Online freelance marketplace Fiverr (NYSE: FVRR) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 13.3% year on year to $103.7 million. On top of that, next quarter’s revenue guidance ($106 million at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its non-GAAP profit of $0.64 per share was 5.8% below analysts’ consensus estimates.

Is now the time to buy Fiverr? Find out by accessing our full research report, it’s free.

Fiverr (FVRR) Q4 CY2024 Highlights:

- Revenue: $103.7 million vs analyst estimates of $101.3 million (13.3% year-on-year growth, 2.3% beat)

- Adjusted EPS: $0.64 vs analyst expectations of $0.68 (5.8% miss)

- Adjusted EBITDA: $20.71 million vs analyst estimates of $20.81 million (20% margin, in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $430 million at the midpoint, beating analyst estimates by 2.7% and implying 9.8% growth (vs 8.3% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $86 million at the midpoint, below analyst estimates of $86.94 million

- Operating Margin: -5.7%, down from -1.8% in the same quarter last year

- Free Cash Flow Margin: 28.6%, up from 10.6% in the previous quarter

- Active Buyers: 3.6 million, down 477,000 year on year

- Market Capitalization: $1.15 billion

“We delivered strong results for 2024, finishing the year well ahead of our initial targets, with double-digit revenue growth and robust margins. We continue to focus on our upmarket initiatives while strategically expanding Services revenue to drive further growth. It has been a year of significant innovation and investment in AI. Our latest launch, the revolutionary and unique human-centered AI platform Fiverr Go, allows our talent community to build their own creation models, control their creative rights, and take their business to the next level,” said Micha Kaufman, founder and CEO of Fiverr.

Company Overview

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

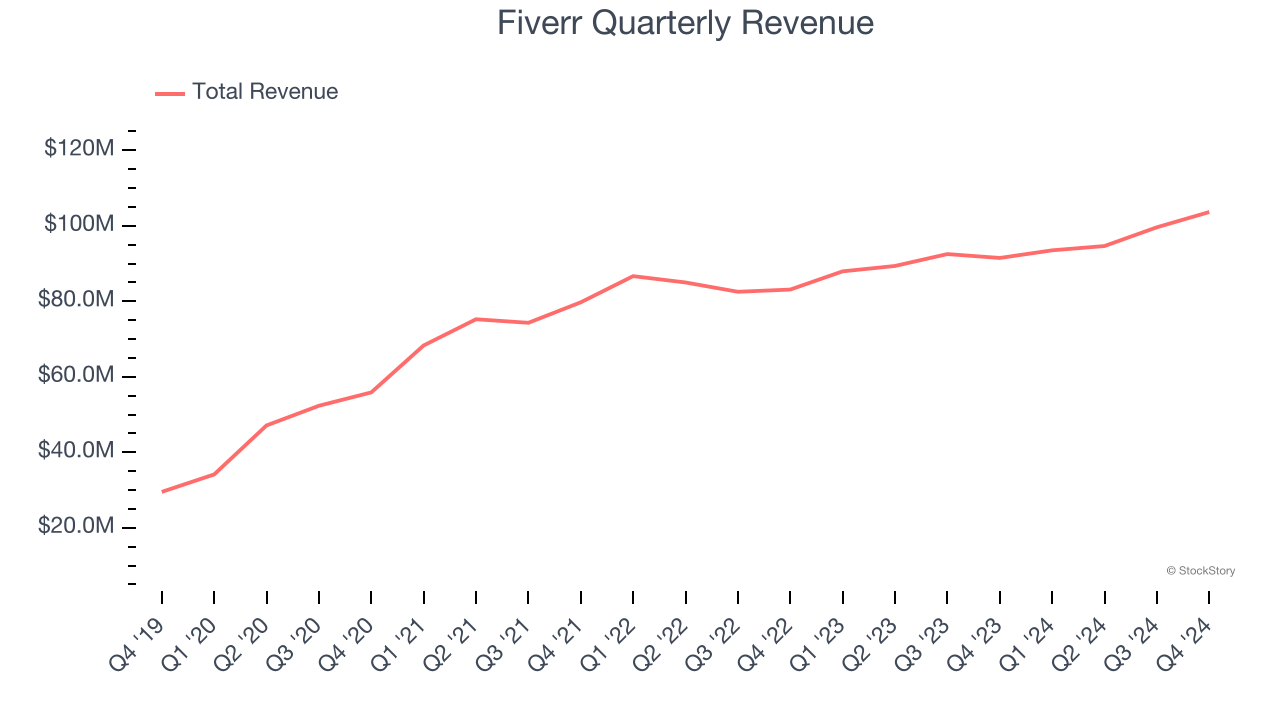

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Fiverr’s sales grew at a mediocre 9.6% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector, but there are still things to like about Fiverr.

This quarter, Fiverr reported year-on-year revenue growth of 13.3%, and its $103.7 million of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 13.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Active Buyers

Buyer Growth

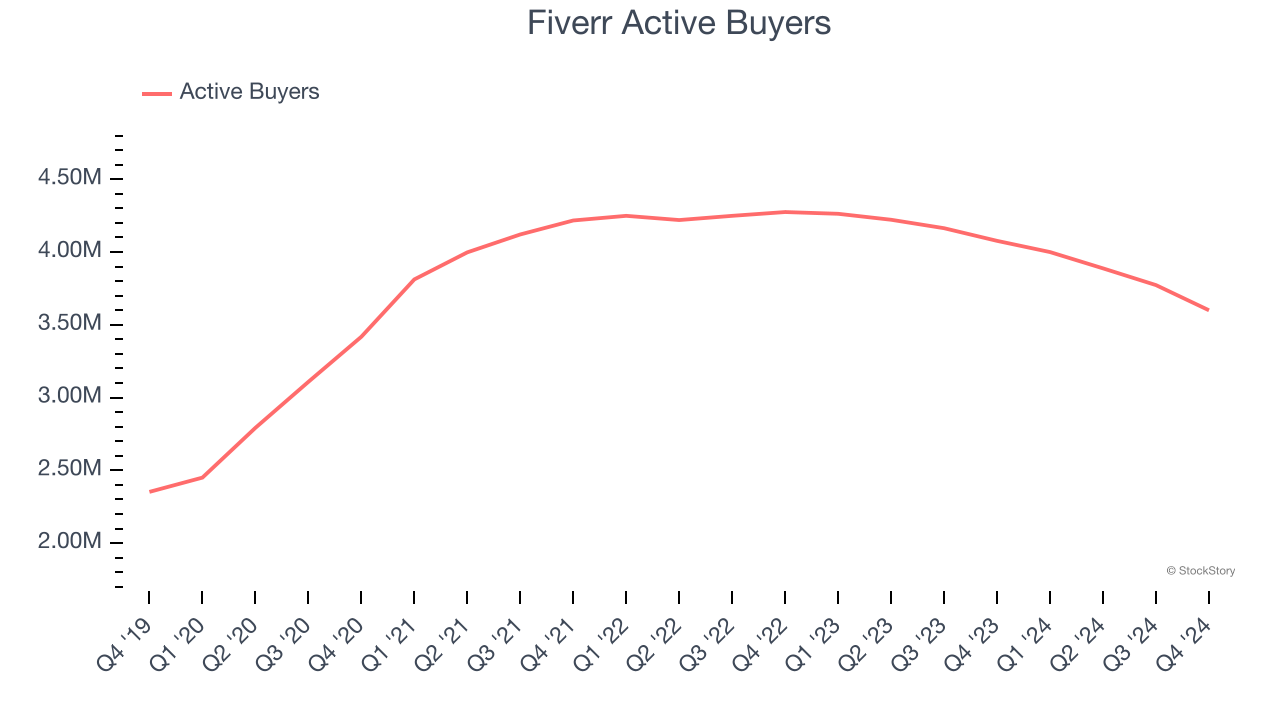

As a gig economy marketplace, Fiverr generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Fiverr struggled to engage its audience over the last two years as its active buyers have declined by 5.2% annually to 3.6 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Fiverr wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q4, Fiverr’s active buyers once again decreased by 477,000, a 11.7% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

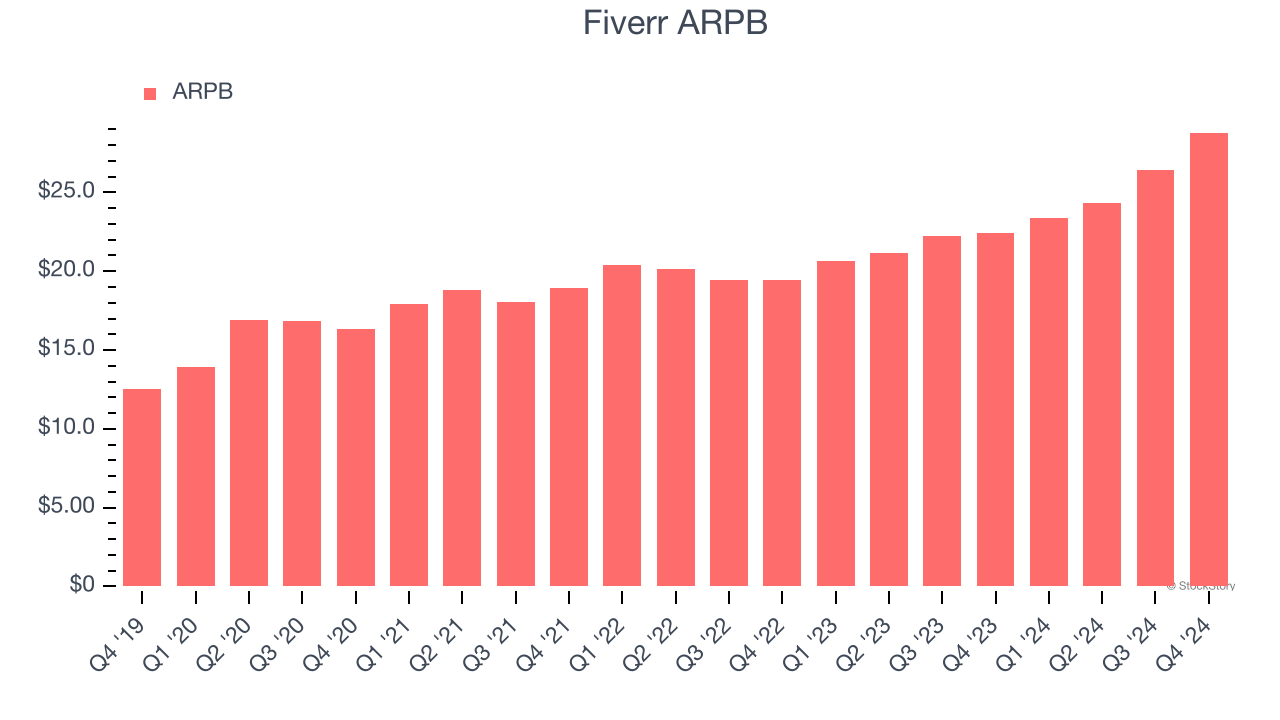

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for gig economy businesses like Fiverr because it measures how much the company earns in transaction fees from each buyer. This number also informs us about Fiverr’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Fiverr’s ARPB growth has been exceptional over the last two years, averaging 13.9%. Although its active buyers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing buyers.

This quarter, Fiverr’s ARPB clocked in at $28.80. It grew by 28.3% year on year, faster than its active buyers.

Key Takeaways from Fiverr’s Q4 Results

Revenue beat but EBITDA was just in line. It was good to see Fiverr’s revenue guidance for next quarter exceed analysts’ expectations. We were also glad its full-year revenue guidance was higher than Wall Street’s estimates. Overall, this was a pretty good quarter. The stock traded up 5.5% to $34.92 immediately following the results.

Is Fiverr an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.