Composite decking and railing products manufacturer Trex Company (NYSE: TREX) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 14.4% year on year to $167.6 million. The company expects the full year’s revenue to be around $1.22 billion, close to analysts’ estimates. Its GAAP profit of $0.09 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Trex? Find out by accessing our full research report, it’s free.

Trex (TREX) Q4 CY2024 Highlights:

- Revenue: $167.6 million vs analyst estimates of $160.5 million (14.4% year-on-year decline, 4.4% beat)

- EPS (GAAP): $0.09 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $28.91 million vs analyst estimates of $19.69 million (17.2% margin, 46.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.22 billion at the midpoint, in line with analyst expectations and implying 6% growth (vs 6.2% in FY2024)

- Operating Margin: 9.2%, down from 14.4% in the same quarter last year

- Free Cash Flow was -$89.33 million, down from $48.03 million in the same quarter last year

- Market Capitalization: $6.49 billion

“The continued strong performance of our premium product lines and stable sequential demand trends for our value-priced products led to fourth quarter sales above our expectations, enabling us to exceed our full year revenue guidance. The significant EBITDA outperformance in the fourth quarter demonstrated the positive leverage of our business model on higher utilization, driven, in part, by our year-end inventory build, as well as the benefits of our continuous cost-out programs,” said Bryan Fairbanks, President and CEO.

Company Overview

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE: TREX) makes wood-alternative decking, railing, and patio furniture.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

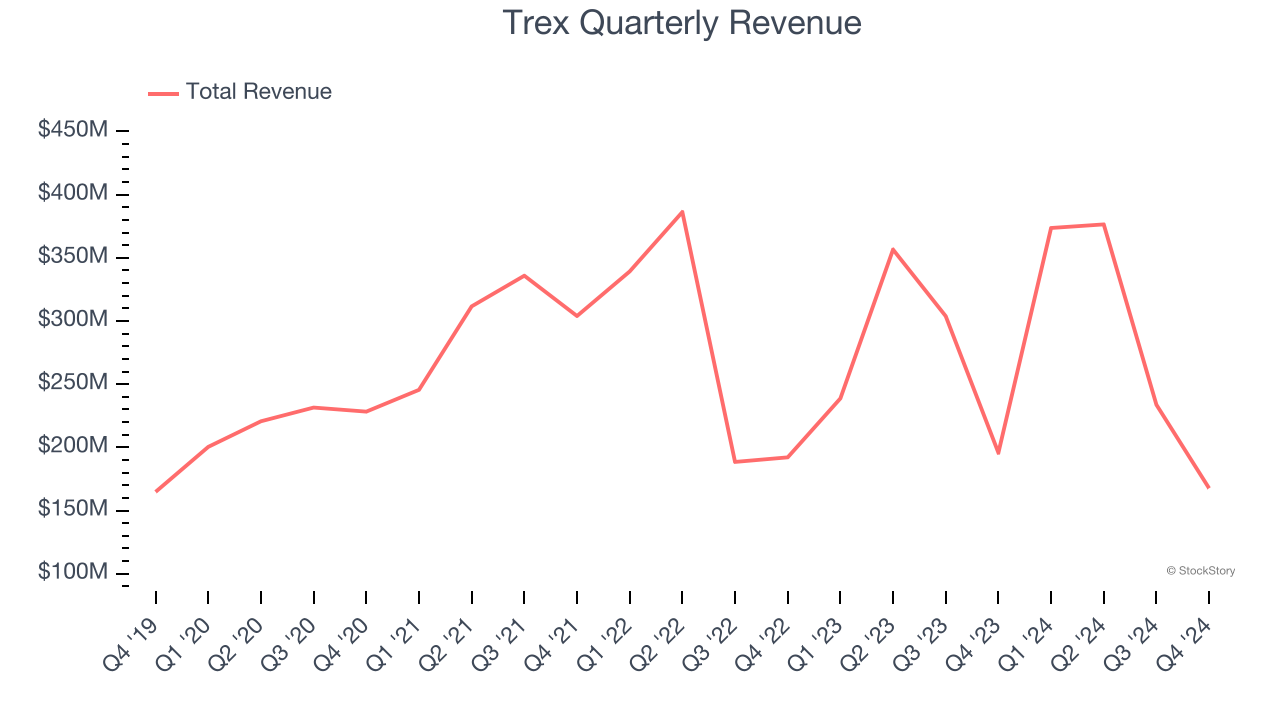

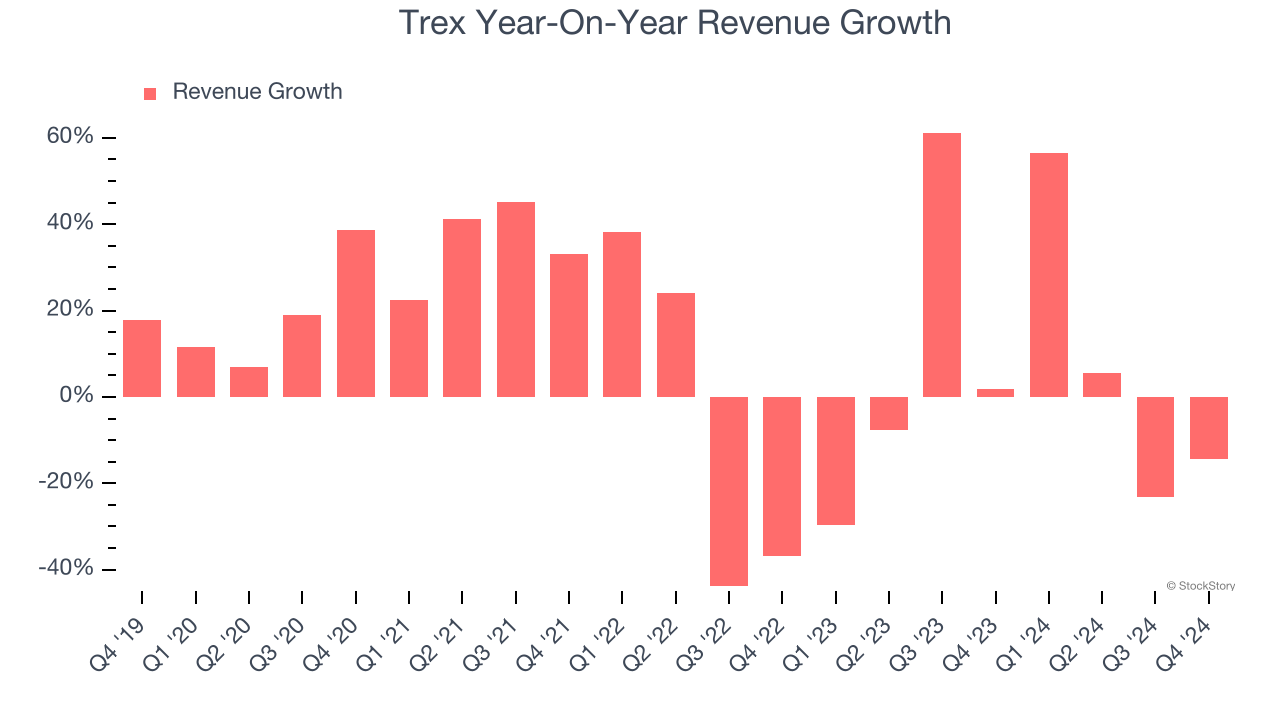

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Trex grew its sales at a solid 9.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trex’s recent history shows its demand slowed as its annualized revenue growth of 2% over the last two years is below its five-year trend.

This quarter, Trex’s revenue fell by 14.4% year on year to $167.6 million but beat Wall Street’s estimates by 4.4%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

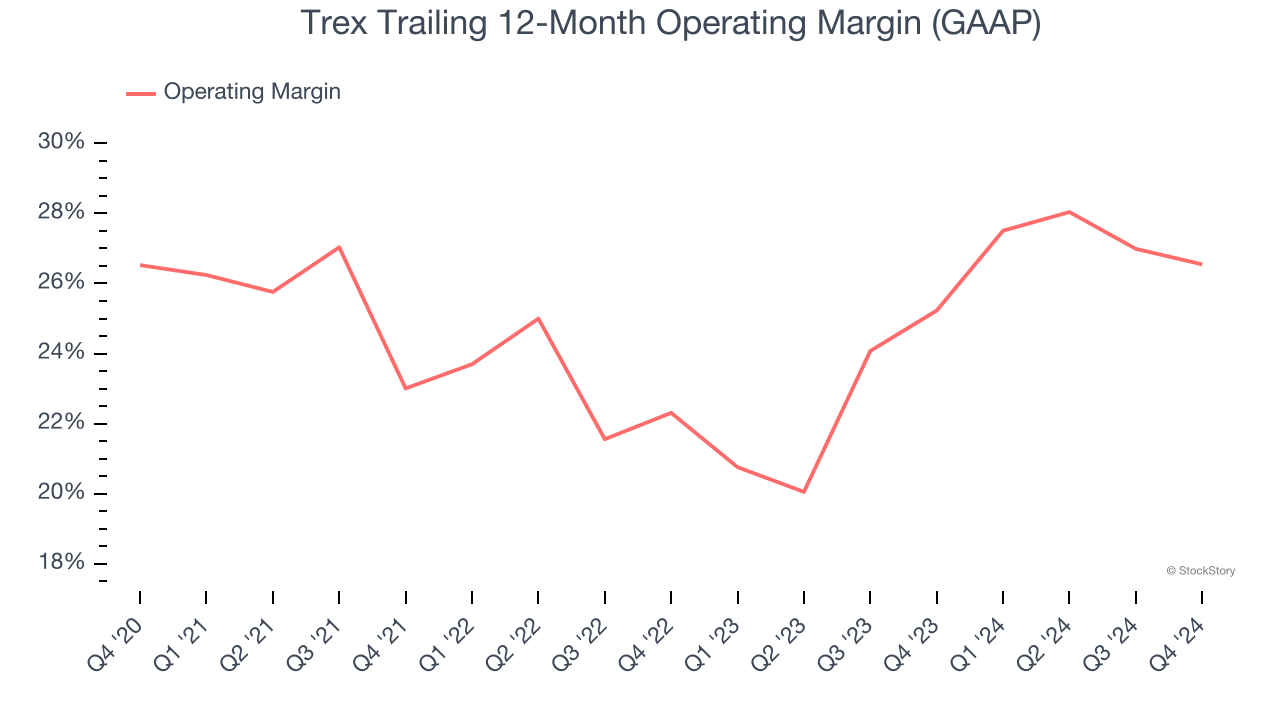

Trex has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Trex’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Trex generated an operating profit margin of 9.2%, down 5.1 percentage points year on year. Since Trex’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

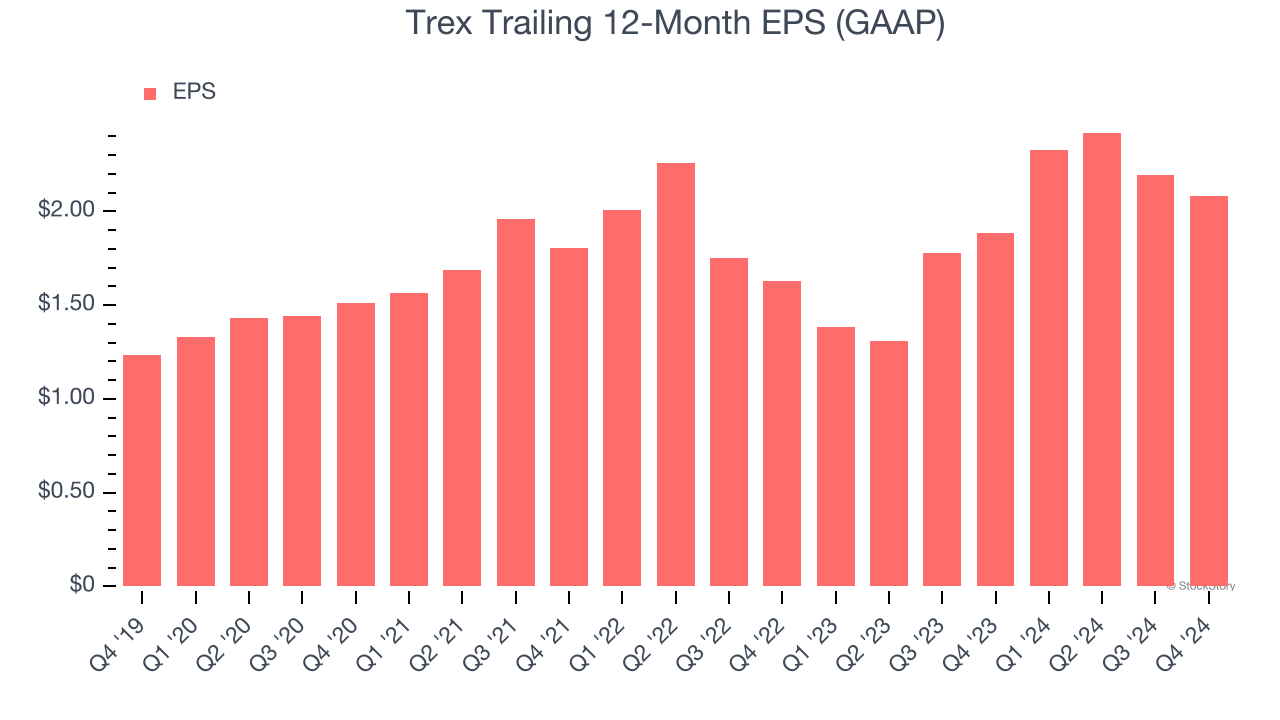

Trex’s EPS grew at a solid 11% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

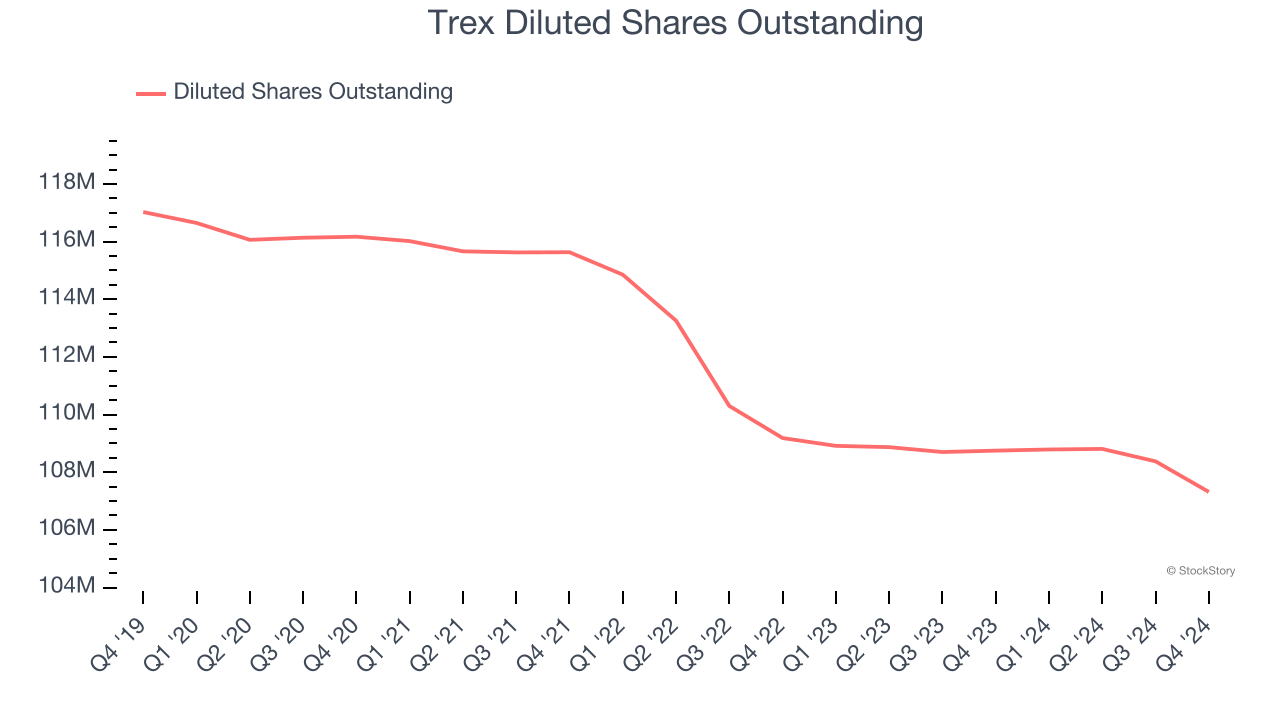

We can take a deeper look into Trex’s earnings to better understand the drivers of its performance. A five-year view shows that Trex has repurchased its stock, shrinking its share count by 8.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Trex, its two-year annual EPS growth of 13.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Trex reported EPS at $0.09, down from $0.20 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Trex’s full-year EPS of $2.08 to grow 4.9%.

Key Takeaways from Trex’s Q4 Results

We were impressed by how significantly Trex blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 2.9% to $63.50 immediately after reporting.

Indeed, Trex had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.