NVR currently trades at $7,516 per share and has shown little upside over the past six months, posting a middling return of 3%. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Is there a buying opportunity in NVR, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is NVR Not Exciting?

We're swiping left on NVR for now. Here are three reasons we avoid NVR and a stock we'd rather own.

1. Backlog Is Unchanged, Sales Pipeline Stalls

In addition to reported revenue, backlog is a useful data point for analyzing Home Builders companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into NVR’s future revenue streams.

Over the last two years, NVR failed to grow its backlog, which came in at $4.39 billion in the latest quarter. This performance was underwhelming and shows the company faced challenges in winning new orders. It also suggests there may be increasing competition or market saturation.

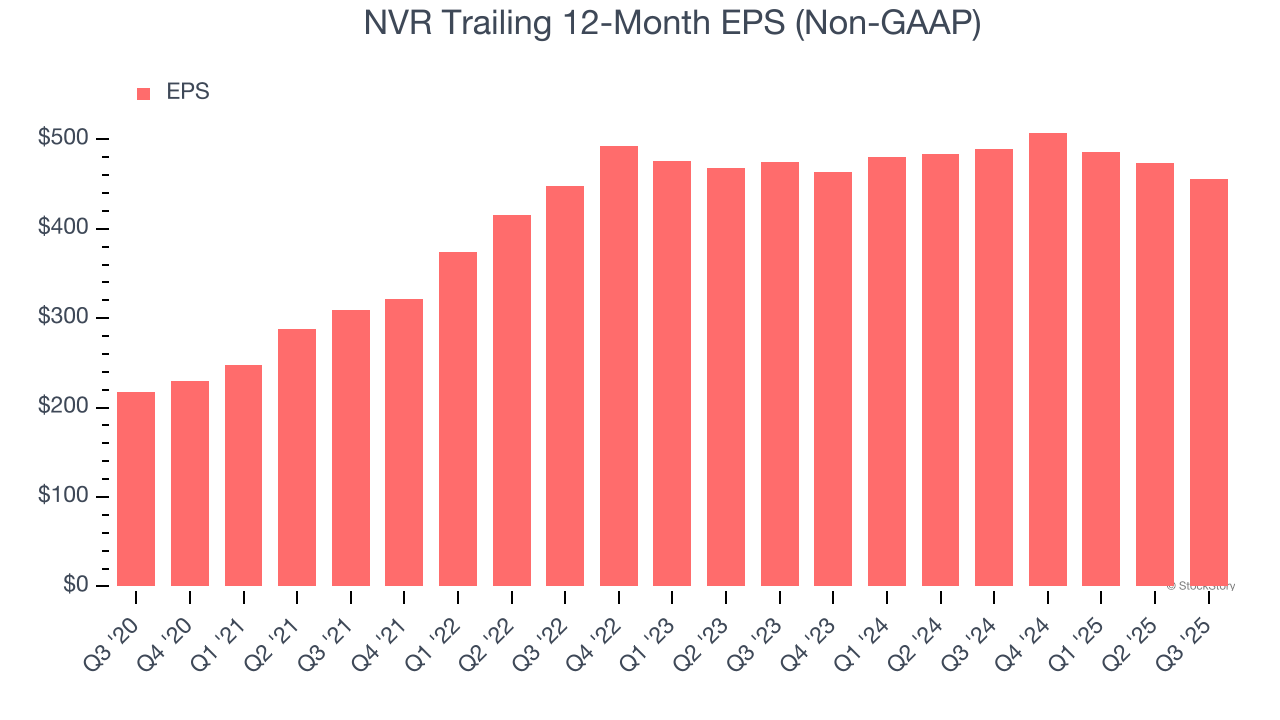

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for NVR, its EPS declined by 2.1% annually over the last two years while its revenue grew by 3.3%. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, NVR’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

NVR isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 17.9× forward P/E (or $7,516 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of NVR

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.