National Vision’s 39% return over the past six months has outpaced the S&P 500 by 25.5%, and its stock price has climbed to $29.87 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in National Vision, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think National Vision Will Underperform?

Despite the momentum, we're sitting this one out for now. Here are three reasons why EYE doesn't excite us and a stock we'd rather own.

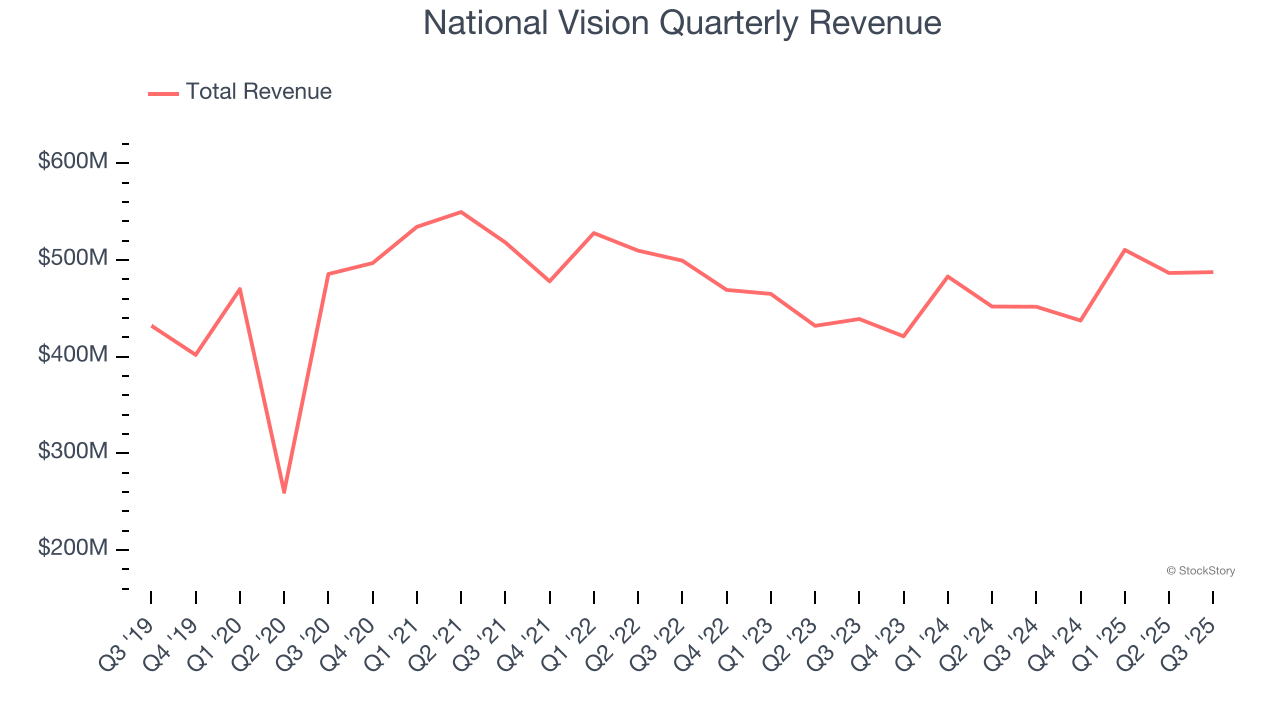

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. National Vision struggled to consistently generate demand over the last three years as its sales dropped at a 1.6% annual rate. This was below our standards and is a sign of poor business quality.

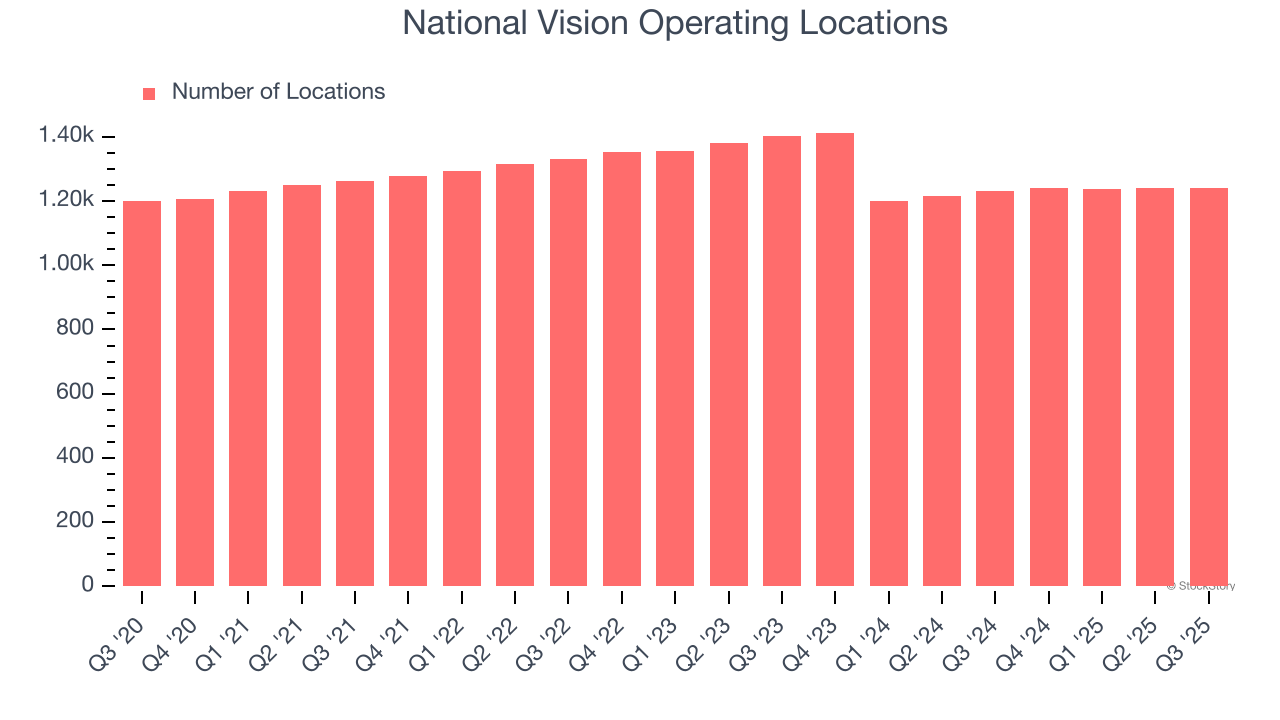

2. Stores Are Closing, a Headwind for Revenue

A retailer’s store count often determines how much revenue it can generate.

National Vision operated 1,242 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 4.7% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

National Vision historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

Final Judgment

We see the value of companies helping consumers, but in the case of National Vision, we’re out. With its shares topping the market in recent months, the stock trades at 31.8× forward P/E (or $29.87 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of National Vision

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.