Lincoln Financial Group’s 27.8% return over the past six months has outpaced the S&P 500 by 13.7%, and its stock price has climbed to $42.75 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Lincoln Financial Group, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Lincoln Financial Group Will Underperform?

Despite the momentum, we don't have much confidence in Lincoln Financial Group. Here are three reasons there are better opportunities than LNC and a stock we'd rather own.

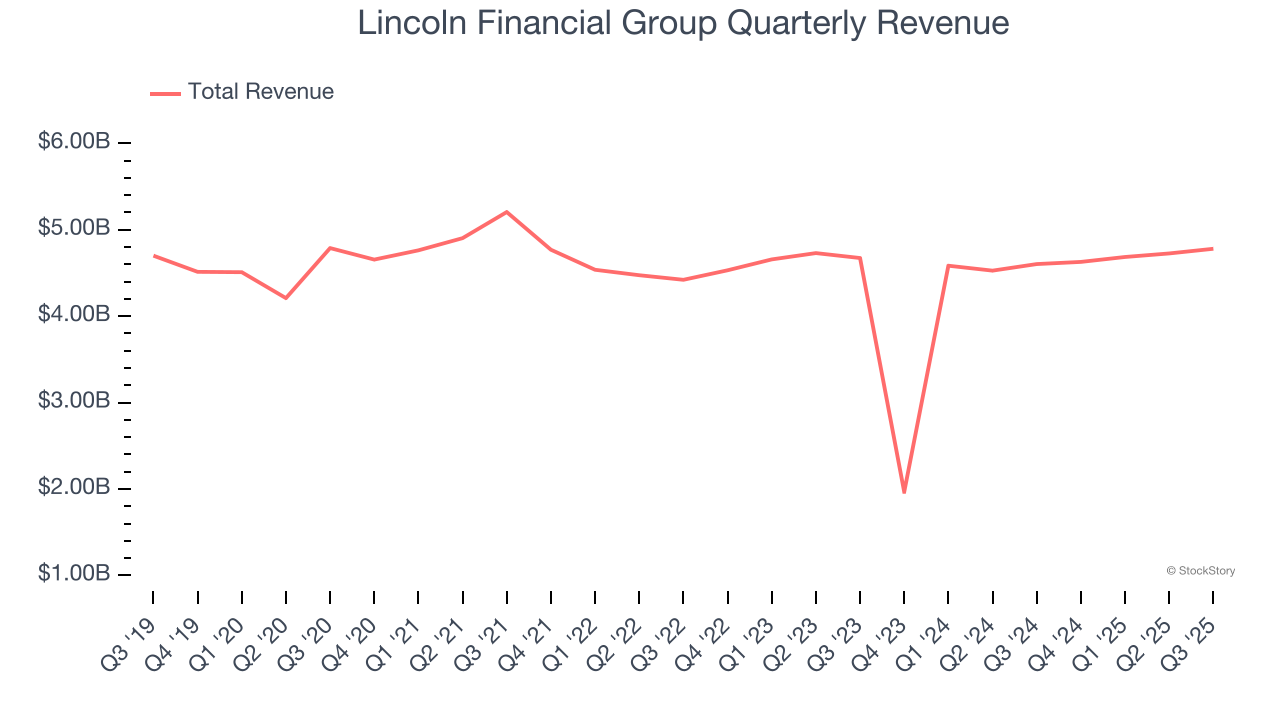

1. Long-Term Revenue Growth Flatter Than a Pancake

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

Unfortunately, Lincoln Financial Group struggled to consistently increase demand as its $18.82 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business.

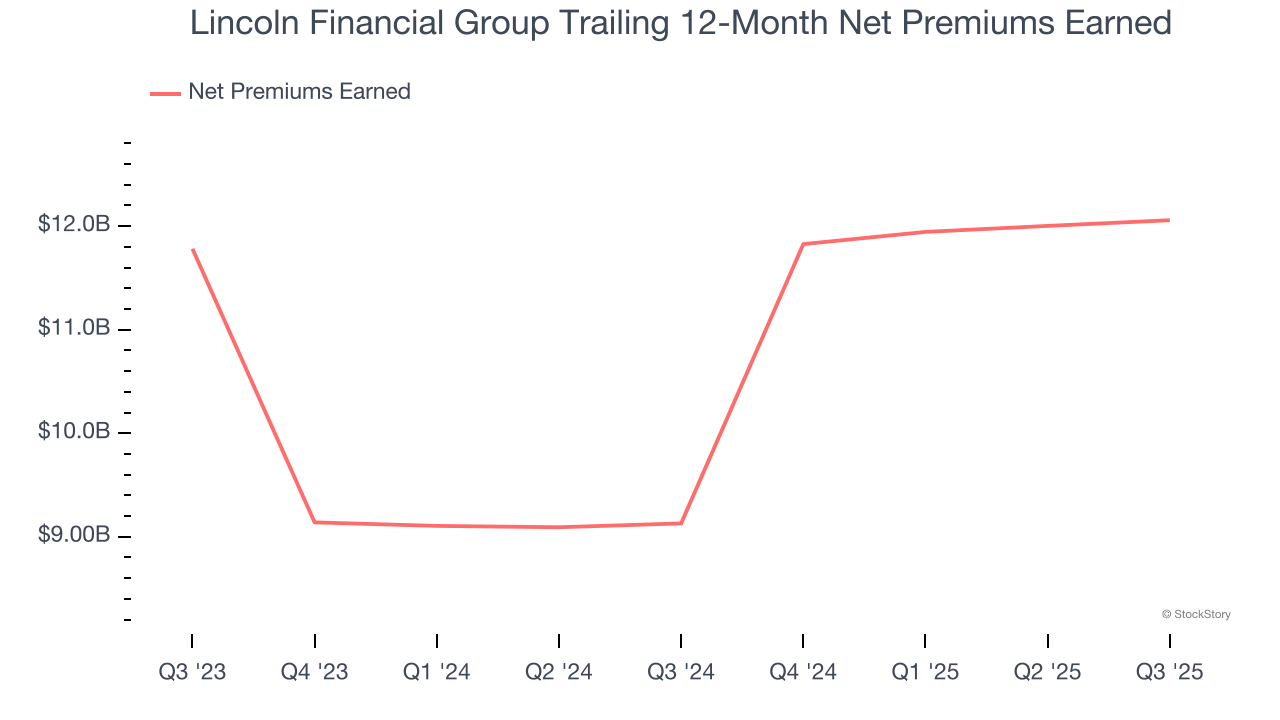

2. Net Premiums Earned Hit a Plateau

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Lincoln Financial Group’s net premiums earned was flat over the last five years, much worse than the broader insurance industry and in line with its total revenue.

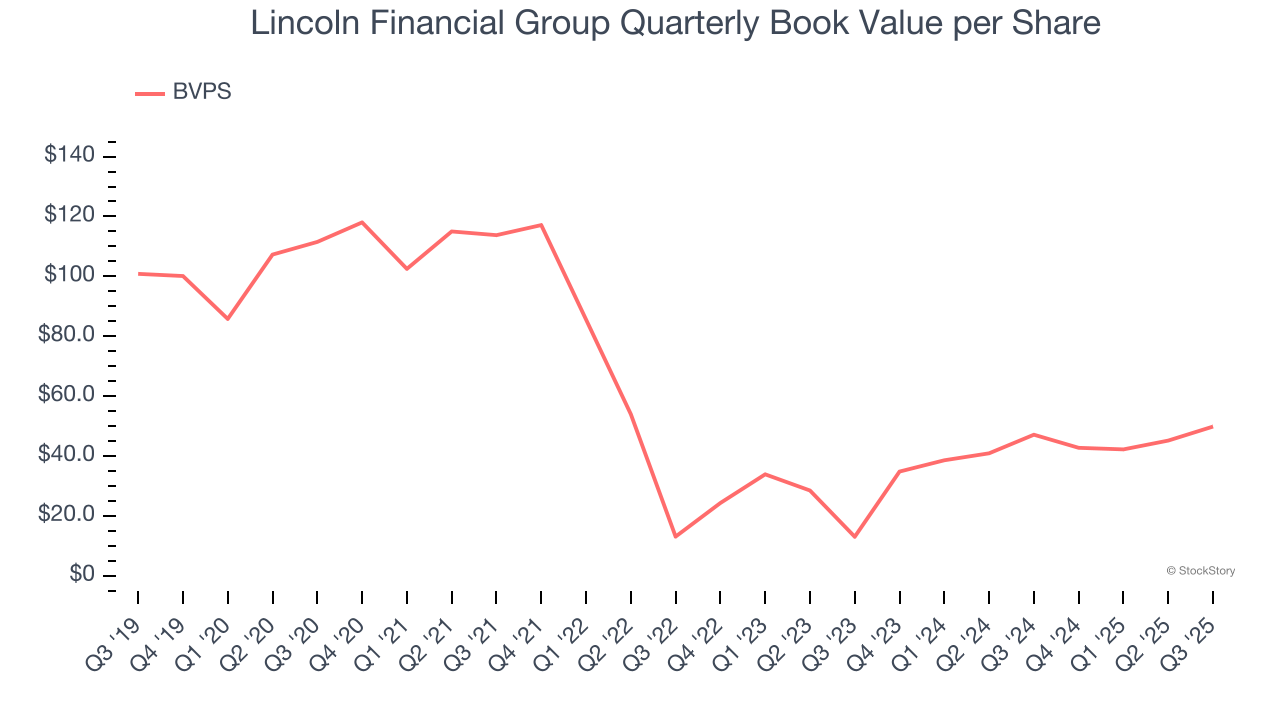

3. Growing BVPS Reflects Strong Asset Base

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Although Lincoln Financial Group’s BVPS declined at a 14.9% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at an incredible 95.5% annual clip (from $13.04 to $49.84 per share).

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Lincoln Financial Group, we’ll be cheering from the sidelines. With its shares beating the market recently, the stock trades at 0.9× forward P/B (or $42.75 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Lincoln Financial Group

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.