Over the past six months, Harley-Davidson’s shares (currently trading at $21.38) have posted a disappointing 12.3% loss, well below the S&P 500’s 13.1% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Harley-Davidson, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Harley-Davidson Will Underperform?

Even though the stock has become cheaper, we're swiping left on Harley-Davidson for now. Here are three reasons why HOG doesn't excite us and a stock we'd rather own.

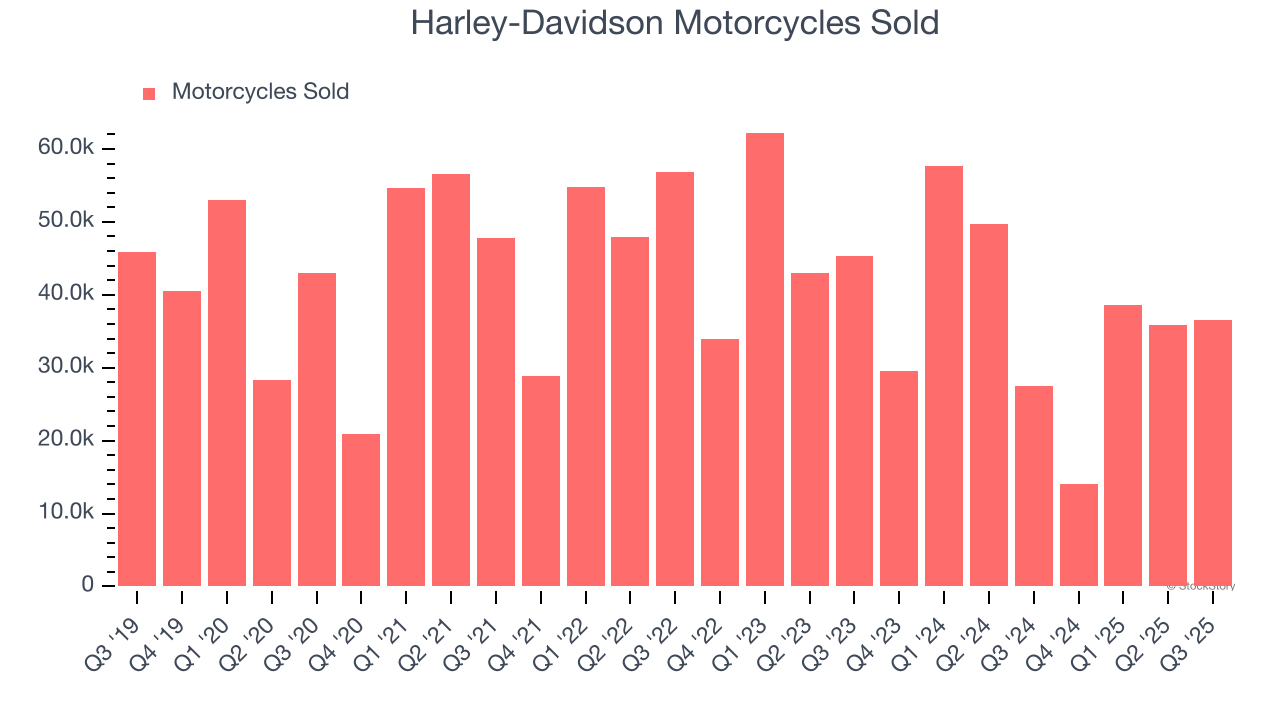

1. Decline in Motorcycles Sold Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Harley-Davidson, our preferred volume metric is motorcycles sold). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Harley-Davidson’s motorcycles sold came in at 36,524 in the latest quarter, and over the last two years, averaged 15.6% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Harley-Davidson might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

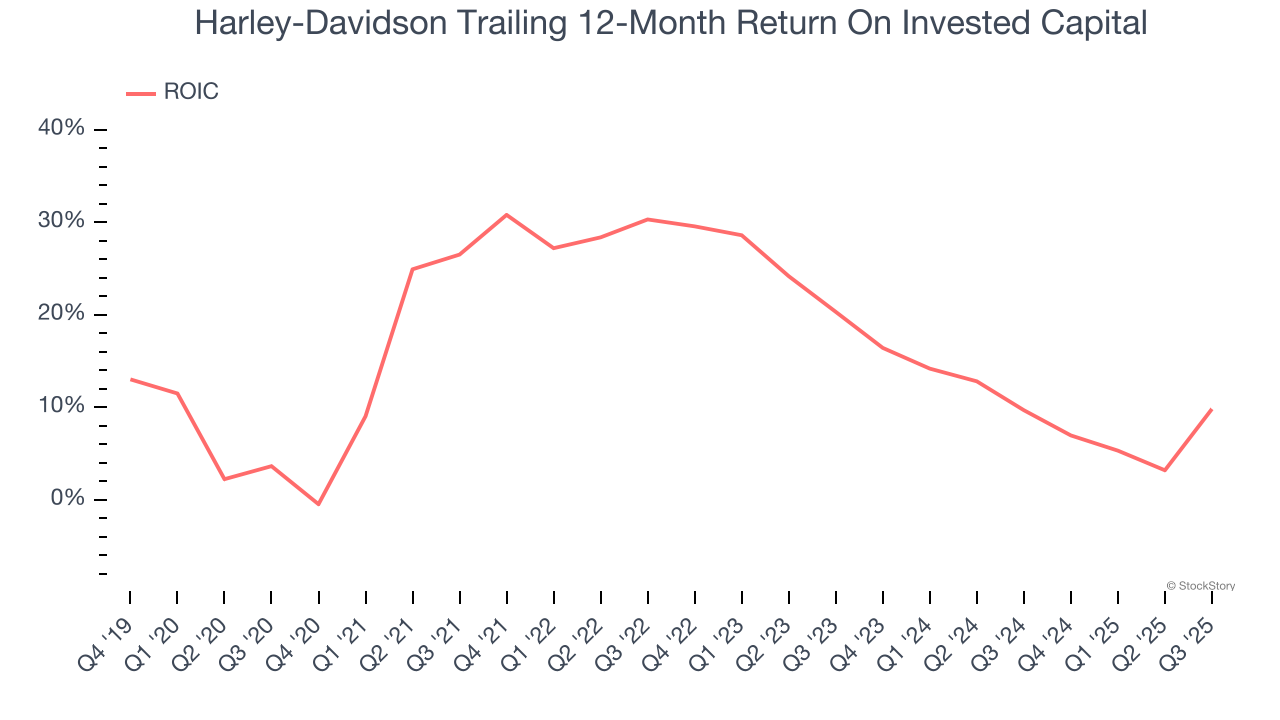

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Harley-Davidson’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

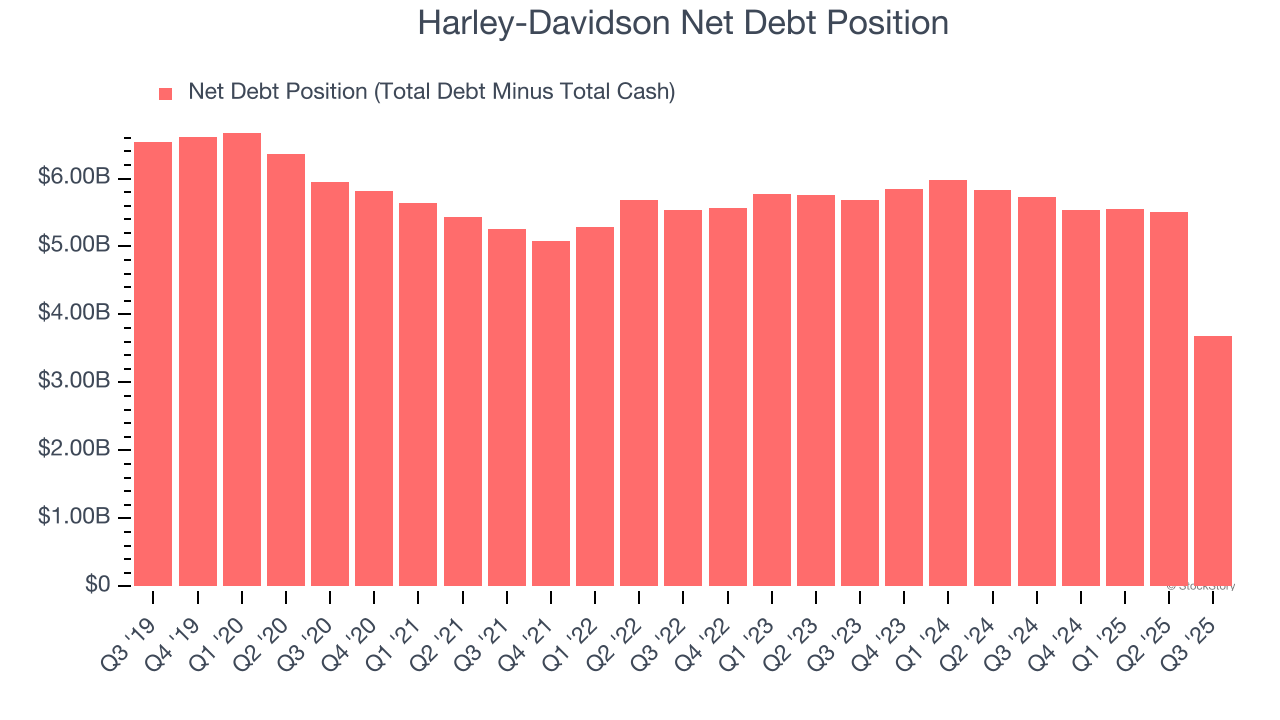

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Harley-Davidson’s $5.45 billion of debt exceeds the $1.78 billion of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $565.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Harley-Davidson could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Harley-Davidson can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Harley-Davidson falls short of our quality standards. Following the recent decline, the stock trades at 15.1× forward P/E (or $21.38 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.