Bel Fuse has been on fire lately. In the past six months alone, the company’s stock price has rocketed 75.8%, reaching $143.05 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Bel Fuse, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Bel Fuse Not Exciting?

We’re happy investors have made money, but we're cautious about Bel Fuse. Here are two reasons we avoid BELFA and a stock we'd rather own.

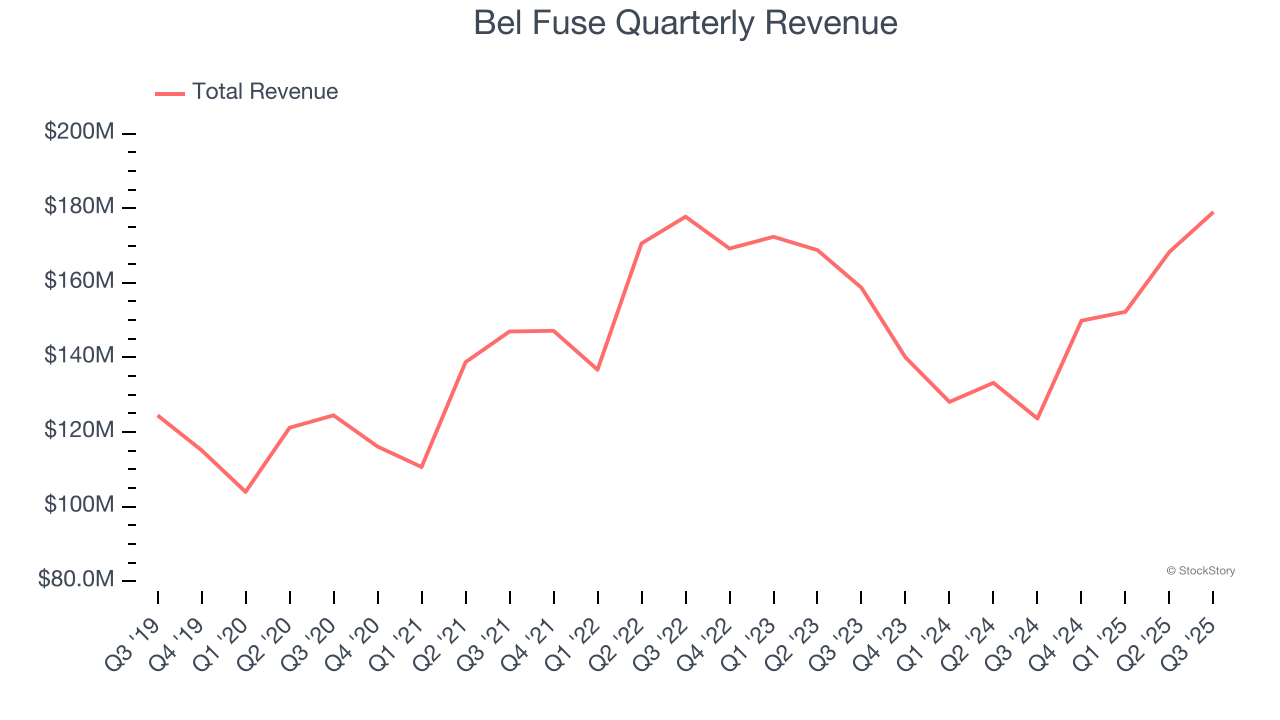

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Bel Fuse’s sales grew at a mediocre 6.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

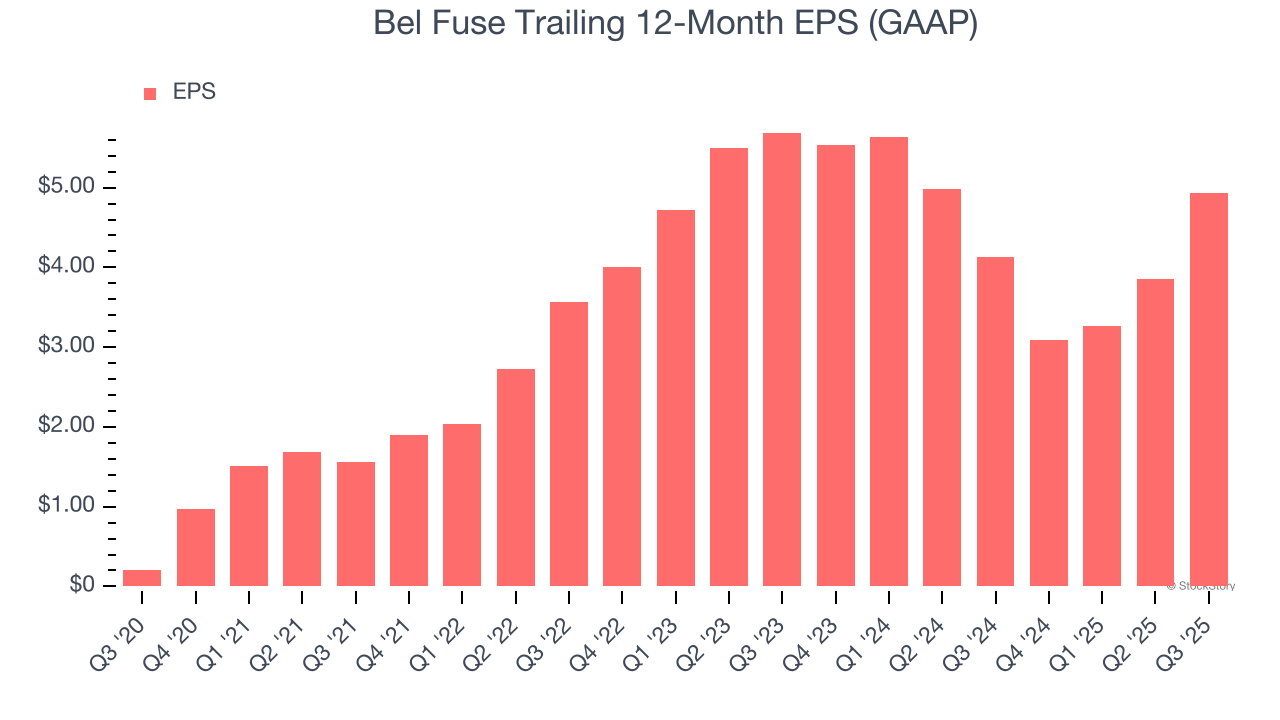

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Bel Fuse, its EPS declined by more than its revenue over the last two years, dropping 6.9%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Bel Fuse’s business quality ultimately falls short of our standards. Following the recent surge, the stock trades at 23.7× forward P/E (or $143.05 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.