Interactive Brokers currently trades at $65.51 and has been a dream stock for shareholders. It’s returned 368% since December 2020, blowing past the S&P 500’s 86.4% gain. The company has also beaten the index over the past six months as its stock price is up 27.8% thanks to its solid quarterly results.

Is there a buying opportunity in Interactive Brokers, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Interactive Brokers Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Interactive Brokers. Here is one reason we avoid IBKR and a stock we'd rather own.

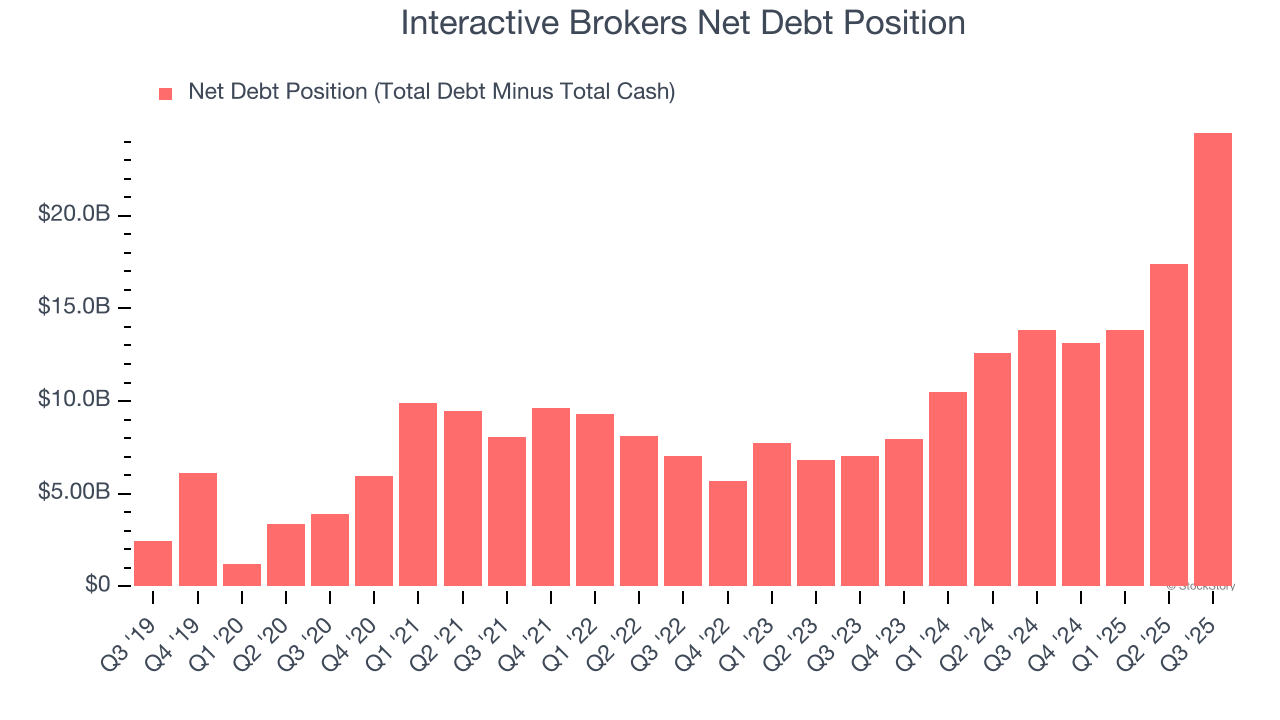

High Debt Levels Increase Risk

Interactive Brokers reported $5.13 billion of cash and $29.62 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $4.61 billion of EBITDA over the last 12 months, we view Interactive Brokers’s 5.3× net-debt-to-EBITDA ratio as inadequate. The company’s lacking profits relative to its borrowings give it little breathing room, raising red flags.

Final Judgment

Interactive Brokers isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 28.9× forward P/E (or $65.51 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.