Swimming pool distributor Pool (NASDAQ: POOL) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 1.6% year on year to $987.5 million. Its GAAP profit of $0.98 per share was 8.2% above analysts’ consensus estimates.

Is now the time to buy Pool? Find out by accessing our full research report, it’s free.

Pool (POOL) Q4 CY2024 Highlights:

- Revenue: $987.5 million vs analyst estimates of $964.7 million (1.6% year-on-year decline, 2.4% beat)

- EPS (GAAP): $0.98 vs analyst estimates of $0.91 (8.2% beat)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $11.33 at the midpoint, missing analyst estimates by 5.5%

- Operating Margin: 6.1%, down from 7.9% in the same quarter last year

- Free Cash Flow Margin: 15.9%, up from 12.1% in the same quarter last year

- Market Capitalization: $12.97 billion

“Our results in 2024 highlight the strength of our business model in a pressured macroenvironment. Strategic execution in our growth initiatives allowed us to achieve net sales of $5.3 billion despite tempered discretionary spending. This year we enhanced our POOL360 digital ecosystem with technology rollouts and expanded our digital marketing programs, leading to increased sales of our private-label chemical products. We also continued to expand our sales center network, further improving our ability to serve our customers and widen our reach, with the addition of 10 greenfield locations and 2 acquisitions, bringing our total locations to 448 worldwide. We ended the year with strong operating cash flows of $659.2 million and are proud to have returned $483.4 million to our shareholders through dividends and share repurchases,” said Peter D. Arvan, president and CEO.

Company Overview

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ: POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

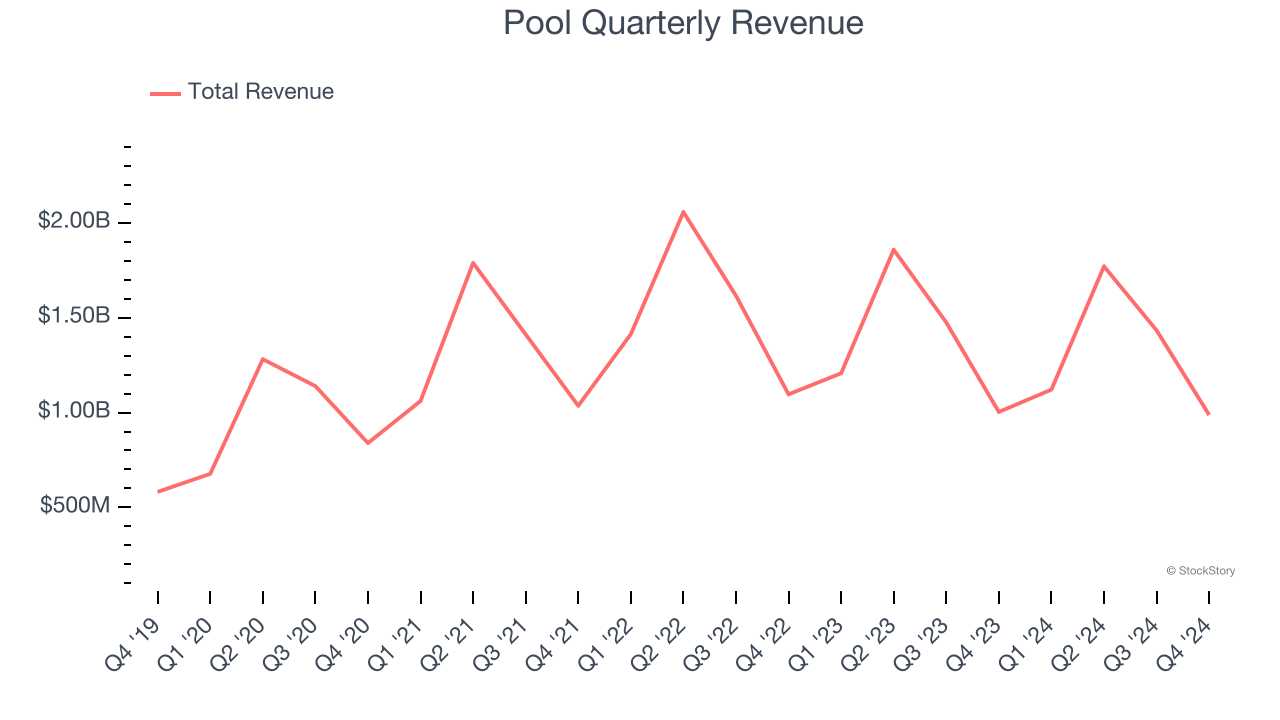

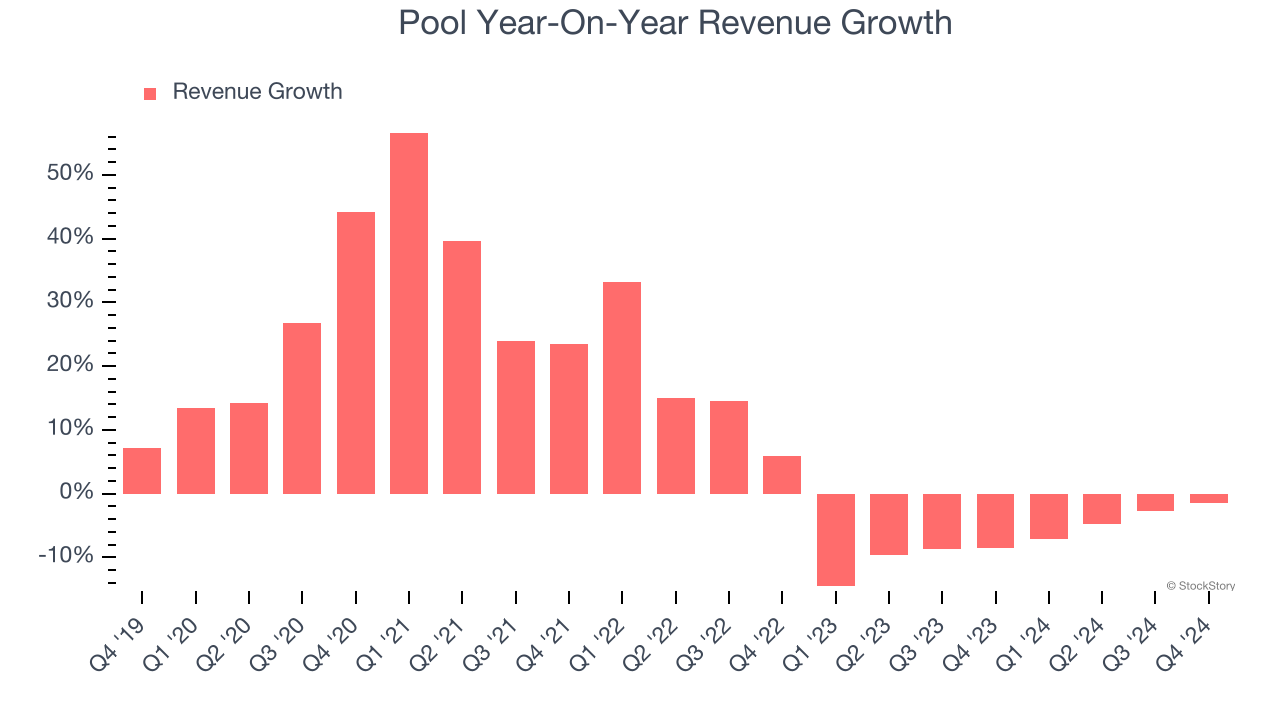

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Pool grew its sales at a 10.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Pool’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.3% annually.

This quarter, Pool’s revenue fell by 1.6% year on year to $987.5 million but beat Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

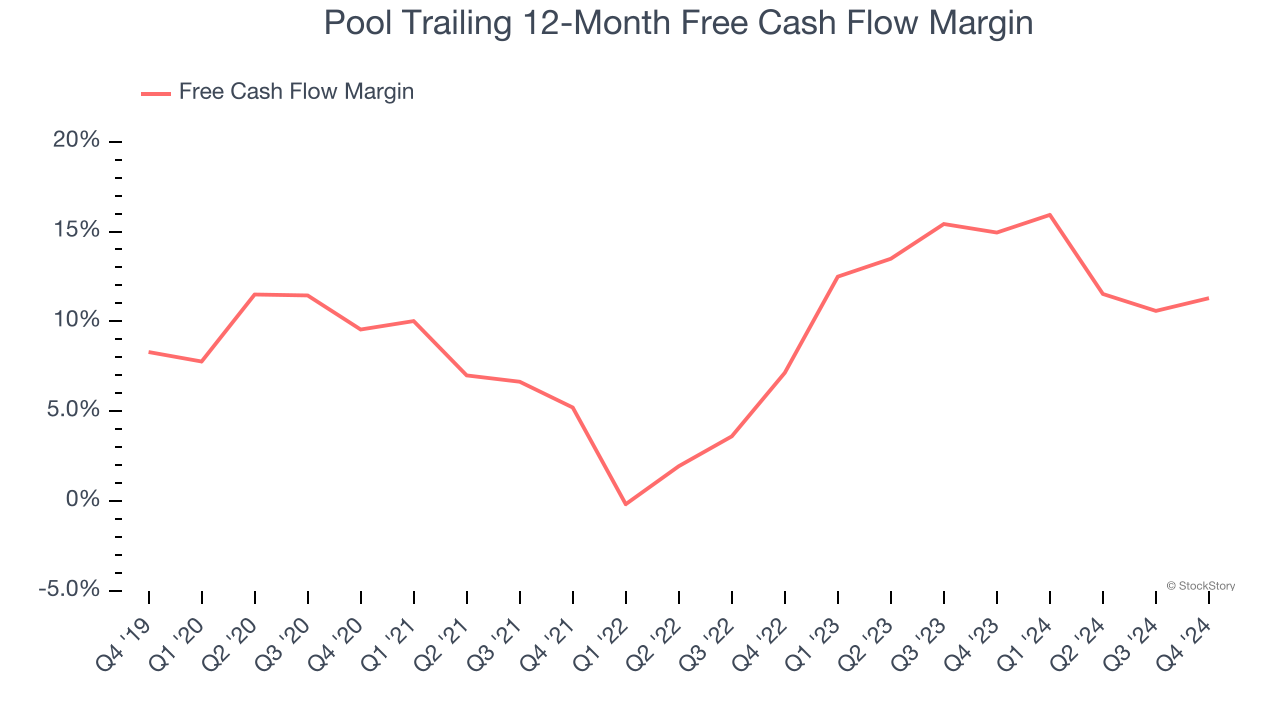

Pool has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.2% over the last two years, better than the broader consumer discretionary sector.

Pool’s free cash flow clocked in at $157 million in Q4, equivalent to a 15.9% margin. This result was good as its margin was 3.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Pool’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 11.3% for the last 12 months will decrease to 7.6%.

Key Takeaways from Pool’s Q4 Results

It was encouraging to see Pool beat analysts’ revenue and EPS expectations this quarter. On the other hand, its full-year EPS guidance missed. Overall, this was a mixed quarter. The stock remained flat at $340.50 immediately after reporting.

Big picture, is Pool a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.