Analog Devices has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 18.2% to $275.75 per share while the index has gained 13.4%.

Is there a buying opportunity in Analog Devices, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Analog Devices Not Exciting?

We're sitting this one out for now. Here are two reasons there are better opportunities than ADI and a stock we'd rather own.

1. Revenue Tumbling Downwards

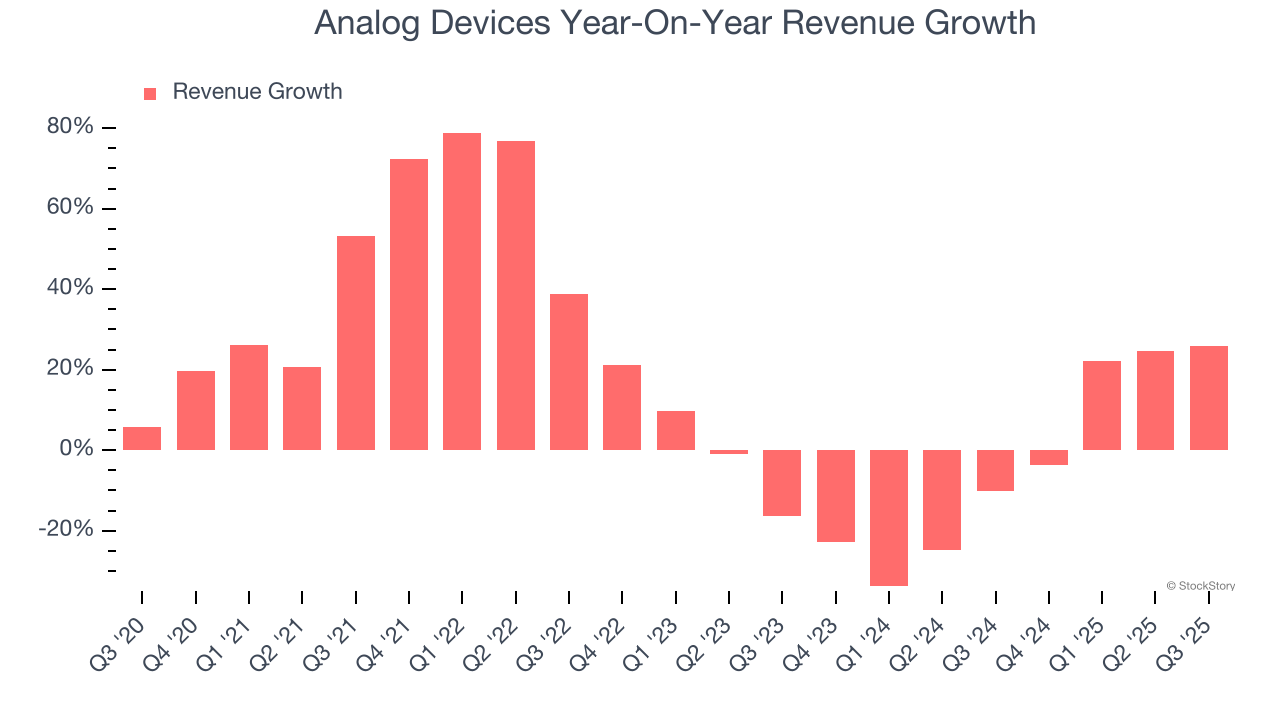

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Analog Devices’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.4% over the last two years.

2. Previous Growth Initiatives Haven’t Impressed

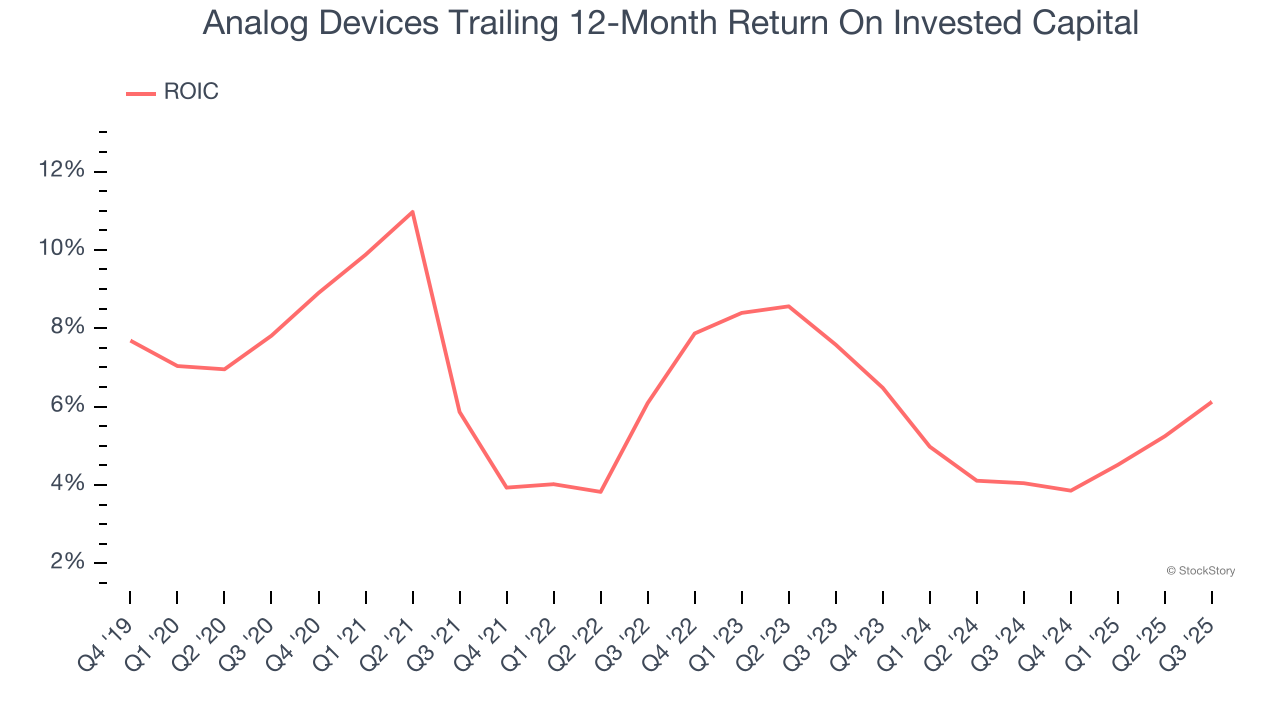

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Analog Devices historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

Final Judgment

Analog Devices isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 28.2× forward P/E (or $275.75 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Analog Devices

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.