Truist Financial trades at $47.70 and has moved in lockstep with the market. Its shares have returned 17.1% over the last six months while the S&P 500 has gained 13.4%.

Is now the time to buy Truist Financial, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Truist Financial Will Underperform?

We don't have much confidence in Truist Financial. Here are three reasons why TFC doesn't excite us and a stock we'd rather own.

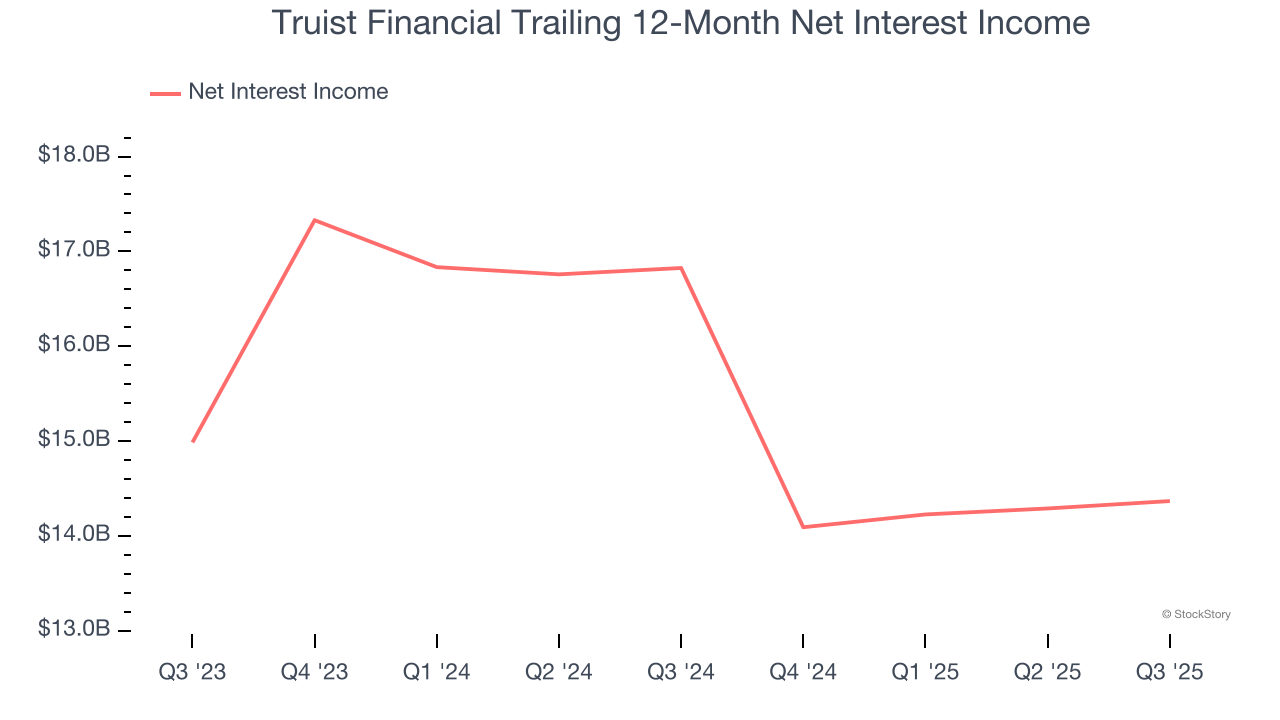

1. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Truist Financial’s net interest income has grown at a 2.5% annualized rate over the last five years, much worse than the broader banking industry.

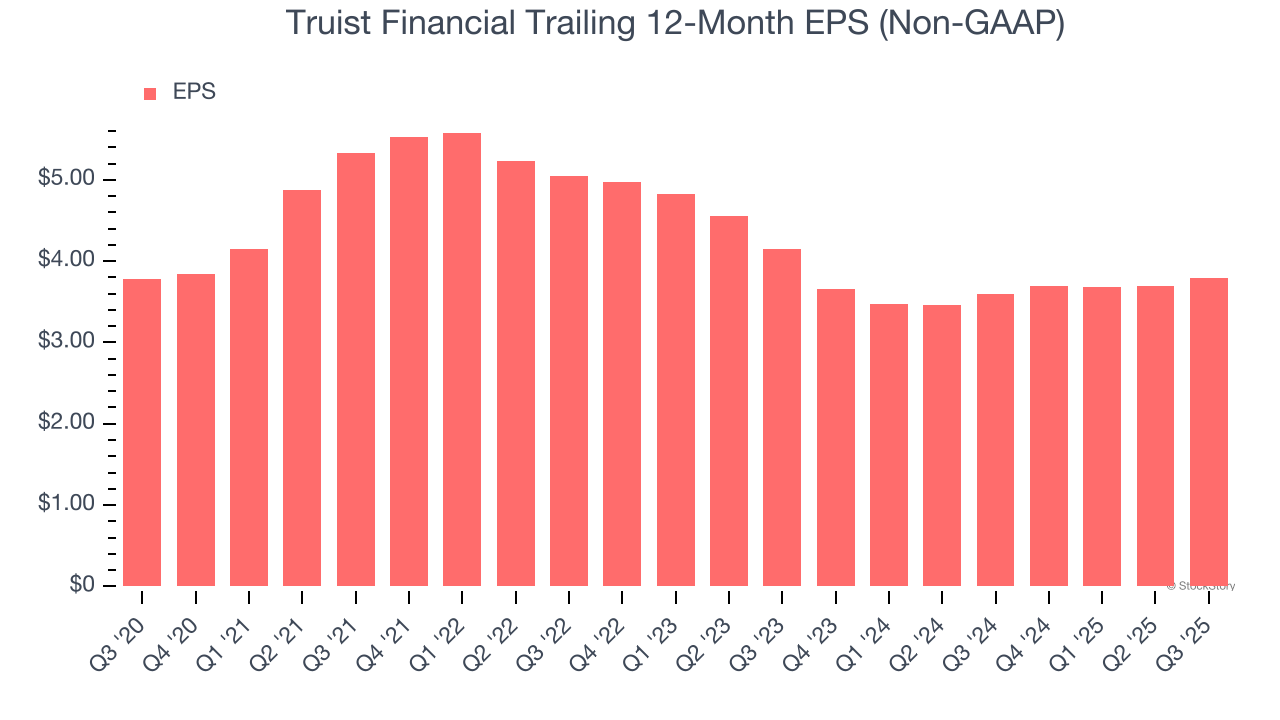

2. EPS Growth Has Stalled

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Truist Financial’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

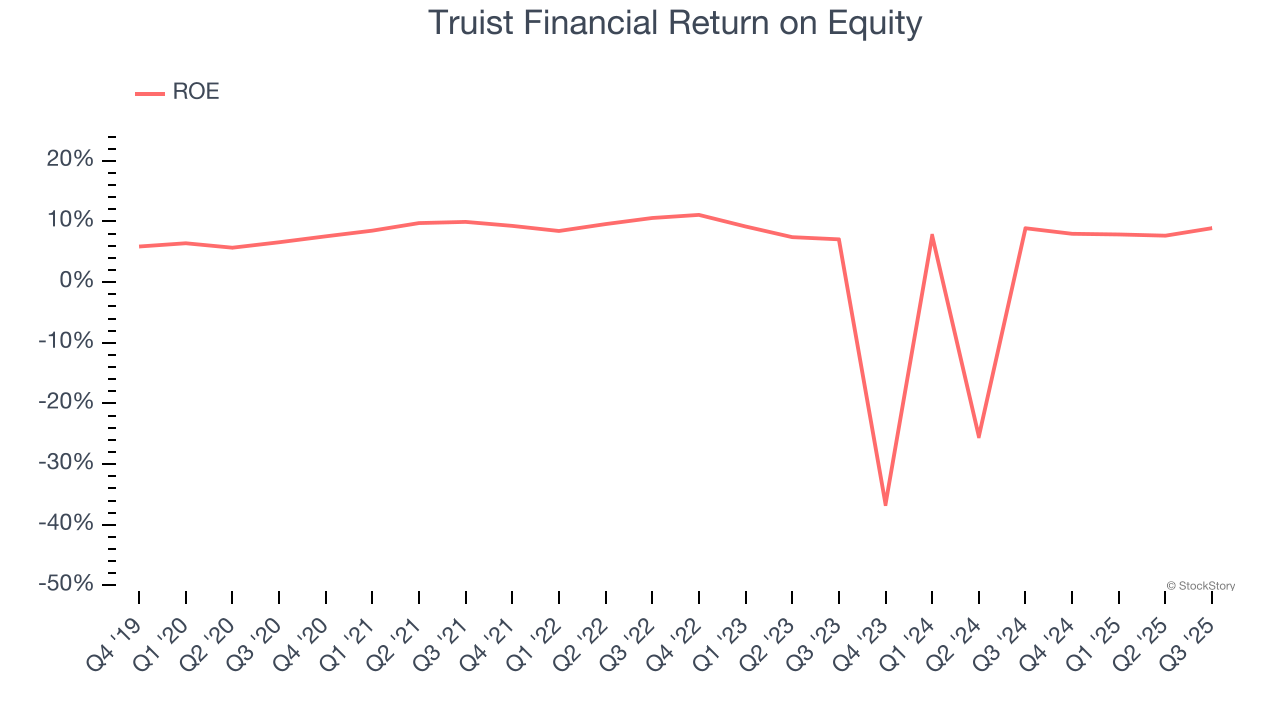

3. Previous Growth Initiatives Haven’t Impressed

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Truist Financial has averaged an ROE of 4.8%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

We see the value of companies driving economic growth, but in the case of Truist Financial, we’re out. That said, the stock currently trades at 1× forward P/B (or $47.70 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.