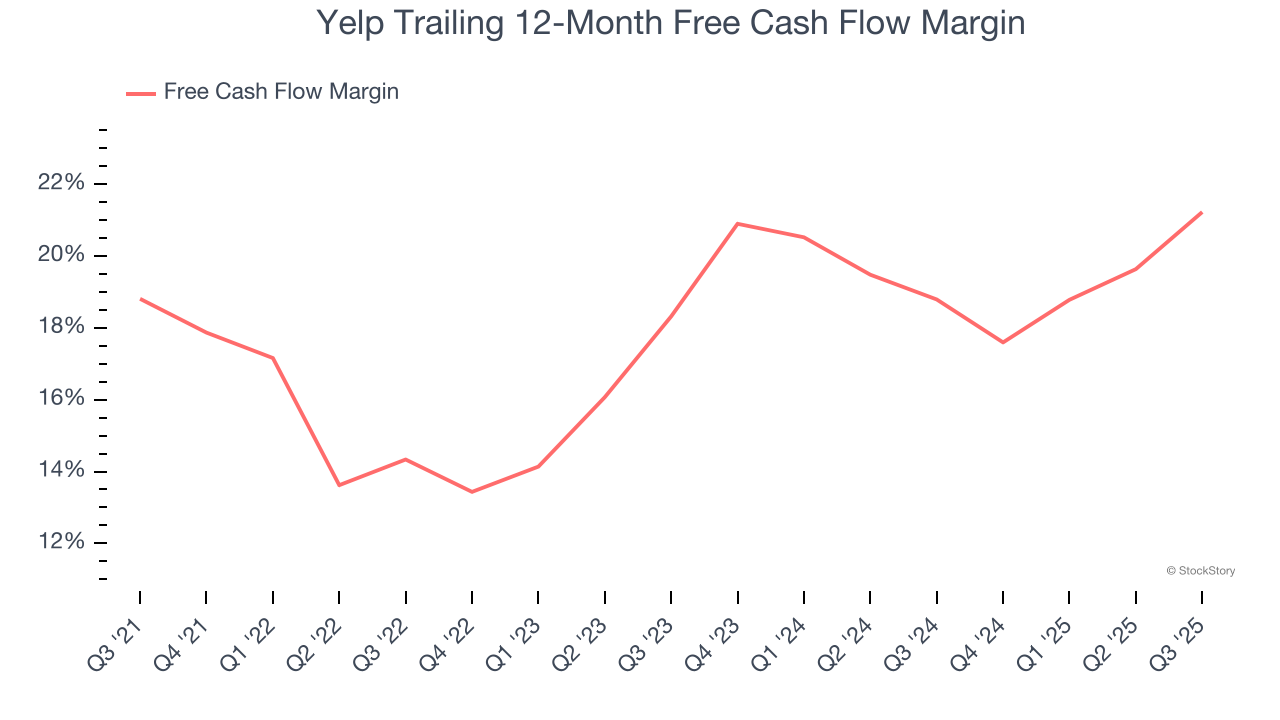

Yelp has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 20% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Yelp’s margin expanded by 6.9 percentage points over the last few years. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Yelp’s free cash flow clocked in at $118.9 million in Q3, equivalent to a 31.6% margin. This result was good as its margin was 5.9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Yelp’s Q3 Results

We were impressed by how significantly Yelp blew past analysts’ EPS and EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. On the other hand, it lowered its full-year revenue guidance. Overall, this print had some key positives. The stock remained flat at $31.94 immediately after reporting.

So do we think Yelp is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.