The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how consumer discretionary stocks fared in Q4, starting with Bowlero (NYSE: BOWL).

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The 66 consumer discretionary stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q4: Bowlero (NYSE: BOWL)

Operating over 300 locations globally, Bowlero (NYSE: BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

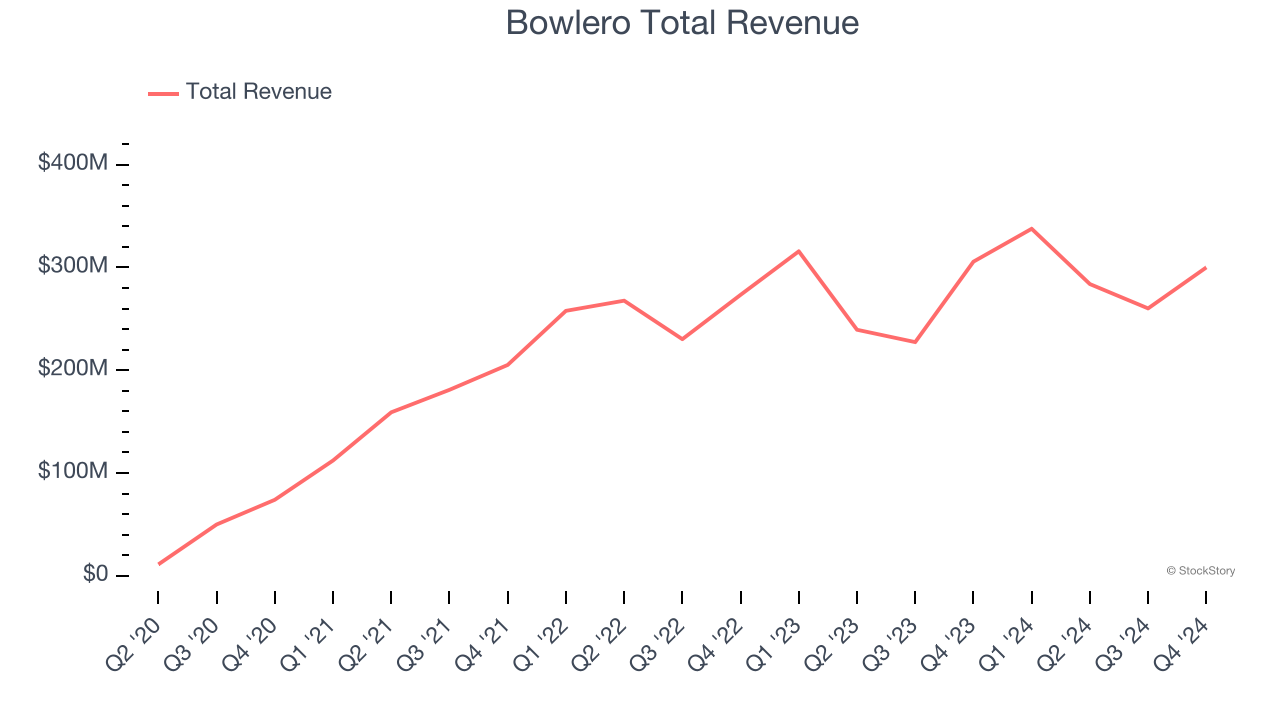

Bowlero reported revenues of $300.1 million, down 1.8% year on year. This print fell short of analysts’ expectations by 4.9%. Overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $11.80.

Read our full report on Bowlero here, it’s free.

Best Q4: Marcus & Millichap (NYSE: MMI)

Founded in 1971, Marcus & Millichap (NYSE: MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

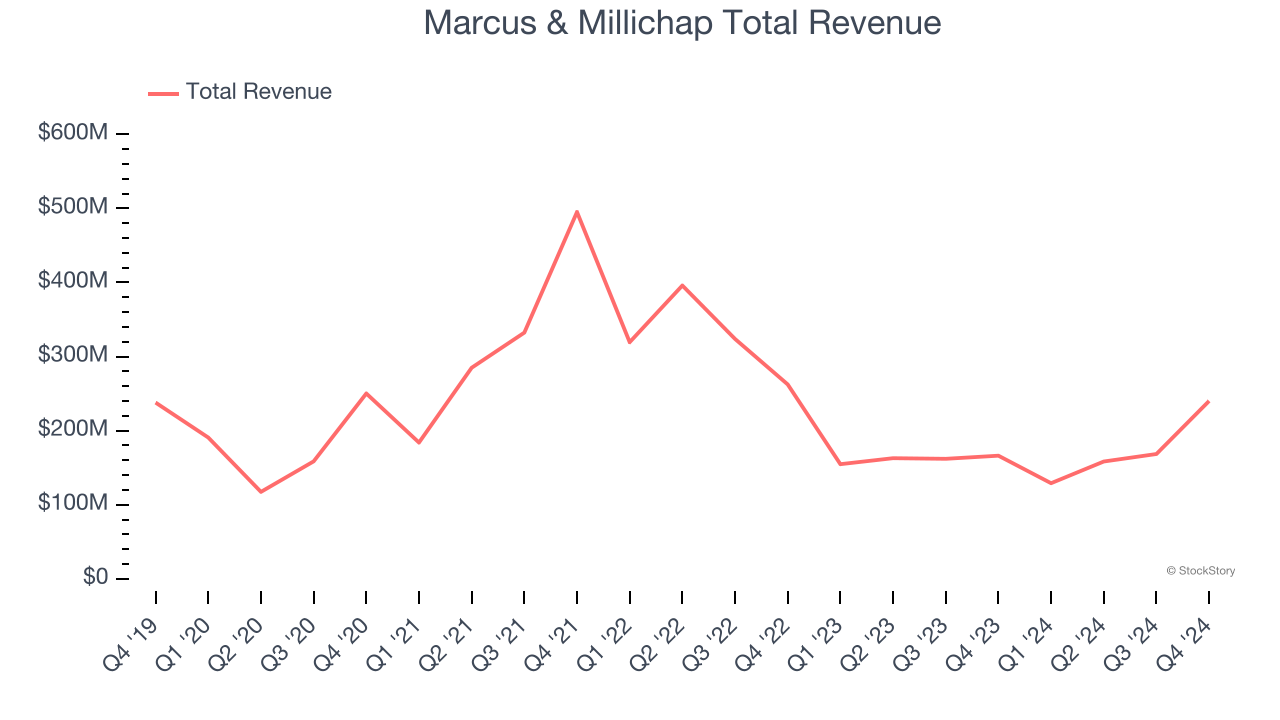

Marcus & Millichap reported revenues of $240.1 million, up 44.4% year on year, outperforming analysts’ expectations by 20.2%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Marcus & Millichap scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 5.4% since reporting. It currently trades at $39.30.

Is now the time to buy Marcus & Millichap? Access our full analysis of the earnings results here, it’s free.

Wynn Resorts (NASDAQ: WYNN)

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ: WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Wynn Resorts reported revenues of $1.84 billion, flat year on year, exceeding analysts’ expectations by 2.8%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 10.2% since the results and currently trades at $88.70.

Read our full analysis of Wynn Resorts’s results here.

Sirius XM (NASDAQ: SIRI)

Known for its commercial-free music channels, Sirius XM (NASDAQ: SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

Sirius XM reported revenues of $2.19 billion, down 4.3% year on year. This print beat analysts’ expectations by 0.7%. Aside from that, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates but full-year revenue guidance slightly missing analysts’ expectations.

The stock is up 25.1% since reporting and currently trades at $27.31.

Read our full, actionable report on Sirius XM here, it’s free.

News Corp (NASDAQ: NWSA)

Established in 2013 after a restructuring, News Corp (NASDAQ: NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

News Corp reported revenues of $2.24 billion, down 13.5% year on year. This number topped analysts’ expectations by 3.1%. It was a very strong quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates.

The stock is up 3.6% since reporting and currently trades at $29.88.

Read our full, actionable report on News Corp here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.