Shareholders of Tilray would probably like to forget the past six months even happened. The stock dropped 54.1% and now trades at $0.87. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Tilray, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we don't have much confidence in Tilray. Here are three reasons why there are better opportunities than TLRY and a stock we'd rather own.

Why Do We Think Tilray Will Underperform?

Founded in 2013, Tilray Brands (NASDAQ: TLRY) engages in in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

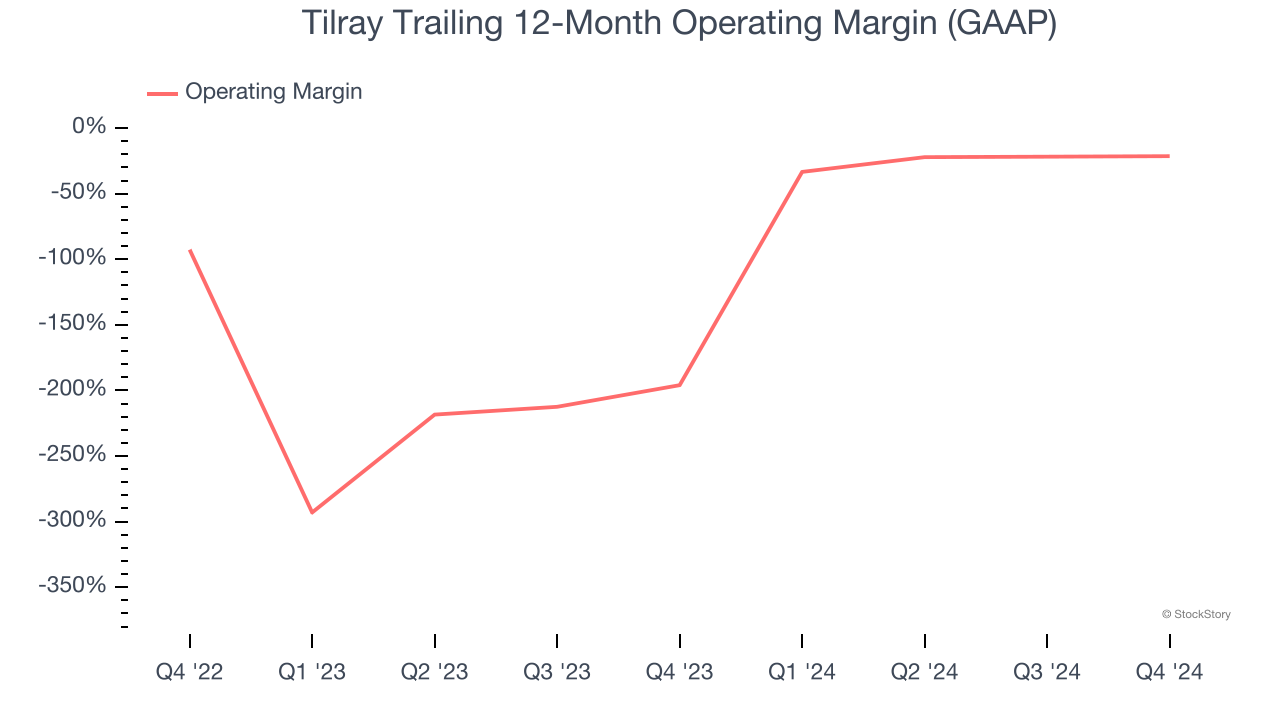

1. Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, Tilray was one of them over the last two years as its high expenses contributed to an average operating margin of negative 101%.

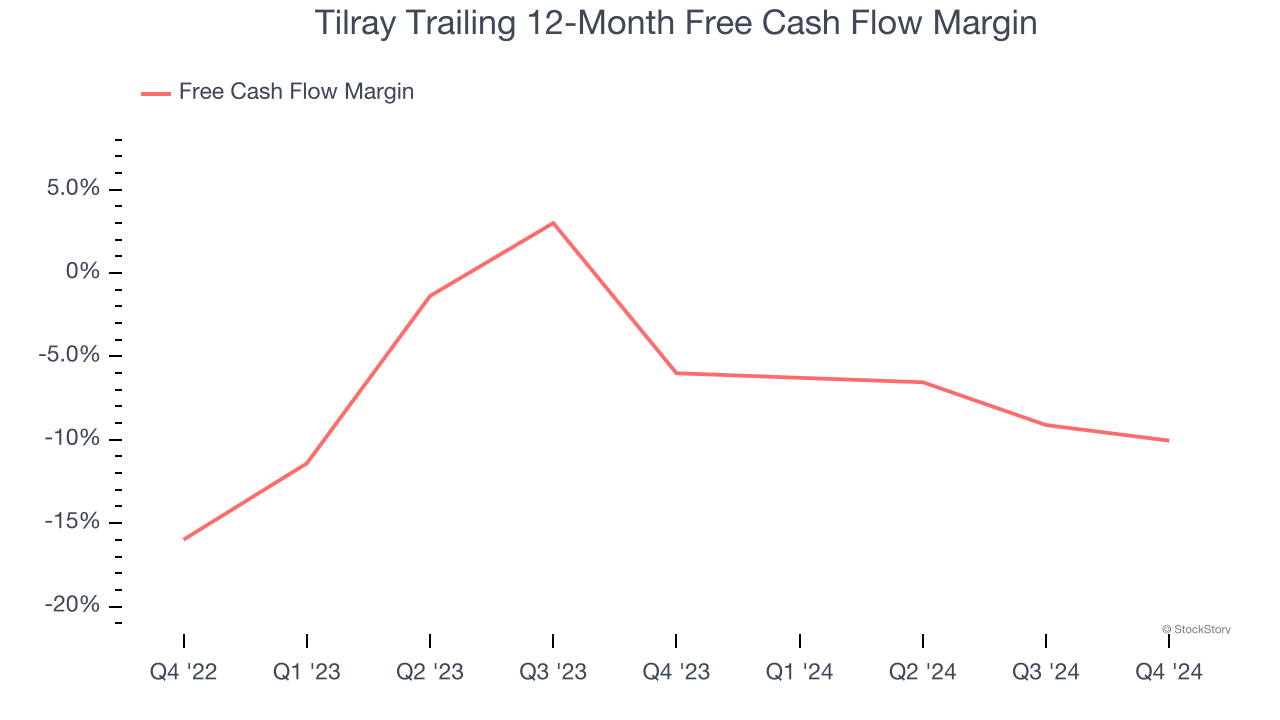

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Tilray’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 8.2%, meaning it lit $8.20 of cash on fire for every $100 in revenue.

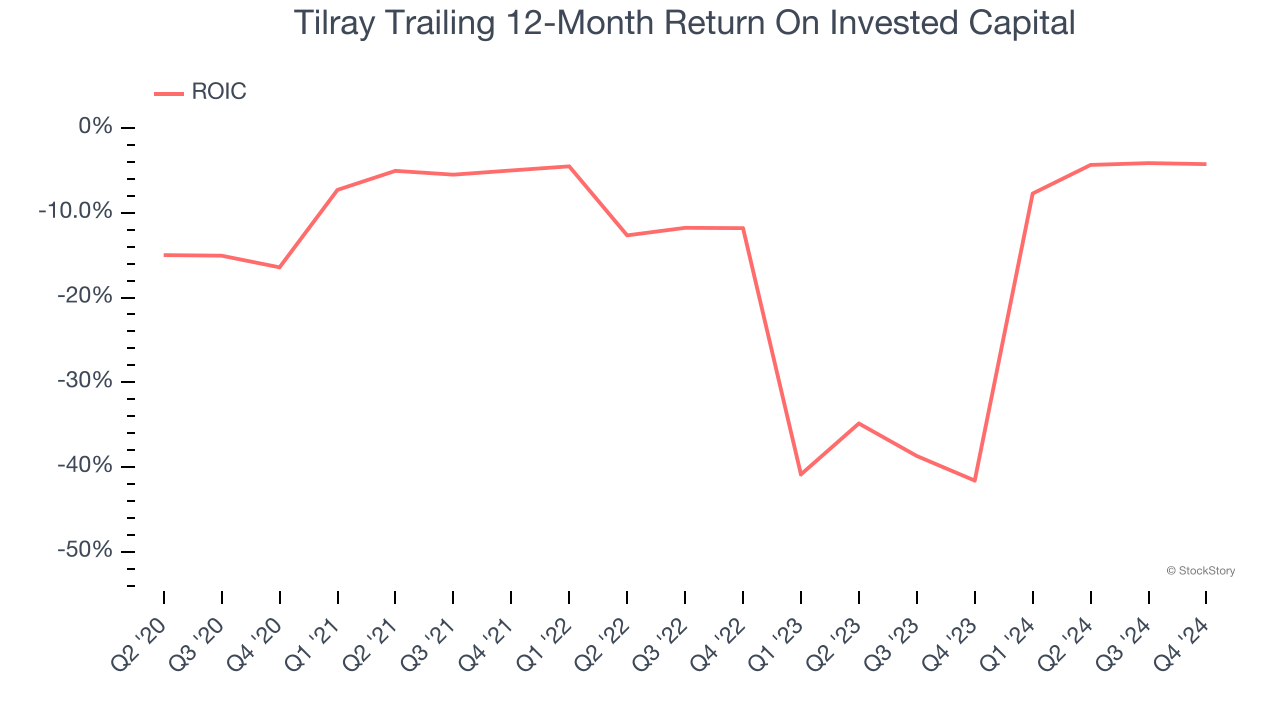

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Tilray’s five-year average ROIC was negative 15.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Final Judgment

We see the value of companies helping consumers, but in the case of Tilray, we’re out. After the recent drawdown, the stock trades at 9.5× forward EV-to-EBITDA (or $0.87 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Tilray

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.