Over the last six months, Waste Management’s shares have sunk to $209.00, producing a disappointing 10.8% loss - a stark contrast to the S&P 500’s 13.6% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now a good time to buy WM? Find out in our full research report, it’s free for active Edge members.

Why Does WM Stock Spark Debate?

Headquartered in Houston, Waste Management (NYSE: WM) is a provider of comprehensive waste management services in North America.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Waste Management’s sales grew at an impressive 10.6% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

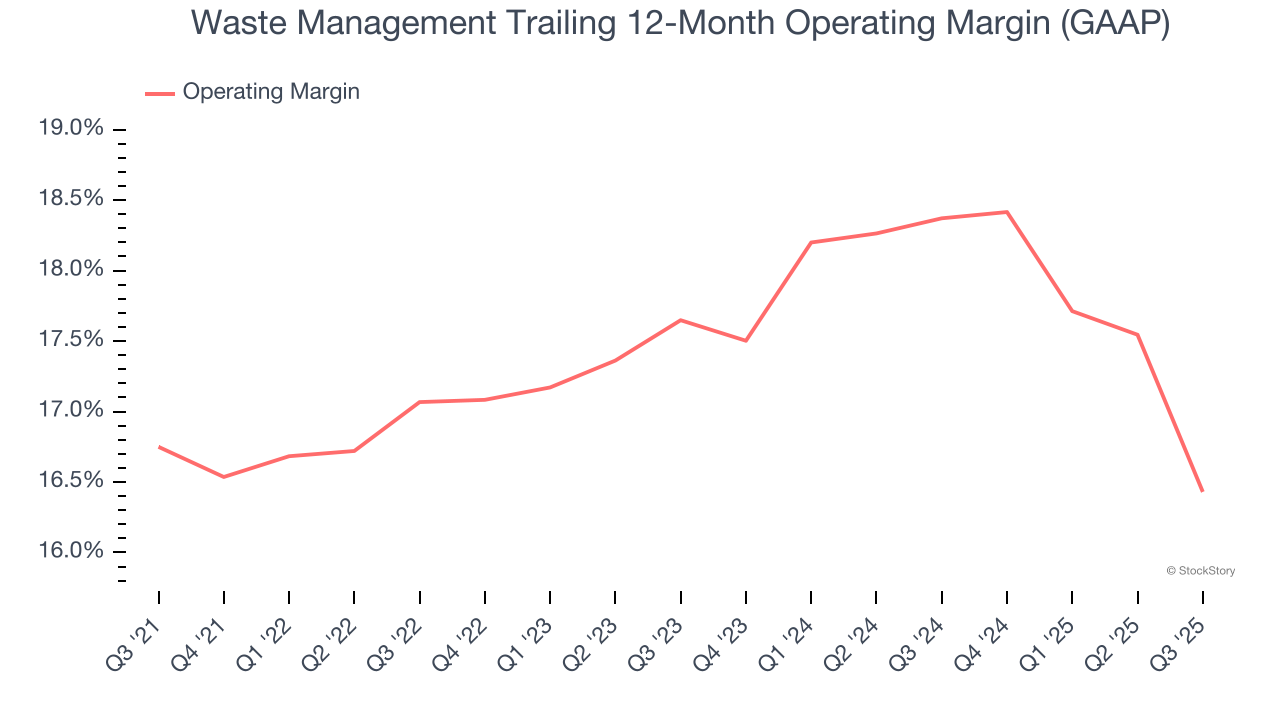

2. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Waste Management’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 17.2% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

One Reason to be Careful:

Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Waste Management’s margin dropped by 5.2 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Waste Management’s free cash flow margin for the trailing 12 months was 9.7%.

Final Judgment

Waste Management has huge potential even though it has some open questions. With the recent decline, the stock trades at 25.9× forward P/E (or $209.00 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Waste Management

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.