Cybersecurity provider Palo Alto Networks (NASDAQ: PANW) announced better-than-expected revenue in Q4 CY2024, with sales up 14.3% year on year to $2.26 billion. The company expects next quarter’s revenue to be around $2.28 billion, close to analysts’ estimates. Its non-GAAP profit of $0.81 per share was 3.9% above analysts’ consensus estimates.

Is now the time to buy Palo Alto Networks? Find out by accessing our full research report, it’s free.

Palo Alto Networks (PANW) Q4 CY2024 Highlights:

- Revenue: $2.26 billion vs analyst estimates of $2.24 billion (14.3% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.81 vs analyst estimates of $0.78 (3.9% beat)

- Adjusted Operating Income: $640.4 million vs analyst estimates of $623.2 million (28.4% margin, 2.8% beat)

- The company slightly lifted its revenue guidance for the full year to $9.17 billion at the midpoint from $9.15 billion

- Management lifted its full-year Adjusted EPS guidance to $3.21, beating analysts' estimates

- Operating Margin: 10.6%, up from 2.7% in the same quarter last year

- Market Capitalization: $129.1 billion

"In Q2, our strong business performance was fueled by customers adopting technology driven by the imperative of AI, including cloud investment and infrastructure modernization," said Nikesh Arora, Chairman and CEO of Palo Alto Networks.

Company Overview

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ: PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Sales Growth

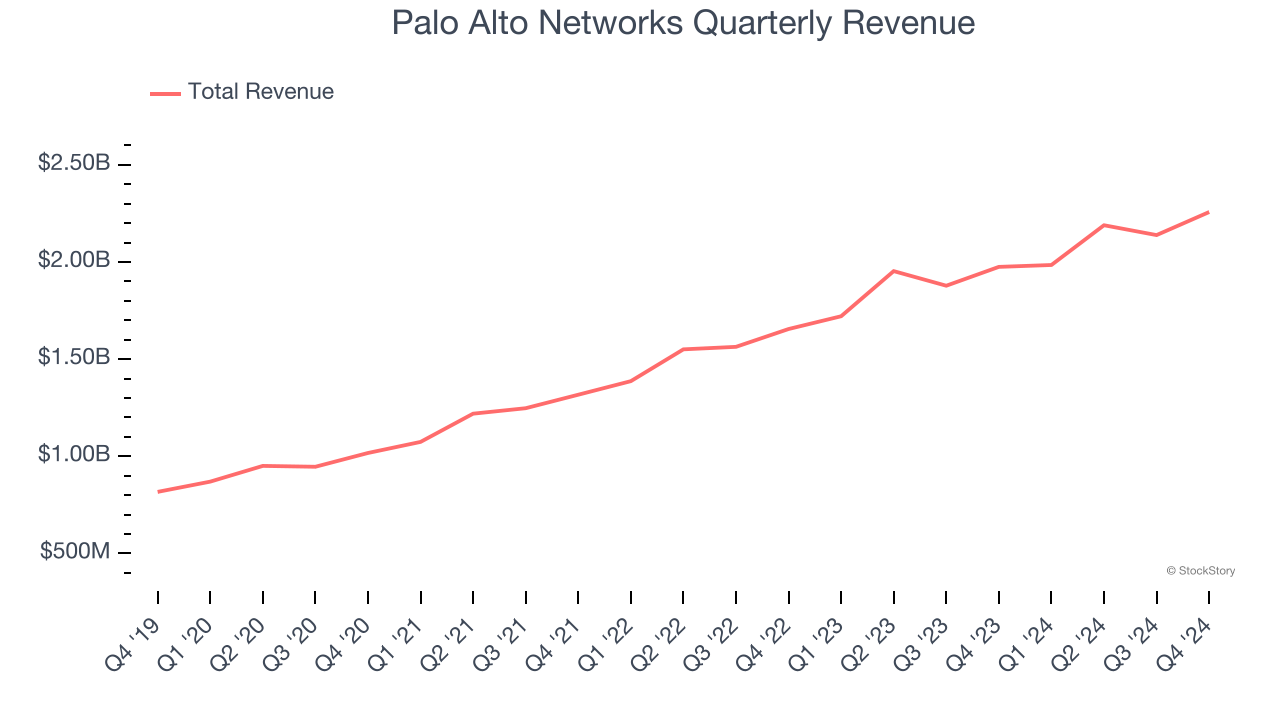

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Palo Alto Networks’s 20.8% annualized revenue growth over the last three years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Palo Alto Networks reported year-on-year revenue growth of 14.3%, and its $2.26 billion of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 14.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.2% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and indicates the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s expensive for Palo Alto Networks to acquire new customers as its CAC payback period checked in at 65.1 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Palo Alto Networks’s Q4 Results

It was good to see Palo Alto Networks beat analysts’ revenue and EPS estimates. We were also glad it lifted its full-year revenue and EPS guidance. Overall, this "beat-and-raise" quarter had some key positives, but shares are moving lower as buy-side expectations were likely higher than published sell-side numbers. The stock traded down 5% to $191.88 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.