The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Vishay Precision (NYSE: VPG) and the rest of the electronic components stocks fared in Q3.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported an exceptional Q3. As a group, revenues beat analysts’ consensus estimates by 4.5% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.6% on average since the latest earnings results.

Vishay Precision (NYSE: VPG)

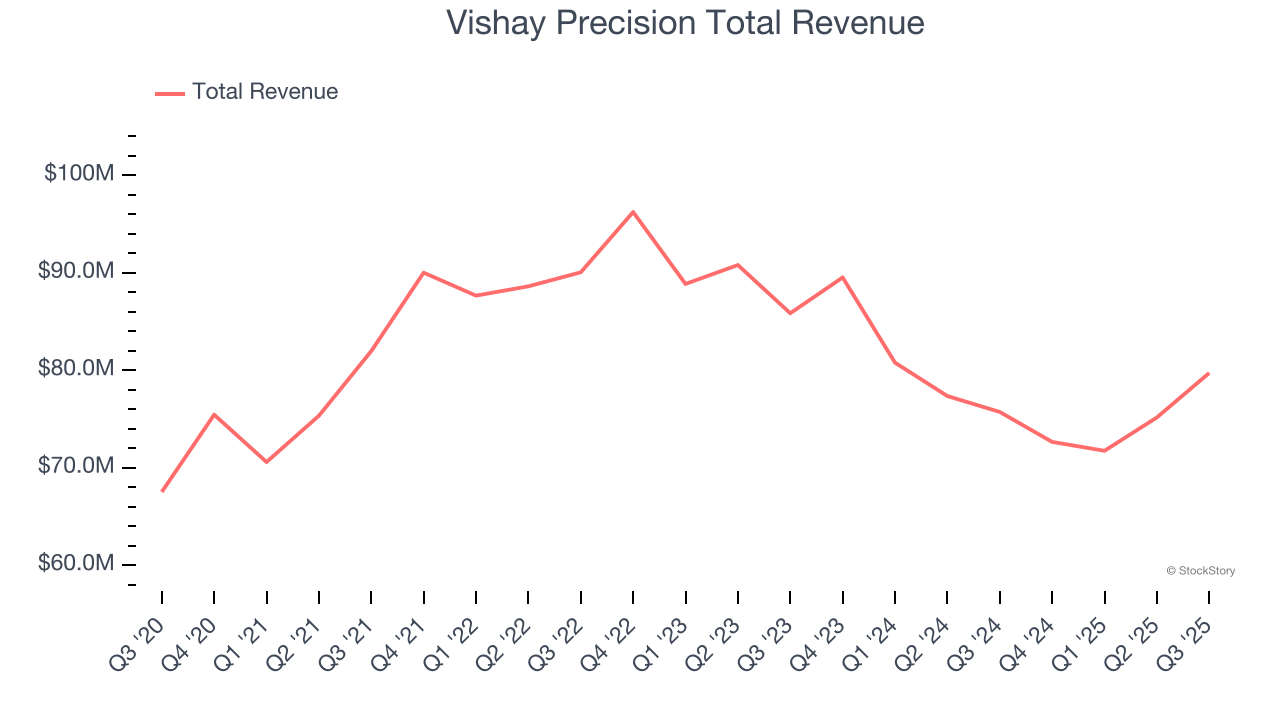

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE: VPG) operates as a global provider of precision measurement and sensing technologies.

Vishay Precision reported revenues of $79.73 million, up 5.3% year on year. This print exceeded analysts’ expectations by 4%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Ziv Shoshani, Chief Executive Officer of VPG, commented, “We achieved a solid quarter for VPG, as third-quarter sales grew 6.1% sequentially and were up 5.3% from the prior year. Total orders of $79.7 million were even with second-quarter levels, as strength in our Sensors segment offset lower orders in Weighing Solutions and Measurement Systems. This resulted in a book-to-bill of 1.00, the fourth consecutive quarter of book-to-bill ratios of 1.00 or better, as our Sensors and Measurement Systems reporting segments recorded book-to-bill ratios of 1.07 and 1.04, respectively. We continue to be encouraged by our business development initiatives, which include our opportunity in humanoid robots.”

Interestingly, the stock is up 2.7% since reporting and currently trades at $39.03.

Is now the time to buy Vishay Precision? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: nLIGHT (NASDAQ: LASR)

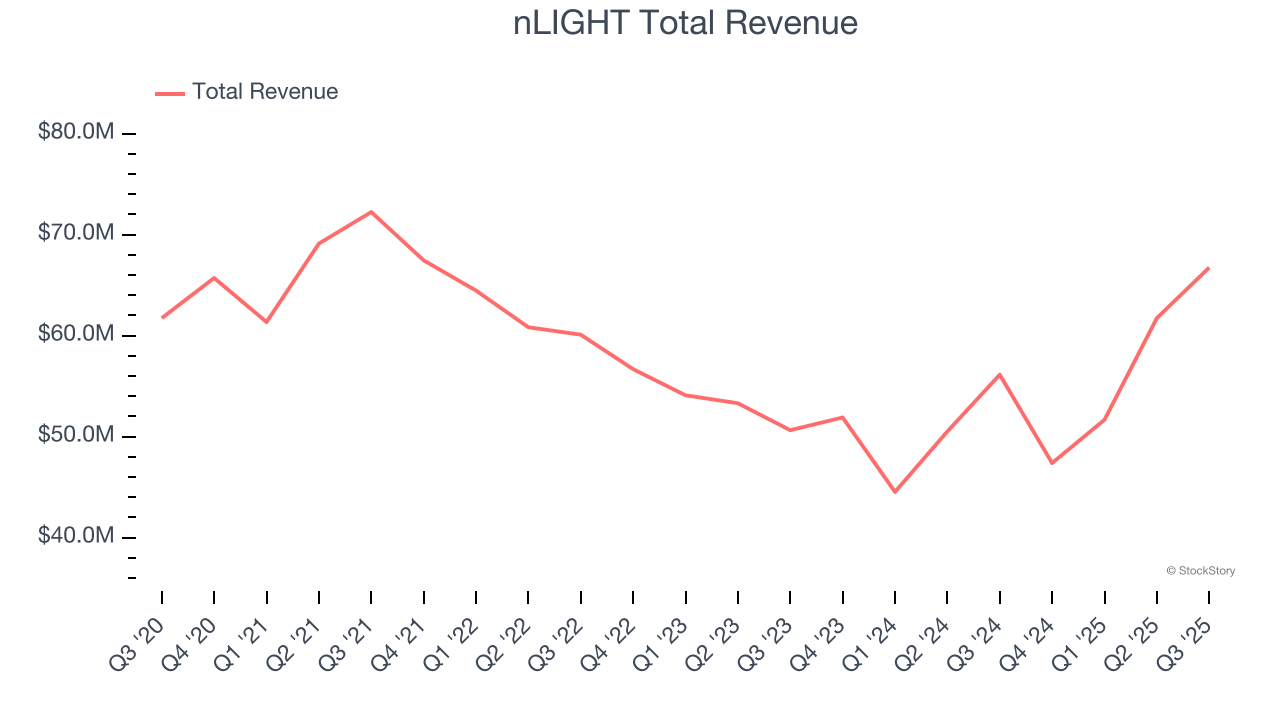

Founded by a former CEO and Harvard-educated entrepreneur Scott Keeneyn, nLIGHT (NASDAQ: LASR) offers semiconductor and fiber lasers to the industrial, aerospace & defense, and medical sectors.

nLIGHT reported revenues of $66.74 million, up 18.9% year on year, outperforming analysts’ expectations by 5.4%. The business had an incredible quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 22.3% since reporting. It currently trades at $36.43.

Is now the time to buy nLIGHT? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Novanta (NASDAQ: NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ: NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $247.8 million, up 1.4% year on year, exceeding analysts’ expectations by 0.8%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

Novanta delivered the slowest revenue growth in the group. As expected, the stock is down 14.7% since the results and currently trades at $115.95.

Read our full analysis of Novanta’s results here.

Vicor (NASDAQ: VICR)

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ: VICR) provides electrical power conversion and delivery products for a range of industries.

Vicor reported revenues of $110.4 million, up 18.5% year on year. This number beat analysts’ expectations by 15.7%. It was an incredible quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Vicor pulled off the biggest analyst estimates beat among its peers. The stock is up 47.2% since reporting and currently trades at $96.85.

Read our full, actionable report on Vicor here, it’s free for active Edge members.

Corning (NYSE: GLW)

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE: GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

Corning reported revenues of $4.27 billion, up 14.4% year on year. This result topped analysts’ expectations by 3.9%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ Display Technologies revenue estimates.

The stock is down 4.6% since reporting and currently trades at $85.62.

Read our full, actionable report on Corning here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.