Over the past six months, Stryker’s shares (currently trading at $350.50) have posted a disappointing 9% loss, well below the S&P 500’s 13.4% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy SYK? Find out in our full research report, it’s free for active Edge members.

Why Do Investors Watch SYK Stock?

With over 150 million patients impacted annually through its innovative healthcare technologies, Stryker (NYSE: SYK) develops and manufactures advanced medical devices and equipment across orthopedics, surgical tools, neurotechnology, and patient care solutions.

Three Positive Attributes:

1. Organic Growth Indicates Solid Core Business

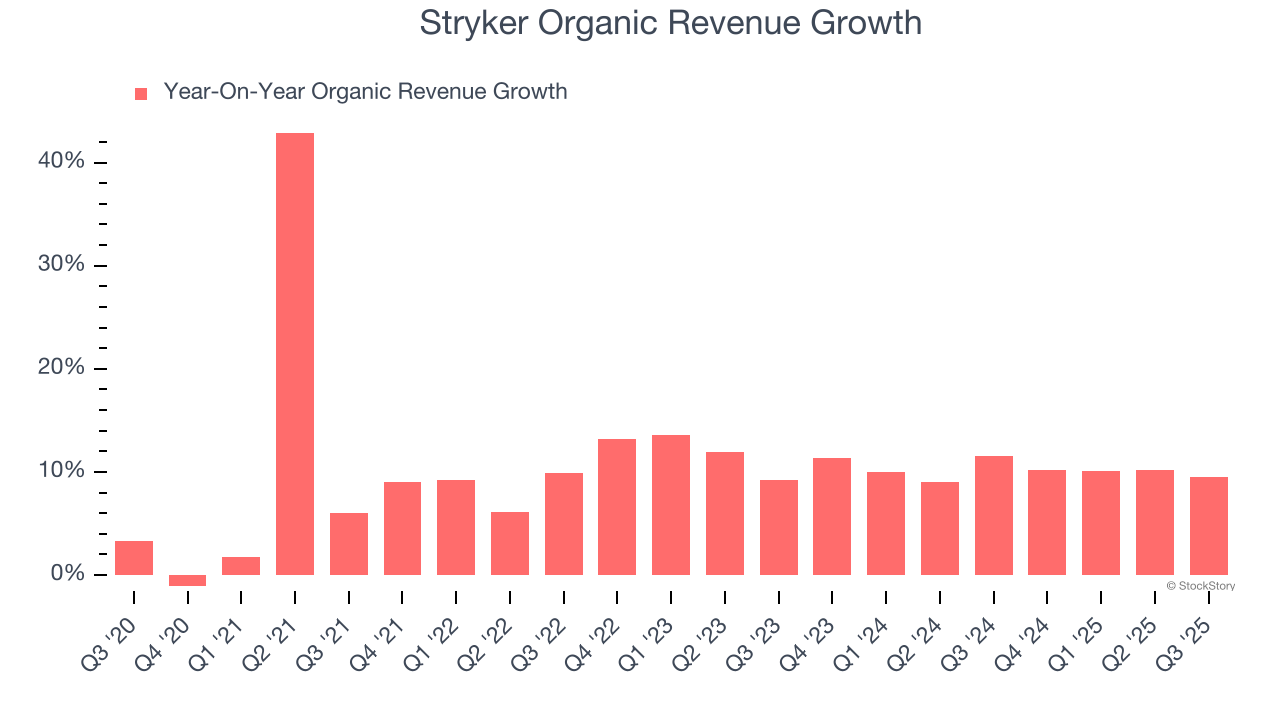

Investors interested in Medical Devices & Supplies - Diversified companies should track organic revenue in addition to reported revenue. This metric gives visibility into Stryker’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Stryker’s organic revenue averaged 10.2% year-on-year growth. This performance was solid and shows it can expand steadily without relying on expensive (and risky) acquisitions.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $24.38 billion in revenue over the past 12 months, Stryker sports economies of scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

3. Outstanding Long-Term EPS Growth

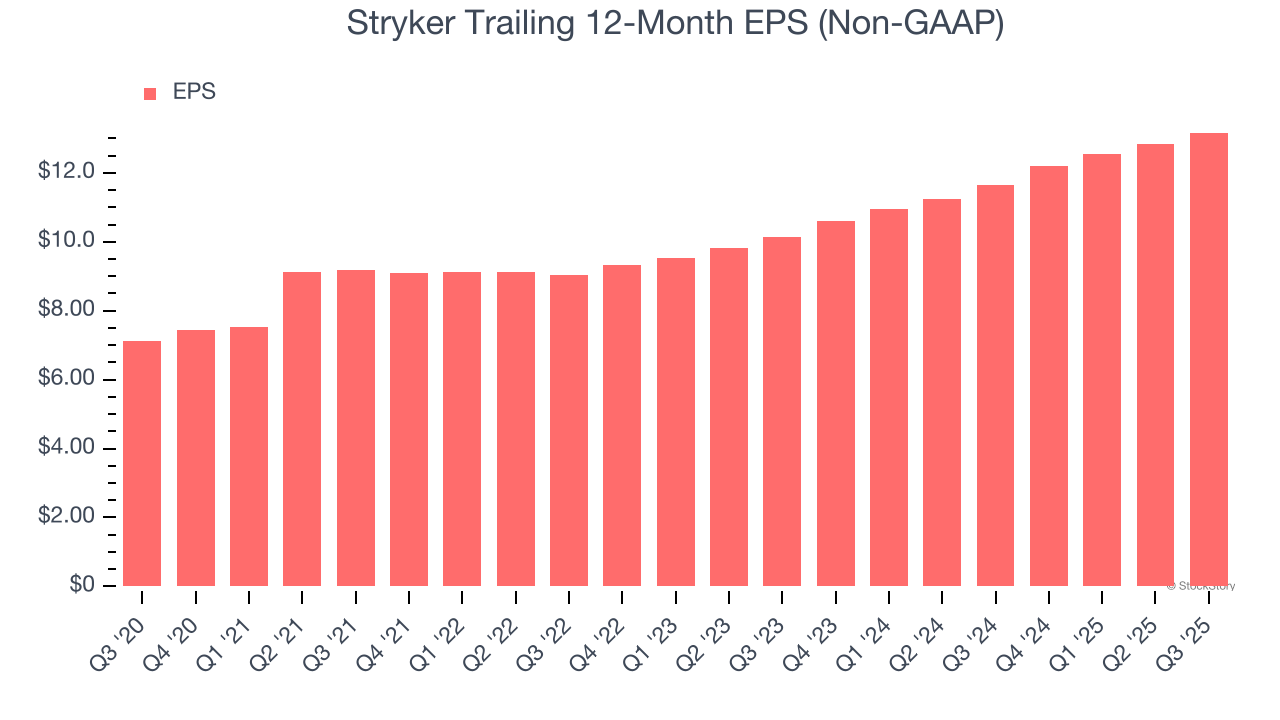

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Stryker’s spectacular 13.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

Stryker possesses several positive attributes. With the recent decline, the stock trades at 24.4× forward P/E (or $350.50 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.