Real estate technology company Compass (NYSE: COMP) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 25.9% year on year to $1.38 billion. On top of that, next quarter’s revenue guidance ($1.41 billion at the midpoint) was surprisingly good and 6.3% above what analysts were expecting. Its GAAP loss of $0.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy Compass? Find out by accessing our full research report, it’s free.

Compass (COMP) Q4 CY2024 Highlights:

- Revenue: $1.38 billion vs analyst estimates of $1.34 billion (25.9% year-on-year growth, 3.4% beat)

- EPS (GAAP): -$0.08 vs analyst estimates of -$0.08 (in line)

- Adjusted EBITDA: $16.7 million vs analyst estimates of $18 million (1.2% margin, 7.2% miss)

- Revenue Guidance for Q1 CY2025 is $1.41 billion at the midpoint, above analyst estimates of $1.33 billion

- EBITDA guidance for Q1 CY2025 is $18 million at the midpoint, above analyst estimates of $8.96 million

- Operating Margin: -2.9%, up from -7.6% in the same quarter last year

- Free Cash Flow was $26.7 million, up from -$41 million in the same quarter last year

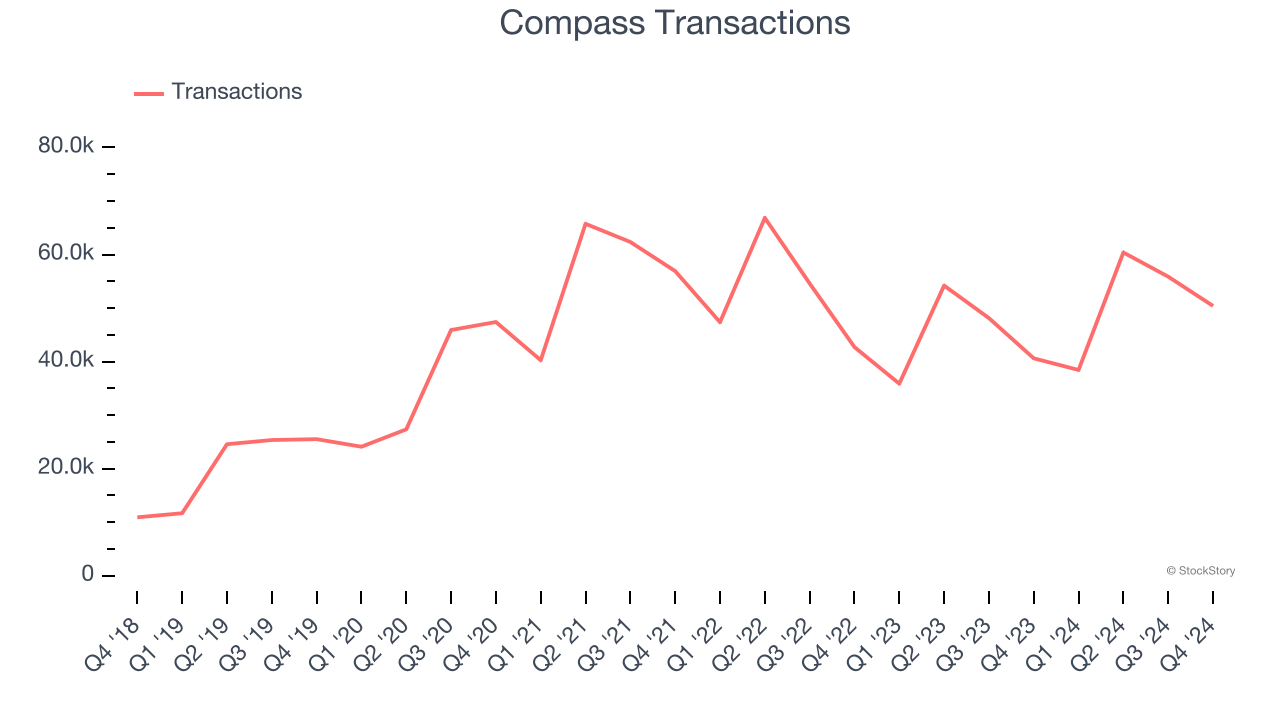

- Transactions: 50,411, up 9,790 year on year

- Market Capitalization: $4.16 billion

"Despite a year in which resale transactions experienced a 29-year low, Compass grew both Revenue and Adjusted EBITDA2 significantly and delivered $122 million in operating cash flow, or $150 million prior to the NAR-related settlement payment. As the market recovers, we believe the combination of our cost discipline and structural advantages, which include our end-to-end proprietary technology platform, national scale, network of top agents, and depth of inventory, positions Compass to capture significant upside," said Robert Reffkin, Founder and Chief Executive Officer of Compass.

Company Overview

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE: COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

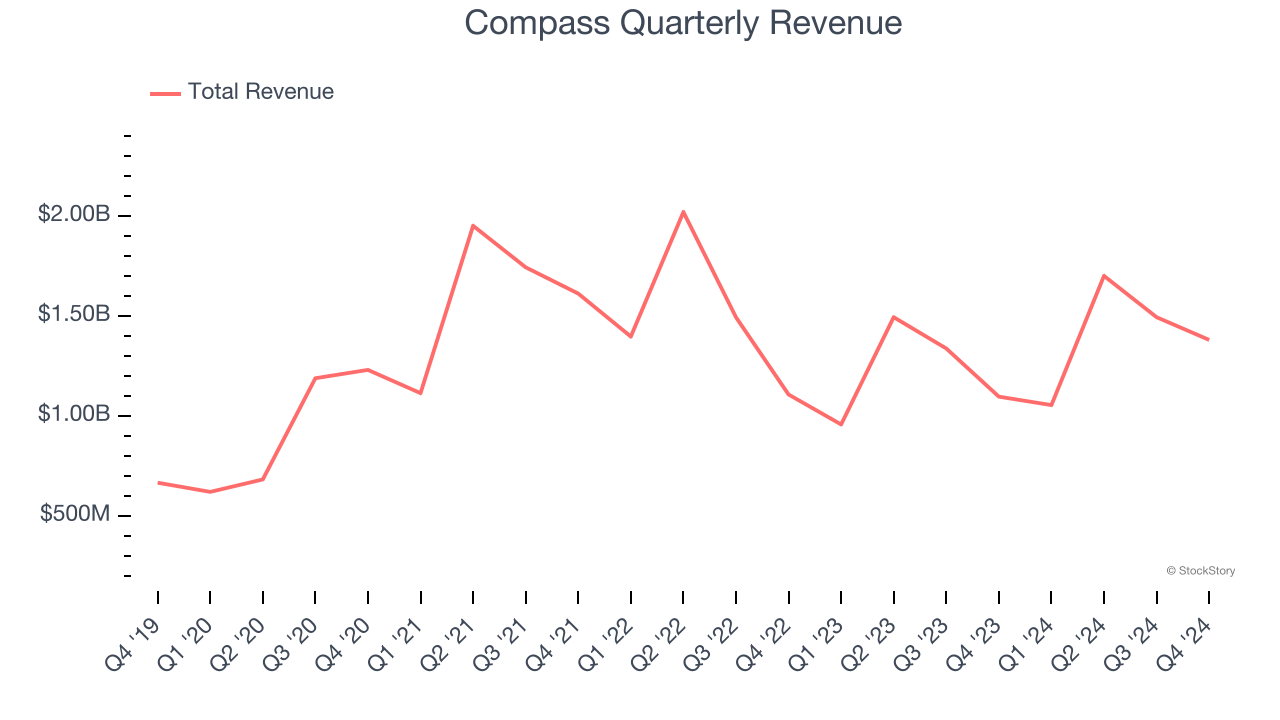

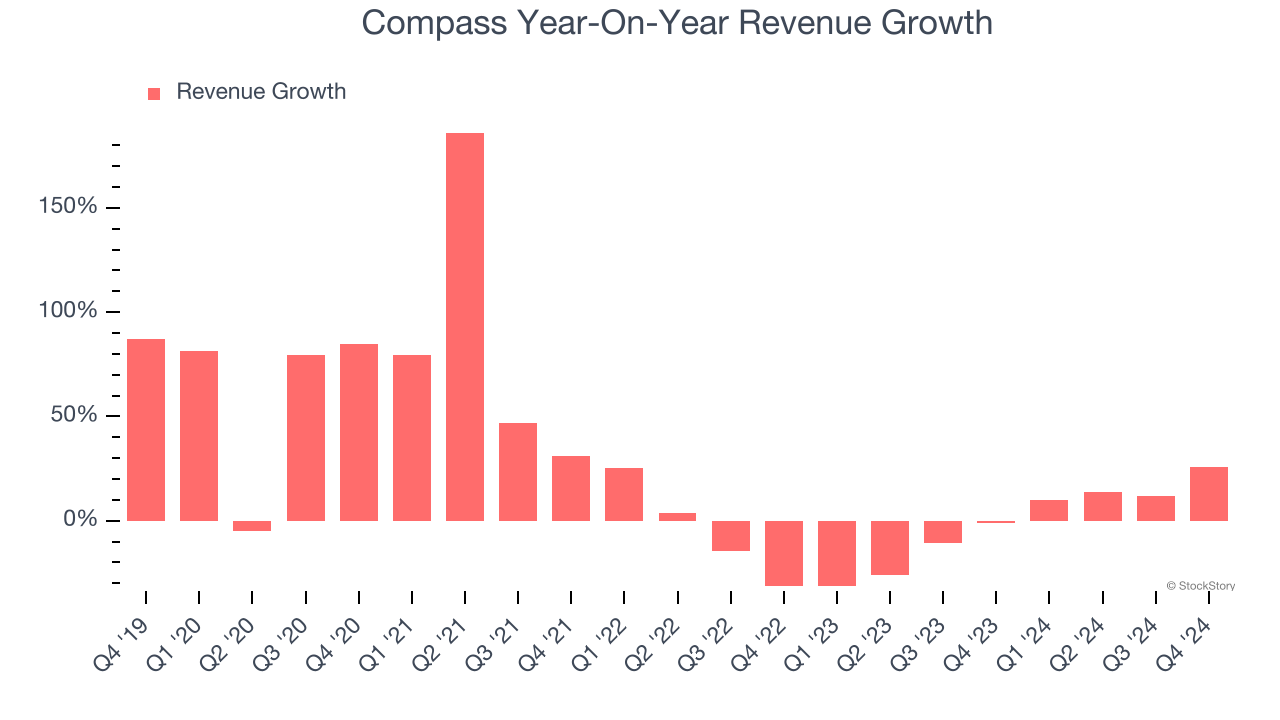

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Compass grew its sales at a solid 18.7% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Compass’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.3% over the last two years.

Compass also discloses its number of transactions, which reached 50,411 in the latest quarter. Over the last two years, Compass’s transactions were flat. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Compass reported robust year-on-year revenue growth of 25.9%, and its $1.38 billion of revenue topped Wall Street estimates by 3.4%. Company management is currently guiding for a 34% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.1% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

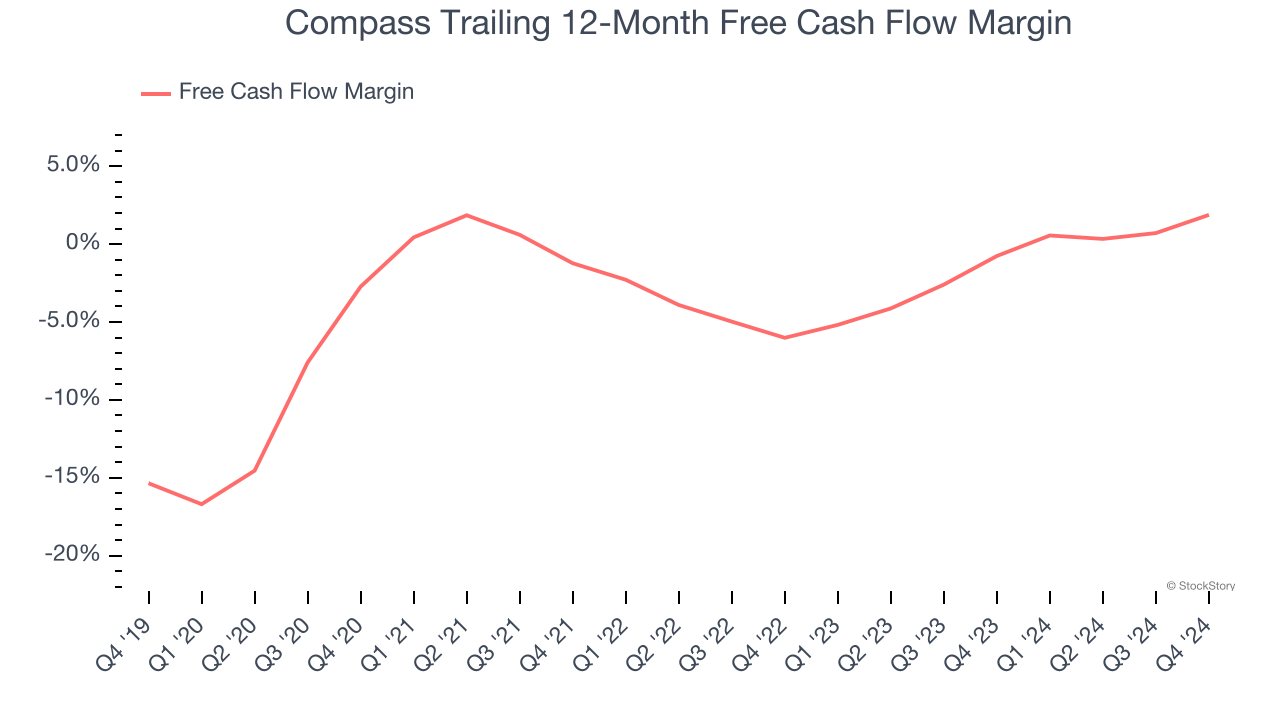

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Compass broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Compass’s free cash flow clocked in at $26.7 million in Q4, equivalent to a 1.9% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Key Takeaways from Compass’s Q4 Results

This was a strong quarter, with revenue and EBITDA above expectations. We were also impressed by Compass’s optimistic revenue and EBITDA guidance for next quarter, both of which beat analysts’ expectations. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 10.5% to $8.82 immediately following the results.

Indeed, Compass had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.