Wrapping up Q3 earnings, we look at the numbers and key takeaways for the dental equipment & technology stocks, including Henry Schein (NASDAQ: HSIC) and its peers.

The dental equipment and technology industry encompasses companies that manufacture orthodontic products, dental implants, imaging systems, and digital tools for dental professionals. These companies benefit from recurring revenue streams tied to consumables, ongoing maintenance, and growing demand for aesthetic and restorative dentistry. However, high R&D costs, significant capital investment requirements, and reliance on discretionary spending make them vulnerable to economic cycles. Over the next few years, tailwinds for the sector include innovation in digital workflows, such as 3D printing and AI-driven diagnostics, which enhance the efficiency and precision of dental care. However, headwinds include economic uncertainty, which could reduce patient spending on elective procedures, regulatory challenges, and potential pricing pressures from consolidated dental service organizations (DSOs).

The 4 dental equipment & technology stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.4% on average since the latest earnings results.

Henry Schein (NASDAQ: HSIC)

With a vast inventory of over 300,000 products stocked in distribution centers spanning more than 5.3 million square feet worldwide, Henry Schein (NASDAQ: HSIC) is a global distributor of healthcare products and services primarily to dental practices, medical offices, and other healthcare facilities.

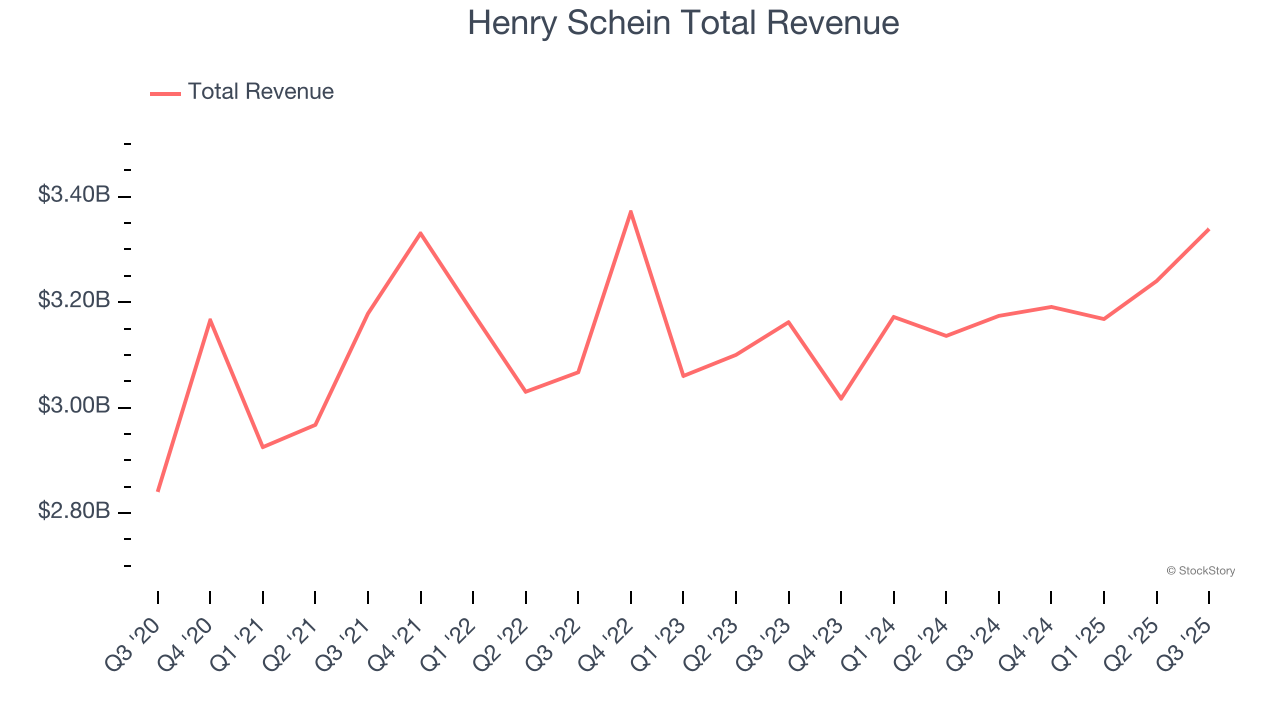

Henry Schein reported revenues of $3.34 billion, up 5.2% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ full-year EPS guidance estimates and a decent beat of analysts’ revenue estimates.

“We are pleased with our financial results for the third quarter, with sales growth accelerating in each of our reportable segments including solid market share gains in our distribution businesses as we are once again focused on driving growth now that the cyber incident is fully behind us. This strong sales performance was a key driver of the underlying improvement in our operating income,” said Stanley M. Bergman, Chairman of the Board and Chief Executive Officer of Henry Schein.

Interestingly, the stock is up 13.1% since reporting and currently trades at $73.09.

Is now the time to buy Henry Schein? Access our full analysis of the earnings results here, it’s free for active Edge members.

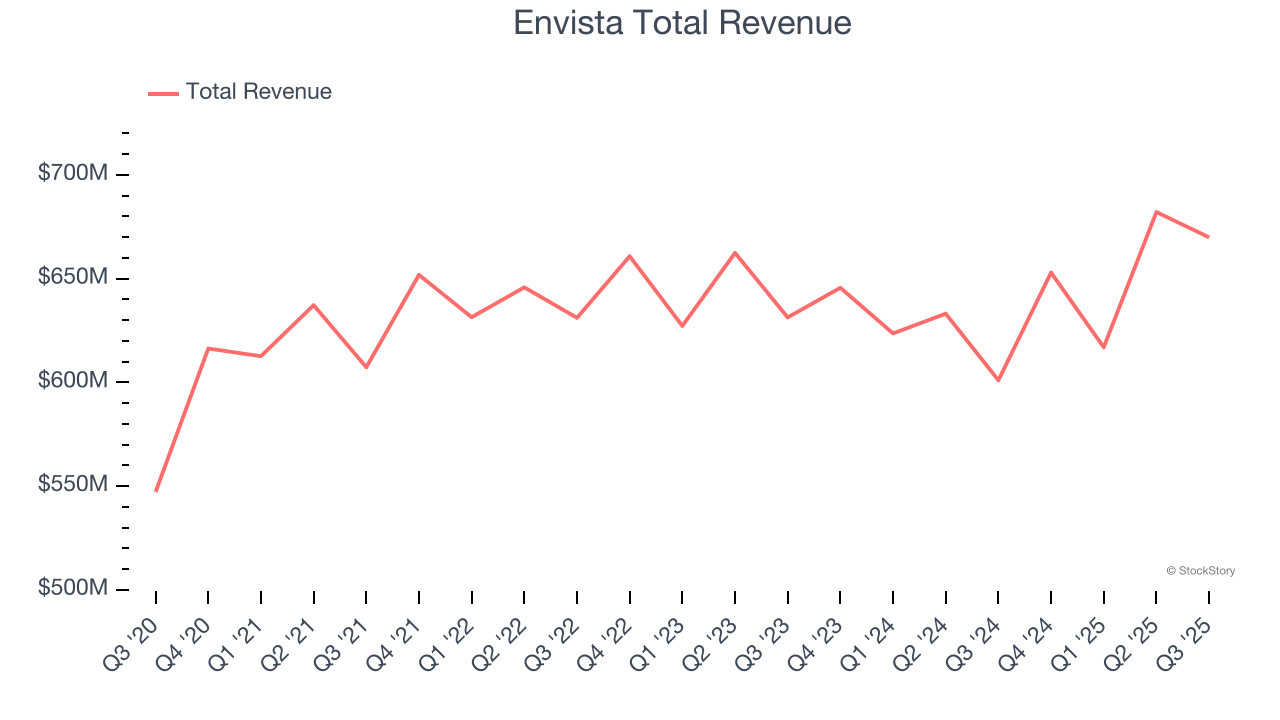

Best Q3: Envista (NYSE: NVST)

Uniting more than 30 trusted brands including Nobel Biocare, Ormco, and DEXIS under one corporate umbrella, Envista Holdings (NYSE: NVST) is a global dental products company that provides equipment, consumables, and specialized technologies for dental professionals.

Envista reported revenues of $669.9 million, up 11.5% year on year, outperforming analysts’ expectations by 4.6%. The business had an exceptional quarter with an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ revenue estimates.

Envista achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 2.3% since reporting. It currently trades at $20.44.

Is now the time to buy Envista? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Dentsply Sirona (NASDAQ: XRAY)

With roots dating back to 1877 when it introduced the first dental electric drill, Dentsply Sirona (NASDAQ: XRAY) manufactures and sells professional dental equipment, technologies, and consumable products used by dentists and specialists worldwide.

Dentsply Sirona reported revenues of $904 million, down 4.9% year on year, exceeding analysts’ expectations by 0.5%. Still, it was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and a significant miss of analysts’ EPS estimates.

Dentsply Sirona delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 10.9% since the results and currently trades at $11.25.

Read our full analysis of Dentsply Sirona’s results here.

Align Technology (NASDAQ: ALGN)

Pioneering an alternative to traditional metal braces with nearly invisible plastic aligners, Align Technology (NASDAQ: ALGN) designs and manufactures Invisalign clear aligners, iTero intraoral scanners, and dental CAD/CAM software for orthodontic and restorative treatments.

Align Technology reported revenues of $995.7 million, up 1.8% year on year. This number surpassed analysts’ expectations by 2.2%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 17.1% since reporting and currently trades at $154.50.

Read our full, actionable report on Align Technology here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.