Biopharmaceutical company Gilead Sciences (NASDAQ: GILD) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 6.4% year on year to $7.57 billion. The company expects the full year’s revenue to be around $28.4 billion, close to analysts’ estimates. Its non-GAAP profit of $1.90 per share was 11.7% above analysts’ consensus estimates.

Is now the time to buy Gilead Sciences? Find out by accessing our full research report, it’s free.

Gilead Sciences (GILD) Q4 CY2024 Highlights:

- Revenue: $7.57 billion vs analyst estimates of $7.12 billion (6.4% year-on-year growth, 6.3% beat)

- Adjusted EPS: $1.90 vs analyst estimates of $1.70 (11.7% beat)

- Adjusted Operating Income: $3.11 billion vs analyst estimates of $2.88 billion (41.1% margin, 8.3% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $28.4 billion at the midpoint, in line with analyst expectations and implying -1.2% growth (vs 6% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $7.90 at the midpoint, beating analyst estimates by 3.9%

- Operating Margin: 32.4%, up from 22.7% in the same quarter last year

- Free Cash Flow Margin: 37.4%, up from 27.5% in the same quarter last year

- Market Capitalization: $119 billion

“Gilead delivered another exceptionally strong full year and fourth quarter, with growth in our base business product sales of 8% for 2024 and 13% year-over-year for the fourth quarter,” said Daniel O’Day, Gilead’s Chairman and Chief Executive Officer.

Company Overview

Best-known for its HIV and Hepatitis treatments, Gilead Sciences (NASDAQ: GILD) is a biopharmaceutical company that discovers, develops, and commercializes innovative medicines.

Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Sales Growth

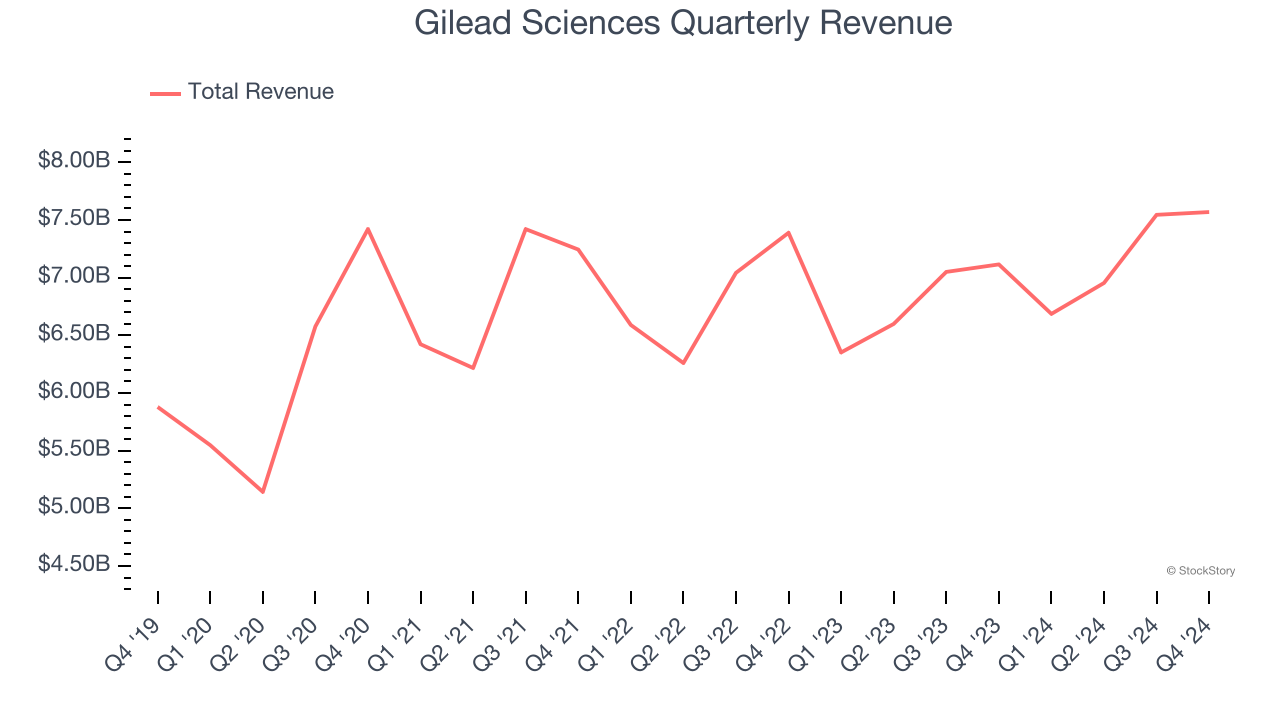

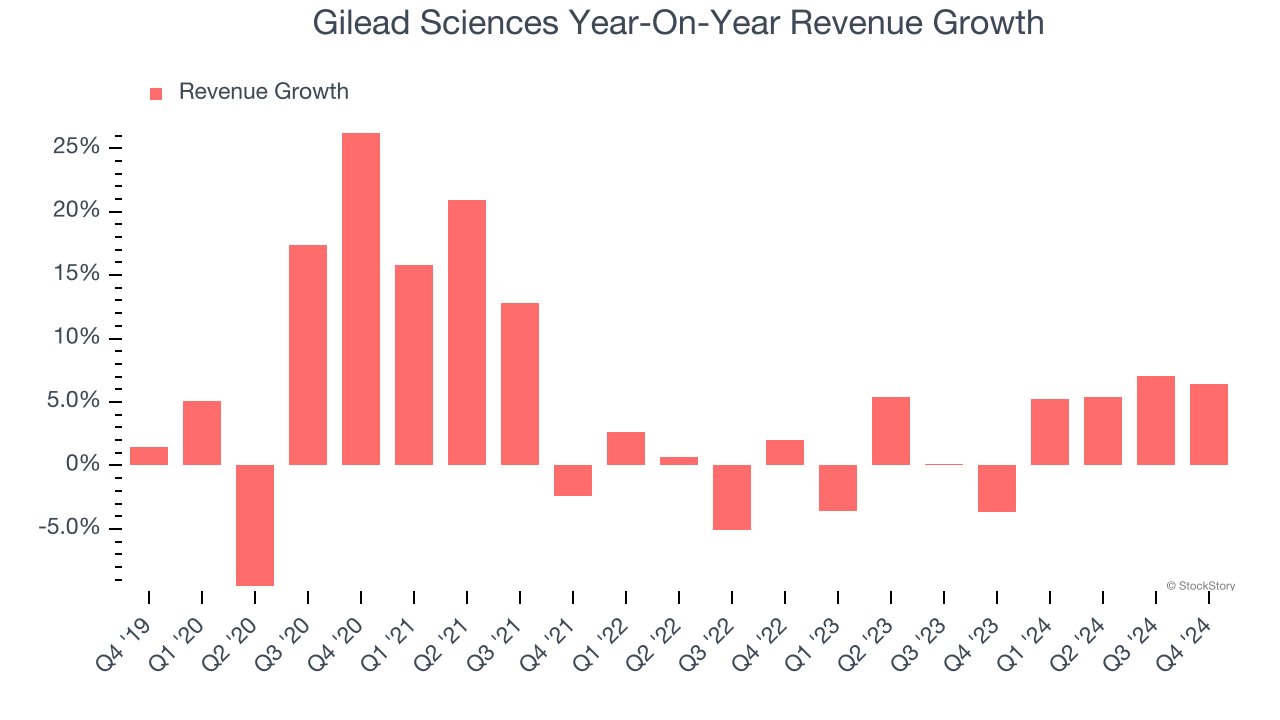

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Gilead Sciences’s sales grew at a mediocre 5.1% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Gilead Sciences’s recent history shows its demand slowed as its annualized revenue growth of 2.7% over the last two years is below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, HIV. Over the last two years, Gilead Sciences’s HIV revenue averaged 7.1% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Gilead Sciences reported year-on-year revenue growth of 6.4%, and its $7.57 billion of revenue exceeded Wall Street’s estimates by 6.3%.

Looking ahead, sell-side analysts expect revenue to decline by 1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Adjusted Operating Margin

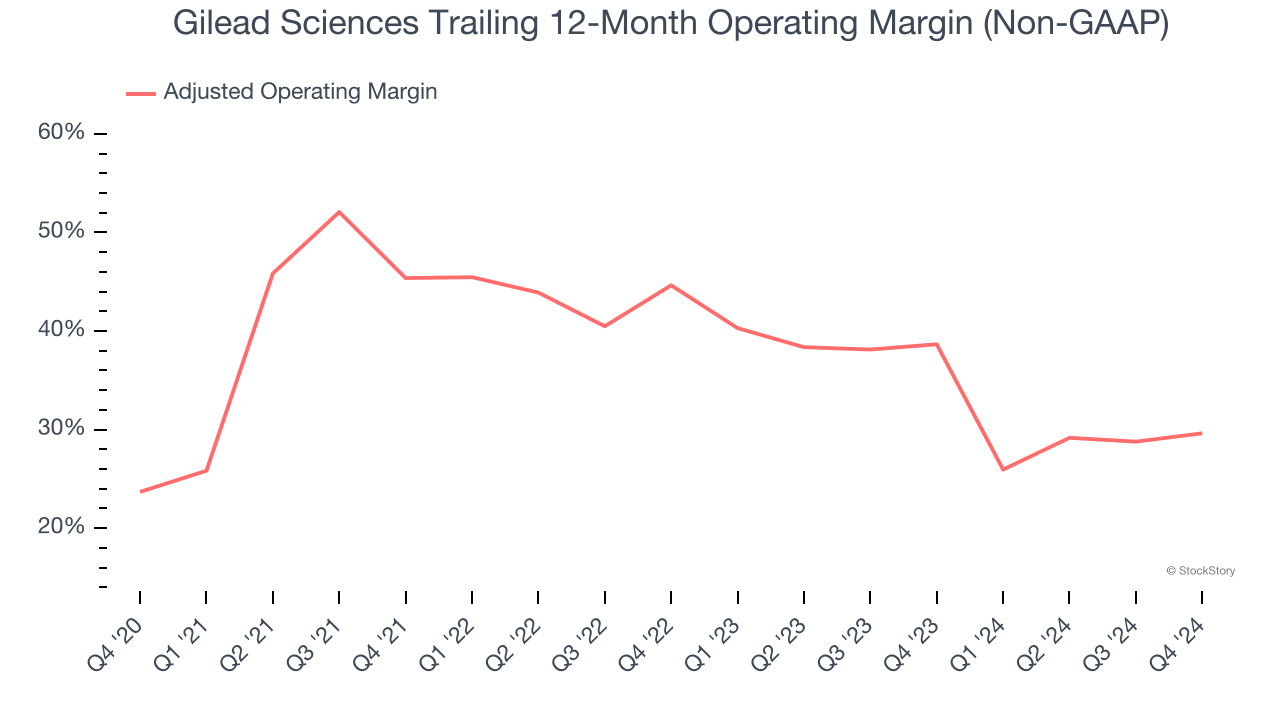

Gilead Sciences has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 36.6%.

Looking at the trend in its profitability, Gilead Sciences’s adjusted operating margin rose by 5.9 percentage points over the last five years. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 15 percentage points on a two-year basis. If Gilead Sciences wants to pass our bar, it must prove it can expand its profitability consistently.

In Q4, Gilead Sciences generated an adjusted operating profit margin of 41.1%, up 2.6 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

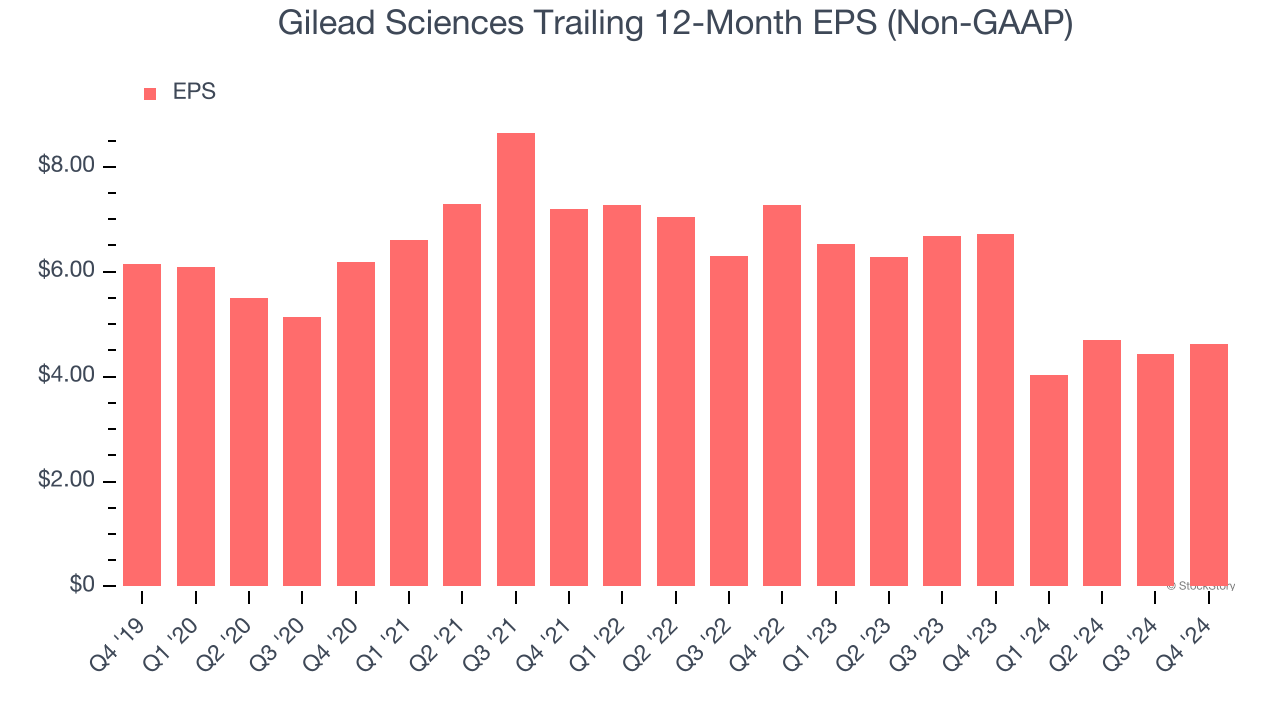

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Gilead Sciences, its EPS declined by 5.6% annually over the last five years while its revenue grew by 5.1%. However, its adjusted operating margin actually expanded during this time and it repurchased its shares, telling us the delta came from reduced interest expenses or taxes.

In Q4, Gilead Sciences reported EPS at $1.90, up from $1.72 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Gilead Sciences’s full-year EPS of $4.61 to grow 69.6%.

Key Takeaways from Gilead Sciences’s Q4 Results

We were impressed by how significantly Gilead Sciences blew past analysts’ revenue, EPS, and adjusted operating income expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4% to $100.02 immediately after reporting.

Gilead Sciences put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.