SPX Technologies currently trades at $207.38 and has been a dream stock for shareholders. It’s returned 292% since December 2020, more than tripling the S&P 500’s 83.9% gain. The company has also beaten the index over the past six months as its stock price is up 32.9% thanks to its solid quarterly results.

Is it too late to buy SPXC? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On SPXC?

With roots dating back to 1912 as the Piston Ring Company, SPX Technologies (NYSE: SPXC) supplies specialized infrastructure equipment for HVAC systems and detection and measurement applications across industrial, commercial, and utility markets.

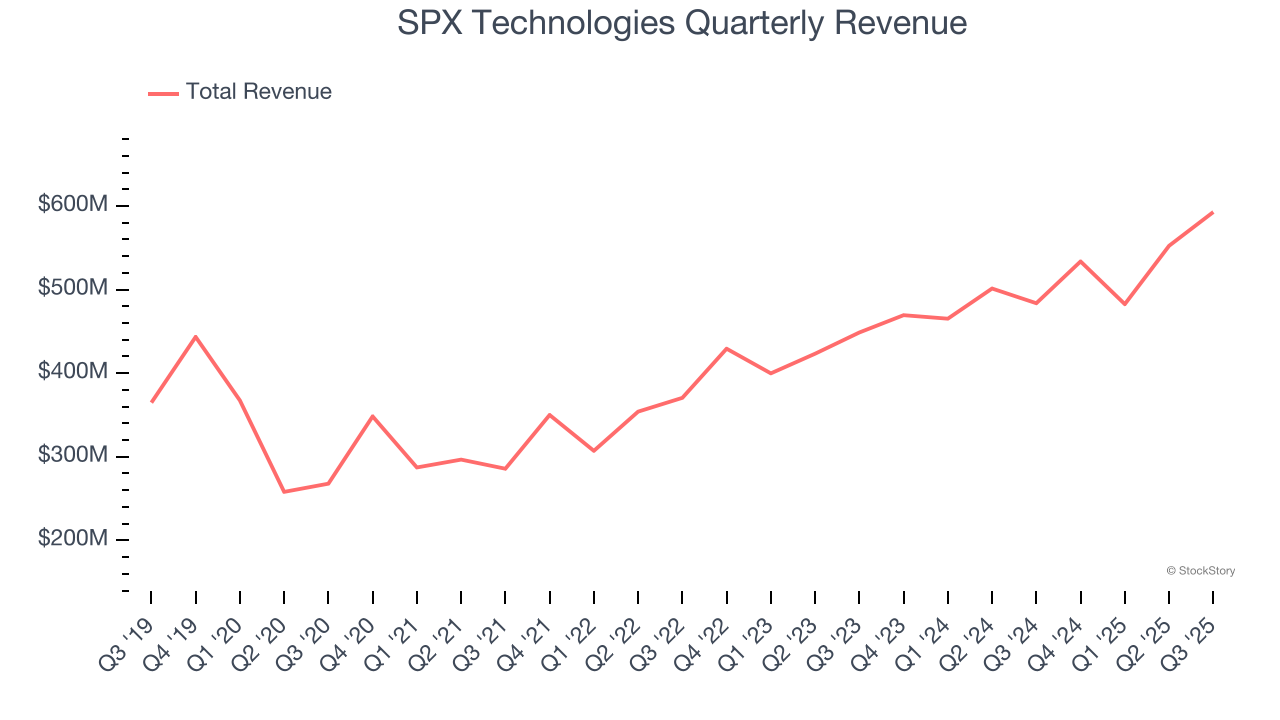

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, SPX Technologies grew its sales at a solid 10.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

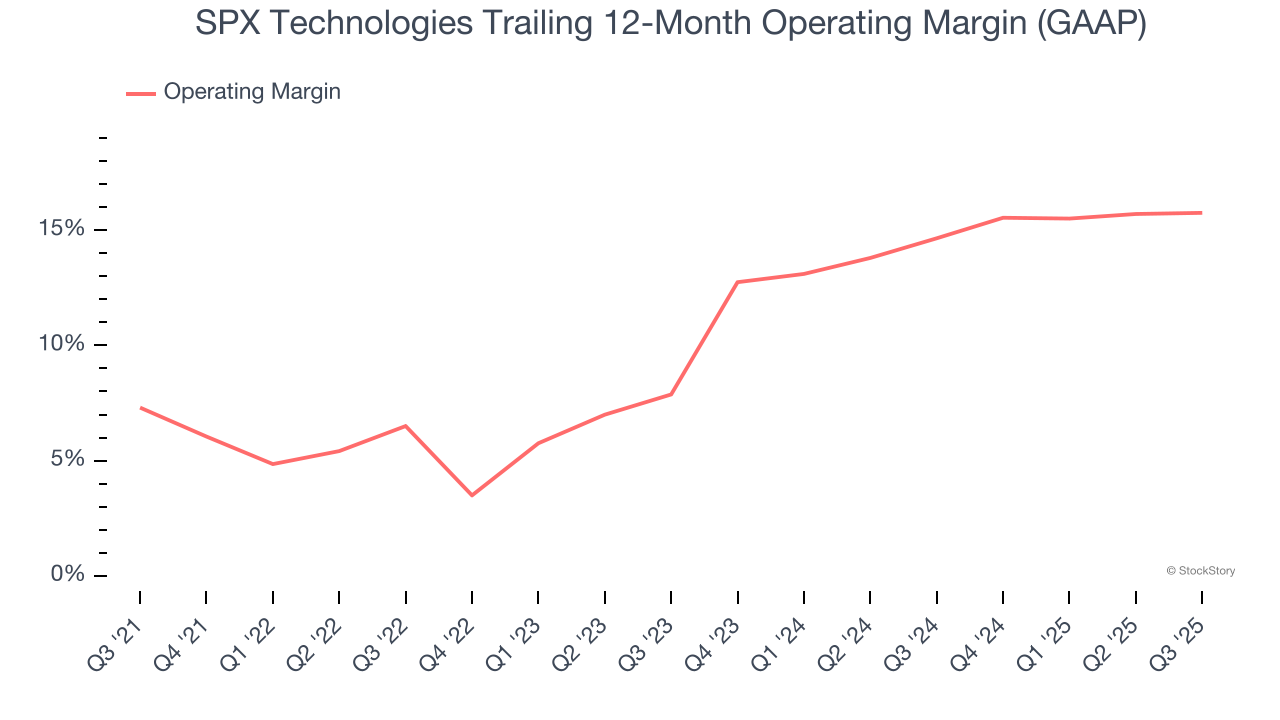

2. Operating Margin Rising, Profits Up

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, SPX Technologies’s operating margin rose by 8.5 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 15.8%.

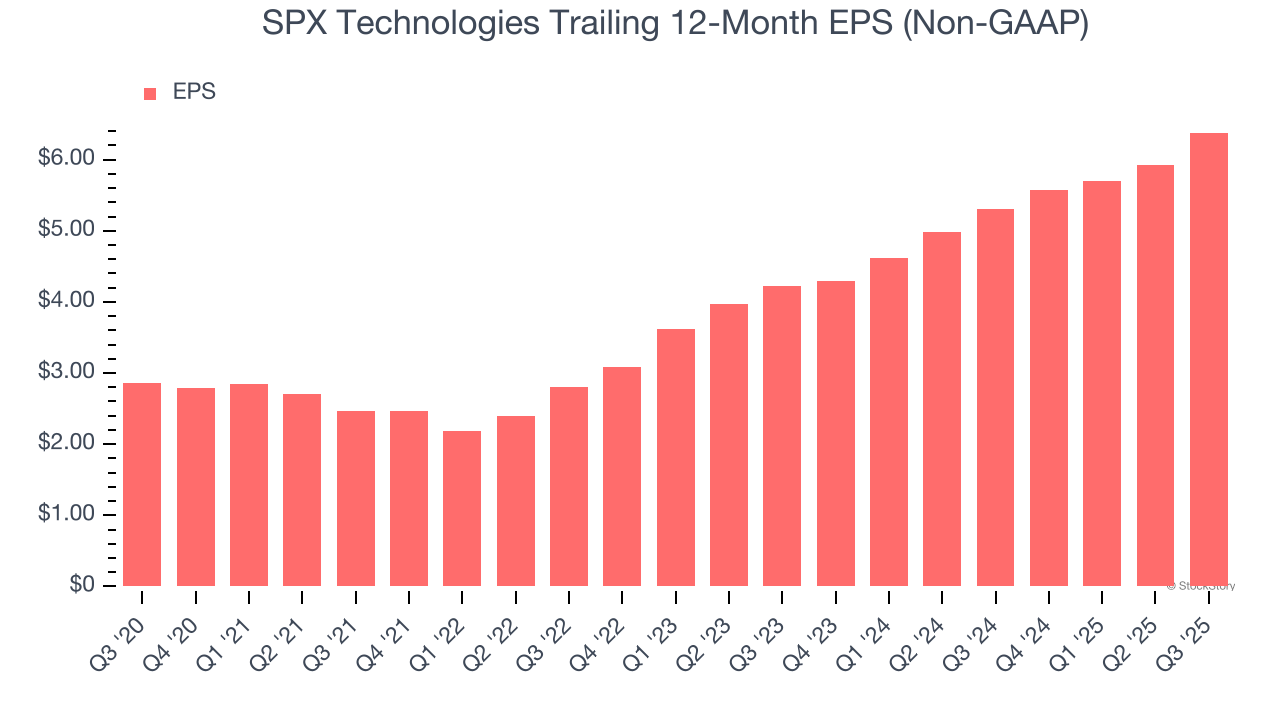

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

SPX Technologies’s EPS grew at a spectacular 17.4% compounded annual growth rate over the last five years, higher than its 10.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think SPX Technologies is a great business, and with its shares topping the market in recent months, the stock trades at 29.6× forward P/E (or $207.38 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than SPX Technologies

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.