Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Bowlero (NYSE: BOWL) and its peers.

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The 59 consumer discretionary stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 1% below.

While some consumer discretionary stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.1% since the latest earnings results.

Bowlero (NYSE: BOWL)

Operating over 300 locations globally, Bowlero (NYSE: BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

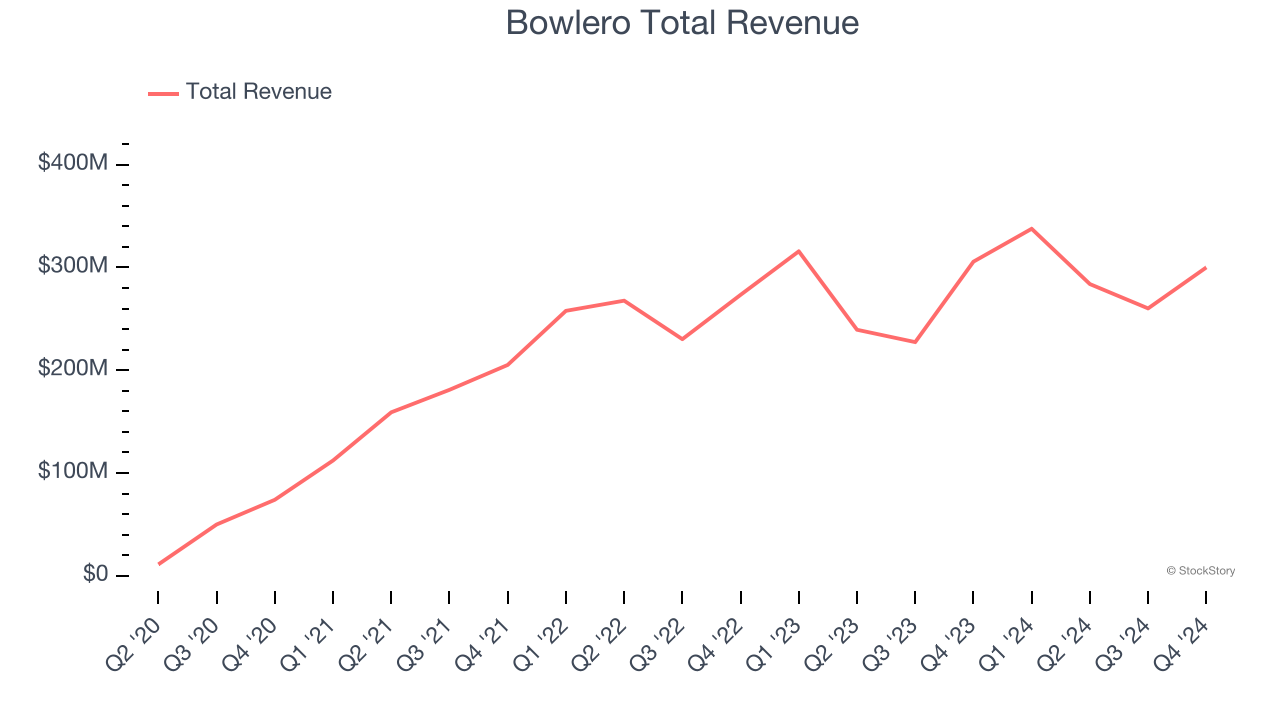

Bowlero reported revenues of $300.1 million, down 1.8% year on year. This print fell short of analysts’ expectations by 4.9%. Overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $11.80.

Read our full report on Bowlero here, it’s free.

Best Q4: VF Corp (NYSE: VFC)

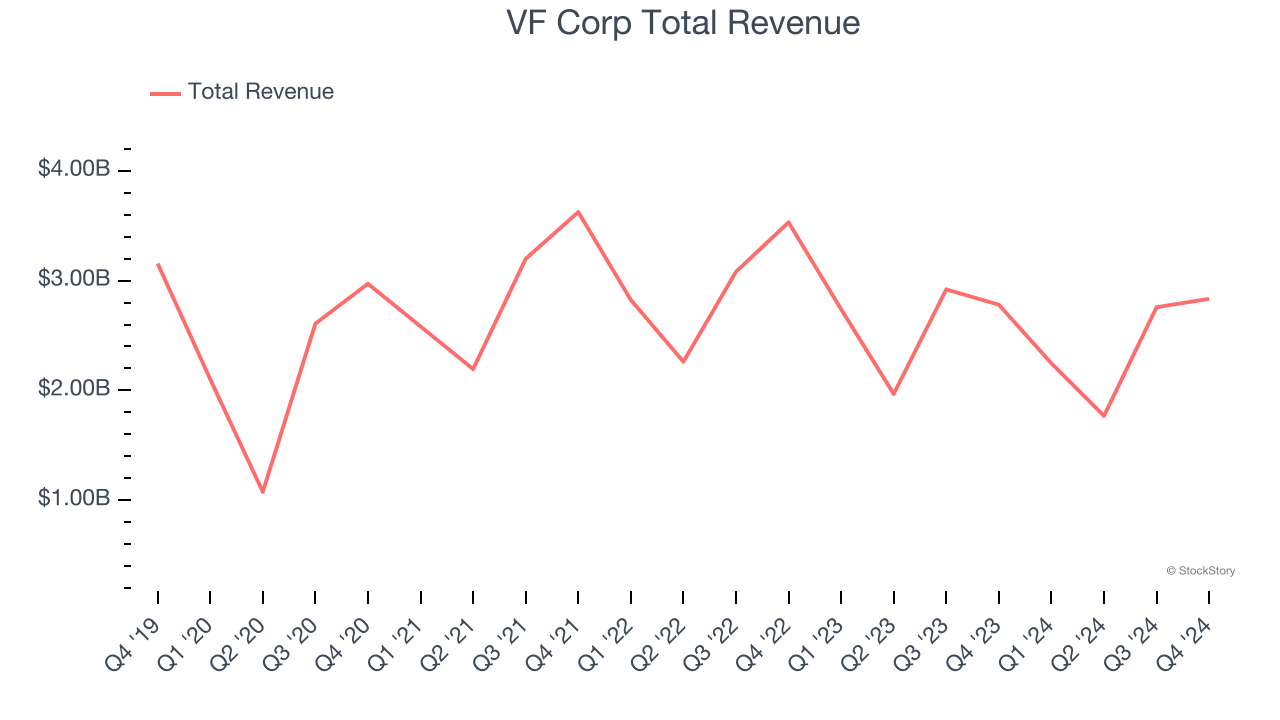

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE: VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

VF Corp reported revenues of $2.83 billion, up 1.9% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with an impressive beat of analysts’ constant currency revenue and EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 4.8% since reporting. It currently trades at $25.29.

Is now the time to buy VF Corp? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: 1-800-FLOWERS (NASDAQ: FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $775.5 million, down 5.7% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 2.8% since the results and currently trades at $8.57.

Read our full analysis of 1-800-FLOWERS’s results here.

Apple (NASDAQ: AAPL)

Creator of the iPhone and shepherd of the App Store, Apple (NASDAQ: AAPL) is a legendary developer of consumer electronics and software.

Apple reported revenues of $124.3 billion, up 4% year on year. This print met analysts’ expectations. Zooming out, it was a mixed quarter as it underperformed in some other aspects of the business.

The stock is up 1.6% since reporting and currently trades at $241.31.

Read our full, actionable report on Apple here, it’s free.

CBRE (NYSE: CBRE)

Established in 1906, CBRE (NYSE: CBRE) is one of the largest commercial real estate services firms in the world.

CBRE reported revenues of $10.4 billion, up 16.2% year on year. This result topped analysts’ expectations by 1.2%. Zooming out, it was a mixed quarter as it also produced a decent beat of analysts’ EPS estimates but full-year EPS guidance slightly missing analysts’ expectations.

The stock is up 1.2% since reporting and currently trades at $142.42.

Read our full, actionable report on CBRE here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.