As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the medical devices & supplies - cardiology, neurology, vascular industry, including Merit Medical Systems (NASDAQ: MMSI) and its peers.

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

The 4 medical devices & supplies - cardiology, neurology, vascular stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.1%.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

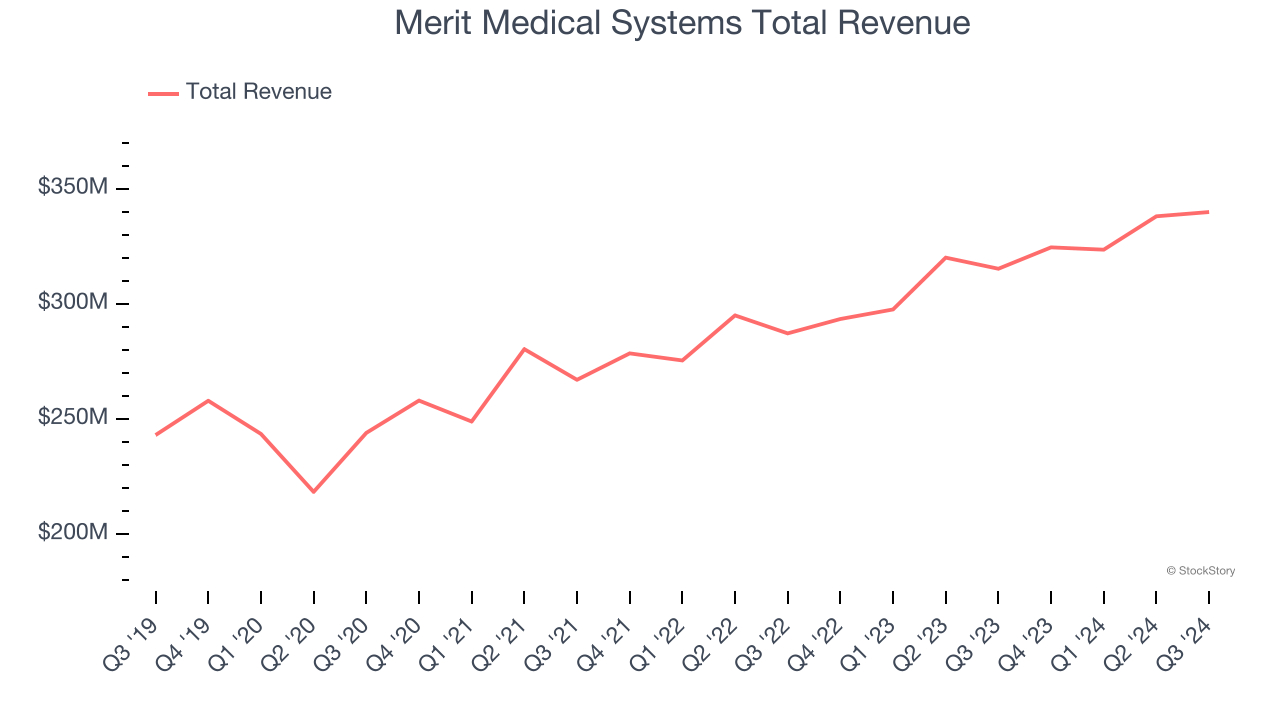

Merit Medical Systems (NASDAQ: MMSI)

Founded in 1987, Merit Medical Systems (NASDAQ: MMSI) designs and manufactures medical devices used in interventional, diagnostic, and therapeutic procedures, with a focus on cardiology, radiology, and endoscopy.

Merit Medical Systems reported revenues of $339.8 million, up 7.8% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ full-year EPS guidance estimates.

“We delivered better-than-expected financial results in the third quarter, reflecting continued strong execution,” said Fred P. Lampropoulos, Merit’s Chairman and Chief Executive Officer.

Merit Medical Systems achieved the biggest analyst estimates beat and highest full-year guidance raise of the whole group. The stock is up 15.9% since reporting and currently trades at $109.97.

Is now the time to buy Merit Medical Systems? Access our full analysis of the earnings results here, it’s free.

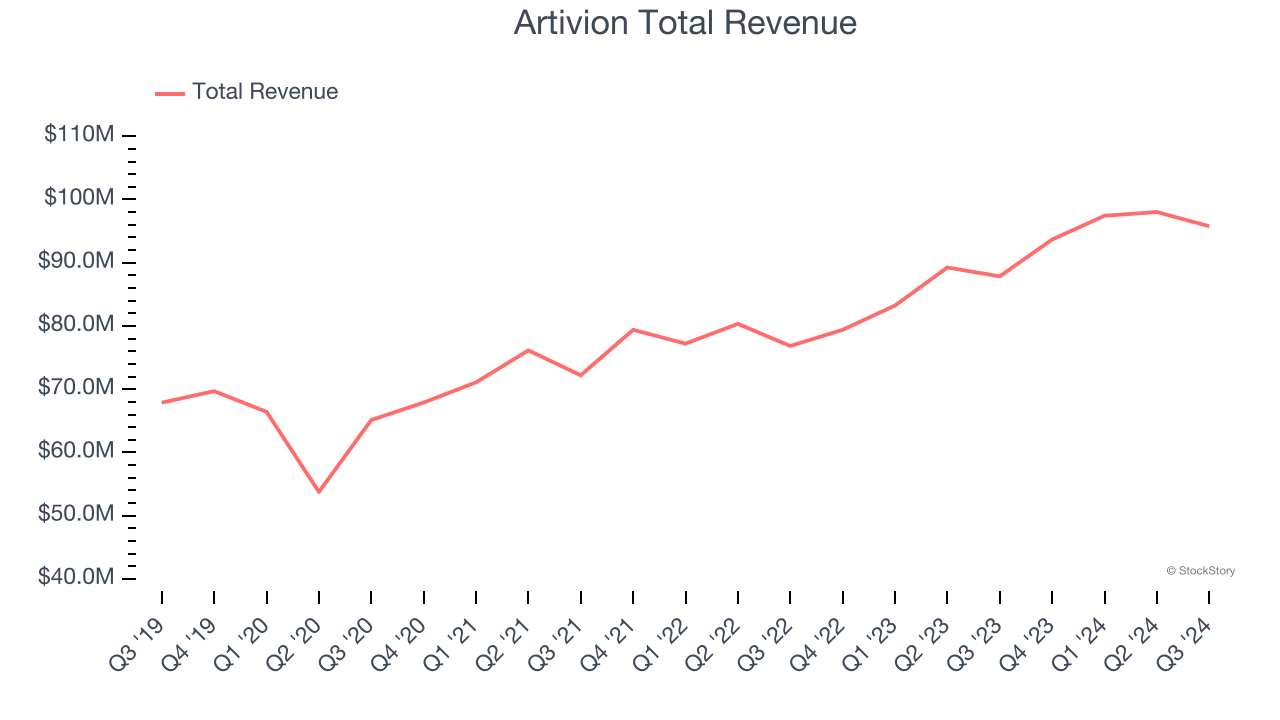

Best Q3: Artivion (NYSE: AORT)

Founded in 1992, Artivion (NYSE: AORT) develops and manufactures medical devices and biomaterials for the treatment of cardiovascular diseases, with a focus on aortic valve replacement, vascular surgery, and cardiac surgery.

Artivion reported revenues of $95.78 million, up 9% year on year, outperforming analysts’ expectations by 0.5%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ sales volume estimates.

The market seems content with the results as the stock is up 2% since reporting. It currently trades at $29.58.

Is now the time to buy Artivion? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: ICU Medical (NASDAQ: ICUI)

Founded in 1984, ICU Medical (NASDAQ: ICUI) provides medical devices and systems for infusion therapy, vascular access, and oncology (cancer) care.

ICU Medical reported revenues of $589.1 million, up 6.5% year on year, exceeding analysts’ expectations by 1%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EPS estimates.

ICU Medical delivered the slowest revenue growth in the group. As expected, the stock is down 11.7% since the results and currently trades at $156.94.

Read our full analysis of ICU Medical’s results here.

Penumbra (NYSE: PEN)

Founded in 2004, Penumbra (NYSE: PEN) designs and manufactures medical devices, focusing on the treatment of neurological and vascular diseases.

Penumbra reported revenues of $301 million, up 11.1% year on year. This result surpassed analysts’ expectations by 1.3%. It was a strong quarter as it also recorded an impressive beat of analysts’ EPS estimates and a narrow beat of analysts’ constant currency revenue estimates.

Penumbra delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 25.5% since reporting and currently trades at $265.02.

Read our full, actionable report on Penumbra here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.