DevSecOps platform provider GitLab (NASDAQ: GTLB) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 24.6% year on year to $244.4 million. The company expects next quarter’s revenue to be around $251.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.25 per share was 24% above analysts’ consensus estimates.

Is now the time to buy GitLab? Find out by accessing our full research report, it’s free for active Edge members.

GitLab (GTLB) Q3 CY2025 Highlights:

- Revenue: $244.4 million vs analyst estimates of $239.1 million (24.6% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.20 (24% beat)

- Adjusted Operating Income: $43.68 million vs analyst estimates of $32.16 million (17.9% margin, 35.8% beat)

- Revenue Guidance for Q4 CY2025 is $251.5 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.96 at the midpoint, a 15.8% increase

- Operating Margin: -5.1%, up from -14.7% in the same quarter last year

- Free Cash Flow Margin: 11.6%, down from 19.7% in the previous quarter

- Net Revenue Retention Rate: 119%, down from 121% in the previous quarter

- Market Capitalization: $6.86 billion

Company Overview

With its all-remote workforce pioneering a new approach to software development, GitLab (NASDAQ: GTLB) provides a single-application DevSecOps platform that helps development, operations, and security teams collaborate to build, secure, and deploy software faster.

Revenue Growth

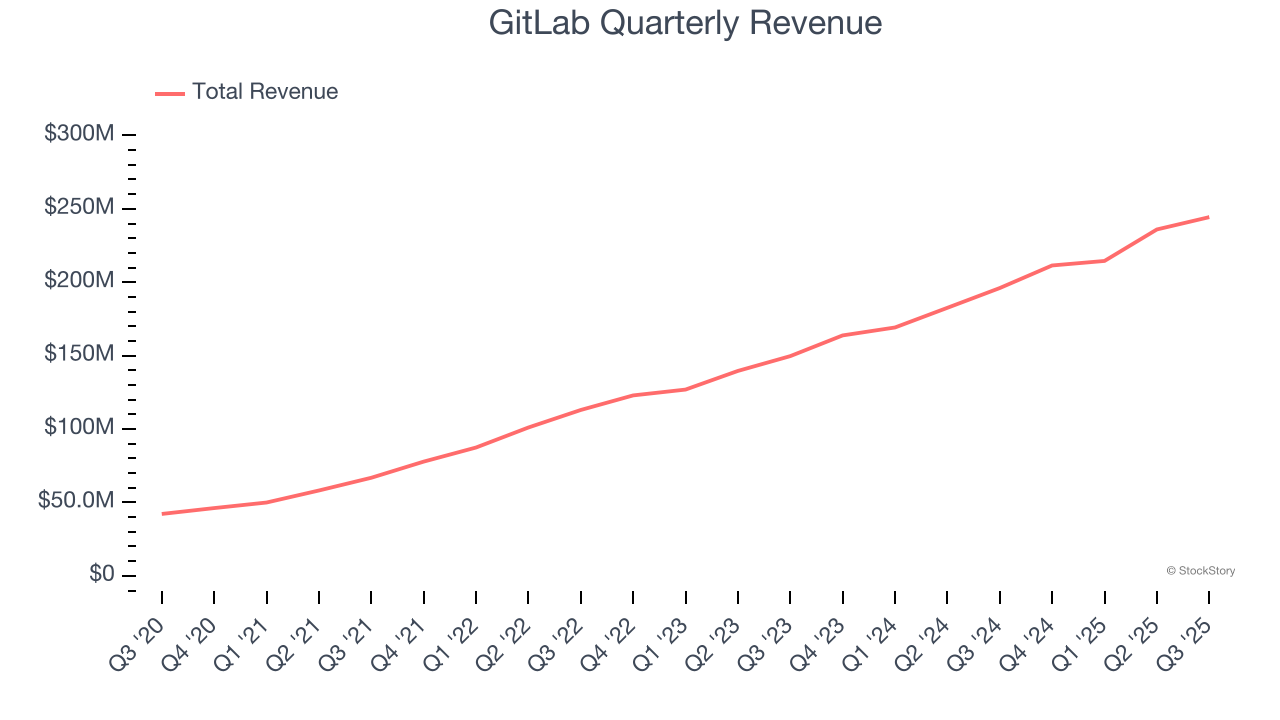

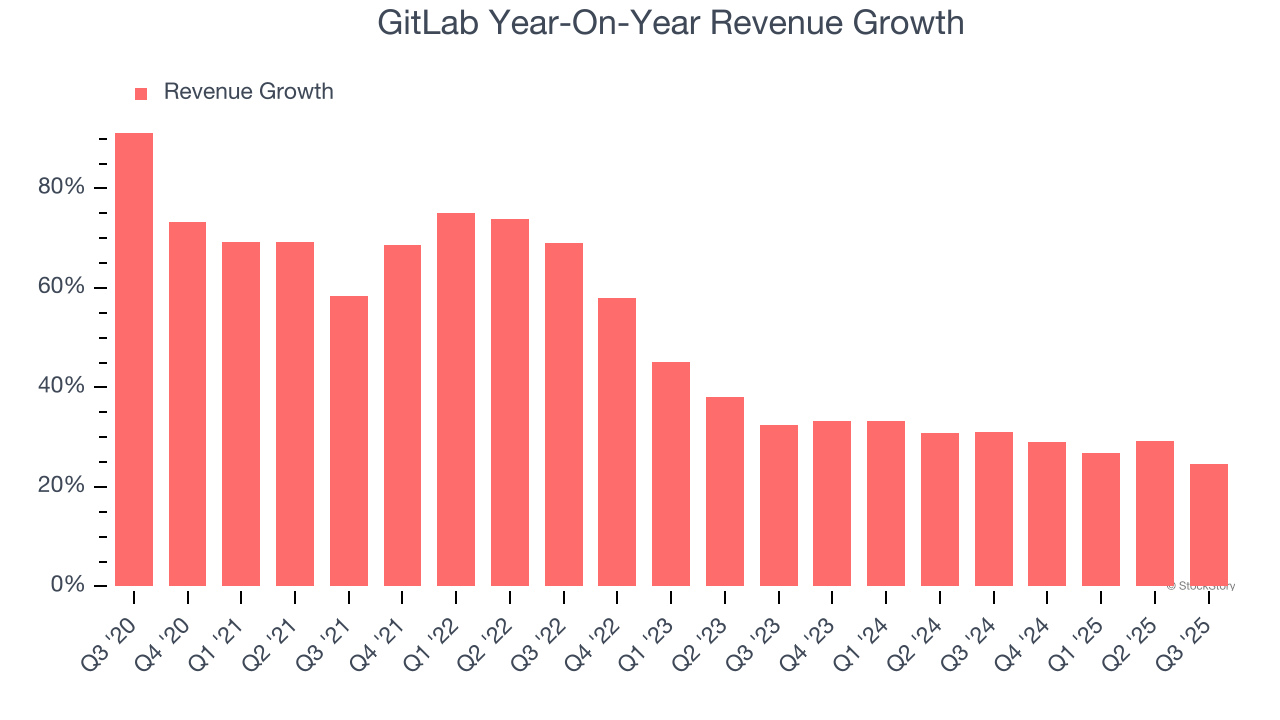

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, GitLab’s sales grew at an incredible 46.9% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. GitLab’s annualized revenue growth of 29.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, GitLab reported robust year-on-year revenue growth of 24.6%, and its $244.4 million of revenue topped Wall Street estimates by 2.2%. Company management is currently guiding for a 19% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market sees success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

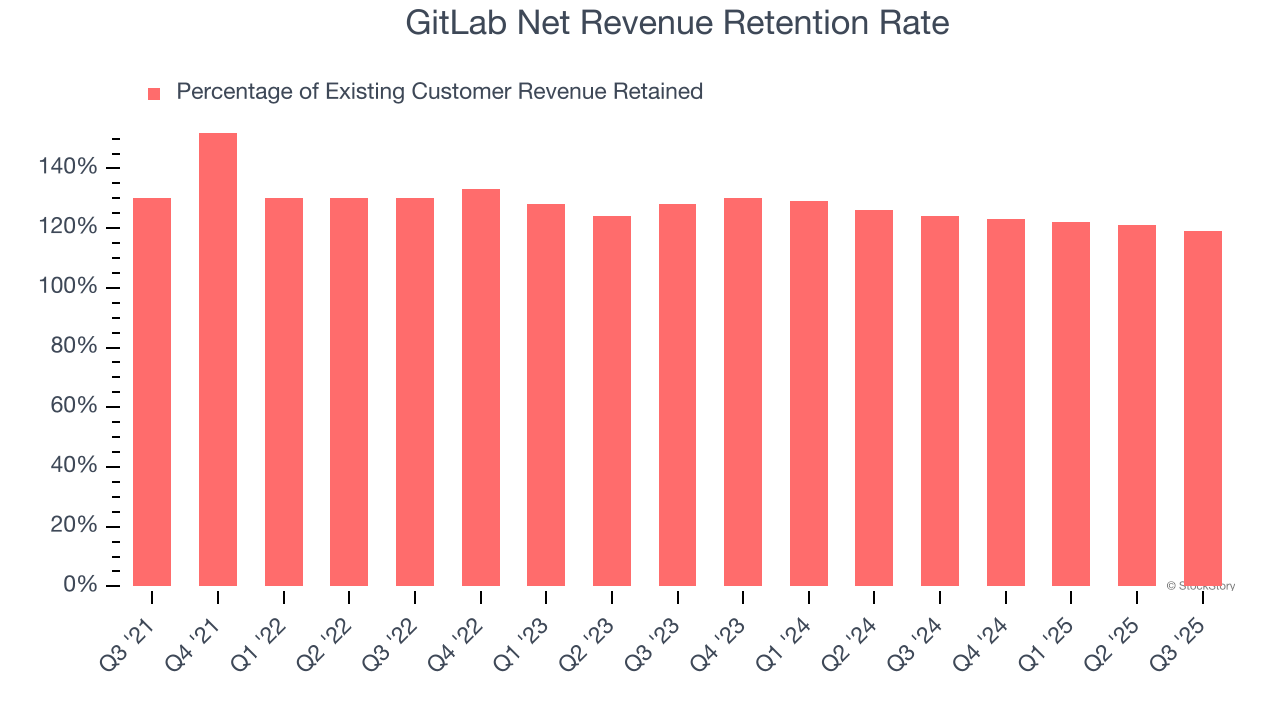

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

GitLab’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 121% in Q3. This means GitLab would’ve grown its revenue by 21.2% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, GitLab still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from GitLab’s Q3 Results

We were impressed by GitLab’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its net revenue retention declined. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 9.6% to $39.33 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.