As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Amazon (NASDAQ: AMZN) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 24 consumer internet stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

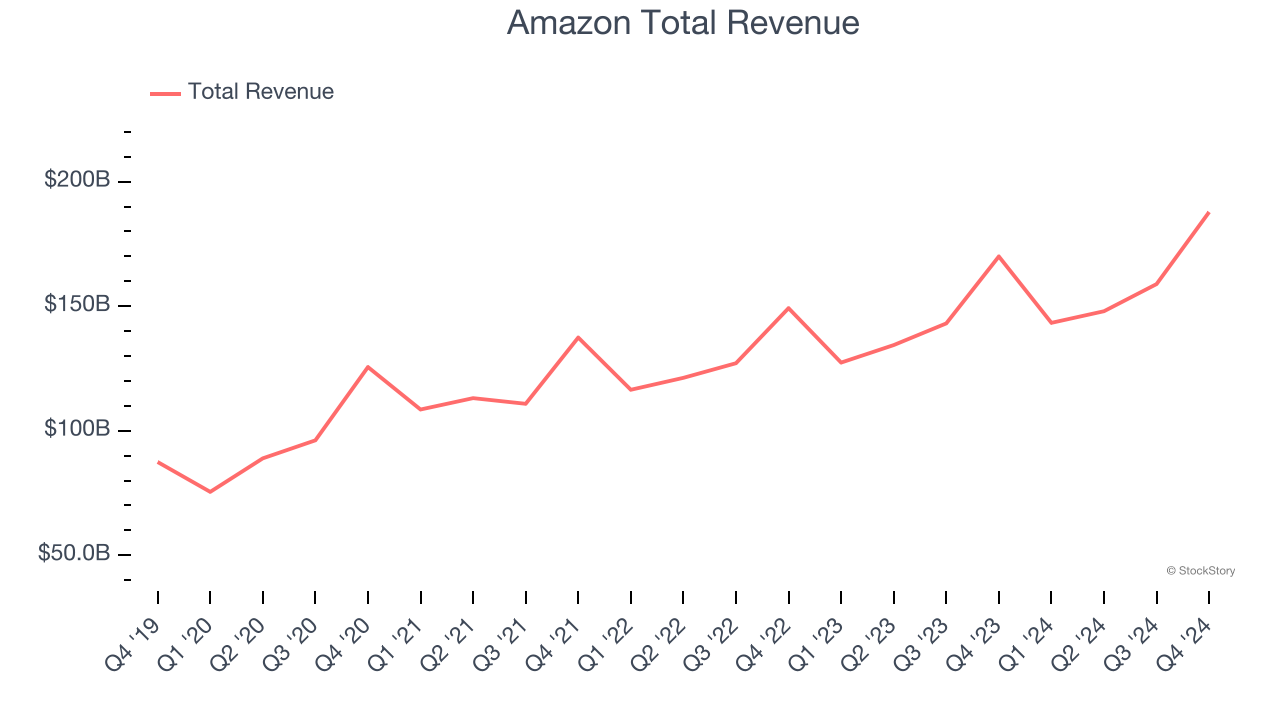

Best Q4: Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $187.8 billion, up 10.5% year on year. This print was in line with analysts’ expectations, and overall, it was a mixed quarter for the company. Amazon beat analysts’ operating profit and EPS expectations. On the other hand, its revenue and operating income guidance for next quarter both fell short of Wall Street’s estimates.

“The holiday shopping season was the most successful yet for Amazon and we appreciate the support of our customers, selling partners, and employees who helped make it so,” said Andy Jassy, President and CEO, Amazon.

The stock is down 4.3% since reporting and currently trades at $228.59.

Is now the time to buy Amazon? Access our full analysis of the earnings results here, it’s free.

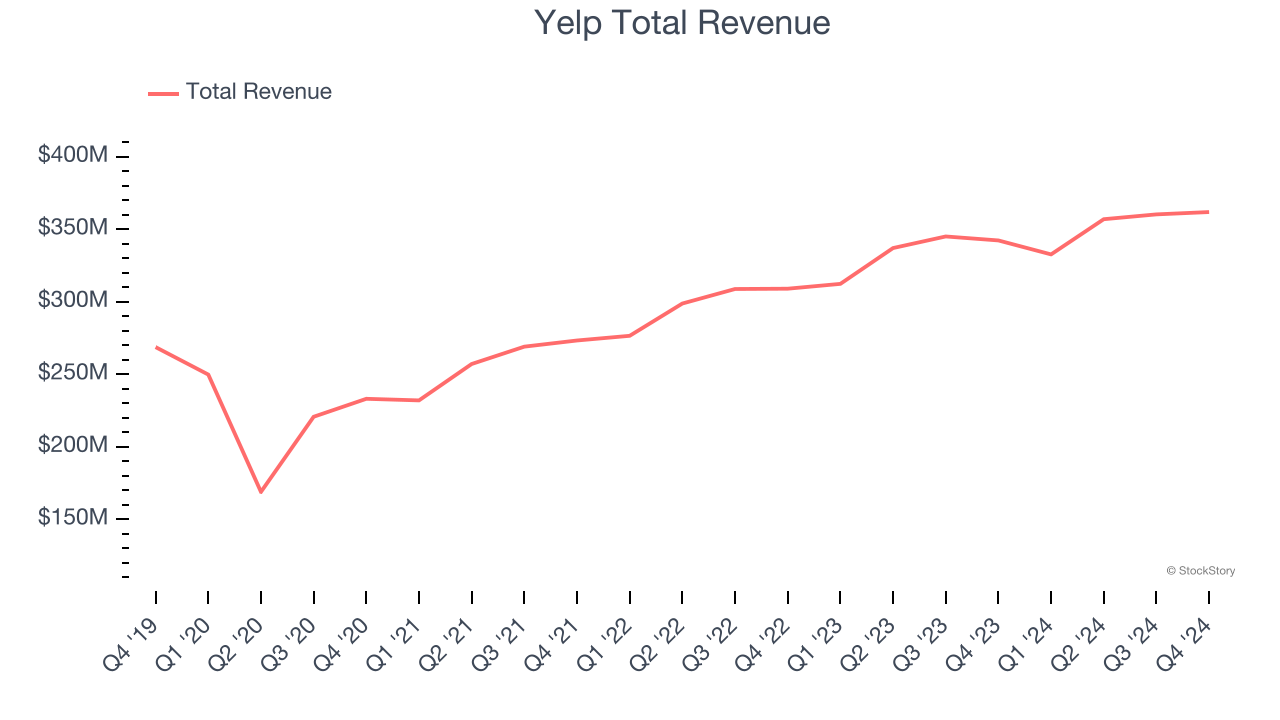

Yelp (NYSE: YELP)

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp reported revenues of $362 million, up 5.7% year on year, outperforming analysts’ expectations by 3.3%. The business performed better than its peers, but it was unfortunately a mixed quarter with full-year EBITDA guidance missing analysts’ expectations.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 8.2% since reporting. It currently trades at $37.24.

Is now the time to buy Yelp? Access our full analysis of the earnings results here, it’s free.

Robinhood (NASDAQ: HOOD)

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $1.01 billion, up 115% year on year, exceeding analysts’ expectations by 7.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of funded customers estimates.

Interestingly, the stock is up 16.5% since the results and currently trades at $65.20.

Read our full analysis of Robinhood’s results here.

Alphabet (NASDAQ: GOOGL)

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $96.47 billion, up 11.8% year on year. This print was in line with analysts’ expectations. Taking a step back, it was a mixed quarter: It was encouraging to see Alphabet beat analysts’ operating income expectations. On the other hand, its total revenue was in line and its all-important Google Cloud revenue missed, spooking some investors with high expectations.

The stock is down 10.2% since reporting and currently trades at $185.22.

Read our full, actionable report on Alphabet here, it’s free.

Lyft (NASDAQ: LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $1.55 billion, up 26.6% year on year. This number lagged analysts' expectations by 0.9%. More broadly, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

The company reported 24.7 million users, up 10.3% year on year. The stock is down 7.1% since reporting and currently trades at $13.39.

Read our full, actionable report on Lyft here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.